Master Your Finances: Unveiling The Power Of Three Main Budgeting Techniques – Click Here To Take Control!

Three Main Budgeting Techniques

Greetings, Readers! Today, we will delve into the world of budgeting and explore the three main budgeting techniques that can help individuals and businesses effectively manage their finances. Budgeting is a crucial skill that allows us to allocate resources wisely, plan for the future, and achieve our financial goals. By understanding these techniques, you will be equipped with the knowledge to make informed decisions and optimize your financial well-being. So, let’s dive into the world of budgeting techniques!

Introduction

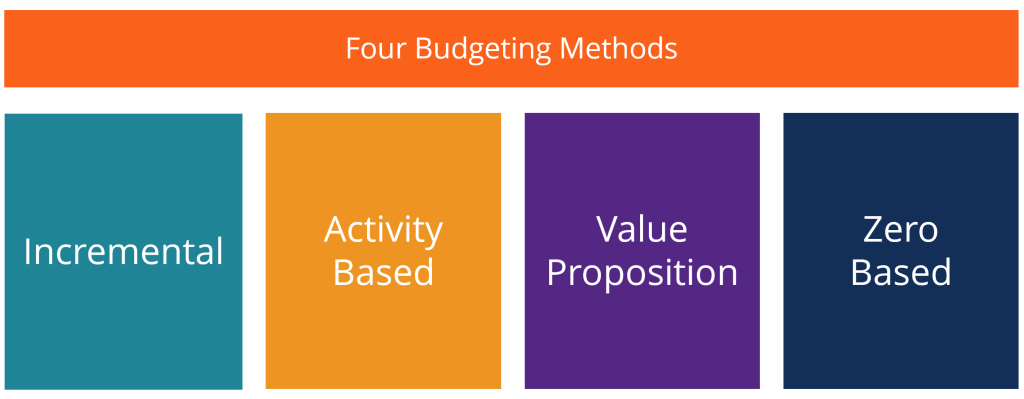

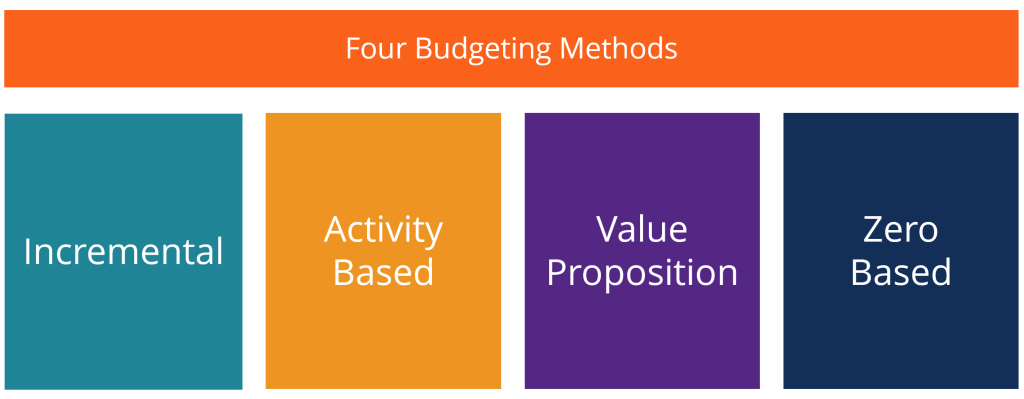

Budgeting is the process of creating a plan to manage income and expenses. It involves setting financial goals, estimating income, forecasting expenses, and allocating funds accordingly. The three main budgeting techniques are:

1 Picture Gallery: Master Your Finances: Unveiling The Power Of Three Main Budgeting Techniques – Click Here To Take Control!

Traditional Budgeting

Zero-Based Budgeting

Activity-Based Budgeting

In this article, we will explore each of these techniques in detail, highlighting their features, benefits, and drawbacks. By the end of this article, you will have a comprehensive understanding of these budgeting techniques and be able to choose the one that suits your needs best.

Traditional Budgeting

Image Source: corporatefinanceinstitute.com

Traditional budgeting is the most commonly used technique. It involves creating a budget based on historical data and incremental changes. The process typically starts with the previous year’s budget and makes adjustments for expected changes in income and expenses. Traditional budgeting offers stability and is relatively easy to implement. However, it may lack flexibility and fail to adapt to changing circumstances.

