Mastering Your Finances: Unleashing The Power Of The Budgeting Strategy Project

Budgeting Strategy Project: A Comprehensive Guide to Effective Financial Planning

Greetings, Readers! In today’s article, we will delve into the topic of budgeting strategy projects and explore how they can be utilized to achieve financial success. Budgeting is a crucial aspect of personal and business finance, and implementing a well-designed strategy can greatly contribute to the attainment of financial goals. So, let’s dive in and discover the ins and outs of budgeting strategy projects!

Introduction

A budgeting strategy project refers to the systematic approach taken to plan and manage finances effectively. It involves creating a detailed roadmap that outlines income, expenses, savings, and investments. By implementing a budgeting strategy project, individuals and businesses can gain better control over their finances, make informed decisions, and work towards achieving their financial objectives.

2 Picture Gallery: Mastering Your Finances: Unleashing The Power Of The Budgeting Strategy Project

In this article, we will explore various aspects of budgeting strategy projects, including their purpose, key components, advantages, disadvantages, and implementation techniques. By the end, you will have a comprehensive understanding of how to develop and execute an effective budgeting strategy project that aligns with your financial goals.

1. What is a Budgeting Strategy Project? 📊

A budgeting strategy project encompasses the process of developing a financial plan to effectively manage income, expenses, and investments. It involves analyzing and organizing financial data, setting realistic goals, and allocating resources accordingly. This project serves as a blueprint for financial success and enables individuals and businesses to monitor their financial health and make necessary adjustments.

Implementing a budgeting strategy project allows for better decision-making by providing a clear overview of income sources and expenditure patterns. It helps identify areas where adjustments can be made to optimize financial resources and achieve long-term financial stability.

