Secure Your Future: Try Our Retirement Savings Estimator Now!

Retirement Savings Estimator: Planning for a Secure Future

Greetings, Readers! Are you concerned about your financial security during retirement? Do you want to ensure that you have enough savings to live comfortably in your golden years? Look no further than the Retirement Savings Estimator, a powerful tool that can help you plan for a secure future. In this article, we will explore the ins and outs of this essential tool and explain how it can benefit you. So, let’s dive in and discover the key features of the Retirement Savings Estimator!

1 Picture Gallery: Secure Your Future: Try Our Retirement Savings Estimator Now!

Introduction

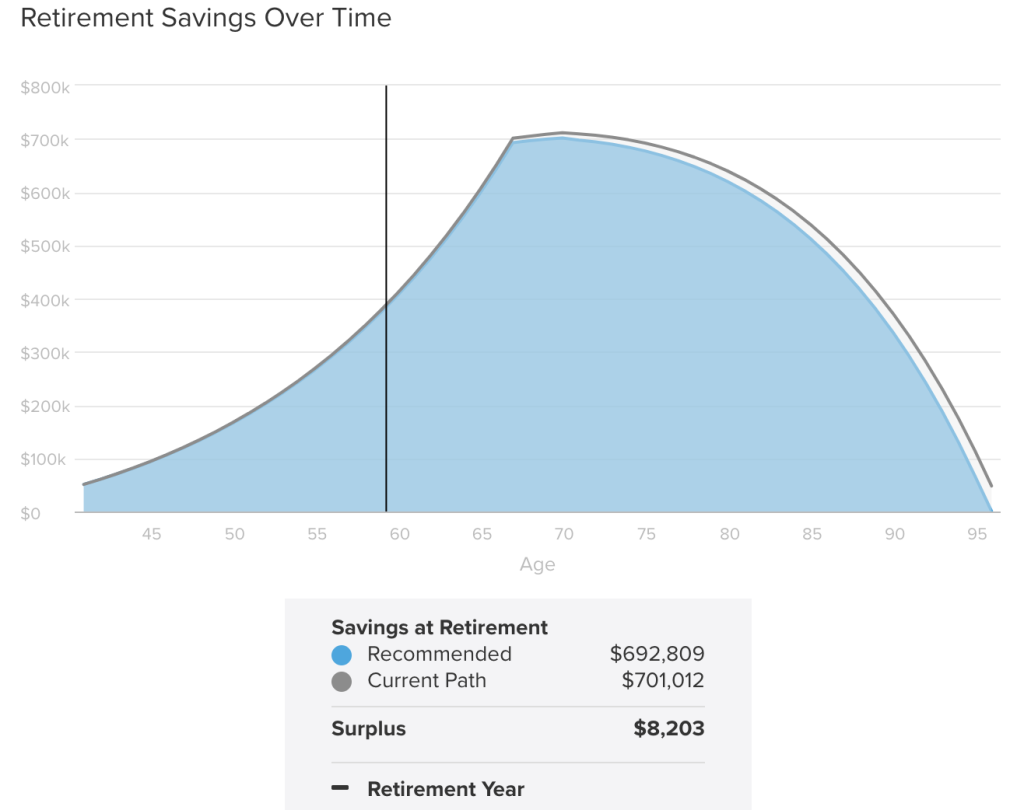

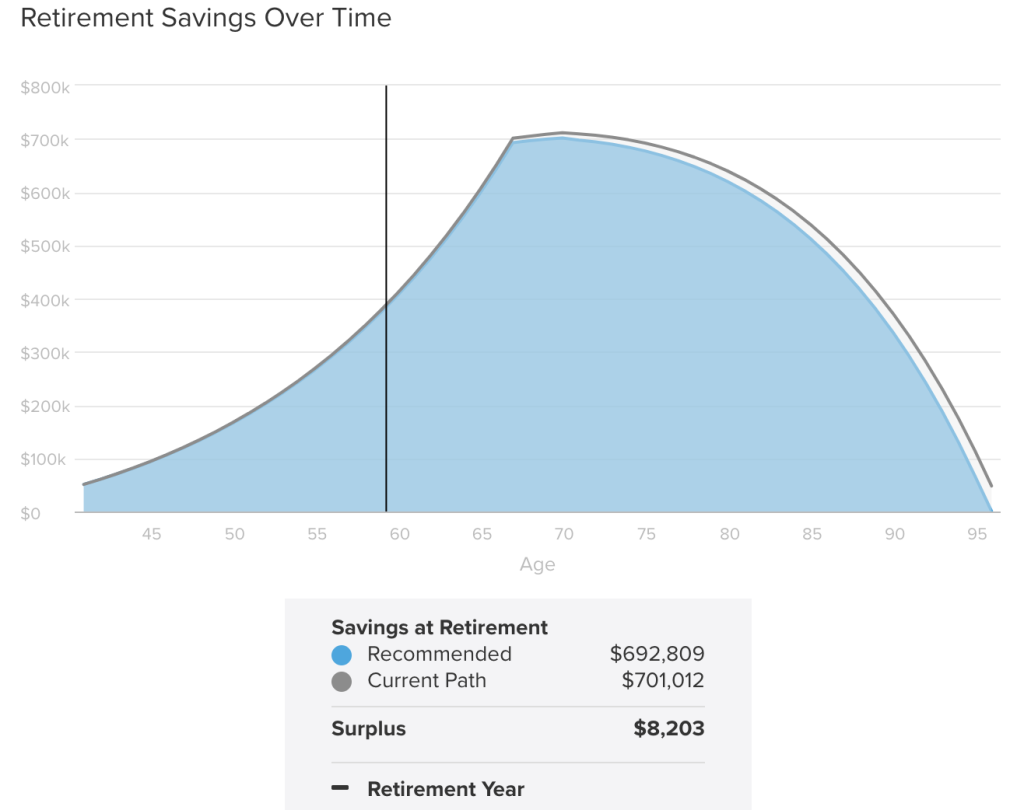

Retirement can be a daunting phase of life, filled with uncertainties and financial challenges. The Retirement Savings Estimator is designed to alleviate these concerns by providing you with a clear picture of your financial standing during retirement. By analyzing various factors such as income, expenses, investments, and retirement age, this tool calculates the amount of savings you need to maintain your desired lifestyle.

Image Source: amazonaws.com

With the Retirement Savings Estimator, you can gain valuable insights into your financial future. It empowers you to make informed decisions, set realistic goals, and take the necessary steps to achieve them. Whether you are just starting your career or are already approaching retirement, this tool is a must-have for everyone who wants to ensure a comfortable and stress-free retirement.

Now, let’s delve deeper into the key aspects of the Retirement Savings Estimator and how it can assist you in securing your financial future.

What is the Retirement Savings Estimator?

The Retirement Savings Estimator is an online tool specifically developed to help individuals gauge their retirement readiness. It takes into account various financial parameters and provides an estimate of the amount of savings required to sustain your desired lifestyle during retirement. This tool considers factors such as your current age, desired retirement age, expected rate of return on investments, and anticipated expenses post-retirement.

By inputting these variables into the Retirement Savings Estimator, you can obtain a comprehensive analysis that outlines the amount you should save each month, the total savings needed by retirement age, and the projected growth of your investments over time. This information empowers you to make informed decisions regarding your retirement savings strategy.

