Mastering Budget Strategies For Young Adults: Unlock Financial Success Now!

Budget Strategies for Young Adults

Welcome, Readers! In this article, we will explore effective budget strategies for young adults. Managing finances can be challenging, especially for those who are just starting their careers and navigating the world of adulthood. However, with the right strategies in place, young adults can take control of their finances and build a strong foundation for their future. Let’s dive in and discover the key strategies that will help you achieve financial success.

Introduction

1. What are budget strategies for young adults?

1 Picture Gallery: Mastering Budget Strategies For Young Adults: Unlock Financial Success Now!

2. Who can benefit from implementing these strategies?

Image Source: mint.com

3. When should young adults start implementing budget strategies?

4. Where can young adults find resources and support to help them with their budgets?

5. Why are budget strategies important for young adults?

6. How can young adults effectively implement and maintain budget strategies?

Budget Strategies for Young Adults

1. What are budget strategies for young adults?

Budget strategies for young adults refer to the practices and techniques employed to effectively manage personal finances. These strategies involve creating a budget, tracking expenses, saving money, and making informed financial decisions.

2. Who can benefit from implementing these strategies?

Young adults who are just starting their careers or have recently entered the workforce can greatly benefit from implementing budget strategies. By developing good financial habits early on, they can avoid unnecessary debt and build a solid financial foundation.

3. When should young adults start implementing budget strategies?

It is never too early to start implementing budget strategies. As soon as young adults start earning an income, they should begin creating a budget and tracking their expenses. This early start will establish good financial habits and set them up for long-term success.

4. Where can young adults find resources and support to help them with their budgets?

There are numerous resources available to help young adults with their budgets. They can seek guidance from financial advisors, attend budgeting workshops, or use online budgeting tools and apps. Additionally, there are many online communities where young adults can connect with peers and share budgeting tips.

5. Why are budget strategies important for young adults?

Budget strategies are crucial for young adults as they lay the foundation for financial stability and success. By managing their money wisely, young adults can avoid unnecessary debt, save for future goals, and have the financial freedom to pursue their dreams.

6. How can young adults effectively implement and maintain budget strategies?

Young adults can effectively implement and maintain budget strategies by following these steps:

1. Set financial goals: Define short-term and long-term financial goals.

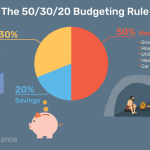

2. Create a budget: Determine income, track expenses, and allocate funds accordingly.

3. Track expenses: Regularly monitor and analyze spending habits.

4. Prioritize savings: Allocate a portion of income towards savings and investments.

5. Reduce unnecessary expenses: Cut back on non-essential spending.

6. Seek financial advice: Consult with financial advisors for guidance and support.

7. Review and adjust: Regularly review the budget and make necessary adjustments.

Advantages and Disadvantages

Advantages of Budget Strategies for Young Adults

1. Financial freedom: Budget strategies provide young adults with the freedom to make informed financial decisions and avoid unnecessary debt.

2. Goal achievement: By budgeting effectively, young adults can save towards their goals and achieve them faster.

3. Stress reduction: A well-managed budget reduces financial stress and promotes peace of mind.

4. Improved financial habits: Budgeting helps young adults develop good financial habits that will benefit them throughout their lives.

5. Increased savings: Implementing budget strategies allows young adults to save for emergencies, future investments, and retirement.

Disadvantages of Budget Strategies for Young Adults

1. Initial learning curve: Young adults may face challenges initially as they learn to create and manage a budget.

2. Restrictive feeling: Following a budget may sometimes feel restrictive, requiring discipline and sacrifice.

3. Unexpected expenses: Budgeting may not always account for unexpected expenses, requiring adjustments to be made.

4. Lifestyle changes: Young adults may need to make changes to their lifestyle to align with their budgeting goals.

5. Peer pressure: Social pressures can sometimes make it difficult for young adults to stick to their budgeting plans.

Frequently Asked Questions (FAQs)

1. How can I start creating a budget as a young adult?

To start creating a budget, gather information about your income and expenses. Categorize your expenses and allocate funds accordingly. Use online budgeting tools or spreadsheet templates to make the process easier.

2. Should I save or invest my money as a young adult?

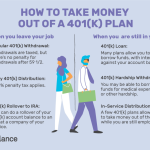

Both saving and investing are important for young adults. Start by building an emergency fund and then explore investment options that align with your financial goals and risk tolerance.

3. How do I handle unexpected expenses in my budget?

Handle unexpected expenses by setting aside a portion of your budget for emergencies. If the unexpected expense exceeds your emergency fund, reassess your budget and make necessary adjustments.

4. How can I stick to my budget when my friends are spending more?

Communicate your budgeting goals to your friends and find alternative activities or affordable options that align with your financial plans. Remember that financial stability is more important than short-term spending.

5. What resources can help me improve my financial literacy as a young adult?

There are numerous resources available to improve financial literacy, such as books, online courses, podcasts, and workshops. Take advantage of these resources to enhance your knowledge and make informed financial decisions.

Conclusion

In conclusion, implementing budget strategies is essential for young adults to achieve financial success. By creating a budget, tracking expenses, and making informed financial decisions, young adults can build a strong financial foundation and achieve their future goals. Start implementing these strategies today and secure a bright financial future for yourself. Remember, the key to success lies in your commitment and discipline to stick to your budget. Best of luck on your financial journey!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. It is always recommended to consult with a professional financial advisor before making any financial decisions.

This post topic: Budgeting Strategies