2. Who Can Benefit from a Budgeting Strategy Project? 🤔

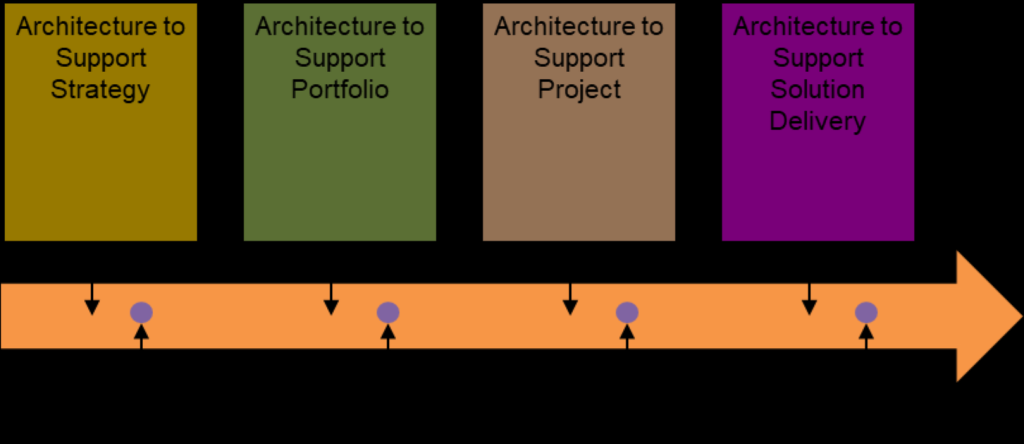

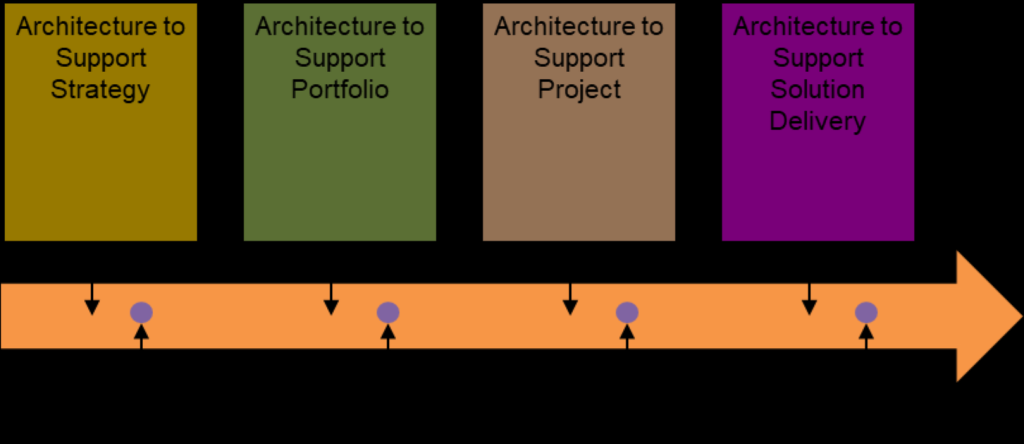

Image Source: opengroup.org

A budgeting strategy project is beneficial for individuals, families, entrepreneurs, and businesses of all sizes. Regardless of your financial situation, implementing a budgeting strategy project can provide valuable insights into your financial standing and aid in achieving financial goals.

For individuals and families, a budgeting strategy project helps in managing personal finances, tracking expenses, and saving for future milestones such as education, homeownership, or retirement. It enables better financial decision-making and promotes responsible spending habits.

Entrepreneurs and small businesses can utilize budgeting strategy projects to plan and allocate resources effectively, monitor cash flow, and identify areas where cost-cutting measures can be implemented. It also aids in evaluating the viability of business initiatives and supports informed decision-making.

3. When Should You Start a Budgeting Strategy Project? ⌛

The ideal time to start a budgeting strategy project is now! Regardless of your current financial situation, implementing a budgeting strategy project can bring numerous benefits. Whether you are just starting your professional journey, have a well-established career, or own a business, a budgeting strategy project can help you build a strong financial foundation and achieve your goals.

It is never too early or too late to begin managing your finances effectively. The sooner you start, the more time you have to make positive changes and reap the rewards of sound financial planning.

