Secure Your Future: Build Your Retirement Savings Of 3 Million Now!

Retirement Savings 3 Million: How to Secure Your Financial Future

Introduction

Dear Readers,

1 Picture Gallery: Secure Your Future: Build Your Retirement Savings Of 3 Million Now!

Welcome to this informative article on retirement savings! In today’s fast-paced world, planning for your financial future is of utmost importance. Whether you are just starting your career or nearing retirement, having a solid retirement savings plan is crucial to ensure a comfortable and stress-free life in your golden years.

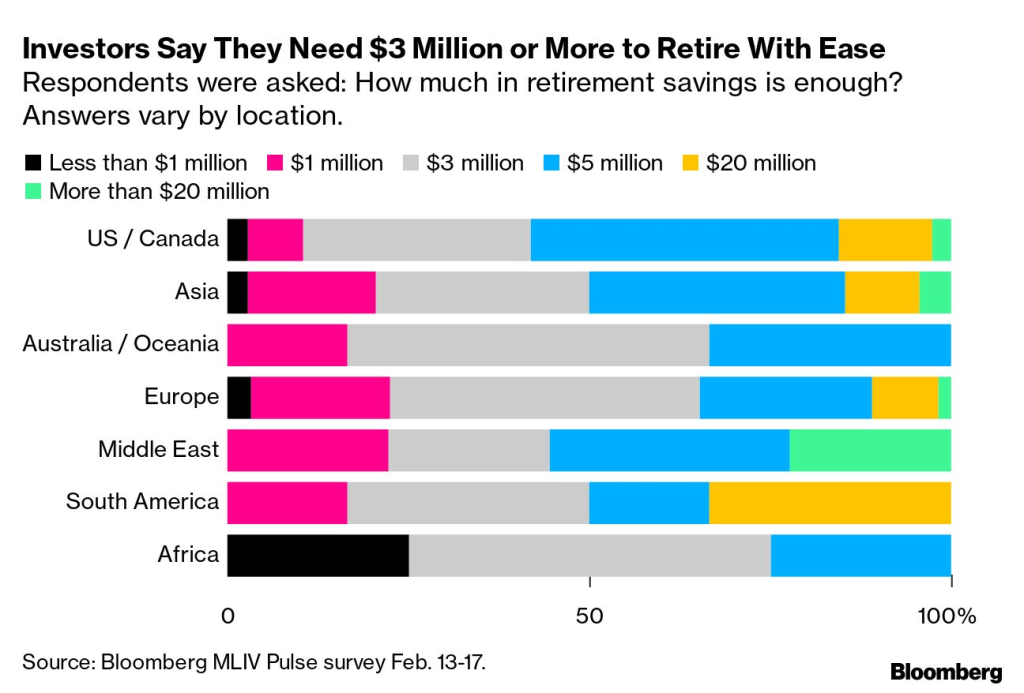

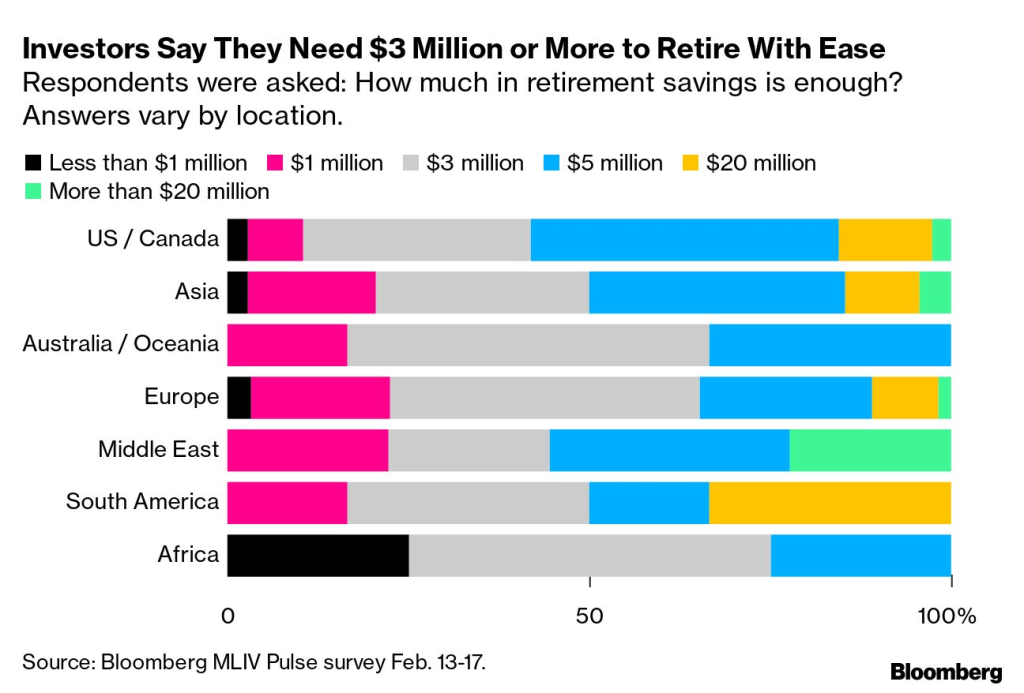

Image Source: twimg.com

In this article, we will delve into the topic of retirement savings of 3 million and explore various aspects related to it. We will discuss what it means, who can benefit from it, when and where to start saving, why it is important, and how to go about it. So, let’s get started and take charge of our financial future!

