Mastering Personal Budgeting Strategies: Your Ultimate Guide To Financial Success

Budgeting Strategies Personal: Managing Your Finances Wisely

Greetings, Readers! In this article, we will explore effective budgeting strategies personal to help you take control of your finances and achieve your financial goals. Budgeting is a vital skill that enables individuals to make informed decisions about their money, ensuring they can cover their expenses, save for the future, and avoid unnecessary debt. By implementing these strategies, you can improve your financial well-being and secure a more stable future. Let’s dive in!

Introduction

3 Picture Gallery: Mastering Personal Budgeting Strategies: Your Ultimate Guide To Financial Success

Budgeting strategies personal involve the process of creating a plan to allocate income and manage expenses wisely. It is about setting financial goals, tracking expenses, and making conscious spending choices. By following these strategies, you can effectively control your finances and achieve financial stability. In this article, we will discuss various aspects of budgeting strategies personal, including what it is, who can benefit from it, when and where to implement it, why it is important, and how to get started.

What is Budgeting Strategies Personal?

📊 Budgeting strategies personal refer to the techniques and methods individuals use to manage their personal finances effectively. It involves creating a budget, tracking income and expenses, prioritizing financial goals, and making informed spending decisions. By implementing these strategies, individuals can gain better control over their money and improve their financial well-being.

Who Can Benefit from Budgeting Strategies Personal?

