Secure Your Future With Retirement Fund 2060: Start Planning Now!

Retirement Fund 2060: Securing Your Future

Introduction

Dear Readers,

1 Picture Gallery: Secure Your Future With Retirement Fund 2060: Start Planning Now!

Welcome to our comprehensive guide on retirement fund 2060, a topic that holds immense importance for individuals planning their financial future. In this article, we will delve into the various aspects of retirement fund 2060, providing you with valuable insights and information to help you make informed decisions.

Image Source: viewjhfunds.com

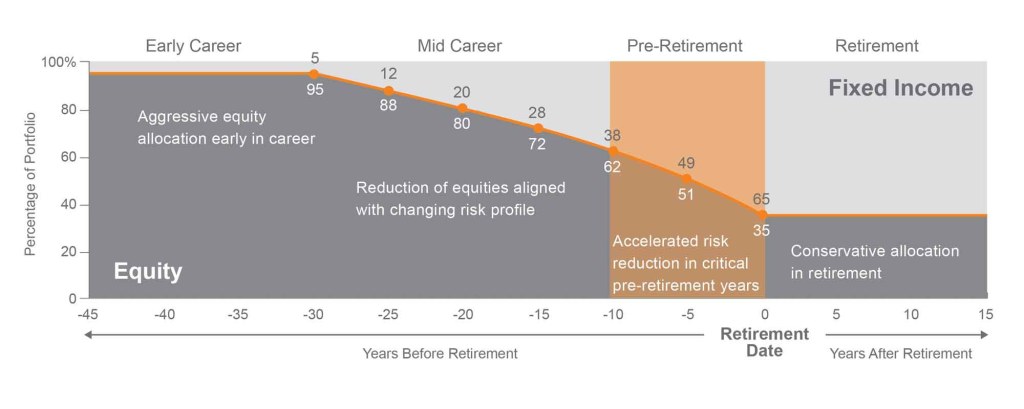

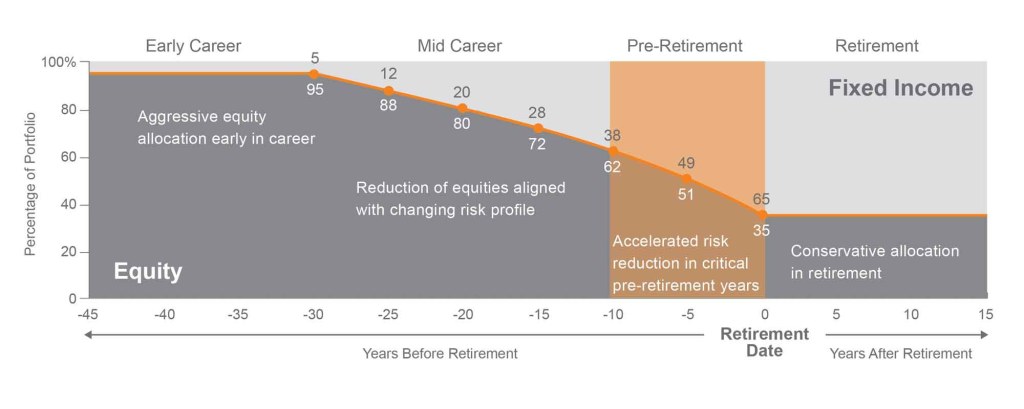

Retirement fund 2060 refers to a long-term investment strategy specifically designed to build wealth and secure financial stability for individuals who plan to retire in the year 2060. It offers a range of benefits and advantages, ensuring a comfortable and worry-free retirement for future generations.

Join us as we explore the key details, advantages, and disadvantages of retirement fund 2060, answering crucial questions such as what it entails, who can benefit from it, when and where to start, why it is essential, and how to make the most of it.

Table: Retirement Fund 2060 Overview

Term

Description

Type

Long-term investment strategy

Image Source: voya.com

Objective

Secure financial stability for retirement

Target Year

2060

Investment Options

Stocks, bonds, mutual funds, etc.

Benefits

Compound interest, tax advantages, diversified portfolio

Considerations

Risk tolerance, retirement goals, investment horizon

What is Retirement Fund 2060?

Retirement fund 2060 is a long-term investment vehicle specifically designed to help individuals achieve financial stability during their retirement years. It involves strategically allocating funds into various investment options, such as stocks, bonds, and mutual funds, to maximize returns over several decades.

By starting early and consistently contributing to a retirement fund, individuals can benefit from the power of compound interest, allowing their investments to grow substantially over time. This long-term approach aims to ensure a comfortable retirement by building a substantial nest egg that can support their desired lifestyle.

Who Can Benefit from Retirement Fund 2060?

Retirement fund 2060 is suitable for individuals who have a long investment horizon and are planning to retire in the year 2060. It is particularly advantageous for young professionals who have just started their careers, as they have ample time to capitalize on the compounding effect and ride out market fluctuations.

