Maximize Your Retirement Savings With Our Interactive Excel Spreadsheet: Start Planning Now!

Retirement Savings Excel Spreadsheet: A Comprehensive Tool for Financial Planning

Gone are the days when people relied solely on manual calculations and guesswork to plan for their retirement. With the advancement of technology, individuals now have access to powerful tools that can simplify and streamline their financial planning process. One such tool is the retirement savings excel spreadsheet, which offers a convenient and efficient way to track and manage retirement funds. In this article, we will explore the benefits, features, and usage of this spreadsheet, empowering readers with the knowledge they need to make informed decisions about their retirement savings.

Introduction

Hello, readers! Welcome to our comprehensive guide on retirement savings excel spreadsheet. In today’s fast-paced world, it is crucial to have a solid financial plan for retirement. We understand the importance of making informed decisions when it comes to managing your hard-earned money. That’s why we have put together this article to introduce you to the power of using an excel spreadsheet for retirement savings. By the end of this article, you will have a clear understanding of how this tool can revolutionize your financial planning journey.

1 Picture Gallery: Maximize Your Retirement Savings With Our Interactive Excel Spreadsheet: Start Planning Now!

Now, let’s dive into the world of retirement savings excel spreadsheets and discover how they can help you achieve your retirement goals.

What is a Retirement Savings Excel Spreadsheet?

