Unlock Your Future With Retirement Plan X On W2: Secure Your Financial Freedom Today!

Retirement Plan X on W2: A Comprehensive Guide to Securing Your Future

Greetings, Readers! In this article, we will delve into the intricacies of Retirement Plan X on W2 and how it can help you secure your future. Planning for retirement is crucial, and understanding the options available to you is the first step towards financial stability in your golden years.

Introduction

Retirement Plan X on W2 is a comprehensive retirement savings plan that offers numerous benefits and incentives for employees. This plan allows individuals to contribute a portion of their pre-tax income towards their retirement savings, providing them with a valuable nest egg for the future.

3 Picture Gallery: Unlock Your Future With Retirement Plan X On W2: Secure Your Financial Freedom Today!

Retirement Plan X on W2 is available to individuals who receive a W2 form, indicating that they are employed and earn income through wages. This plan is designed to provide financial security to employees by offering tax advantages and employer contributions.

Now, let’s take a closer look at Retirement Plan X on W2 and explore its various aspects.

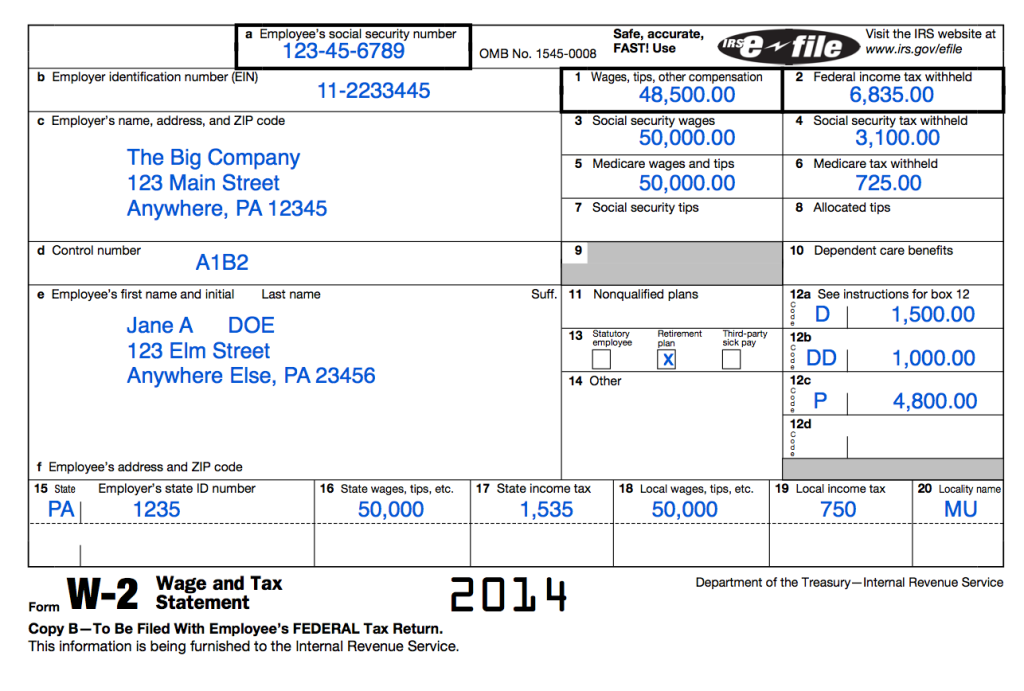

What is Retirement Plan X on W2? 🤔

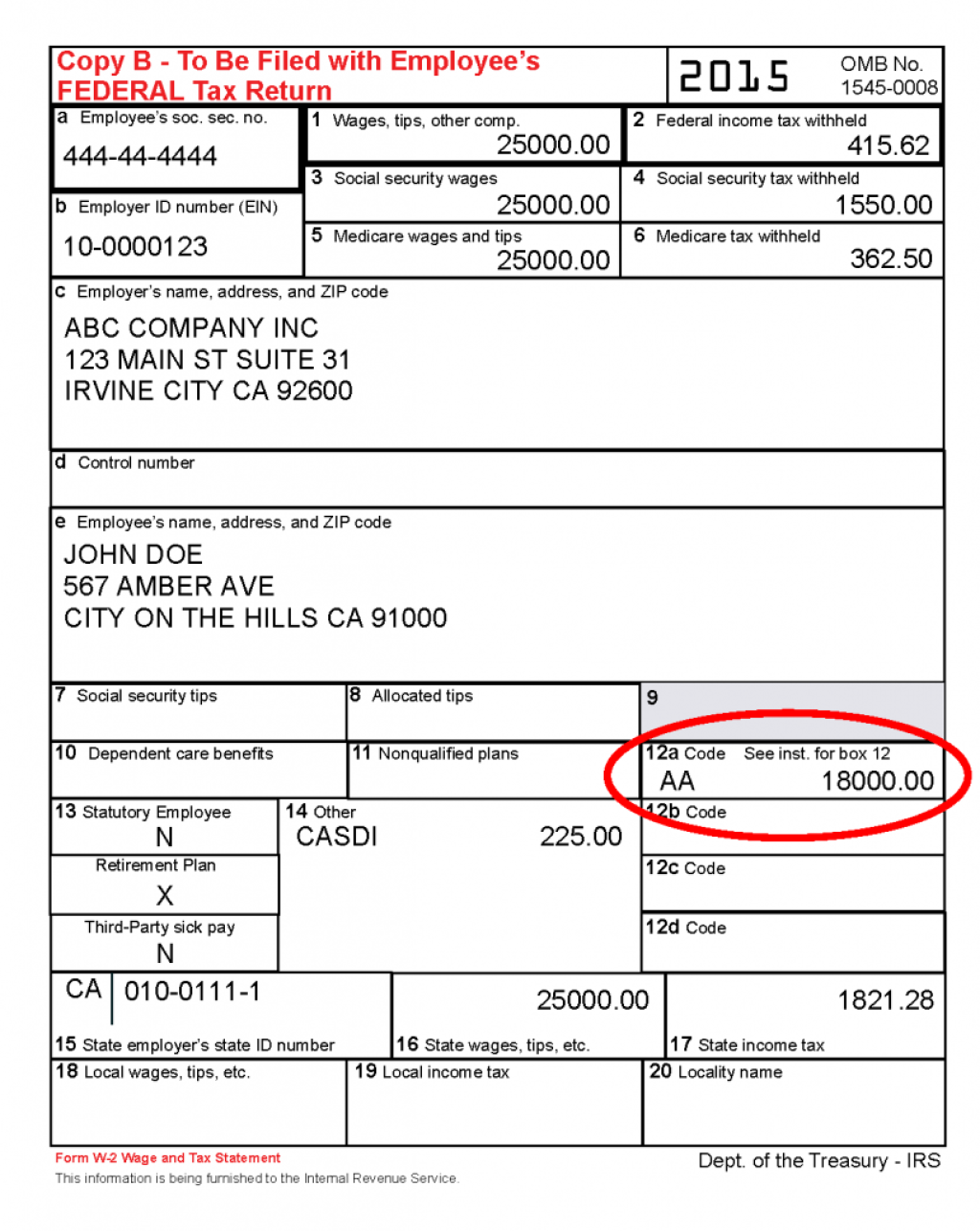

Retirement Plan X on W2 is a type of employer-sponsored retirement savings plan that allows employees to save for retirement by contributing a portion of their pre-tax income. This plan is governed by the Internal Revenue Service (IRS) and offers several advantages, including tax-deferred growth and potential employer match contributions.

Image Source: avocadoughtoast.com

By participating in Retirement Plan X on W2, employees can reduce their taxable income, as contributions are made with pre-tax dollars. This means that the money contributed towards the plan is not subject to federal income taxes until it is withdrawn during retirement.