The Retirement Savings Estimator also allows you to adjust the variables and instantly see the impact on your savings goal. This flexibility enables you to explore different scenarios and make appropriate adjustments to achieve your financial objectives.

Who can Benefit from the Retirement Savings Estimator?

The Retirement Savings Estimator is beneficial for individuals at all stages of their careers. Whether you are a young professional just starting to save for retirement or a seasoned employee getting closer to your desired retirement age, this tool can provide valuable insights and guidance.

For young professionals, the Retirement Savings Estimator helps establish a solid financial plan early on. It allows them to set realistic savings targets and make informed investment decisions to maximize long-term growth. By leveraging the power of compounding, individuals can harness the potential of their investments and ensure a financially secure retirement.

For those nearing retirement, the Retirement Savings Estimator acts as a reality check. It helps individuals determine if they are on track to meet their retirement goals or if adjustments need to be made. By accurately assessing their current financial situation, they can take proactive steps to bridge any gaps and make necessary changes to their retirement plans.

In short, the Retirement Savings Estimator caters to individuals of all ages who seek financial security and peace of mind during retirement.

When Should You Start Using the Retirement Savings Estimator?

The sooner you start using the Retirement Savings Estimator, the better. It is never too early to plan for your retirement and ensure you have adequate savings to support your desired lifestyle. By starting early, you give yourself more time to build a substantial retirement fund and take advantage of long-term investment growth.

However, even if you have not started saving for retirement yet, it is never too late to utilize the Retirement Savings Estimator. This tool can help you assess your current financial situation and determine the steps you need to take to catch up. By making adjustments to your savings strategy and potentially increasing your contributions, you can still improve your retirement outlook.

Remember, time is a crucial factor when it comes to retirement savings. The earlier you start, the more you benefit from compounding and the greater your chances of achieving your desired lifestyle during retirement.

Where Can You Access the Retirement Savings Estimator?

The Retirement Savings Estimator is readily accessible online, making it convenient for individuals to use. You can find this valuable tool on various financial planning websites, retirement planning platforms, and even on some banking websites.