What is Retirement Savings 3 Million?

Retirement savings 3 million refers to the target amount of money one aims to accumulate in their retirement fund. It is a substantial sum that provides financial security and allows individuals to maintain their desired lifestyle after retirement. This goal is often considered as a benchmark to ensure a comfortable retirement.

Who Can Benefit from Retirement Savings 3 Million?

Retirement savings of 3 million is a goal that can benefit anyone who wishes to have a financially secure retirement. Whether you are a young professional just starting your career or someone who is nearing retirement age, it is never too early or too late to start saving for your retirement. By diligently saving and investing, you can work towards achieving this milestone and enjoy a worry-free retirement.

When and Where to Start Saving?

Image Source: bwbx.io

It is essential to start saving for retirement as early as possible. The power of compounding can significantly amplify the growth of your savings over time. The earlier you begin, the longer your investments have to grow, and the easier it becomes to achieve your retirement savings goal of 3 million.

As for where to save, there are various options available such as individual retirement accounts (IRAs), employer-sponsored retirement plans like 401(k)s, or a combination of both. It is advisable to consult with a financial advisor to determine the best strategy based on your individual circumstances and goals.

Why is Retirement Savings 3 Million Important?

Retirement savings of 3 million is important because it provides financial security during your retirement years. It allows you to maintain your desired standard of living, cover medical expenses, pursue hobbies, travel, and have peace of mind. Without adequate savings, individuals may face financial strain and have to compromise on their retirement dreams.

How to Achieve Retirement Savings 3 Million?

Building a retirement savings nest egg of 3 million requires careful planning and disciplined saving. Here are some steps you can take to work towards this goal:

Set a realistic target: Calculate your retirement needs based on your desired lifestyle and expected expenses.

Create a budget: Track your expenses and identify areas where you can cut back to save more.

Maximize contributions: Contribute the maximum allowed amount to your retirement accounts each year.

Invest wisely: Develop an investment strategy that suits your risk tolerance and long-term goals.

Monitor and adjust: Regularly review your retirement savings plan and make adjustments as needed.

Seek professional advice: Consult with a financial advisor who can provide guidance tailored to your specific situation.

Stay disciplined: Stick to your savings plan and avoid dipping into your retirement funds prematurely.

Advantages and Disadvantages of Retirement Savings 3 Million

Advantages:

Financial security in retirement.

Ability to maintain desired lifestyle.

Peace of mind and reduced financial stress.

Opportunity to pursue hobbies and travel.

Flexibility to handle unexpected expenses.

Disadvantages:

Requires disciplined saving and long-term commitment.

Market fluctuations can impact investment returns.

Inflation may erode the value of savings over time.

May require adjustments to current lifestyle to meet savings goals.

Unforeseen circumstances may affect the ability to save.

FAQs about Retirement Savings 3 Million

1. Can I retire comfortably with 3 million in savings?

Yes, retiring with 3 million in savings can provide a comfortable retirement lifestyle, depending on factors such as your desired standard of living and expected expenses.

2. How much should I save per month to reach 3 million in retirement savings?

The amount you need to save per month depends on various factors, including your current age, desired retirement age, and expected investment returns. A financial advisor can help you determine the appropriate savings rate.

3. What investment strategies should I consider for my retirement savings?

There are various investment strategies to consider, including diversifying your portfolio, investing in low-cost index funds, and regularly rebalancing your investments. Consult with a financial advisor to determine the best strategy for your goals.

4. Is it too late to start saving for retirement if I am in my 40s?

No, it is never too late to start saving for retirement. While starting earlier allows for more time to accumulate savings, diligently saving and investing can still help you reach your retirement savings goals.

5. Should I consider additional sources of income for my retirement?

Yes, considering additional sources of income, such as rental properties or part-time work, can provide extra financial security during retirement. However, it is essential to evaluate the feasibility and risks associated with these options.

Conclusion

In conclusion, retirement savings of 3 million is a significant goal that can provide financial security and a comfortable retirement lifestyle. By starting early, setting realistic targets, and following a disciplined savings and investment plan, you can work towards achieving this milestone. Remember, it’s never too late to start saving for retirement, and every dollar you save today will contribute to a brighter financial future.

Take action today to secure your financial future and enjoy a worry-free retirement!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. It is always recommended to consult with a qualified financial advisor before making any investment or retirement planning decisions. The author and publisher are not liable for any losses or damages arising from any actions taken based on the information provided.

This post topic: Budgeting Strategies