Secure Your Retirement With $1M Savings: Act Now For A Prosperous Future!

Retirement $1M Savings: Building a Secure Future

Introduction

Dear Readers,

3 Picture Gallery: Secure Your Retirement With $1M Savings: Act Now For A Prosperous Future!

Welcome to our comprehensive guide on retirement $1M savings. In today’s fast-paced world, it is crucial to plan for your retirement to ensure financial security and peace of mind in your golden years. By diligently saving and investing, you can build a substantial nest egg that will support you throughout your retirement. In this article, we will explore the various aspects of retirement $1M savings, including what it is, who can benefit from it, when and where to start, why it matters, and how to achieve it. Let’s dive in and secure your future!

What is Retirement $1M Savings?

Image Source: annuityexpertadvice.com

🔍 Retirement $1M savings refers to the goal of amassing a total of $1 million in savings and investments to fund your retirement. It is a common benchmark used by many individuals as a financial milestone to ensure a comfortable and fulfilling retirement lifestyle.

Retirement $1M savings is not a fixed amount that everyone must achieve, but rather a goal that can be adjusted based on your retirement needs and lifestyle aspirations. It provides a rough estimate of the savings required to sustain your desired standard of living after retirement.

It is important to note that the $1 million figure is not a guarantee of financial security in retirement, as individual circumstances and living costs may vary. However, it serves as a useful target for those seeking a solid foundation for their retirement years.

Who Can Benefit from Retirement $1M Savings?