To access the Retirement Savings Estimator, simply visit a trusted financial website or platform, and look for the Retirement Savings Estimator section. Once there, you will be prompted to input relevant financial information such as your current age, desired retirement age, income, expenses, and expected rate of return on investments. After providing these details, the tool will generate a personalized savings estimate and provide recommendations to help you reach your retirement goals.

It is important to note that the Retirement Savings Estimator is designed to provide estimates and guidance and should be used as a starting point for your retirement planning. To create a comprehensive retirement strategy, consider consulting with a certified financial planner who can help tailor a plan to your specific needs and goals.

Why Should You Use the Retirement Savings Estimator?

The Retirement Savings Estimator offers numerous benefits that can significantly enhance your retirement planning process. Here are some compelling reasons why you should utilize this powerful tool:

Accurate Analysis: The Retirement Savings Estimator employs advanced algorithms to analyze your financial data and provide accurate estimates tailored to your unique circumstances. It takes into account crucial factors like inflation and projected investment returns, ensuring a realistic assessment of your retirement goals.

Goal Clarity: By using the Retirement Savings Estimator, you gain clarity on your retirement goals. It helps you identify how much you need to save, the monthly contributions required, and the potential growth of your investments. This clarity allows you to set achievable objectives and stay on track.

Savings Strategies: The Retirement Savings Estimator provides valuable insights into various savings strategies and investment options. It helps you determine the most suitable approach for your financial situation and risk tolerance. By identifying the optimal strategies, you can make the most of your savings and potentially enhance your retirement fund.

Flexibility and Adjustments: As life circumstances change, so do your retirement needs. The Retirement Savings Estimator allows you to adjust your parameters and instantly see the impact on your savings goal. This flexibility empowers you to adapt your strategy as needed and ensure your retirement plan remains aligned with your evolving goals.

Peace of Mind: By utilizing the Retirement Savings Estimator, you gain peace of mind knowing that you are taking proactive steps towards a financially secure retirement. The tool provides reassurance that you are on the right track and assists you in making informed decisions to safeguard your future.

Overall, the Retirement Savings Estimator is a valuable tool that offers comprehensive analysis, goal clarity, savings strategies, flexibility, and peace of mind. It is an indispensable resource for anyone serious about planning for a financially secure retirement.

FAQs (Frequently Asked Questions)

1. Is the Retirement Savings Estimator free to use?

Yes, the Retirement Savings Estimator is typically available for free on various financial planning websites and platforms. However, some premium versions may offer additional features for a fee. It is important to explore different options and choose the one that best suits your needs and budget.

2. Can I save for retirement without using the Retirement Savings Estimator?

While it is possible to save for retirement without utilizing the Retirement Savings Estimator, this powerful tool significantly simplifies the process and provides valuable insights. It helps you set realistic goals, evaluate different scenarios, and make informed decisions. By using the Retirement Savings Estimator, you can enhance your retirement planning and increase the likelihood of achieving your desired lifestyle.

3. How often should I update my retirement savings estimates?

It is recommended to update your retirement savings estimates at least once a year or whenever there are significant changes in your financial situation. Life events such as marriage, having children, career advancements, or unexpected expenses can impact your retirement goals. Regularly reviewing and adjusting your estimates ensures that your retirement plan remains aligned with your evolving circumstances.

4. Can the Retirement Savings Estimator guarantee a secure retirement?

While the Retirement Savings Estimator is a powerful tool, it cannot guarantee a secure retirement on its own. It provides estimates and guidance based on the information provided. To ensure a financially secure retirement, it is essential to implement a comprehensive retirement strategy that takes into account factors such as inflation, unforeseen expenses, and potential changes in income. Consider consulting with a certified financial planner for personalized advice tailored to your specific needs.

5. Are there any limitations to the Retirement Savings Estimator?

While the Retirement Savings Estimator is a valuable tool, it is important to acknowledge its limitations. The estimates provided are based on assumptions and projections, which may not always reflect actual market conditions or individual circumstances. Use the Retirement Savings Estimator as a starting point for your retirement planning and supplement it with professional advice to create a robust and personalized strategy.

Conclusion

In conclusion, the Retirement Savings Estimator is an indispensable tool for individuals seeking financial security during retirement. By accurately assessing your financial standing, setting realistic goals, and providing valuable insights, this tool empowers you to take proactive steps towards a financially secure future.

Do not leave your retirement to chance. Start using the Retirement Savings Estimator today and embark on a path towards a comfortable and stress-free retirement. Your future self will thank you for it!

Final Remarks

The information contained in this article is for informational purposes only and should not be considered as financial advice. Consult with a certified financial planner or professional advisor before making any financial decisions or implementing any retirement strategy. The Retirement Savings Estimator is a valuable tool, but it is essential to consider individual circumstances and seek personalized guidance to ensure a secure retirement.

This post topic: Budgeting Strategies