Unlock Your Future With The Ultimate Retirement Plan 2023 Limits – Act Now!

Retirement Plan 2023 Limits: Maximizing Your Savings for a Secure Future

Introduction

Dear Readers,

3 Picture Gallery: Unlock Your Future With The Ultimate Retirement Plan 2023 Limits – Act Now!

Welcome to our comprehensive guide on retirement plan 2023 limits. In this article, we will delve into the latest updates and regulations surrounding retirement plans, helping you navigate the intricacies of securing a financially stable future. Whether you are just starting your career or approaching retirement, understanding the limits imposed on retirement plans is crucial for making informed decisions.

Image Source: innovativecpagroup.com

Retirement planning is an essential aspect of personal finance, and with the ever-changing economic landscape, it is essential to stay updated on the latest regulations. By familiarizing yourself with the retirement plan 2023 limits, you can make strategic financial decisions that will impact your retirement years positively.

Join us as we explore the intricacies of retirement plan 2023 limits, the advantages and disadvantages, and the steps you can take to maximize your savings. Let’s dive in!

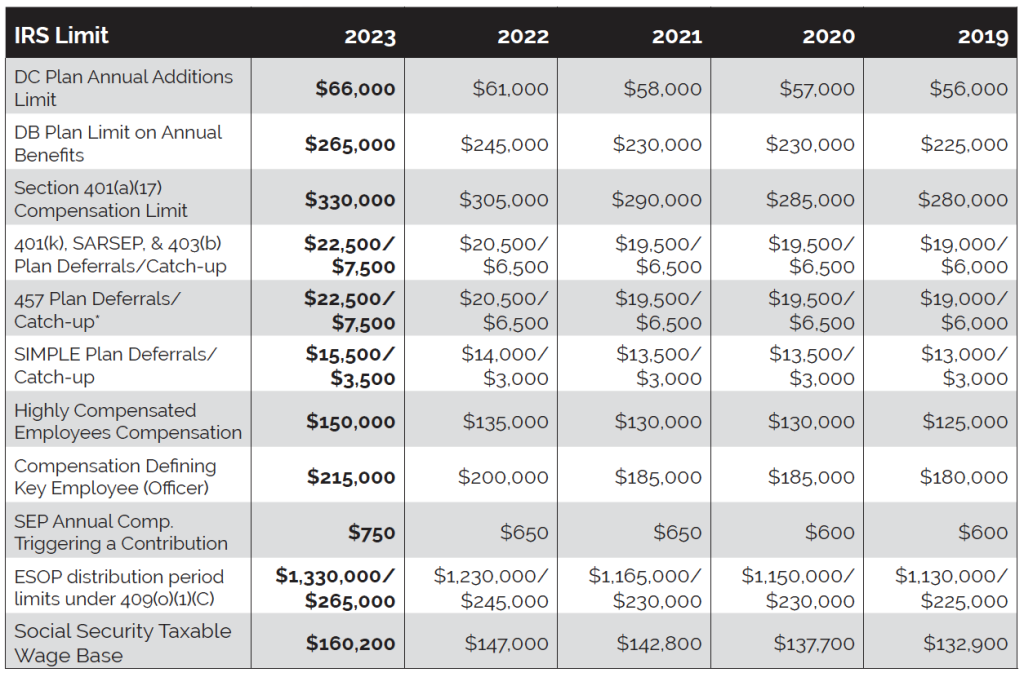

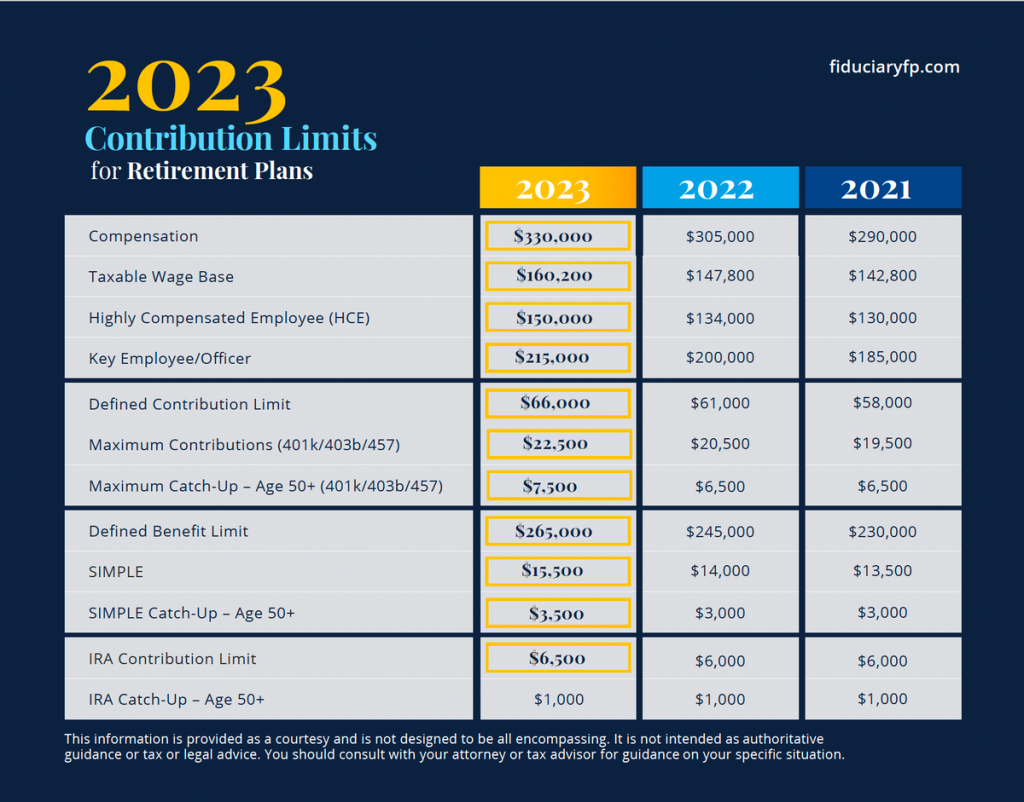

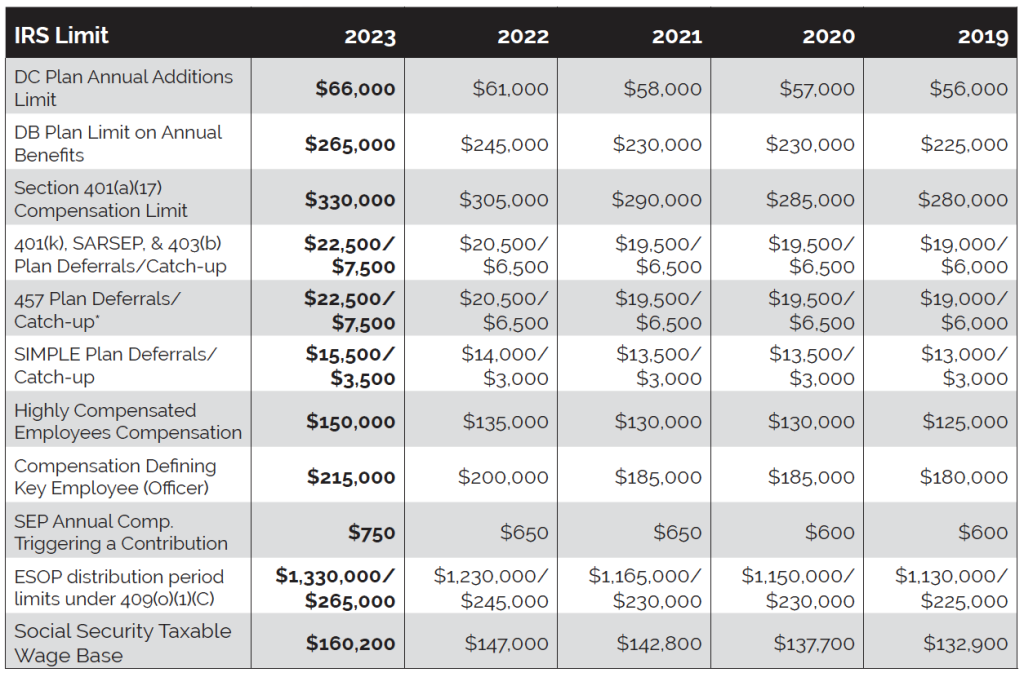

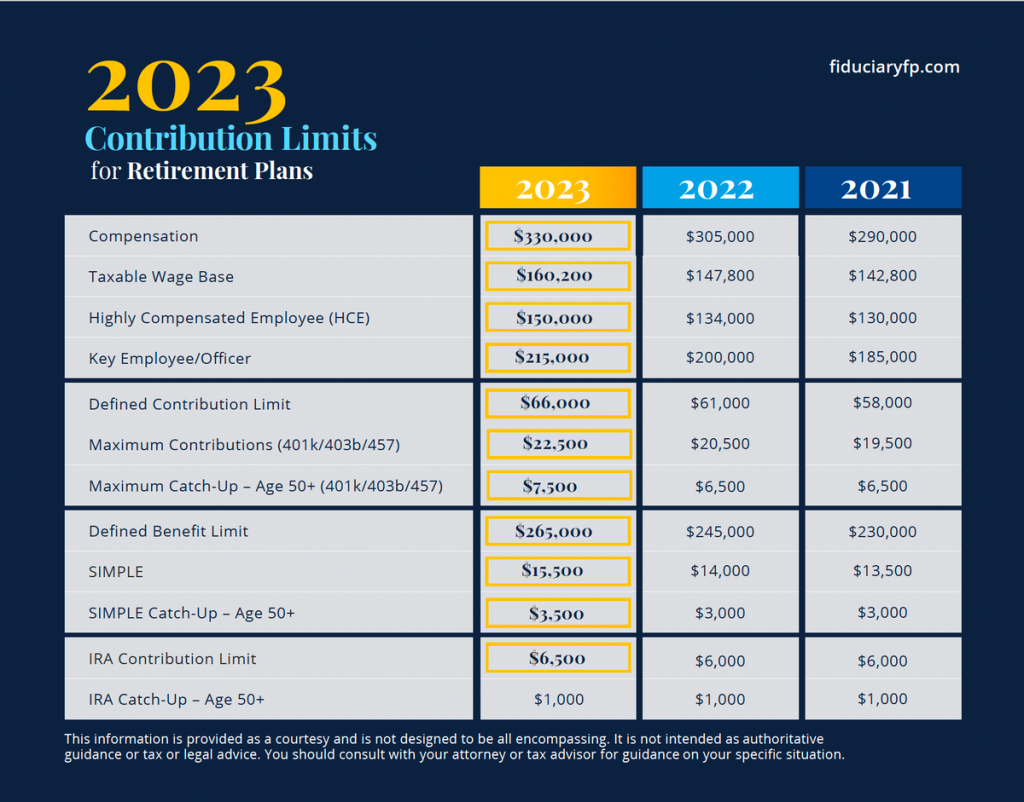

Table: Retirement Plan 2023 Limits

Retirement Plan Type

2023 Contribution Limit

Catch-Up Contribution Limit (Age 50+)

401(k) plans

$20,500

$6,500

Image Source: midlandsb.com

IRA

$6,500

$1,000

403(b) plans

$20,500

$6,500

457 plans

$20,500

$6,500

What is Retirement Plan 2023 Limits? 😃

Retirement plan 2023 limits refer to the maximum amount an individual can contribute to their retirement savings accounts in a given year. These limits are set by the Internal Revenue Service (IRS) and are designed to regulate the amount of pre-tax income individuals can allocate towards retirement savings. By adhering to these limits, individuals can enjoy tax advantages and build a substantial nest egg for their retirement years.

Who is Affected by Retirement Plan 2023 Limits? 🤔

Image Source: fmgsuite.com

The retirement plan 2023 limits impact anyone who contributes to retirement savings accounts, such as 401(k) plans, IRAs, 403(b) plans, and 457 plans. Whether you are an employee participating in an employer-sponsored retirement plan or a self-employed individual looking to save for retirement, understanding these limits is crucial for maximizing your savings potential.

When Do the Retirement Plan 2023 Limits Apply? ⌛

The retirement plan 2023 limits apply to contributions made in the calendar year 2023. It is important to note that these limits are subject to change annually, so it is essential to stay updated on the latest regulations to ensure compliance and maximize your retirement savings.