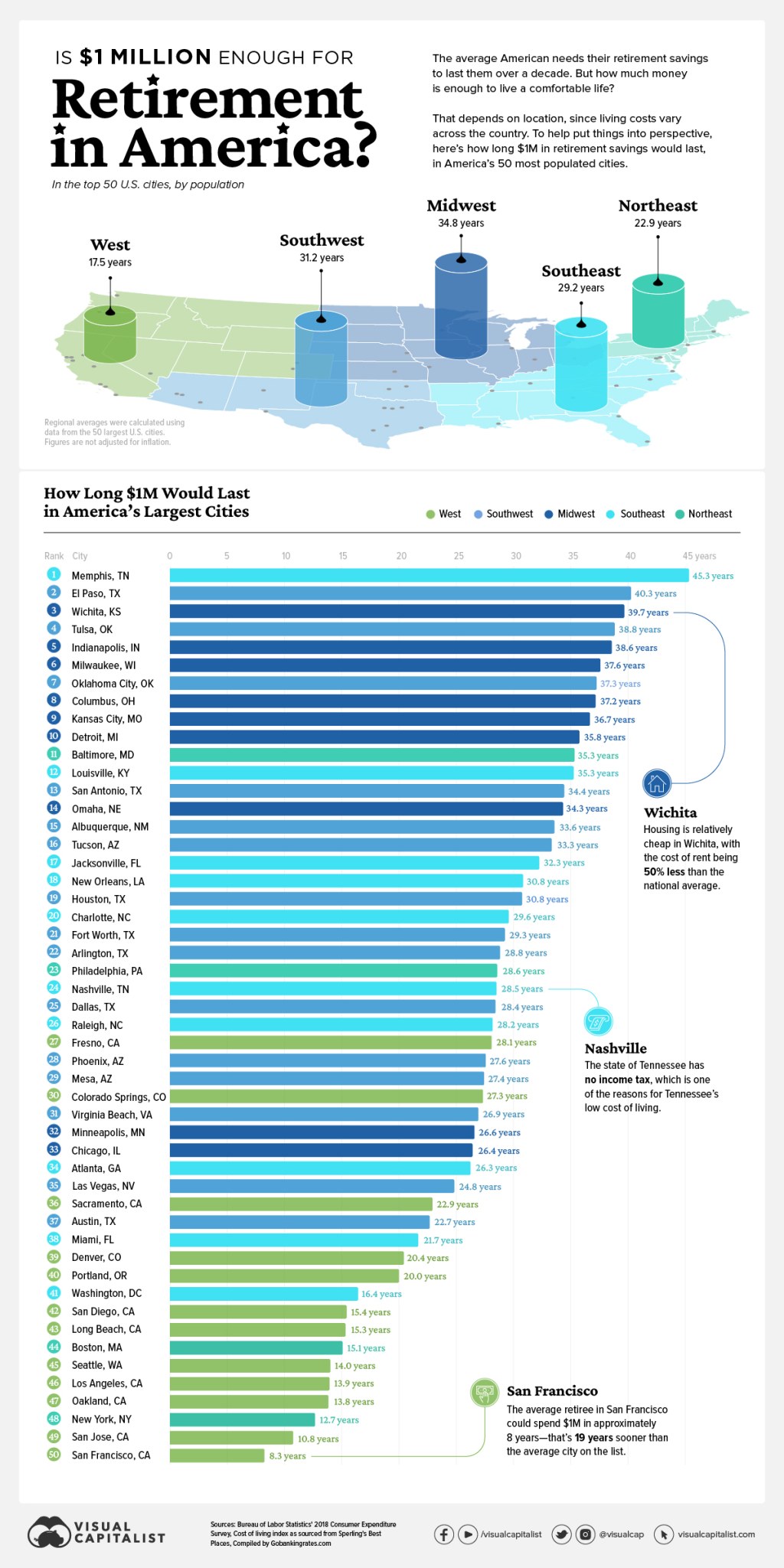

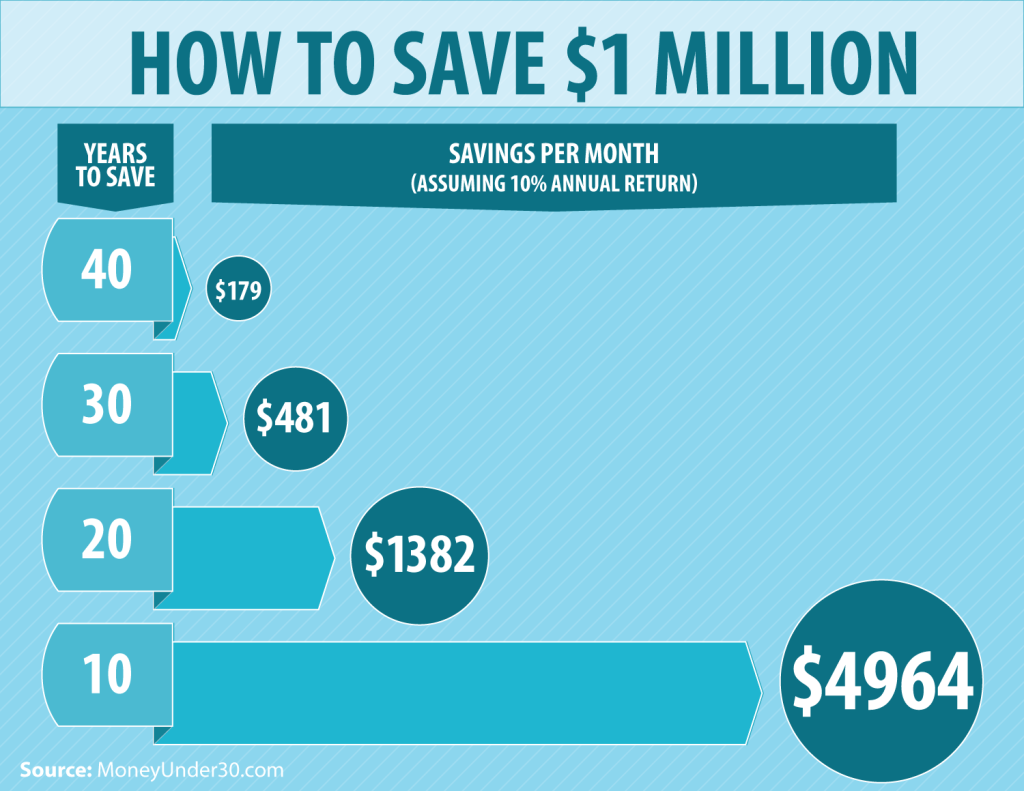

Image Source: moneyunder30.com

🔍 Retirement $1M savings is a goal that can benefit individuals from all walks of life, regardless of their current age or income level. Whether you are just starting your career or nearing retirement, it is never too early or too late to begin saving for your future.

Young professionals can take advantage of the power of compounding by starting early and allowing their investments to grow over time. On the other hand, individuals closer to retirement can adopt strategies to catch up on their savings and maximize their investments in a shorter timeframe.

