Unlock Your Future: Discover The Astonishing Truth About Average Retirement Savings In The UK And Take Action Now!

Average Retirement Savings in the UK

Greetings, Readers!

Welcome to this informative article about average retirement savings in the UK. In today’s fast-paced world, planning for retirement is essential to ensure financial security and a comfortable lifestyle in your golden years. Understanding the average retirement savings in the UK will help you gauge your own preparedness and make informed decisions for your future.

1 Picture Gallery: Unlock Your Future: Discover The Astonishing Truth About Average Retirement Savings In The UK And Take Action Now!

Introduction

Retirement savings refer to the funds individuals set aside during their working years to support themselves financially after they stop working. It is crucial to have a retirement savings plan in place to cover living expenses, healthcare costs, and fulfill personal aspirations during retirement.

The average retirement savings in the UK can vary significantly depending on various factors such as age, income, and individual circumstances. To gain a clear understanding, let’s explore some key points related to average retirement savings in the UK.

What Are Average Retirement Savings?

🔎 Average retirement savings refer to the amount saved by individuals throughout their working lives to support themselves during retirement. It represents the median value of retirement savings across the UK population.

Image Source: raisin.co.uk

🔎 These savings can include contributions to pension plans, individual retirement accounts (IRAs), and other investments specifically designed for retirement purposes.

🔎 It is important to note that average retirement savings can vary significantly from individual to individual, as people have different financial goals, risk tolerances, and income levels.

Who Has Retirement Savings in the UK?

🔎 Retirement savings are crucial for everyone, regardless of their occupation or income level. Building a solid retirement fund is a responsibility that falls on individuals, regardless of whether they are self-employed, work for a company, or have multiple income streams.

🔎 In the UK, the majority of retirement savings come from workplace pension schemes, wherein both employees and employers contribute to the fund. However, not everyone has access to such schemes, especially those who are self-employed or work in sectors without mandatory pension provisions.

When Should You Start Saving for Retirement?

🔎 The earlier you start saving for retirement, the better. It is recommended to begin saving as soon as you start earning income. This allows for maximum time for your investments to grow and compound, increasing the overall value of your retirement savings.

🔎 However, it is never too late to start saving for retirement. Even if you are closer to retirement age, it is essential to prioritize saving and make the most of the time you have left to build a sufficient nest egg for your future.

Where Can You Save for Retirement?

🔎 There are various avenues available to save for retirement in the UK, including workplace pension schemes, personal pensions, self-invested personal pensions (SIPPs), and individual savings accounts (ISAs).

🔎 Workplace pension schemes are the most common and convenient way to save for retirement, as contributions are deducted automatically from your salary. Personal pensions and SIPPs offer more flexibility and control over investment choices, while ISAs provide tax advantages for retirement savings.

Why Are Retirement Savings Important?

🔎 Retirement savings are essential for financial security during your retirement years. They serve as a safety net to cover living expenses, healthcare costs, and indulge in recreational activities or pursue passions without financial constraints.

🔎 Relying solely on the state pension may not be sufficient to maintain the standard of living you desire. Building a substantial retirement fund ensures you can enjoy retirement to the fullest without worrying about money.

How Can You Maximize Your Retirement Savings?

🔎 There are several strategies you can employ to maximize your retirement savings, such as starting early, contributing regularly, diversifying investments, and seeking professional advice.

🔎 It is crucial to regularly review your retirement savings plan and make adjustments as needed to align with your changing financial circumstances and goals.

Advantages and Disadvantages of Retirement Savings

Advantages:

1️⃣ 💰 Financial Security: Retirement savings provide a safety net to support yourself financially during retirement.

2️⃣ 📈 Investment Growth: Properly invested retirement savings can grow over time, allowing for a more comfortable retirement.

3️⃣ 🎯 Goal-Oriented: Retirement savings help you achieve specific financial goals and fulfill lifelong dreams.

Disadvantages:

1️⃣ 💸 Financial Constraints: Saving for retirement may require sacrificing current spending, potentially impacting your lifestyle.

2️⃣ 📉 Investment Risks: Retirement savings are subject to market volatility and investment risks, which can impact returns.

3️⃣ ⏳ Time Commitment: Building a substantial retirement fund requires long-term commitment and discipline.

Frequently Asked Questions (FAQ)

Q: Are state pensions sufficient to cover retirement expenses in the UK?

A: While state pensions provide a basic income, they may not be enough to maintain a comfortable lifestyle. It is advisable to supplement them with additional retirement savings.

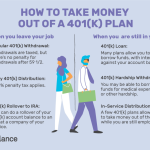

Q: Can I withdraw my retirement savings before reaching retirement age?

A: Generally, retirement savings are meant to be accessed after reaching a certain age. Early withdrawal may incur penalties or tax implications.

Q: How much should I save for retirement?

A: The amount you should save for retirement depends on your lifestyle goals, expected expenses, and desired retirement age. Consulting a financial advisor can help determine a suitable savings target.

Q: Can I contribute to multiple retirement savings accounts simultaneously?

A: Yes, you can contribute to multiple retirement savings accounts as long as you stay within the annual contribution limits and understand the tax implications of each account.

Q: Should I seek professional advice for retirement planning?

A: It is highly recommended to consult with a financial advisor or retirement specialist who can provide personalized guidance based on your unique financial situation and goals.

Conclusion

In conclusion, understanding the average retirement savings in the UK is vital for anyone planning for their future. By starting early, saving regularly, and making informed investment decisions, you can build a robust retirement fund that will provide financial security and enable you to enjoy a fulfilling retirement.

Take action today and evaluate your current retirement savings plan. Seek professional advice if needed and make adjustments to ensure you are on track to achieve your retirement goals. Your future self will thank you!

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Individual circumstances may vary, and it is advisable to consult with a qualified financial professional before making any financial decisions.

This post topic: Budgeting Strategies

![OC] Retirement ages in G : r/dataisbeautiful](https://fantotal.info/wp-content/uploads/2023/09/oc-retirement-ages-in-g-r-dataisbeautiful-150x150.png)