What is Traditional Budgeting?

Traditional budgeting is a method that relies on previous financial data to create a budget for the upcoming period. It typically follows a top-down approach, where senior management sets targets and allocates funds to various departments or cost centers. The budget is often based on the assumption that the future will resemble the past.

Who Uses Traditional Budgeting?

Traditional budgeting is commonly used by organizations of all sizes, ranging from small businesses to large corporations. It is prevalent in industries where stability and predictability are high, such as manufacturing or utilities. Additionally, individuals who prefer a structured approach to budgeting may also opt for traditional budgeting.

When to Use Traditional Budgeting?

Traditional budgeting is suitable when historical data is reliable, and the organization’s environment is stable. It works well for businesses with consistent revenue streams and predictable expenses. However, in rapidly changing industries or uncertain economic conditions, traditional budgeting may be less effective.

Where Can Traditional Budgeting Be Applied?

Traditional budgeting can be applied in various settings, including businesses, non-profit organizations, and personal finances. It is commonly used for departmental budgets, project budgets, and annual personal budgets.

Why Choose Traditional Budgeting?

Image Source: twimg.com

Traditional budgeting offers stability and ease of implementation. It provides a framework for financial planning and control, allowing organizations to monitor performance against targets. By using historical data as a reference, it simplifies the budgeting process and saves time and effort.

How to Implement Traditional Budgeting?

The implementation of traditional budgeting involves several steps. First, gather historical financial data and assess its reliability. Then, set financial goals and allocate resources based on expected income and expenses. Monitor and review the budget regularly, making adjustments as necessary. Finally, evaluate performance against the budget and take corrective actions if needed.

Zero-Based Budgeting

Zero-based budgeting takes a different approach compared to traditional budgeting. It requires every expense to be justified, starting from zero. This technique forces individuals or organizations to critically evaluate their spending and prioritize resources based on their needs and goals. Zero-based budgeting promotes efficiency and cost optimization but requires more time and effort to implement.

What is Zero-Based Budgeting?

Zero-based budgeting is a budgeting technique where expenses are justified and allocated based on their merits rather than historical allocations. Unlike traditional budgeting, zero-based budgeting starts from scratch, requiring every expense to be justified and approved before inclusion in the budget.

Who Uses Zero-Based Budgeting?

Zero-based budgeting is commonly used by organizations that want to optimize their resource allocation and identify cost-saving opportunities. It is particularly prevalent in industries with high competition, limited resources, or rapidly changing environments. Individuals who prioritize cost optimization may also adopt zero-based budgeting.

When to Use Zero-Based Budgeting?

Zero-based budgeting is suitable when there is a need to reassess and optimize resource allocation. It works well in situations where historical data may not accurately represent current needs or when significant changes have occurred. Zero-based budgeting is also effective when cost reduction is a key objective.

Where Can Zero-Based Budgeting Be Applied?

Zero-based budgeting can be applied in various contexts, including businesses, government agencies, and personal finances. It is often used for project budgets, departmental budgets, and cost reduction initiatives.

Why Choose Zero-Based Budgeting?

Zero-based budgeting promotes cost optimization and efficiency. By requiring every expense to be justified, it eliminates unnecessary spending and encourages resource prioritization. It also provides a fresh perspective on resource allocation and allows for better alignment with organizational goals.

How to Implement Zero-Based Budgeting?

The implementation of zero-based budgeting involves several steps. First, identify and evaluate all expenses, ensuring their alignment with goals and objectives. Justify each expense based on its merits and prioritize resources accordingly. Review and revise the budget regularly to adapt to changing circumstances. Finally, monitor performance and identify opportunities for further optimization.

Activity-Based Budgeting

Activity-based budgeting focuses on the costs associated with specific activities or processes. It aims to allocate resources based on the expected costs of each activity, providing a more accurate representation of the resources required. Activity-based budgeting enhances cost control, improves decision-making, and enables organizations to identify cost drivers.

What is Activity-Based Budgeting?

Activity-based budgeting is a technique that links resource allocation to specific activities or processes within an organization. It identifies the costs associated with each activity and allocates resources accordingly. By focusing on activities rather than departments or cost centers, activity-based budgeting provides a more detailed and accurate representation of resource requirements.