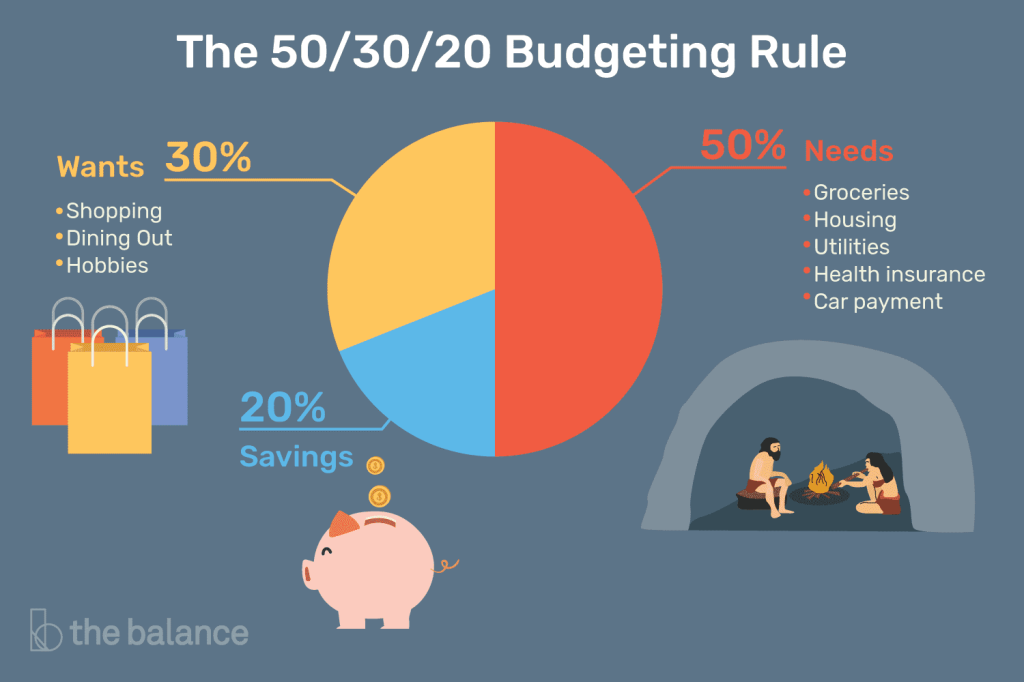

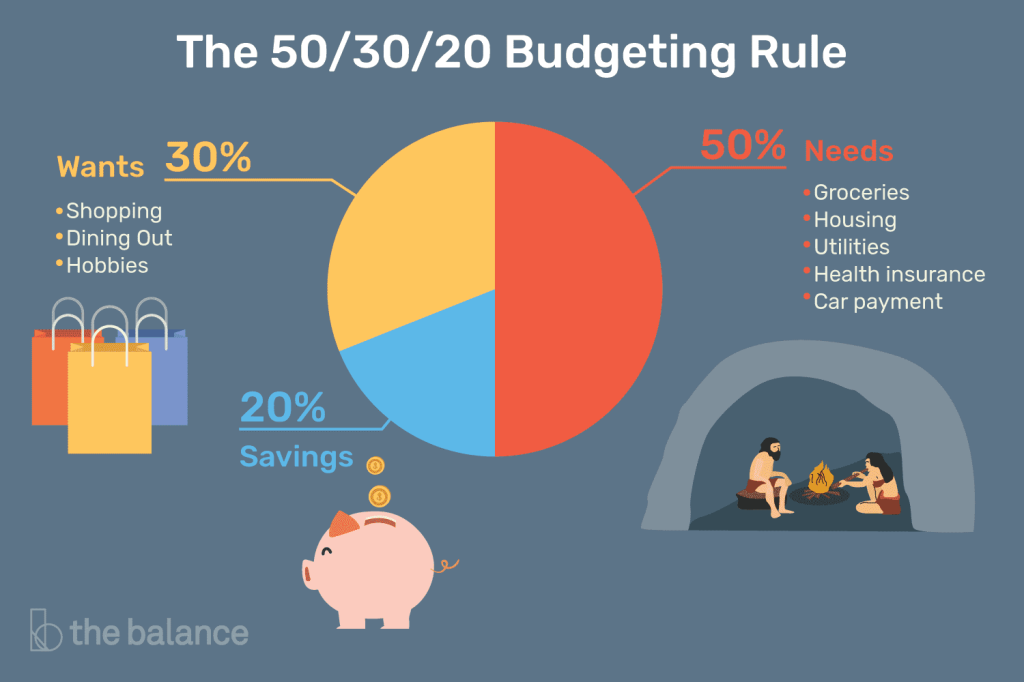

Image Source: thebalancemoney.com

🤔 Budgeting strategies personal can benefit individuals from all walks of life. Whether you are a student, a working professional, or a retiree, managing your personal finances is crucial for long-term financial success. People who want to save for a particular goal, pay off debt, or simply have a better understanding of where their money goes can greatly benefit from implementing budgeting strategies personal.

When and Where to Implement Budgeting Strategies Personal?

⌚ Budgeting strategies personal can be implemented at any stage of life. Whether you are just starting your career, getting married, or planning for retirement, it is never too early or too late to start managing your personal finances effectively. These strategies can be implemented in various settings, including households, small businesses, and personal financial planning.

Why is Budgeting Strategies Personal Important?