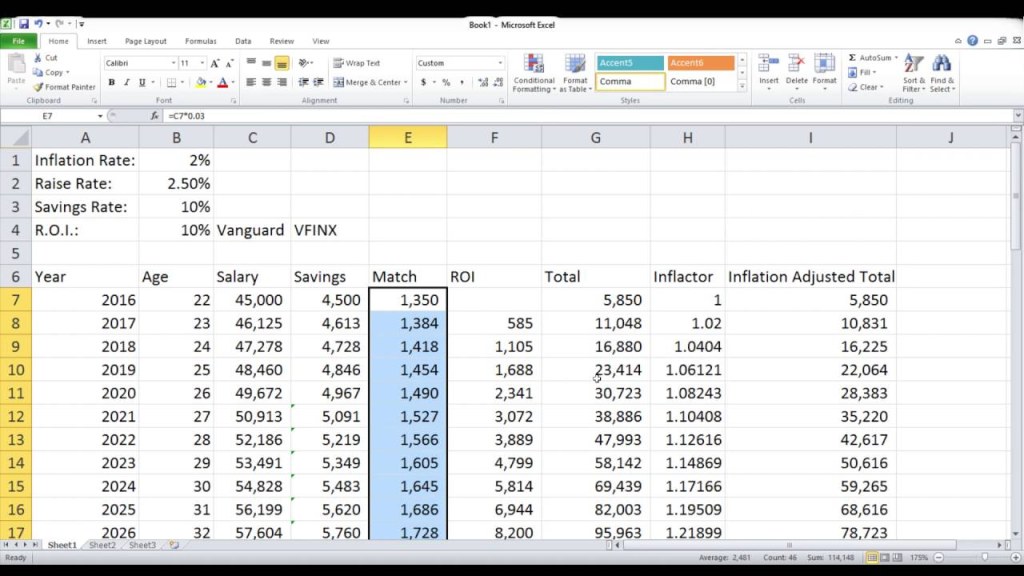

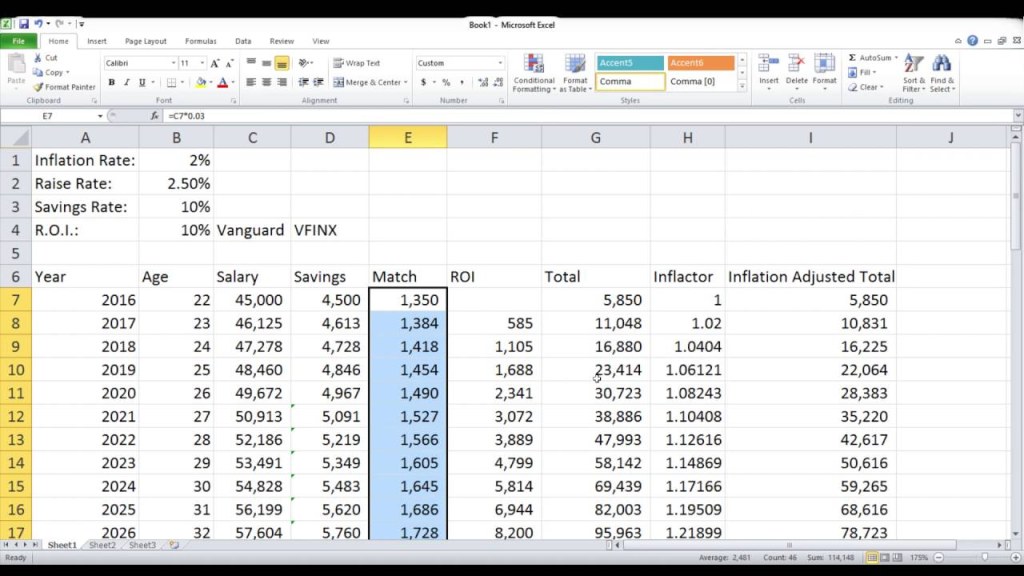

An excel spreadsheet designed for retirement savings is a digital tool that allows individuals to calculate, track, and monitor their retirement funds. It provides a structured framework to input various financial data such as income, expenses, investments, and retirement goals. With the spreadsheet’s built-in formulas and functions, it automatically calculates key metrics such as savings rate, projected retirement age, and required savings amount to achieve desired retirement income.

By organizing and analyzing financial data, the retirement savings excel spreadsheet becomes a valuable resource for individuals to make informed decisions about their retirement planning strategies.

Why Choose a Retirement Savings Excel Spreadsheet?

Image Source: ytimg.com

There are several reasons why individuals choose to use an excel spreadsheet for their retirement savings:

1. 📈 Comprehensive Tracking: The spreadsheet allows users to monitor their retirement funds in a centralized location, providing a holistic view of their financial health.

2. 💡 Customizable: Users can personalize the spreadsheet according to their specific financial situation, goals, and risk tolerance.

3. ⏳ Time-Saving: The automated calculations and pre-built formulas in the spreadsheet eliminate the need for manual calculations, saving users valuable time and effort.

4. 💰 Goal-Oriented: The spreadsheet helps users set realistic retirement goals by providing projections and insights based on their current financial data.

5. 📊 Data Visualization: With charts, graphs, and visual representations, the spreadsheet makes it easier for users to understand and analyze their financial data.

Now that we have explored the what and the why of a retirement savings excel spreadsheet, let’s move on to the next section to understand who can benefit from using this tool.

Who can Benefit from a Retirement Savings Excel Spreadsheet?

The retirement savings excel spreadsheet is a versatile tool that can benefit a wide range of individuals:

1. 🎯 Young Professionals: Starting early is key when it comes to retirement savings. Young professionals can use the spreadsheet to set financial goals, track their progress, and make adjustments along the way.

2. 🏢 Employees: Whether you are an employee of a company or self-employed, the spreadsheet provides a simple yet powerful way to manage your retirement funds and make informed investment decisions.

3. 🤝 Couples and Families: The spreadsheet can be used jointly by couples and families to plan their retirement together, ensuring that both partners are actively involved in the process.

4. 🌍 Expatriates: Individuals living and working abroad can utilize the spreadsheet to navigate complex tax implications, currency fluctuations, and retirement plans specific to their host countries.

5. 💼 Business Owners: Entrepreneurs and business owners can use the spreadsheet to manage both personal and business retirement funds, ensuring a comprehensive approach to financial planning.

Now that we have identified the target audience for a retirement savings excel spreadsheet, let’s move on to discussing when and where to use this tool.

When and Where to Use a Retirement Savings Excel Spreadsheet?

The retirement savings excel spreadsheet can be used in various scenarios and locations:

1. 🏠 Personal Use: Individuals can use the spreadsheet to manage their personal retirement savings, irrespective of their location.

2. 🏢 Workplace: Many employers provide retirement savings plans, such as 401(k) or pension schemes. The spreadsheet can be used to complement these plans and provide additional insights into retirement readiness.

3. 🌍 International Assignments: Individuals working abroad can use the spreadsheet to compare retirement plans across different countries and make informed decisions regarding their financial future.

4. 💼 Financial Institutions: Banks, financial advisors, and other financial institutions can use the spreadsheet as a tool to assist their clients in retirement planning and investment management.

