Unlock Financial Stability: Maximize Your Retirement Plan Hardship Withdrawal Today!

Retirement Plan Hardship Withdrawal: What You Need to Know

Introduction

Dear Readers,

1 Picture Gallery: Unlock Financial Stability: Maximize Your Retirement Plan Hardship Withdrawal Today!

Welcome and thank you for taking the time to learn about retirement plan hardship withdrawal. In this article, we will explore the ins and outs of this financial option that can significantly impact your retirement savings. Whether you are facing unforeseen circumstances or considering this withdrawal as a last resort, it is crucial to understand the implications and potential consequences. So, let’s dive in and explore the world of retirement plan hardship withdrawal.

Retirement Plan Hardship Withdrawal: A Complete Guide

What is Retirement Plan Hardship Withdrawal? 🤔

Image Source: thebalancemoney.com

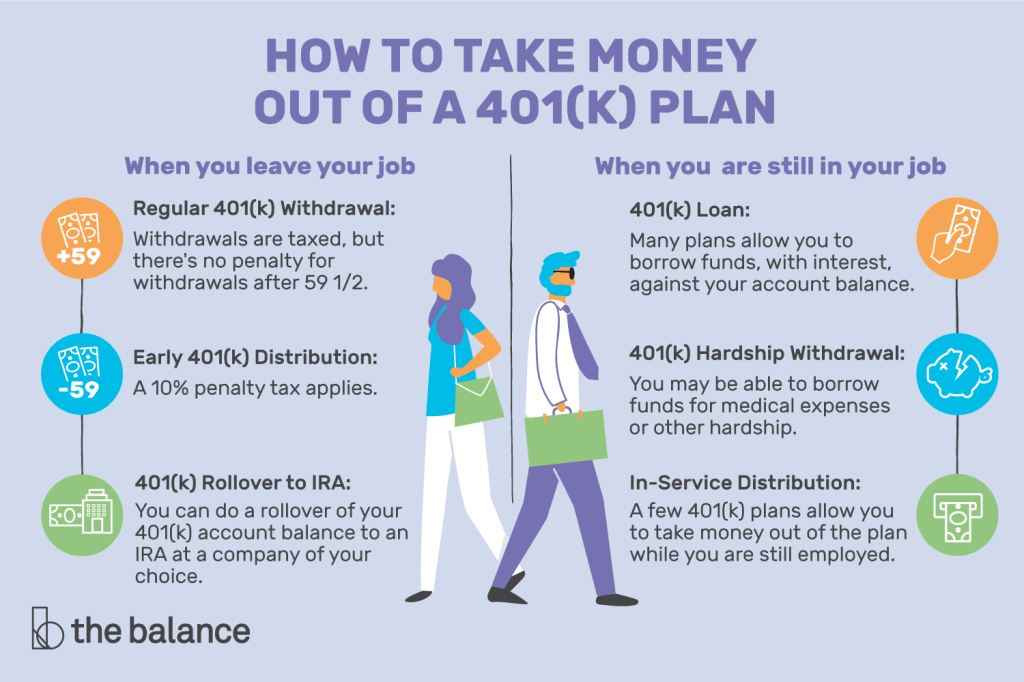

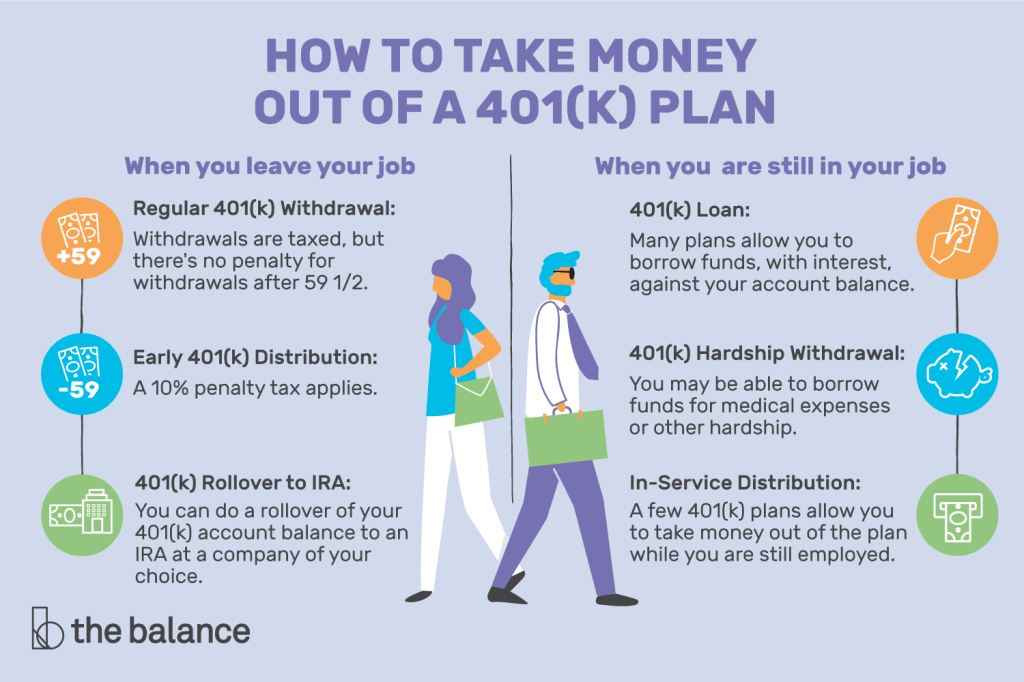

Retirement plan hardship withdrawal is a provision that allows individuals to withdraw funds from their retirement accounts before reaching the eligible retirement age. This option is specifically designed for individuals facing financial hardships, such as medical expenses, funeral costs, or the need to prevent eviction or foreclosure. It provides immediate access to funds that otherwise would be locked away until retirement.