Where Can I Contribute to Retirement Savings? 🏦

Retirement savings can be contributed to various types of accounts, including 401(k) plans, IRAs, 403(b) plans, and 457 plans. These accounts are typically offered through employers or can be opened individually, depending on your employment status. By utilizing these accounts, you can take advantage of tax benefits and build a robust retirement fund.

Why Should You Be Aware of Retirement Plan 2023 Limits? 🧐

Being aware of retirement plan 2023 limits is crucial for several reasons. Firstly, it allows you to maximize your tax advantages by contributing the maximum allowable amount to your retirement savings accounts. Additionally, understanding these limits helps you plan and budget effectively for your retirement years, ensuring a financially secure future. By staying informed, you can make strategic decisions that align with your long-term financial goals.

How Can You Maximize Your Retirement Savings? 💰

To maximize your retirement savings within the limits set for 2023, consider the following strategies:

1. Take advantage of employer matching contributions: If your employer offers a matching contribution to your retirement plan, contribute at least enough to receive the full match. This is essentially free money that can significantly boost your savings.

2. Consider catch-up contributions: If you are aged 50 or older, take advantage of catch-up contributions, which allow you to contribute additional funds beyond the regular limits. This can help you make up for any lost time in saving for retirement.

3. Diversify your investments: Allocate your retirement savings across a range of investment options to minimize risk and maximize potential returns. Consult with a financial advisor to determine the best investment strategy for your specific needs.

4. Automate your contributions: Set up automatic contributions from your paycheck or bank account to ensure consistent savings. This eliminates the temptation to spend the money elsewhere and helps you stay on track towards your retirement goals.

5. Regularly review and adjust your plan: Life circumstances change, and so should your retirement plan. Regularly review your savings strategy and make adjustments as needed to ensure you are on track to meet your retirement goals.

Advantages and Disadvantages of Retirement Plan 2023 Limits

Advantages:

1. Tax advantages: Retirement plans offer tax benefits such as tax-deferred growth or tax-free withdrawals, allowing you to keep more of your hard-earned money.

2. Financial security: By maximizing your retirement savings within the limits, you can build a substantial nest egg to support yourself during your retirement years.

3. Employer contributions: Many retirement plans offer employer matching contributions, effectively increasing your savings potential.

Disadvantages:

1. Contribution limits: The retirement plan 2023 limits may impose restrictions on the amount you can contribute, potentially limiting your ability to save as much as you desire.

2. Risk exposure: Investments made within retirement plans are subject to market fluctuations, which can impact the overall value of your savings.

3. Withdrawal restrictions: Withdrawing funds from retirement accounts before reaching the eligible age may result in penalties and taxes, limiting your access to the funds when needed.

Frequently Asked Questions (FAQ)

1. Can I contribute to multiple retirement plans simultaneously?

Yes, you can contribute to multiple retirement plans simultaneously, provided you do not exceed the overall contribution limits set for each plan.

2. Can I make catch-up contributions if I am not yet 50 years old?

No, catch-up contributions are only available for individuals aged 50 or older.

3. What happens if I exceed the retirement plan 2023 limits?

If you exceed the retirement plan 2023 limits, you may be subject to penalties and additional taxes on the excess contributions. It is essential to monitor your contributions to avoid exceeding the limits.

4. Can I withdraw funds from my retirement plan before retirement?

Yes, but early withdrawals may be subject to penalties and taxes. It is advisable to consult with a financial advisor before making any early withdrawals.

5. Are there any income restrictions for contributing to retirement plans?

Income restrictions may apply to certain retirement plans, such as Roth IRAs. Consult with a tax professional or financial advisor to determine your eligibility based on your income.

Conclusion: Secure Your Future Today!

As we conclude our exploration of retirement plan 2023 limits, we encourage you to take action and prioritize your retirement savings. By understanding the limits, maximizing your contributions, and making strategic investment decisions, you can build a financially secure future for yourself and your loved ones.

Remember, time is of the essence when it comes to retirement planning. Start early, stay disciplined, and regularly assess your progress towards your retirement goals. Your future self will thank you!

Final Remarks

The information provided in this article is for educational purposes only and should not be considered as financial or investment advice. It is always advisable to consult with a qualified financial advisor or tax professional before making any decisions regarding your retirement savings.

Stay informed, stay proactive, and secure your financial future!

This post topic: Budgeting Strategies