Who Uses Activity-Based Budgeting?

Activity-based budgeting is commonly used by organizations that want to enhance cost control and improve decision-making. It is particularly prevalent in industries with complex operations or significant variations in activity costs. Individuals who seek a detailed understanding of their expenses may also adopt activity-based budgeting.

When to Use Activity-Based Budgeting?

Activity-based budgeting is suitable when there is a need to allocate resources based on specific activities or processes. It works well in organizations where activities have different cost structures and resource requirements. Activity-based budgeting is also effective when cost control and accurate cost estimation are essential.

Where Can Activity-Based Budgeting Be Applied?

Activity-based budgeting can be applied in various settings, including manufacturing, service industries, and project-based organizations. It is often used for project budgets, activity-based costing, and process improvement initiatives.

Why Choose Activity-Based Budgeting?

Activity-based budgeting provides a more accurate representation of resource requirements by focusing on activities and their associated costs. It enhances cost control, allowing organizations to identify cost drivers and allocate resources more efficiently. Activity-based budgeting also improves decision-making by providing insights into the cost implications of different activities.

How to Implement Activity-Based Budgeting?

The implementation of activity-based budgeting involves several steps. First, identify and analyze the activities within the organization. Assess the costs associated with each activity and allocate resources accordingly. Continuously monitor activity costs and adjust resource allocation as needed. Finally, evaluate the budget’s effectiveness in achieving cost control and enhancing decision-making.

Advantages and Disadvantages of the Three Main Budgeting Techniques

Each of the three main budgeting techniques has its advantages and disadvantages. Let’s take a closer look at them:

Traditional Budgeting: Advantages

Stability and ease of implementation.

Provides a framework for financial planning and control.

Saves time and effort by using historical data as a reference.

Traditional Budgeting: Disadvantages

Lacks flexibility and may not adapt well to changing circumstances.

Relies heavily on assumptions and may not reflect current needs accurately.

May perpetuate inefficiencies by allocating resources based on previous allocations.

Zero-Based Budgeting: Advantages

Promotes cost optimization and resource prioritization.

Provides a fresh perspective on resource allocation.

Eliminates unnecessary spending and encourages critical evaluation of expenses.

Zero-Based Budgeting: Disadvantages

Requires more time and effort to implement compared to traditional budgeting.

May encounter resistance from individuals accustomed to historical allocations.

May overlook certain costs or activities if not thoroughly evaluated.

Activity-Based Budgeting: Advantages

Provides a more accurate representation of resource requirements.

Enhances cost control and identification of cost drivers.

Improves decision-making by considering the cost implications of activities.

Activity-Based Budgeting: Disadvantages

Requires detailed analysis and understanding of activities and their costs.

May encounter challenges in allocating resources to complex or dynamic activities.

Requires continuous monitoring and adjustments to accurately reflect changing costs.

Frequently Asked Questions (FAQ)

Q: Is there a one-size-fits-all budgeting technique?

A: No, the choice of budgeting technique depends on various factors such as the organization’s needs, industry, and environmental conditions.

Q: Can I combine different budgeting techniques?

A: Yes, organizations can adopt hybrid approaches that combine elements of different budgeting techniques to suit their specific requirements.

Q: How frequently should I review and revise my budget?

A: Regular budget reviews are recommended, with the frequency depending on the organization’s dynamics and the pace of change in its environment.

Q: Are these budgeting techniques applicable to personal finances?

A: Yes, individuals can leverage these budgeting techniques to effectively manage their personal finances and achieve their financial goals.

Q: How can budgeting techniques help me achieve financial success?

A: Budgeting techniques provide a structured approach to managing finances, enabling individuals and organizations to allocate resources wisely, plan for the future, and achieve financial goals.

Conclusion

In conclusion, understanding the three main budgeting techniques – traditional budgeting, zero-based budgeting, and activity-based budgeting – is essential for effective financial management. Each technique offers its own set of advantages and disadvantages, catering to different needs and circumstances. By selecting the appropriate technique and implementing it diligently, individuals and organizations can optimize their resource allocation, enhance cost control, and make informed financial decisions. So, take a proactive step towards financial success by embracing these budgeting techniques and unlocking your full financial potential!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. It is always recommended to consult with a qualified financial professional before making any financial decisions.

This post topic: Budgeting Strategies