Maximizing Success: Unlocking The Power Of Strategy Budget Schedule – Take Action Now!

Strategy Budget Schedule

Introduction

Dear Readers,

1 Picture Gallery: Maximizing Success: Unlocking The Power Of Strategy Budget Schedule – Take Action Now!

Welcome to our article on strategy budget schedule. In today’s fast-paced and competitive business world, it is crucial for companies to have an effective strategy in place to allocate their resources efficiently. A well-planned budget schedule plays a vital role in achieving business objectives and maximizing profitability. In this article, we will explore the importance of strategy budget schedule, its key components, and the benefits it can bring to your organization. So, let’s dive in and learn more about this essential business tool.

What is Strategy Budget Schedule? 📅

Image Source: smartsheet.com

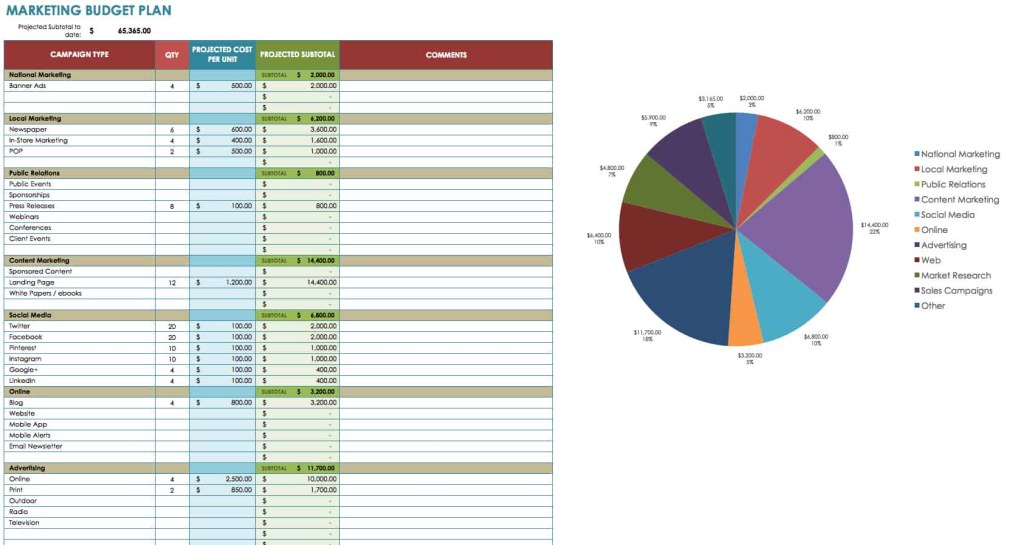

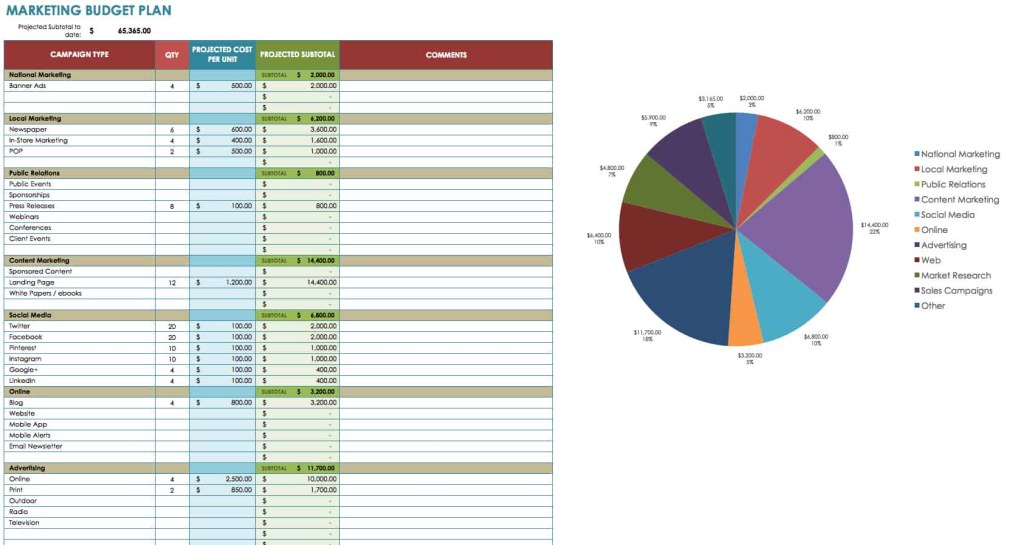

At its core, strategy budget schedule refers to a detailed plan that outlines how a company will allocate its financial resources over a specific period of time. It involves setting goals, identifying key expenses, and determining the timing and frequency of expenditure. A strategy budget schedule serves as a roadmap for the company’s financial activities and helps to ensure that funds are allocated in alignment with the organization’s strategic priorities. It allows businesses to make informed decisions regarding resource allocation and enables them to track their financial performance.

Who Needs a Strategy Budget Schedule? 🤔

A strategy budget schedule is essential for organizations of all sizes and across various industries. From small startups to large corporations, every business can benefit from having a well-planned budget in place. Whether you are an entrepreneur looking to launch a new venture or a seasoned executive managing an established company, a strategy budget schedule provides the financial structure and discipline necessary to achieve your business goals. It helps to ensure that resources are allocated efficiently and effectively, enabling you to optimize your operations and drive growth.

