Mastering Budget Balancing Strategies: Unlock Financial Success With Our Power-Packed Tips!

Budget Balancing Strategies: Achieving Financial Stability

Greetings, Readers! In this article, we will delve into the world of budget balancing strategies and explore effective ways to achieve financial stability. Taking control of your finances is crucial in today’s fast-paced world, and by implementing these strategies, you can ensure a bright financial future. So let’s dive in and discover the secrets to balancing your budget!

2 Picture Gallery: Mastering Budget Balancing Strategies: Unlock Financial Success With Our Power-Packed Tips!

Introduction

Before we dive into the specifics of budget balancing strategies, let’s take a moment to understand what it entails. Balancing your budget simply means aligning your income and expenses in a way that allows you to save and avoid unnecessary debt. It requires careful planning, prioritization, and disciplined financial habits. By achieving a balanced budget, you can eliminate financial stress, achieve your goals, and secure a stable financial future.

Now, let’s explore the main components of budget balancing strategies:

What exactly is budget balancing?

Image Source: scaledagileframework.com

🔍 Budget balancing refers to the process of managing your income and expenses in a way that allows you to meet your financial goals and maintain financial stability. It involves evaluating your income sources, tracking your expenses, and making necessary adjustments to ensure a healthy financial situation.

Who can benefit from budget balancing strategies?

🔍 Budget balancing strategies are beneficial for individuals from all walks of life. Whether you are a student trying to manage your expenses, a young professional juggling multiple financial commitments, or a family looking to save for the future, these strategies can help you achieve financial stability.

When should you start implementing budget balancing strategies?

Image Source: naco.org

🔍 The answer is simple: now! It’s never too late or too early to start taking control of your finances. The sooner you start implementing budget balancing strategies, the faster you can achieve financial stability and make your money work for you.

Where can you implement budget balancing strategies?

🔍 Budget balancing strategies can be implemented in all aspects of your financial life. Whether it’s managing your household expenses, controlling your impulsive spending habits, or optimizing your investments, these strategies can be applied in various areas to ensure a balanced budget.

Why is budget balancing important?

🔍 Budget balancing is essential for several reasons. Firstly, it allows you to save for emergencies and future goals such as buying a house or retirement. Secondly, it helps you avoid unnecessary debt and financial stress. Additionally, budget balancing enables you to gain control over your finances and make informed financial decisions.