4. Where Should You Implement a Budgeting Strategy Project? 🌍

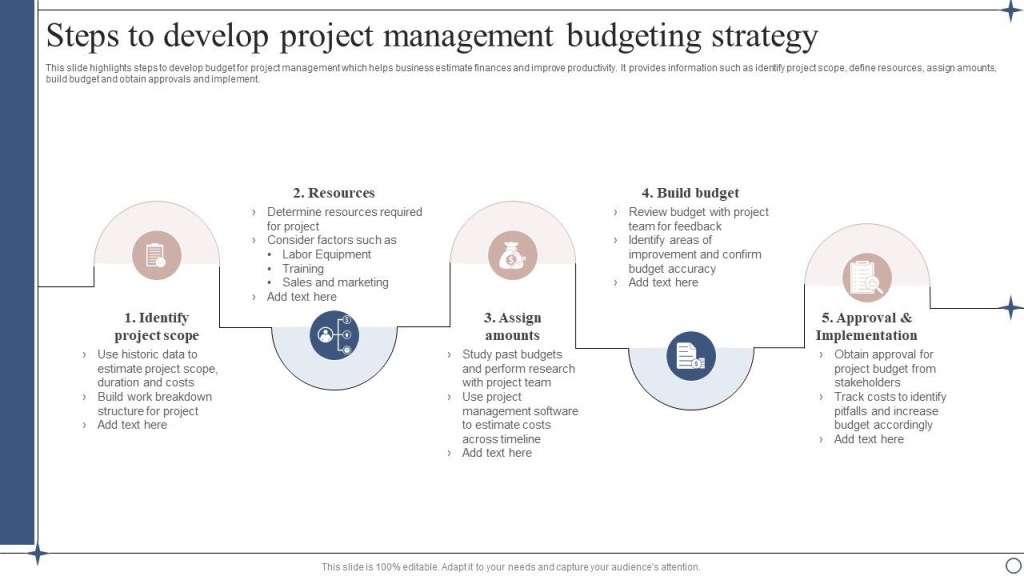

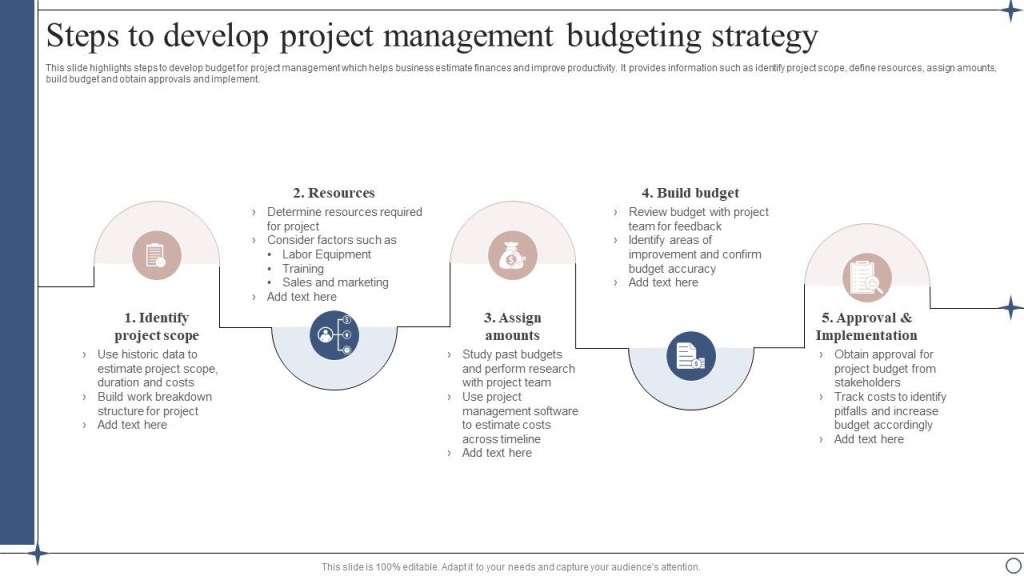

Image Source: slideteam.net

A budgeting strategy project can be implemented in various settings, including personal finance, households, businesses, and organizations. The core principles remain the same across these different contexts, but the specific application may vary.

In personal finance, individuals can implement a budgeting strategy project using various tools such as spreadsheets, budgeting apps, or specialized software. It can be done independently or with the help of financial advisors or consultants.

Similarly, businesses and organizations can adopt budgeting strategy projects to enhance financial management and achieve organizational objectives. This may involve collaboration between different departments, financial analysis, and goal-setting in alignment with the overall business strategy.

5. Why is a Budgeting Strategy Project Important? 🤷♂️

A budgeting strategy project plays a vital role in achieving financial stability and success. Here are some key reasons why it is important:

5.1 Financial Control and Discipline

Implementing a budgeting strategy project provides a sense of financial control and discipline. It allows individuals and businesses to track their income and expenses, avoid overspending, and make informed financial decisions.

5.2 Goal Setting and Achievement

A budgeting strategy project enables effective goal setting by outlining financial targets and milestones. It provides a structured approach to work towards these goals and increases the likelihood of achieving them.

5.3 Resource Allocation and Optimization

By analyzing income and expenditure patterns, a budgeting strategy project helps allocate resources optimally. It identifies areas where adjustments can be made to reduce unnecessary expenses and redirect funds towards more productive endeavors.

5.4 Emergency Preparedness

A well-designed budgeting strategy project includes provisions for emergencies and unexpected expenses. It ensures that individuals and businesses are financially prepared to handle unforeseen circumstances without significant disruptions.

5.5 Debt Management

For individuals and businesses struggling with debt, a budgeting strategy project offers an effective framework for debt management. It helps prioritize debt repayments, minimize interest payments, and work towards becoming debt-free.