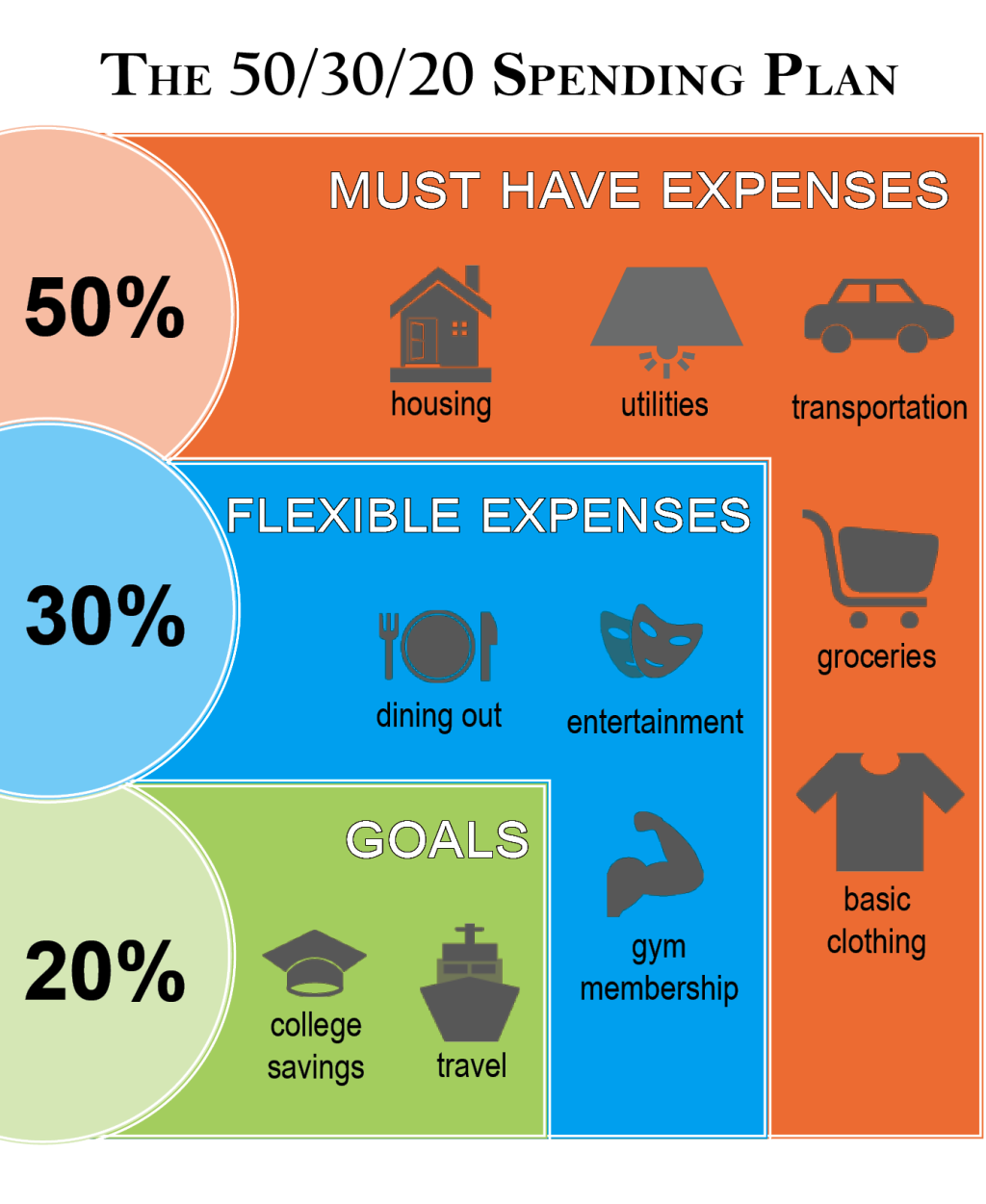

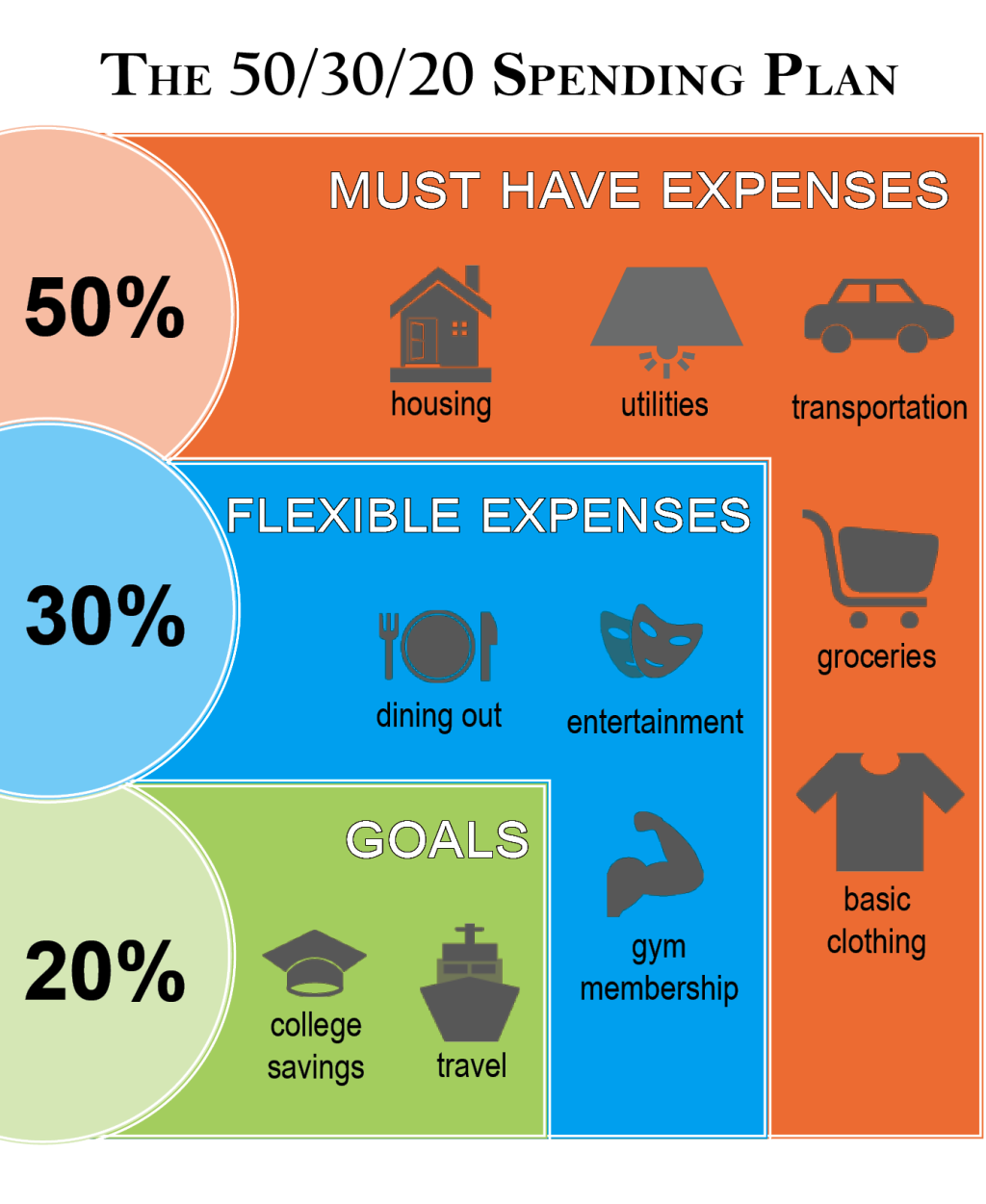

Image Source: oklahomamoneymatters.org

🔑 Budgeting strategies personal are important because they provide a roadmap for financial success. By creating a budget and sticking to it, individuals can avoid overspending, save for emergencies, and achieve their financial goals. Budgeting helps individuals make conscious spending choices, reduce debt, and build a solid financial foundation for the future.

How to Get Started with Budgeting Strategies Personal?

📝 Getting started with budgeting strategies personal is easier than you might think. Follow these steps to begin your journey towards financial freedom:

Evaluate Your Current Financial Situation: Take a close look at your income, expenses, and debts. Understand where your money goes and identify areas where you can cut back.

Set Financial Goals: Determine what you want to achieve financially. This could be saving for a down payment on a house, paying off student loans, or building an emergency fund.

Create a Budget: Develop a monthly budget that outlines your income, expenses, and savings goals. Allocate your income to cover your expenses while ensuring you save for your financial goals.

Track Your Expenses: Keep a record of all your expenses to identify spending patterns and areas where you can make adjustments.

Review and Adjust: Regularly review your budget to ensure it aligns with your financial goals. Adjust your budget as needed based on changes in income or expenses.

Establish an Emergency Fund: Set aside a portion of your income for unexpected expenses. Aim for at least three to six months’ worth of living expenses in your emergency fund.

Seek Professional Help: If needed, consult a financial advisor or planner who can provide guidance and help you create a comprehensive financial plan.

Advantages and Disadvantages of Budgeting Strategies Personal

Image Source: holbornassets.com

✅ Here are some advantages of implementing budgeting strategies personal:

Financial Organization: Budgeting helps you stay organized by providing a clear overview of your income, expenses, and financial goals.

Debt Reduction: By tracking your expenses and making conscious spending choices, you can reduce debt and avoid unnecessary interest charges.

Savings Growth: Budgeting allows you to allocate a portion of your income towards savings, helping you build an emergency fund and achieve long-term financial goals.

