Unlock Your Future: Discover The Optimal Retirement Savings Percentage By Age

Retirement Savings Percentage by Age: Planning for a Secure Future

Greetings, Readers! Today, we are going to discuss a crucial topic that affects each and every one of us: retirement savings percentage by age. As we navigate through life, it’s essential to plan for our future and ensure a financially stable retirement. In this article, we will delve into the importance of retirement savings and provide you with valuable insights on how to allocate your savings based on your age.

Introduction

1 Picture Gallery: Unlock Your Future: Discover The Optimal Retirement Savings Percentage By Age

Retirement savings is the cornerstone of a secure and comfortable retirement. It refers to the portion of your income that you set aside for your post-work years. By consistently saving a percentage of your earnings throughout your career, you can build a substantial nest egg that will provide financial independence during retirement.

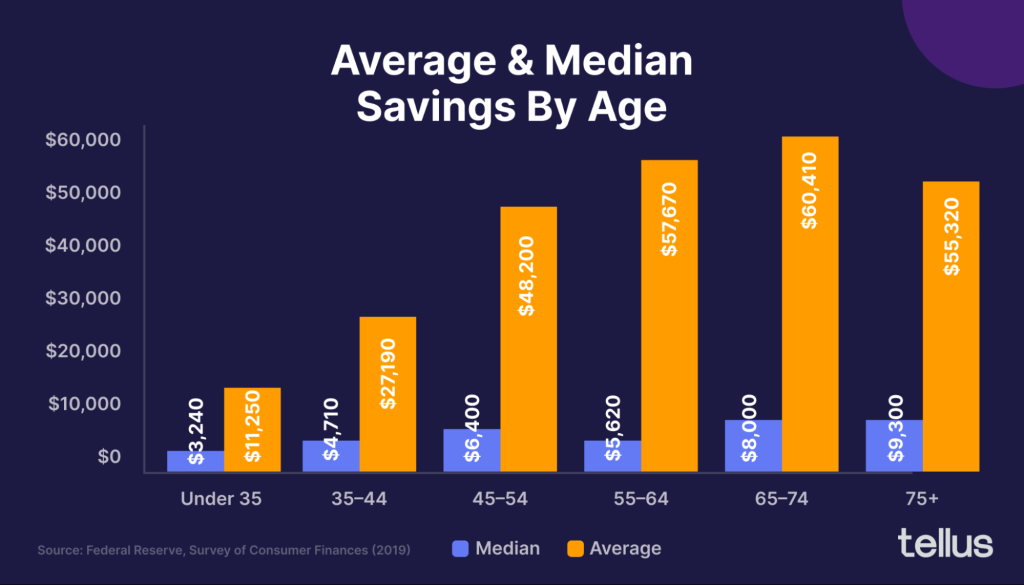

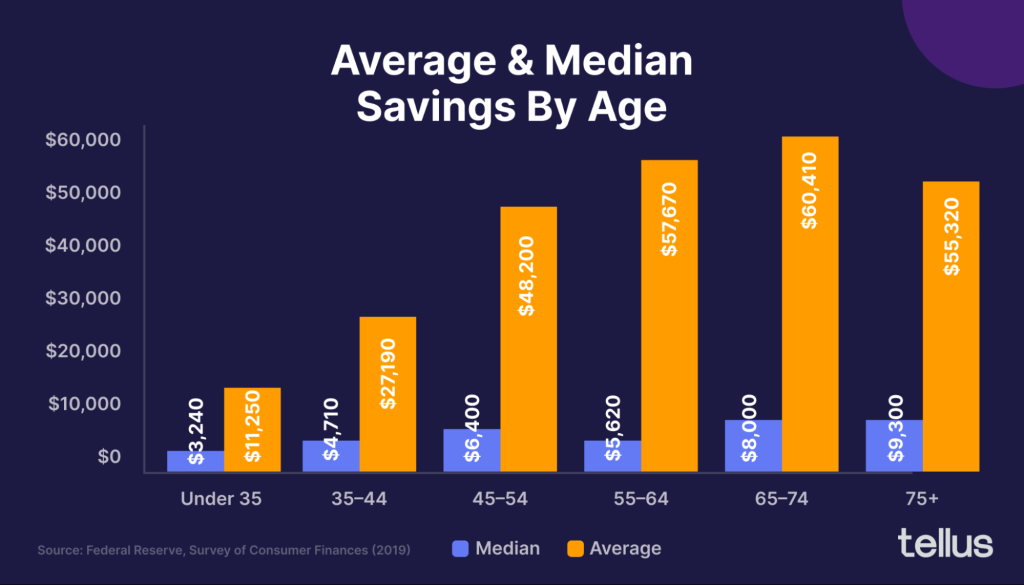

What is Retirement Savings Percentage by Age? 👇

Image Source: tellusapp.com

Retirement savings percentage by age refers to the recommended amount of income that individuals should save based on their age. It is a guideline that helps individuals determine the percentage of their earnings they should set aside for retirement at different stages of their lives.