5. 📈 Investment Clubs: Members of investment clubs can utilize the spreadsheet to collectively analyze and track their retirement investments, promoting collaboration and knowledge-sharing.

Now that we have explored the when and where of using a retirement savings excel spreadsheet, let’s dig deeper into the reasons why individuals should consider incorporating this tool into their financial planning journey.

Why Use a Retirement Savings Excel Spreadsheet?

The retirement savings excel spreadsheet offers several advantages and disadvantages:

Advantages of Using a Retirement Savings Excel Spreadsheet

1. 📊 Comprehensive Analysis: The spreadsheet allows users to perform in-depth analysis of their retirement savings, enabling them to make informed decisions based on data-driven insights.

2. 💪 Flexibility: Users can customize the spreadsheet to match their unique financial goals, risk tolerance, and investment preferences.

3. ⏰ Time-Saving: The automated calculations and formulas in the spreadsheet save users valuable time and effort compared to manual calculations.

4. 📈 Performance Tracking: Users can track the performance of their retirement investments over time, allowing them to make adjustments and optimize their portfolio.

5. 🌍 Portability: The spreadsheet can be accessed and updated from various devices, making it convenient for users to manage their retirement savings on the go.

Disadvantages of Using a Retirement Savings Excel Spreadsheet

1. 📉 Learning Curve: Users without prior experience in excel may face a learning curve while setting up and utilizing the spreadsheet for retirement savings.

2. 🖥️ Technical Issues: Like any digital tool, excel spreadsheets may encounter technical issues, such as software compatibility or system crashes, which can disrupt the workflow.

3. 📂 Manual Data Entry: Regular manual data entry is required to keep the spreadsheet updated, which can be time-consuming and prone to human errors.

4. 💰 Limited Integration: Excel spreadsheets may have limited integration capabilities with other financial tools and platforms, limiting the overall connectivity of financial data.

5. 📈 Complex Scenarios: For individuals with complex financial situations, such as multiple income streams or intricate tax considerations, the simplicity of an excel spreadsheet may not suffice.

Now that we have explored the advantages and disadvantages of using a retirement savings excel spreadsheet, let’s move on to answering some frequently asked questions that users may have.

Frequently Asked Questions (FAQ)

1. How do I get started with a retirement savings excel spreadsheet?

To get started, you can download a pre-designed retirement savings excel spreadsheet template from various online sources or create your own from scratch using excel’s built-in features.

2. Can I use the retirement savings excel spreadsheet for multiple retirement accounts?

Yes, the spreadsheet can be customized to accommodate multiple retirement accounts, allowing you to track and manage each account separately or collectively.

3. How often should I update my retirement savings excel spreadsheet?

It is recommended to update the spreadsheet regularly, preferably on a monthly or quarterly basis, to ensure accurate and up-to-date financial data.

4. What are the essential financial data I should input into the retirement savings excel spreadsheet?

The essential financial data to include in the spreadsheet are income, expenses, investments, retirement goals, and any other relevant financial information specific to your situation.

5. Can I use the retirement savings excel spreadsheet for retirement planning beyond traditional savings accounts?

Yes, the spreadsheet can be used to plan for retirement beyond traditional savings accounts, such as individual retirement accounts (IRAs), employer-sponsored plans, annuities, and investment portfolios.

Now that we have answered some frequently asked questions, let’s move on to the conclusion of this article.

Conclusion

In conclusion, the retirement savings excel spreadsheet is a powerful tool for individuals seeking to take control of their financial future. It provides a structured and comprehensive platform to calculate, track, and manage retirement funds, enabling users to make informed decisions about their retirement planning strategies. While the spreadsheet offers advantages such as comprehensive analysis, flexibility, and performance tracking, it is essential to be aware of its disadvantages, including a learning curve and manual data entry. By leveraging the benefits and understanding the limitations, individuals can harness the power of the retirement savings excel spreadsheet to pave the way for a secure and comfortable retirement.

Final Remarks

Friends, we hope this article has provided you with valuable insights into the world of retirement savings excel spreadsheets. It is important to remember that while this tool can significantly simplify your retirement planning process, it should be used in conjunction with professional financial advice tailored to your specific needs. Always consult with a qualified financial advisor before making any significant financial decisions. Here’s to a prosperous and fulfilling retirement!

This post topic: Budgeting Strategies