Additionally, retirement fund 2060 is an excellent choice for individuals who prefer a hands-off approach to investing. By utilizing professional fund managers and predefined investment strategies, they can confidently grow their retirement savings without the need for constant monitoring and adjustment.

When and Where Should You Start?

The best time to start a retirement fund 2060 is as early as possible. The power of compounding works best over a more extended period, allowing your investments to grow exponentially. By starting young, you give your investments more time to weather market volatility and potentially earn higher returns.

As for where to start, there are various financial institutions, such as banks, investment firms, and retirement plan providers, that offer retirement fund options. It is essential to research and compare different providers, considering factors such as fees, investment options, and customer service, to find the one that best suits your needs.

Why is Retirement Fund 2060 Essential?

Retirement fund 2060 is essential for several reasons. Firstly, it provides individuals with a reliable and sustainable income source during their retirement years, ensuring a comfortable and worry-free lifestyle. It helps alleviate financial stress and allows retirees to pursue their passions and enjoy the fruits of their labor.

Furthermore, retirement fund 2060 offers tax advantages, allowing individuals to defer taxes on their contributions until retirement when they may be in a lower tax bracket. It also provides a diverse investment portfolio, reducing the risk of relying on a single asset class and increasing the potential for long-term growth.

How to Make the Most of Retirement Fund 2060?

To make the most of retirement fund 2060, it is crucial to consider several factors. Firstly, determine your risk tolerance and investment goals, allowing you to create a well-balanced portfolio that aligns with your preferences. Consult with a financial advisor to ensure your investment strategy suits your long-term objectives.

Consistent contributions are also vital. Set up automatic contributions from your paycheck or bank account to ensure you consistently save for your retirement. Regularly review your investment performance and make adjustments as needed to optimize your returns.

Advantages and Disadvantages of Retirement Fund 2060

Advantages

1. Potential for long-term growth and wealth accumulation 📈

2. Compound interest amplifies returns over time 🔢

3. Diversification minimizes risk 🌐

4. Tax advantages reduce overall tax liability 💰

5. Professional management for a hands-off approach 👔

Disadvantages

1. Market volatility may affect short-term returns 📉

2. Lack of flexibility in accessing funds 💼

3. Risks associated with the chosen investment options 🎢

4. Potential for fees and expenses that can eat into returns 💸

5. Inflation may erode purchasing power over time 💹

Frequently Asked Questions (FAQ)

Q: Can I access my retirement fund 2060 before retirement?

A: In most cases, accessing retirement funds before retirement age may result in penalties and taxes. However, specific circumstances, such as financial hardship or disability, may allow for early withdrawals with certain conditions.

Q: How much should I contribute to my retirement fund 2060?

A: The ideal contribution amount depends on various factors, including your income, expenses, retirement goals, and desired lifestyle. It is recommended to contribute as much as possible while ensuring it aligns with your overall financial well-being.

Q: Can I change my investment options within the retirement fund 2060?

A: Yes, most retirement fund providers allow you to change your investment options periodically. However, it is essential to consider the potential consequences of such changes and consult a financial advisor if needed.

Q: What happens to my retirement fund 2060 if I change jobs?

A: When changing jobs, you typically have several options for your retirement funds, such as rolling them over into an IRA or transferring them into your new employer’s retirement plan. It is advisable to carefully evaluate each option and consider the associated fees and investment options.

Q: Can I have multiple retirement funds for different retirement years?

A: Yes, it is possible to have multiple retirement funds for different retirement years. This approach allows you to tailor your investments to specific timeframes and adjust your risk tolerance accordingly.

Conclusion

In conclusion, retirement fund 2060 offers a strategic and effective way to secure your financial future. By starting early, investing consistently, and making informed decisions, you can build a substantial nest egg that ensures a comfortable retirement in the year 2060.

While retirement fund 2060 comes with advantages and disadvantages, its long-term benefits far outweigh the potential challenges. With careful planning, professional guidance, and a commitment to your financial goals, you can pave the way for a worry-free retirement.

We hope this article has provided you with valuable insights and information to embark on your retirement fund 2060 journey. Remember, the key is to start early, stay consistent, and make informed decisions. Your future self will thank you!

Final Remarks

Dear Readers,

Before concluding, it is essential to note that the information provided in this article serves as a general guide and does not constitute personalized financial advice. Each individual’s financial situation is unique, and it is advisable to consult with a qualified financial advisor before making any investment decisions.

Additionally, past performance of investment options does not guarantee future results, and it is crucial to consider the risks associated with investing in the stock market and other asset classes. Make sure to conduct thorough research and seek professional guidance to make informed choices.

Thank you for joining us on this journey to explore retirement fund 2060. We hope you found this article informative and empowering. Here’s to a prosperous and fulfilling retirement!

This post topic: Budgeting Strategies