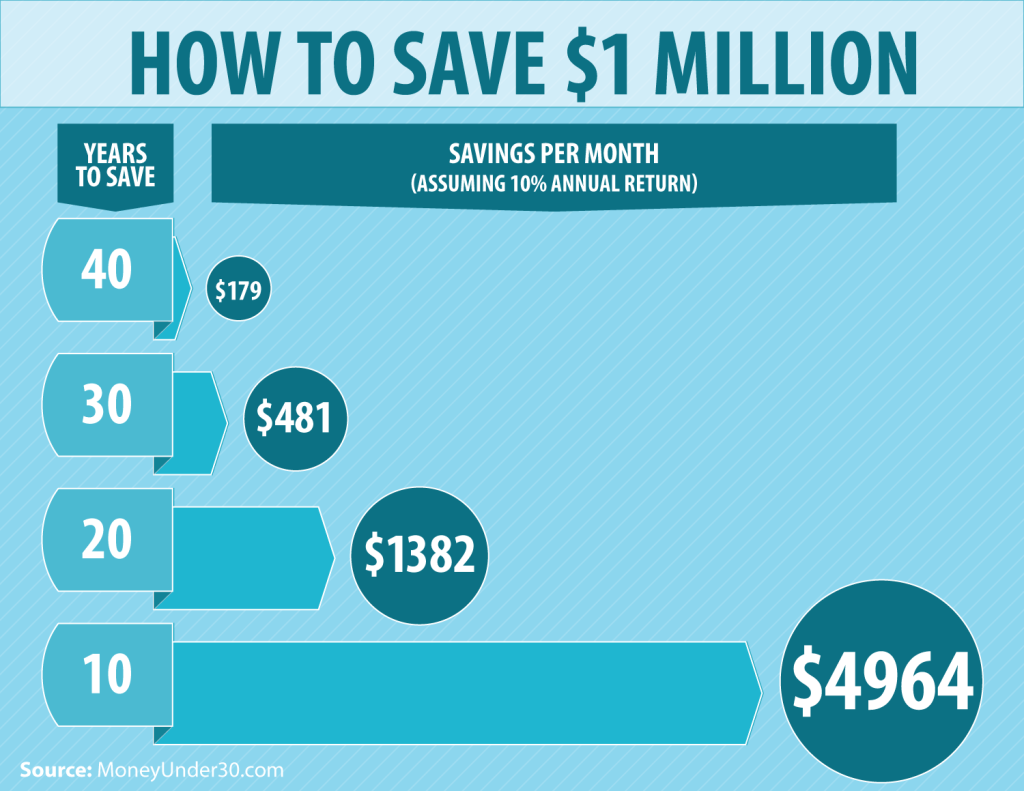

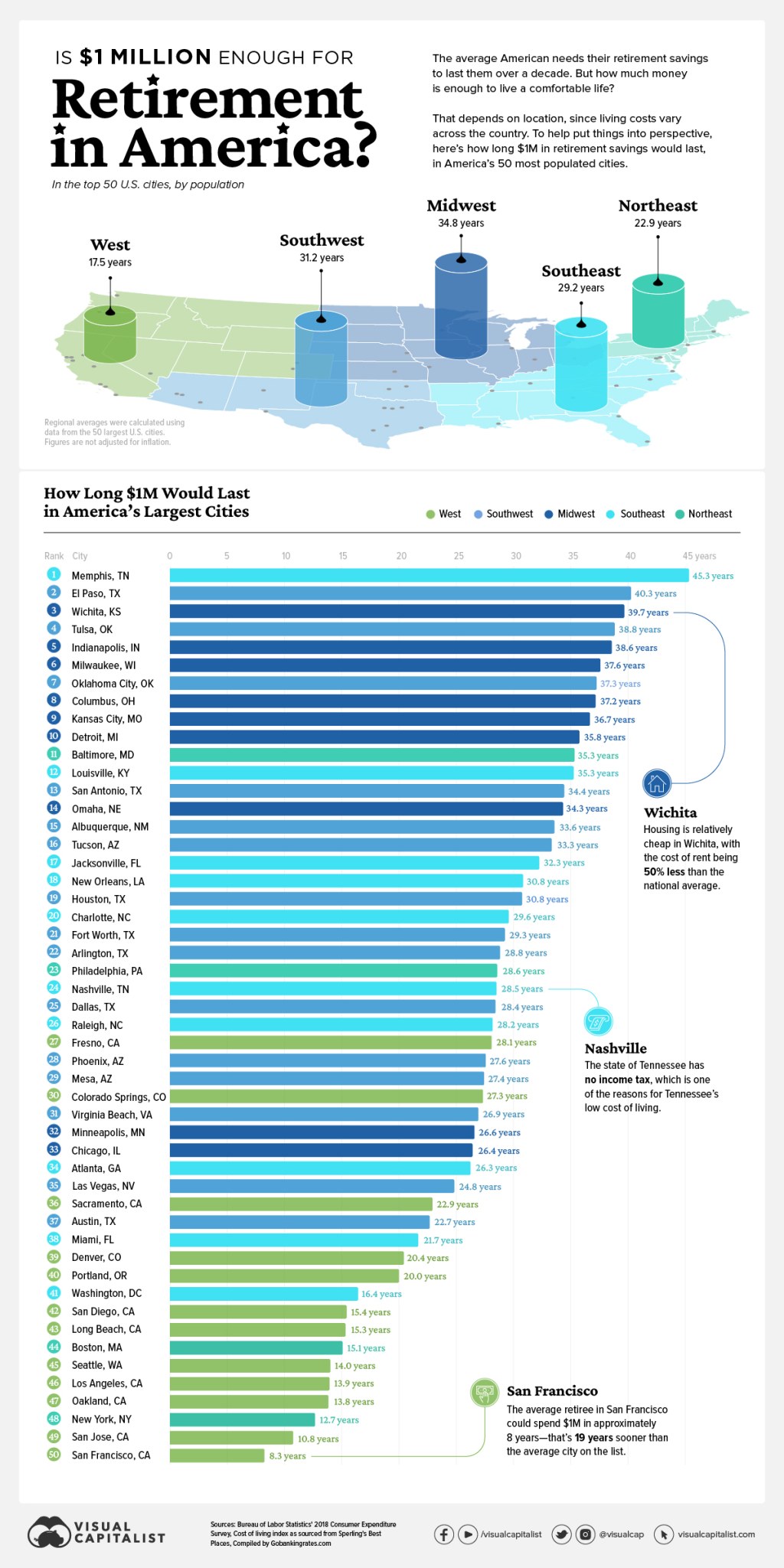

Image Source: visualcapitalist.com

Retirement $1M savings is especially crucial for those without a pension plan or other retirement benefits. By taking control of your financial future, you can secure a comfortable retirement independent of government or employer assistance.

When and Where to Start Saving for Retirement?

🔍 The best time to start saving for retirement is now. The power of compound interest and long-term investments greatly favors early savers. By starting early, you give your investments more time to grow, potentially allowing you to accumulate a larger retirement fund.

When it comes to where to save for retirement, various options are available. Employer-sponsored retirement plans, such as 401(k)s or pension plans, offer tax advantages and matching contributions, making them an excellent starting point. Individual Retirement Accounts (IRAs) also provide tax benefits and flexibility in investment choices.

Additionally, investing in low-cost index funds and exchange-traded funds (ETFs) can help diversify your portfolio and minimize investment fees. It is essential to consult with a financial advisor to determine the best investment strategy based on your risk tolerance and retirement goals.

Why Retirement $1M Savings Matters?

🔍 Retirement $1M savings matters because it provides a tangible goal and a sense of financial security for your retirement years. With the rising cost of living and increasing life expectancy, it is crucial to have a substantial nest egg to maintain your desired lifestyle in retirement.

By achieving retirement $1M savings, you can enjoy a worry-free retirement, free from financial constraints. It provides you with the freedom to pursue your passions, travel, spend time with loved ones, and engage in activities that bring you joy.

Furthermore, retirement $1M savings ensures that you are prepared for unexpected expenses, such as medical emergencies or long-term care. It allows you to maintain your independence and access the necessary resources to enjoy your retirement to the fullest.

How to Achieve Retirement $1M Savings?

🔍 Achieving retirement $1M savings requires a combination of consistent saving, prudent investing, and diligent financial planning. Here are some steps to help you on your journey:

Step 1: Set Clear Retirement Goals

Clearly define your retirement goals and the lifestyle you desire. Consider factors such as living expenses, healthcare costs, and desired activities to estimate your retirement income needs.