Financial Security: With budgeting, you can plan for unexpected expenses, ensuring you have the means to handle emergencies without resorting to debt.

Peace of Mind: Knowing where your money goes and having control over your finances gives you peace of mind and reduces financial stress.

❌ However, there are also some potential disadvantages to be aware of:

Restrictions on Spending: Budgeting requires discipline and may restrict your spending in certain areas to prioritize your financial goals.

Time and Effort: Maintaining a budget requires time and effort to track expenses, review budgets, and adjust spending habits.

Frequently Asked Questions (FAQ)

1. 🤔 Is budgeting only for people with high incomes?

No. Budgeting is for everyone, regardless of income. It helps individuals make the most of their money and achieve their financial goals, regardless of their income level.

2. 🤔 How often should I review my budget?

It is recommended to review your budget at least once a month. This allows you to assess your progress, make adjustments, and ensure your budget aligns with your financial goals.

3. 🤔 What if I have irregular income?

If you have irregular income, it is important to create a budget based on your average monthly income. Set aside a portion for essential expenses, savings, and discretionary spending. Adjust your budget as your income fluctuates.

4. 🤔 How can I stick to my budget?

To stick to your budget, track your expenses diligently, avoid impulsive purchases, and remind yourself of your financial goals regularly. Consider using budgeting apps or setting up automatic transfers to make budgeting easier.

5. 🤔 Can I modify my budget?

Yes. Your budget is not set in stone. It is essential to regularly review and modify your budget as your financial situation changes. Adjustments can be made to accommodate new expenses, changes in income, or shifting financial goals.

Conclusion

In conclusion, implementing budgeting strategies personal is a crucial step towards achieving financial stability. By creating a budget, setting financial goals, and making informed spending choices, you can take control of your finances and build a secure future. Start today, and reap the rewards of financial freedom!

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Consult with a professional financial advisor or planner for personalized guidance.

This post topic: Budgeting Strategies