The ideal time to create a strategy budget schedule is during the annual planning process. As the new fiscal year approaches, it is crucial to evaluate your business objectives and financial goals. By aligning your strategy with a well-defined budget schedule, you can ensure that your resources are allocated in a manner that supports your vision and objectives. However, it is important to note that a strategy budget schedule is not a one-time exercise. It should be regularly reviewed and updated to reflect changing market conditions, internal dynamics, and business priorities.

Where to Start with Strategy Budget Schedule? 🏢

When starting with a strategy budget schedule, it is important to begin by clearly defining your business objectives and goals. This will help you identify the key areas where resources need to be allocated. You should also analyze your historical financial data and market trends to make informed projections and estimates. Once you have a clear understanding of your financial needs, you can start allocating resources to different departments and activities. It is important to involve key stakeholders in the budgeting process and ensure that everyone is aligned with the overall strategy.

Why is Strategy Budget Schedule Important? 📈

A strategy budget schedule is important for several reasons. Firstly, it helps to ensure that financial resources are allocated in a manner that supports the organization’s strategic objectives. By setting clear goals and aligning them with a budget schedule, companies can prioritize their spending and focus on activities that drive growth and profitability. Secondly, a strategy budget schedule provides transparency and accountability within the organization. It allows for better financial control and facilitates decision-making based on accurate and up-to-date information. Finally, a well-planned budget schedule enables companies to measure their financial performance and make adjustments as needed to stay on track.

How to Create an Effective Strategy Budget Schedule? ✅

Creating an effective strategy budget schedule requires careful planning and attention to detail. Here are some key steps to consider:

Set Clear Objectives: Clearly define your business objectives and goals.

Analyze Historical Data: Review past financial performance and market trends to inform your projections.

Identify Key Expenses: Determine the major expenses that need to be accounted for in your budget.

Allocate Resources: Distribute your financial resources to different departments and activities based on their priority and importance.

Monitor and Review: Regularly monitor your budget performance and review it against your actual results.

Make Adjustments: If necessary, make adjustments to your budget based on changing circumstances or new opportunities.

Communicate and Involve: Ensure that all relevant stakeholders are aware of the budget plan and involve them in the decision-making process.

Advantages and Disadvantages of Strategy Budget Schedule

Advantages:

Improved Financial Control: A strategy budget schedule enables organizations to have better control over their financial resources, leading to more informed decision-making.

Resource Optimization: By allocating resources based on strategic priorities, companies can optimize their operations and achieve better results.

Performance Measurement: A well-planned budget schedule allows for the measurement of financial performance and facilitates the identification of areas that require improvement.

Transparency and Accountability: A budget schedule promotes transparency within the organization and holds stakeholders accountable for their financial responsibilities.

Decision-Making Support: A strategy budget schedule provides valuable insights and data, enabling management to make informed decisions.

Disadvantages:

Time-Consuming: Creating and maintaining a strategy budget schedule requires time and effort, especially in large organizations with complex operations.

Uncertainty: External factors such as market volatility or regulatory changes can impact the accuracy of budget projections.

Resistance to Change: Implementing a budget schedule may face resistance from employees who are not accustomed to financial planning and control.

Inflexibility: A rigid budget schedule may limit the organization’s ability to respond to unforeseen circumstances or exploit new opportunities.

Over-Reliance on Historical Data: Budgeting solely based on past performance may fail to account for future market trends or emerging technologies.

Frequently Asked Questions (FAQ)

Q: Is it necessary for small businesses to have a strategy budget schedule?

A: Absolutely! A strategy budget schedule is essential for small businesses as it helps them allocate their limited resources effectively and make informed decisions to drive growth.

Q: How often should a strategy budget schedule be reviewed?

A: It is recommended to review the budget schedule at least quarterly or whenever significant changes occur in the business environment.

Q: Can a strategy budget schedule be adjusted during the fiscal year?

A: Yes, a budget schedule should be flexible enough to accommodate unforeseen circumstances or changes in business priorities.

Q: How can a strategy budget schedule help in cost control?

A: By setting clear spending limits and tracking expenses, a budget schedule enables organizations to have better control over costs and identify areas of potential savings.

Q: What role does communication play in the budgeting process?

A: Communication is crucial in the budgeting process as it ensures that all stakeholders are aligned with the budget plan and fosters a sense of ownership and accountability.

Conclusion

In conclusion, a well-planned strategy budget schedule is a powerful tool that can help organizations effectively allocate their financial resources and achieve their business objectives. By setting clear goals, prioritizing expenses, and regularly monitoring performance, companies can optimize their operations, drive growth, and maximize profitability. However, it is important to recognize the potential challenges and drawbacks associated with budgeting and take proactive steps to address them. With proper planning and implementation, a strategy budget schedule can be a valuable asset for any organization striving for success.

Thank you for reading!

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be construed as professional advice. Before making any financial decisions, it is recommended to consult with a qualified professional.

This post topic: Budgeting Strategies