Who is Eligible for Retirement Plan X on W2? 🕵️♀️

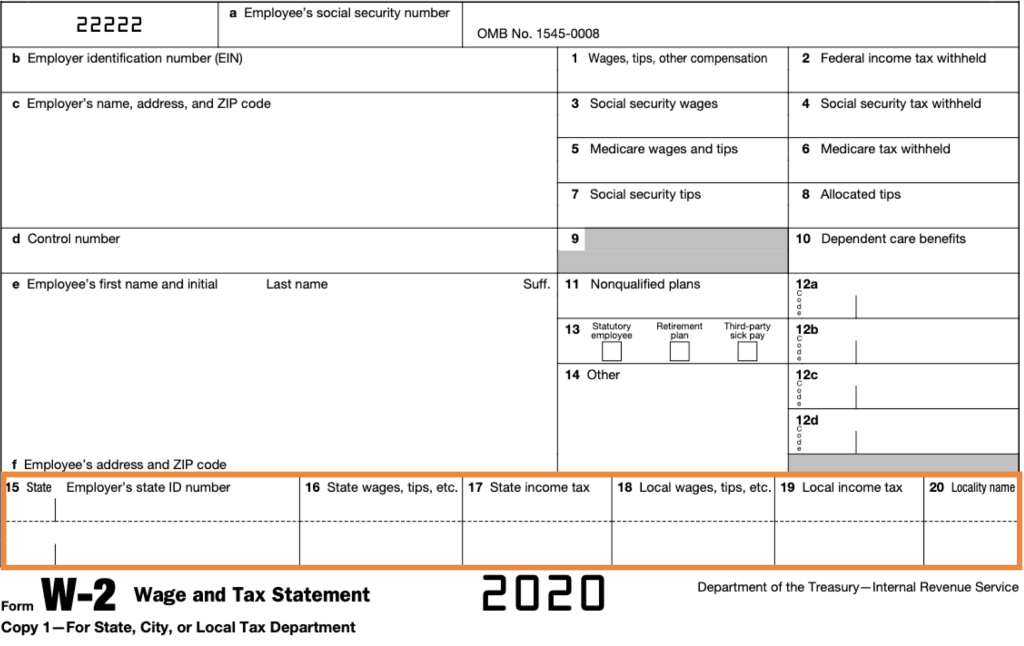

Retirement Plan X on W2 is available to employees who receive a W2 form from their employer. This form is issued to individuals who are classified as employees and receive income through wages. Self-employed individuals or independent contractors are not eligible for this particular retirement plan.

Additionally, employers may have specific eligibility criteria for their Retirement Plan X on W2. It is essential to check with your employer to determine if you meet the requirements to participate in the plan.

