Master Your Finances: 5 Budgeting Tips For A Prosperous Future!

5 Budgeting Tips

Introduction

Dear Readers,

2 Picture Gallery: Master Your Finances: 5 Budgeting Tips For A Prosperous Future!

Welcome to our article on 5 budgeting tips. In today’s fast-paced world, managing our finances efficiently has become more important than ever. Whether you’re saving for a big purchase, paying off debt, or simply trying to make ends meet, budgeting can help you achieve your financial goals. In this article, we will explore five budgeting tips that are not only practical but also effective in helping you take control of your finances. So let’s dive in!

1. Set Financial Goals 🎯

Image Source: freshbooks.com

One of the first steps towards effective budgeting is setting clear financial goals. Having a specific target in mind gives you a sense of purpose and direction when managing your money. Whether it’s saving a certain amount each month, paying off a debt by a specific date, or building an emergency fund, having goals will help you stay motivated and focused on your budgeting journey.

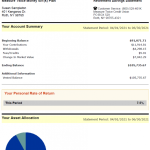

2. Track Your Spending 📊

In order to make a budget that works for you, it’s essential to have a clear understanding of your spending habits. Track every cent you spend for at least a month to identify areas where you can cut back or make adjustments. This can be done through various tools and apps that help you categorize your expenses, making it easier to analyze and plan your budget effectively.

3. Create a Realistic Budget 📝

Once you have a good grasp of your spending patterns, it’s time to create a realistic budget. Start by listing all your sources of income and then allocate funds towards your essential expenses such as rent, utilities, and groceries. Next, prioritize your financial goals and allocate a portion of your income towards achieving them. Finally, set aside some money for discretionary spending, but be mindful not to go overboard.

4. Use Cash Envelopes 💸

Image Source: roadmapmoney.com

One effective way to stick to your budget is by using cash envelopes. This involves allocating a specific amount of cash for each category in your budget, such as groceries, entertainment, or transportation. Once the cash in an envelope is gone, you know you’ve reached your limit for that category. This method helps prevent overspending and encourages you to be more mindful of your expenses.

5. Review and Adjust Regularly 🔄

Lastly, it’s crucial to regularly review and adjust your budget as your financial situation changes. Life is unpredictable, and circumstances may arise that require you to make adjustments to your budget. By reviewing your budget regularly, you can ensure that it remains realistic and aligned with your goals. Be prepared to make changes when necessary and stay flexible in your approach to budgeting.

What are budgeting tips?

Budgeting tips refer to practical strategies and techniques that help individuals manage their finances effectively. These tips usually involve creating a budget, tracking expenses, setting financial goals, and making adjustments as needed.

Who can benefit from budgeting tips?

Anyone who wants to take control of their finances and achieve their financial goals can benefit from budgeting tips. Whether you’re a student trying to save for tuition, a young professional paying off student loans, or a family trying to make ends meet, budgeting can help you manage your money more efficiently.

When should you start using budgeting tips?

It’s never too early or too late to start using budgeting tips. The sooner you begin implementing these strategies, the better equipped you’ll be to handle your finances. Whether you’re just starting out in your career or nearing retirement, budgeting can provide you with a sense of control and peace of mind.

Where can you apply budgeting tips?

Budgeting tips can be applied in various aspects of your financial life. You can use them to manage your monthly expenses, save for a specific goal, pay off debt, or even plan for retirement. The key is to adapt these tips to your unique circumstances and goals.

Why are budgeting tips important?

Budgeting tips are important because they help you gain control of your finances and work towards achieving your financial goals. By following these tips, you can avoid unnecessary debt, build an emergency fund, save for the future, and ultimately achieve financial freedom.

How can you implement budgeting tips effectively?

To implement budgeting tips effectively, start by setting clear financial goals. Then, track your expenses and create a realistic budget that aligns with your goals. Use cash envelopes to limit your spending, and regularly review and adjust your budget as needed. Remember to stay disciplined and committed to your financial goals.

Advantages and Disadvantages of 5 Budgeting Tips

1. Advantages of budgeting tips:

Helps you save money and achieve financial goals

Provides a clear overview of your financial situation

Allows you to make informed decisions about spending

Helps you prioritize your expenses

Reduces financial stress and anxiety

2. Disadvantages of budgeting tips:

Requires discipline and self-control

Can be time-consuming to track expenses

May require adjustments as your financial situation changes

Limits discretionary spending

May require sacrifices to achieve long-term goals

FAQs about Budgeting Tips

1. Is budgeting only for people with limited income?

No, budgeting is beneficial for everyone regardless of their income level. It helps you allocate your resources effectively and make the most out of your money.

2. How often should I review my budget?

It’s recommended to review your budget at least once a month. However, if there are significant changes in your financial situation, such as a new job or an unexpected expense, it’s wise to review and adjust your budget accordingly.

3. Can budgeting help me save for vacations or other non-essential expenses?

Yes, budgeting can help you save for both essential and non-essential expenses. By allocating a certain amount of money towards your desired goal each month, you can gradually save up for that vacation or any other non-essential expense.

4. Is it necessary to use cash envelopes?

No, using cash envelopes is just one method of budgeting. If you prefer digital tools or tracking your expenses online, you can choose a method that works best for you. The key is to find a system that helps you stick to your budget.

5. Can budgeting help me pay off my debts?

Yes, budgeting can be an effective tool in paying off debts. By allocating a certain amount of money towards debt payments each month and cutting back on unnecessary expenses, you can accelerate your debt repayment and become debt-free sooner.

Conclusion

In conclusion, implementing these five budgeting tips can significantly improve your financial well-being. Setting clear goals, tracking your spending, creating a realistic budget, using cash envelopes, and reviewing and adjusting regularly are essential steps towards gaining control over your finances. By being disciplined, committed, and adaptable, you can achieve financial freedom and secure a brighter future.

Final Remarks

Dear Readers, we hope this article has provided you with valuable insights and practical tips on budgeting. Remember that everyone’s financial journey is unique, so it’s important to tailor these tips to your specific situation. Be proactive in managing your money, seek professional advice when needed, and never hesitate to make adjustments along the way. Here’s to your financial success!

This post topic: Budgeting Strategies