Eligibility and Restrictions

Before considering a hardship withdrawal, it is important to understand the eligibility criteria and any restrictions imposed by your retirement plan. Generally, individuals must demonstrate a financial need that meets the requirements specified by the Internal Revenue Service (IRS). These criteria may include specific expenses, such as medical bills that exceed a certain percentage of their income or the threat of eviction or foreclosure.

Withdrawal Limits and Taxes

It is essential to note that hardship withdrawals are typically subject to certain limitations. The maximum amount an individual can withdraw is usually determined by the plan administrator or the IRS. Additionally, these withdrawals are subject to income tax and may incur an early withdrawal penalty if the individual is below the retirement age of 59 and a half.

Documentation and Approval Process

When considering a hardship withdrawal, individuals must provide documentation to support their financial need. This may include medical bills, eviction notices, or other relevant documents. The documentation is then reviewed by the retirement plan administrator, who determines whether the withdrawal meets the eligibility criteria. It is crucial to follow the proper application process and provide accurate and complete information to avoid delays or potential denial of the withdrawal.

Impact on Future Retirement Savings

While hardship withdrawals can provide immediate financial relief, they can also have long-term consequences on your retirement savings. Withdrawing funds early reduces the amount available for compounding growth over time. This reduction can significantly impact your retirement nest egg and potentially lead to a lower standard of living during your retirement years. It is important to carefully weigh the pros and cons before making a hardship withdrawal.

Alternatives to Hardship Withdrawal

In some cases, individuals may have alternative options to consider before resorting to a hardship withdrawal. These options may include taking out a loan against the retirement account, exploring other sources of financial assistance, or adjusting their budget to meet their immediate needs. It is advisable to consult with a financial advisor or retirement planning specialist to explore all available alternatives and make an informed decision.

Retirement Plan Hardship Withdrawal: A Last Resort

It is important to remember that retirement plan hardship withdrawal should be considered as a last resort when all other options have been exhausted. Due to the potential long-term consequences, it is crucial to carefully evaluate your financial situation and consider the impact on your retirement savings. Seeking guidance from professionals in the field can provide valuable insights and help you make the best decision for your financial future.

Advantages and Disadvantages of Retirement Plan Hardship Withdrawal

Advantages of Retirement Plan Hardship Withdrawal

1. Immediate access to funds in times of financial need, providing relief during challenging circumstances.

2. Flexibility to use the funds for specific expenses, such as medical bills or preventing eviction.

3. No requirement to repay the withdrawn amount, unlike loans taken against retirement accounts.

4. Avoidance of potential penalties in situations where no other options are available.

5. Can help individuals cover necessary expenses and prevent further financial hardship.

Disadvantages of Retirement Plan Hardship Withdrawal

1. Reduction of retirement savings, potentially leading to a lower standard of living during retirement.

2. Taxes and penalties associated with early withdrawals, which can further diminish the withdrawn amount.

3. Limitations on the maximum amount that can be withdrawn, potentially not covering the full financial need.

4. Documentation and approval process can be time-consuming and may result in delays or denial of the withdrawal.

5. Impact on future retirement goals and the need for additional financial planning to compensate for the withdrawn amount.

Frequently Asked Questions (FAQs)

1. Can I withdraw funds from my retirement plan for any reason?

No, retirement plan hardship withdrawals are specifically reserved for individuals facing financial hardships as defined by the IRS. The eligibility criteria must be met to qualify for a hardship withdrawal.

2. Do I need to pay taxes on the withdrawn amount?

Yes, hardship withdrawals are subject to income tax. The withdrawn amount is considered taxable income in the year you receive it.

3. Are there any penalties for taking a hardship withdrawal?

Retirement plan hardship withdrawals taken before the age of 59 and a half are subject to an additional early withdrawal penalty of 10% unless an exception applies.

4. What happens if my hardship withdrawal is denied?

If your hardship withdrawal is denied, you may need to explore alternative options, such as loans or other sources of financial assistance. It is advisable to consult with a retirement planning specialist for guidance.

5. Can I contribute to my retirement plan after taking a hardship withdrawal?

Some retirement plans may require a temporary suspension of contributions after a hardship withdrawal. However, it is essential to consult with your plan administrator to understand the specific rules and regulations.

Conclusion: Take Action for Your Future

In conclusion, retirement plan hardship withdrawal can provide immediate relief during challenging financial situations. However, it is crucial to carefully consider the long-term implications and explore alternative options before making this decision. Your retirement savings are a vital component of your financial future, and seeking professional guidance can help you navigate the complexities of retirement planning. Take action today to secure a prosperous and comfortable retirement.

Final Remarks

Dear Readers,

Retirement plan hardship withdrawal is a serious financial decision that should not be taken lightly. It is crucial to fully educate yourself on the process, eligibility criteria, and potential consequences before proceeding. This article serves as a comprehensive guide to help you understand retirement plan hardship withdrawal and make informed decisions. However, it is always recommended to consult with a financial advisor or retirement planning specialist to tailor the information to your specific circumstances. Remember, your retirement savings are a valuable asset, and making wise choices today will impact your future financial well-being. Best of luck on your retirement planning journey!

This post topic: Budgeting Strategies