6. How to Implement a Budgeting Strategy Project? 📝

Implementing a budgeting strategy project involves several steps. Here’s a simplified guide to get you started:

6.1 Set Financial Goals

Begin by defining your financial goals. Identify what you want to achieve in terms of savings, investments, debt reduction, or other financial objectives.

6.2 Gather Financial Data

Collect all relevant financial data, including income statements, bank statements, bills, and receipts. This data will serve as the foundation for your budgeting strategy project.

6.3 Categorize Expenses

Categorize your expenses into different groups, such as fixed expenses (rent, mortgage) and variable expenses (groceries, entertainment). This will help you understand where your money is going and identify areas for potential savings.

6.4 Create a Budget

Based on your financial goals and expenses, create a budget that outlines how much you can allocate to each category. Be realistic and consider any existing financial commitments.

6.5 Monitor and Adjust

Regularly monitor your budget and compare it with your actual income and expenses. Make adjustments as necessary to stay on track and optimize your financial resources.

6.6 Seek Professional Help

If necessary, consult with financial advisors or experts who can provide guidance and support in implementing your budgeting strategy project. They can offer valuable insights and help you make informed financial decisions.

Advantages and Disadvantages of Budgeting Strategy Projects

Like any financial approach, budgeting strategy projects have their own set of advantages and disadvantages. Let’s explore them in detail:

Advantages:

1. Enhanced Financial Control

Implementing a budgeting strategy project gives you a clear overview of your finances, enabling better control and decision-making.

2. Goal-Oriented Approach

With a budgeting strategy project, you can set specific financial goals and work towards achieving them systematically.

3. Reduced Financial Stress

Effective budgeting helps minimize financial stress by ensuring that you have enough funds for essential expenses and emergencies.

Disadvantages:

1. Time-Consuming

Creating and maintaining a budgeting strategy project requires time and effort, especially when starting from scratch.

2. Adapting to Changes

Changes in income, expenses, or financial circumstances may require adjustments to the budgeting strategy project, which can be challenging.

3. Unexpected Expenses

A budgeting strategy project may not account for all unexpected expenses, which can disrupt financial plans.

Frequently Asked Questions (FAQs)

1. How often should I review my budgeting strategy project?

It is recommended to review your budgeting strategy project on a monthly basis to ensure it remains aligned with your financial goals and any changing circumstances.

2. Can I make changes to my budgeting strategy project?

Absolutely! Your budgeting strategy project should be flexible and adaptable. Feel free to make adjustments as your financial situation evolves.

3. What if I overspend in a specific category?

If you overspend in a specific category, you may need to reallocate funds from other categories or look for ways to reduce expenses in the following month.

4. Should I involve my family or team in the budgeting strategy project?

Involving your family or team in the budgeting strategy project promotes transparency, shared responsibility, and better financial decision-making.

5. Can a budgeting strategy project help me save for long-term goals?

Yes, a well-executed budgeting strategy project can help you save for long-term goals by allocating funds specifically towards those objectives.

Conclusion: Take Control of Your Finances Today!

Friends, the key to financial success lies in effective budgeting. By implementing a budgeting strategy project, you can gain better control over your finances, set achievable goals, and work towards securing your financial future.

Remember to start by defining your financial goals, analyzing your income and expenses, and creating a realistic budget. Regularly monitor and adjust your budget as needed, seek professional help when necessary, and stay committed to your financial objectives.

Take charge of your financial well-being, and let a budgeting strategy project guide you towards a brighter and more secure future!

Final Remarks: Disclaimer

The information provided in this article is for general informational purposes only and should not be considered as financial advice. Before implementing any budgeting strategy project or making significant financial decisions, it is recommended to consult with a qualified financial professional. The author and publisher of this article disclaim any liability for any direct or indirect loss or damage incurred as a result of relying on the information provided herein.

This post topic: Budgeting Strategies