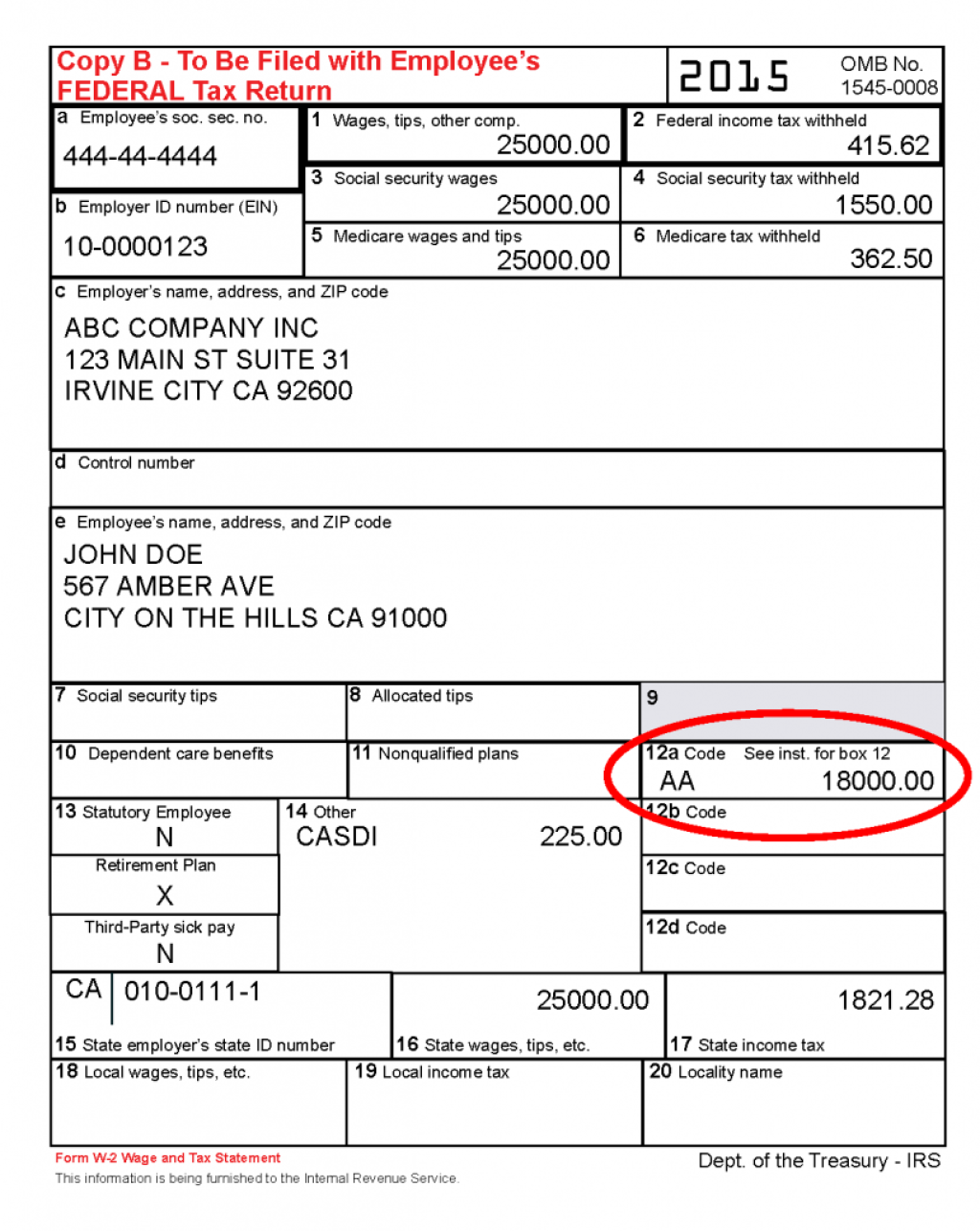

When Can I Contribute to Retirement Plan X on W2? ⏰

The contributions to Retirement Plan X on W2 are typically made through regular payroll deductions. The specific timing of contributions may vary depending on your employer’s payroll schedule.

Image Source: onpay.com

Most employers offer the option to contribute a percentage of your pre-tax income to the plan with every paycheck. This automates the process and ensures that you consistently save for retirement.

Where are Retirement Plan X on W2 Contributions Invested? 🏦

Retirement Plan X on W2 contributions are typically invested in a range of financial instruments, such as mutual funds, stocks, bonds, and other investment options. The exact investment choices offered may vary depending on the plan and the investment options selected by your employer.

It is crucial to review the available investment options and consider your risk tolerance and retirement goals when selecting how your contributions will be invested.

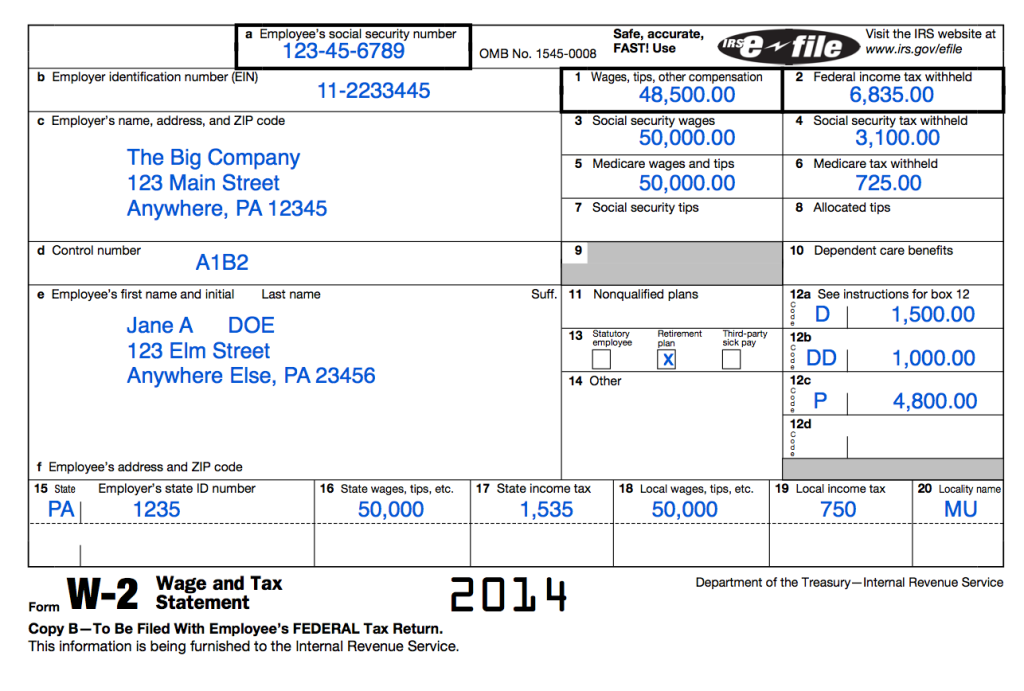

Why Should I Choose Retirement Plan X on W2? 🤷♂️

Retirement Plan X on W2 offers several advantages that make it an attractive option for individuals looking to save for retirement:

Tax advantages: Contributions to the plan are made with pre-tax dollars, reducing your taxable income in the present and allowing your savings to grow tax-deferred until withdrawal.

Employer match: Some employers offer a matching contribution to Retirement Plan X on W2, effectively providing free money towards your retirement savings.

Automatic savings: Contributions are deducted directly from your paycheck, making it easy to save consistently without having to actively manage your investments.

Investment growth: The funds contributed to Retirement Plan X on W2 have the potential to grow over time, thanks to the various investment options available.

Portability: In many cases, you can take your retirement savings with you if you change jobs, allowing you to continue building your nest egg without disruption.

Image Source: forbes.com

While Retirement Plan X on W2 offers several advantages, it is essential to consider the potential disadvantages as well.

This post topic: Budgeting Strategies