Who Should Pay Attention to Retirement Savings Percentage by Age? 👇

Everyone should pay attention to retirement savings percentage by age, regardless of their current financial situation. Whether you are just starting your career, in the prime of your earning years, or approaching retirement, understanding the recommended savings percentage for your age group will help you plan and achieve your retirement goals.

When Should You Start Saving for Retirement? 👇

The ideal time to start saving for retirement is as early as possible. The power of compound interest allows your savings to grow exponentially over time. By starting early, you can benefit from the compounding effect and potentially accumulate a more substantial retirement fund.

Where Should You Invest Your Retirement Savings? 👇

Choosing the right investment vehicles for your retirement savings is crucial. Common options include employer-sponsored retirement plans like 401(k)s, individual retirement accounts (IRAs), and brokerage accounts. Each option has its own set of advantages and considerations, so it’s important to research and consult with financial professionals to determine which investment strategy aligns with your goals.

Why is Retirement Savings Percentage by Age Important? 👇

Retirement savings percentage by age is essential because it provides a roadmap for individuals to gauge their progress towards their retirement goals. It ensures that you are saving an appropriate amount based on your age, income level, and retirement aspirations. By following the recommended savings percentages, you can better prepare for a secure and worry-free retirement.

How to Determine Your Retirement Savings Percentage by Age? 👇

Determining your retirement savings percentage by age involves assessing several factors, including your current income, expenses, financial obligations, and retirement goals. It’s crucial to strike a balance between enjoying your present life and saving enough for your future. Consulting with financial advisors or retirement planners can provide valuable insights and help you make informed decisions.

Advantages and Disadvantages of Retirement Savings Percentage by Age

Advantages 👍

1. Financial Security: Following the recommended savings percentage ensures that you are adequately preparing for your retirement, providing financial security when you need it the most.

2. Compound Growth: Starting early and consistently saving a percentage of your income allows your retirement savings to grow exponentially through the power of compound interest.

3. Flexibility: By adhering to the recommended savings percentage, you can adjust your lifestyle and expenses accordingly, ensuring a comfortable retirement.

4. Peace of Mind: Knowing that you are on track with your retirement savings brings peace of mind and reduces financial stress.

5. Potential Generational Wealth: Building a substantial retirement fund can also benefit future generations, allowing you to leave a legacy for your loved ones.

Disadvantages 👎

1. Sacrifices in the Present: Following the recommended savings percentage may require you to make lifestyle adjustments and sacrifices in the present to secure your future.

2. Economic Factors: The performance of financial markets and economic fluctuations can impact the growth of your retirement savings.

3. Inflation: Inflation can erode the purchasing power of your retirement savings over time, necessitating careful planning to mitigate its effects.

4. Unexpected Life Events: Unexpected expenses or life events can disrupt your retirement savings plan, emphasizing the need for emergency funds and insurance coverage.

5. Lack of Financial Literacy: A lack of understanding about retirement savings and investment vehicles can lead to suboptimal decisions and potential losses.

Frequently Asked Questions (FAQs)

1. What happens if I don’t save enough for retirement?

If you don’t save enough for retirement, you may find yourself reliant on social security benefits or facing financial difficulties during your post-work years. It’s crucial to start saving early and consistently to avoid such situations.

2. Can I catch up on retirement savings if I start late?

While it’s more challenging to catch up on retirement savings if you start late, it’s not impossible. By increasing your savings rate, exploring investment options, and making informed financial decisions, you can still improve your retirement prospects.

3. Should I prioritize paying off debt or saving for retirement?

It depends on the interest rates and terms of your debt. In most cases, it’s advisable to strike a balance between debt repayment and retirement savings. Consult with financial professionals to determine the best approach based on your specific circumstances.

4. Can I withdraw money from my retirement savings before retirement?

Yes, it’s possible to withdraw money from retirement savings accounts before retirement, but it may come with penalties and tax implications. It’s crucial to understand the rules and regulations surrounding early withdrawals and explore alternative options to avoid financial setbacks.

5. How often should I review my retirement savings plan?

It’s recommended to review your retirement savings plan at least once a year or whenever significant life events occur, such as career changes, marriage, or the birth of a child. Regular reviews ensure that your savings strategy aligns with your evolving goals and circumstances.

Conclusion

In conclusion, understanding and adhering to the retirement savings percentage by age is essential for a secure and comfortable retirement. By starting early, consistently saving, and making informed financial decisions, you can build a substantial retirement fund that will provide financial independence in your post-work years. Don’t delay, take action today, and secure your future!

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial advice. Consult with a professional financial advisor or retirement planner to tailor a retirement savings plan that suits your individual needs and goals.

This post topic: Budgeting Strategies