Step 2: Create a Budget and Stick to It

Develop a realistic budget that allows you to save a significant portion of your income. Cut unnecessary expenses and redirect those funds towards your retirement savings.

Step 3: Maximize Retirement Account Contributions

Take full advantage of employer-sponsored retirement plans and individual retirement accounts. Contribute the maximum allowed amount and benefit from any employer matching contributions.

Step 4: Diversify Your Investments

Spread your investments across different asset classes to minimize risk. Consider diversifying your portfolio with stocks, bonds, real estate, and other investment vehicles to enhance potential returns.

Step 5: Monitor and Adjust Your Plan

Regularly review your retirement plan and make necessary adjustments based on changing circumstances, market conditions, and your evolving retirement goals.

Step 6: Consult with a Financial Advisor

Seek guidance from a qualified financial advisor who specializes in retirement planning. They can provide personalized advice tailored to your unique financial situation and help you stay on track towards your retirement $1M savings goal.

Advantages and Disadvantages of Retirement $1M Savings

Advantages

1. Financial Security: Retirement $1M savings provide a secure financial foundation for your retirement years.

2. Independence: It allows you to maintain your independence and make choices based on your preferences and desires.

3. Flexibility: With retirement $1M savings, you have the flexibility to adapt to unexpected life events and enjoy your retirement on your terms.

4. Peace of Mind: Knowing that you have a substantial retirement fund brings peace of mind and reduces financial stress.

5. Generational Wealth: By building a significant retirement fund, you can leave a financial legacy for your loved ones.

Disadvantages

1. Required Discipline: Achieving retirement $1M savings requires discipline and sacrifice in terms of saving and budgeting.

2. Market Volatility: Economic downturns and market fluctuations can impact investment returns and potentially affect your retirement fund.

3. Inflation Risk: The rising cost of living can erode the purchasing power of your retirement savings over time.

4. Long-Term Commitment: Building a retirement fund takes time, and it may require a long-term commitment before you can fully enjoy its benefits.

5. Individual Circumstances: Every individual’s financial situation is unique, and retirement $1M savings may not be suitable for everyone. It is essential to assess your specific needs and adjust your retirement goals accordingly.

Frequently Asked Questions (FAQs)

1. Is $1 million enough for retirement?

Yes, $1 million can provide a comfortable retirement for many individuals, especially when combined with other sources of income like Social Security or a pension. However, individual circumstances may vary, and it is crucial to assess your specific needs and adjust your savings goals accordingly.

2. How much should I save for retirement each month?

The amount you should save for retirement each month depends on various factors, including your current age, retirement goals, and desired lifestyle. It is recommended to save at least 10-15% of your income towards retirement, but the more you can save, the better.

3. Can I retire before reaching $1 million in savings?

Yes, you can retire before reaching $1 million in savings, especially if you have other sources of income or if you are willing to adjust your lifestyle accordingly. However, it is important to analyze your financial situation and ensure that your retirement savings can sustain your desired lifestyle.

4. What investment options are suitable for retirement $1M savings?

Investment options suitable for retirement $1M savings include a diversified portfolio of stocks, bonds, real estate, and other assets. It is essential to consult with a financial advisor to determine the optimal investment strategy based on your risk tolerance and retirement goals.

5. When should I start saving for retirement?

The best time to start saving for retirement is as early as possible. The power of compound interest allows your investments to grow over time, giving you a head start towards achieving your retirement $1M savings goal.

Conclusion

In conclusion, retirement $1M savings is a crucial milestone to aim for in securing a comfortable and fulfilling retirement. It provides financial security, independence, and peace of mind, allowing you to enjoy your golden years to the fullest.

By following the steps outlined in this guide and taking control of your financial future, you can build a substantial retirement fund that will support you throughout your retirement. Remember, it is never too early or too late to start saving for retirement. Start today, and secure a bright future for yourself!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. It is essential to consult with a qualified financial advisor before making any investment decisions or implementing a retirement savings strategy. Remember that individual circumstances may vary, and it is crucial to assess your specific needs and adjust your retirement goals accordingly.

This post topic: Budgeting Strategies