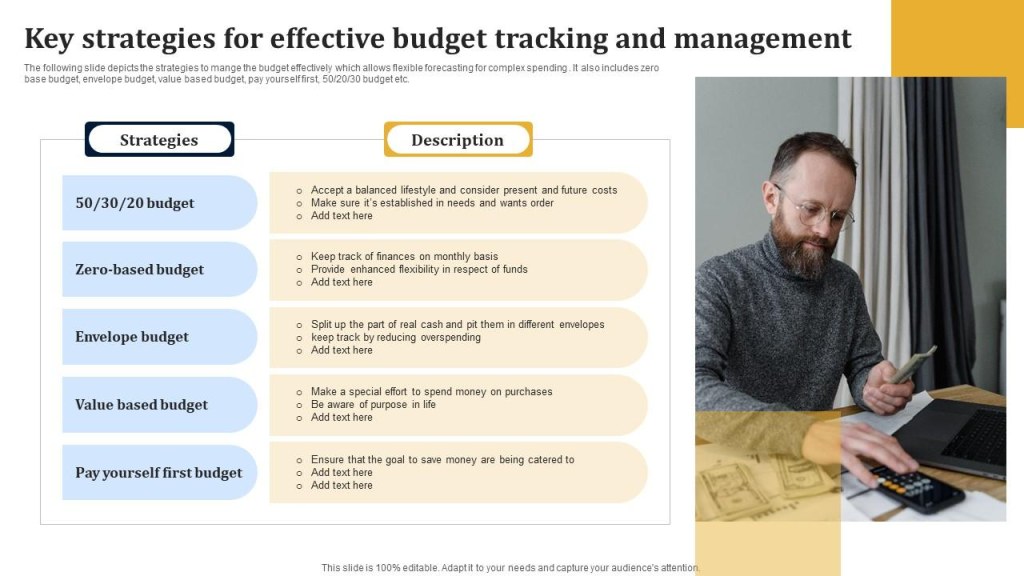

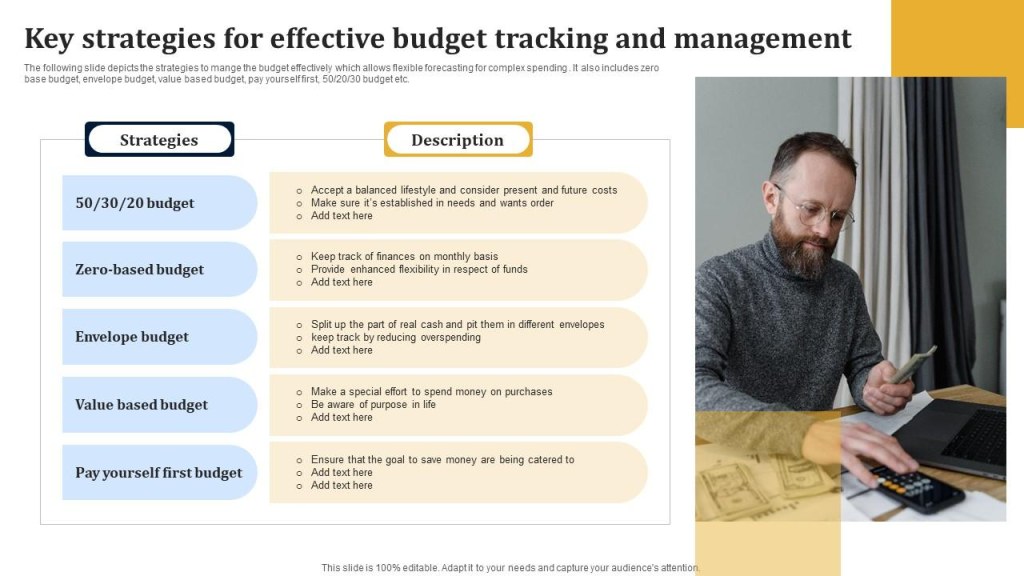

How can you implement budget balancing strategies?

Image Source: slideteam.net

🔍 Implementing budget balancing strategies requires careful planning and disciplined financial habits. It involves creating a realistic budget, tracking your expenses, prioritizing your needs, cutting unnecessary expenses, and finding ways to increase your income. By following these steps, you can achieve a balanced budget and take control of your financial future.

Advantages and Disadvantages of Budget Balancing Strategies

Now, let’s take a closer look at the advantages and disadvantages of implementing budget balancing strategies:

Advantages:

1. Financial Stability: By balancing your budget, you can achieve financial stability and eliminate stress caused by financial uncertainties.

2. Debt Reduction: Budget balancing strategies help you avoid unnecessary debt and pay off existing debts more efficiently.

3. Goal Achievement: With a balanced budget, you can save for your goals, whether it’s buying a car, going on a dream vacation, or starting a business.

4. Improved Financial Decision-Making: By tracking your expenses and understanding your financial situation, you can make informed decisions and avoid impulsive spending.

5. Peace of Mind: Knowing that your finances are in order brings peace of mind and allows you to focus on other aspects of your life.

Disadvantages:

1. Sacrifices and Discipline: Implementing budget balancing strategies may require sacrifices such as cutting back on certain expenses and maintaining discipline in your financial habits.

2. Initial Adjustment Period: It may take time to adjust to the new budgeting habits and find the right balance between income and expenses.

3. Unexpected Expenses: Despite careful planning, unexpected expenses can still arise, which may disrupt your budget temporarily.

4. Limited Flexibility: Strict budgeting may limit your flexibility in certain areas, such as impromptu purchases or spontaneous outings.

5. Emotional Challenges: Balancing your budget may bring up emotional challenges, especially when it comes to cutting back on certain expenses or making difficult financial decisions.

Frequently Asked Questions

1. Is it possible to balance my budget if I have a low income?

Yes, it is possible! Budget balancing is all about aligning your income and expenses, regardless of the amount. By creating a realistic budget and prioritizing your needs, you can achieve financial stability even with a low income.

2. How often should I review and adjust my budget?

It’s recommended to review and adjust your budget regularly, ideally on a monthly basis. This allows you to track your expenses, identify areas for improvement, and ensure that your budget remains aligned with your financial goals.

3. Can budget balancing strategies help me save for retirement?

Absolutely! Budget balancing strategies are instrumental in saving for retirement. By allocating a portion of your income towards retirement savings and making consistent contributions, you can secure a comfortable retirement.

4. What if I have multiple sources of income?

Having multiple sources of income can provide additional flexibility when balancing your budget. It’s important to track and manage all income sources effectively and allocate them wisely to meet your financial goals.

5. Should I seek professional help for budget balancing?

While budget balancing is something you can do on your own, seeking professional help, such as a financial advisor or planner, can provide valuable insights and guidance. They can help you create a personalized budget and develop effective strategies to achieve your financial goals.

Conclusion

In conclusion, balancing your budget is a crucial step towards achieving financial stability and securing a bright financial future. By implementing effective budget balancing strategies, you can take control of your finances, eliminate unnecessary debt, and save for your goals. Remember, it’s never too late to start! Begin your journey towards a balanced budget today and reap the rewards in the long run.

Final Remarks

Please note that the information provided in this article is for educational purposes only and should not be considered financial advice. It’s important to consult with a professional financial advisor or planner before making any significant financial decisions. The responsibility for managing your finances lies solely with you, and by implementing budget balancing strategies, you can pave the way for a secure financial future.

This post topic: Budgeting Strategies