Maximize Your Finances With Our Dynamic Budget Strategy Template: Click Here For Success!

Budget Strategy Template: A Comprehensive Guide for Effective Financial Planning

Greetings, Readers! In this article, we will delve into the world of budget strategy templates and explore how they can revolutionize your financial planning. Whether you are an individual looking to manage your personal finances or a business aiming to optimize your budget, the right strategy template can provide a solid foundation for success. So, let’s dive in and discover the key aspects of budget strategy templates that can help you achieve your financial goals.

Introduction

When it comes to financial planning, having a well-defined budget strategy is crucial. A budget strategy template serves as a roadmap for managing your income, expenses, and savings efficiently. It provides a structured approach to allocate resources, set financial goals, and track your progress. By implementing a budget strategy template, you can gain better control over your finances, reduce unnecessary expenses, and save for future endeavors.

2 Picture Gallery: Maximize Your Finances With Our Dynamic Budget Strategy Template: Click Here For Success!

To help you understand the concept of budget strategy templates more comprehensively, let us explore the following key aspects:

What is a Budget Strategy Template?

📋 A budget strategy template is a pre-designed framework that helps individuals or businesses plan their financial activities effectively. It outlines the necessary steps to create and manage a budget, enabling you to allocate resources wisely and achieve your financial objectives. The template typically includes sections for income, expenses, savings, investments, and debt management.

Why is a Budget Strategy Template Important?

🔑 Having a budget strategy template is important as it provides a systematic approach to financial planning. It allows you to prioritize your spending, identify areas where you can save money, and make informed decisions about your financial future. A well-structured budget strategy template enables you to track your progress, make adjustments when necessary, and stay on top of your financial goals.

Who Can Benefit from a Budget Strategy Template?

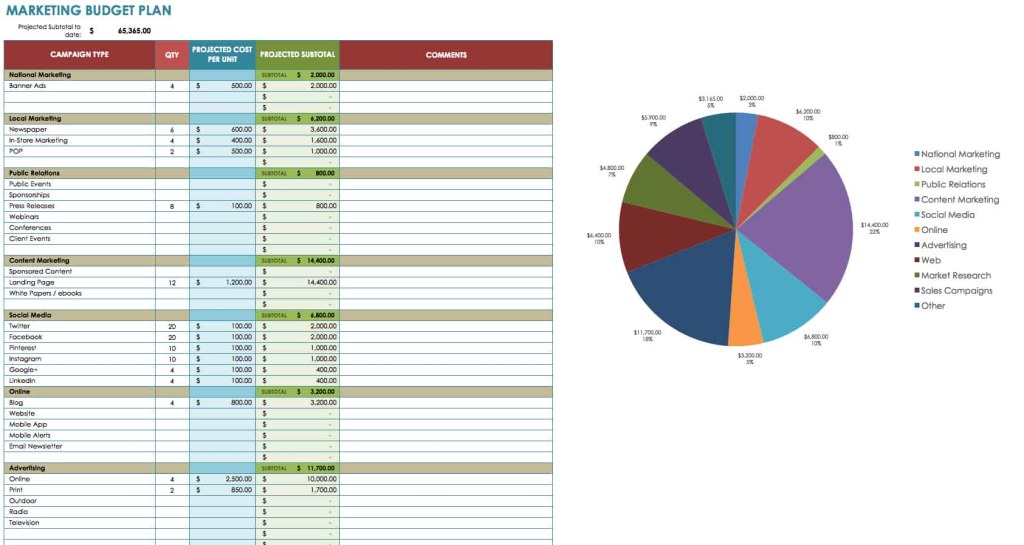

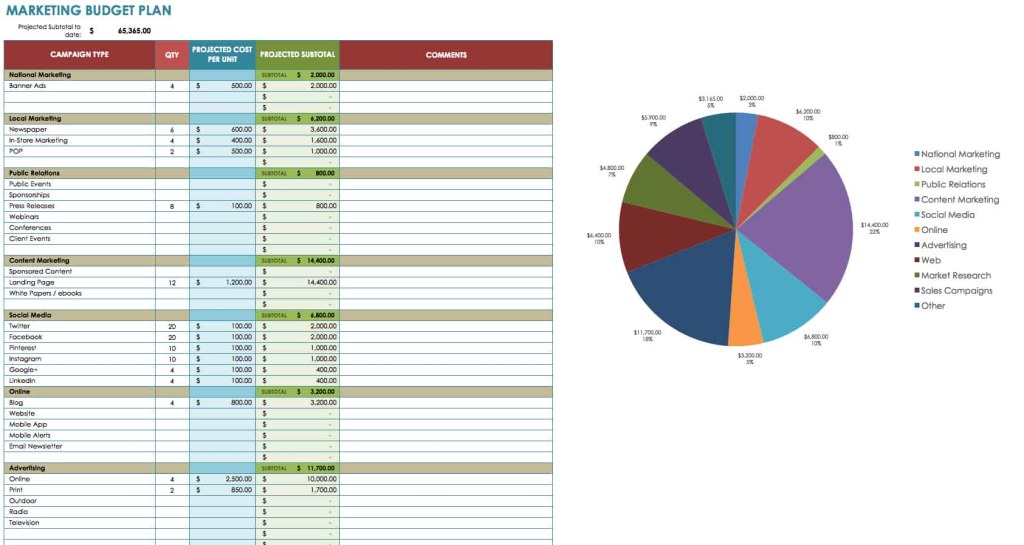

Image Source: smartsheet.com

🙋♂️🙋♀️ Both individuals and businesses can benefit from utilizing a budget strategy template. For individuals, it helps in managing personal finances, including income, expenses, savings, and investments. For businesses, it aids in budget allocation, cost control, and financial forecasting. Whether you are an employee, a business owner, or a freelancer, a budget strategy template can be a valuable tool to manage your financial resources effectively.

When Should You Implement a Budget Strategy Template?

📆 Implementing a budget strategy template is beneficial at any stage of your financial journey. Whether you are just starting to track your expenses or looking to optimize your existing budget, a strategy template can provide the necessary structure and guidance. It is especially useful during major life events, such as getting married, buying a house, or starting a business, when financial planning becomes even more critical.

Where Can You Find a Budget Strategy Template?

🔍 Budget strategy templates can be found online through various financial planning resources or software. Many websites and apps offer free or paid templates that cater to different needs and preferences. Additionally, you can customize your own template using spreadsheet software like Microsoft Excel or Google Sheets. The key is to choose a template that aligns with your financial goals and provides the flexibility to adapt to your unique circumstances.

Why Should You Use a Budget Strategy Template?

💡 Using a budget strategy template provides several advantages. Firstly, it helps in organizing your financial information in a structured manner, making it easier to analyze and make informed decisions. Additionally, it enables you to identify potential areas of improvement, such as reducing unnecessary expenses or increasing savings. Moreover, a budget strategy template promotes financial discipline and accountability, ensuring that you stay on track towards your goals.

How to Create a Budget Strategy Template?

🔧 Creating a budget strategy template involves a few key steps. Firstly, gather all relevant financial information, including income sources, expenses, debts, and savings goals. Next, categorize your expenses into fixed and variable categories. Allocate a specific percentage of your income to each category, ensuring that you prioritize essential expenses while leaving room for discretionary spending and savings. Finally, track your actual expenses and compare them with your budget regularly to make necessary adjustments.

Advantages and Disadvantages of Budget Strategy Templates

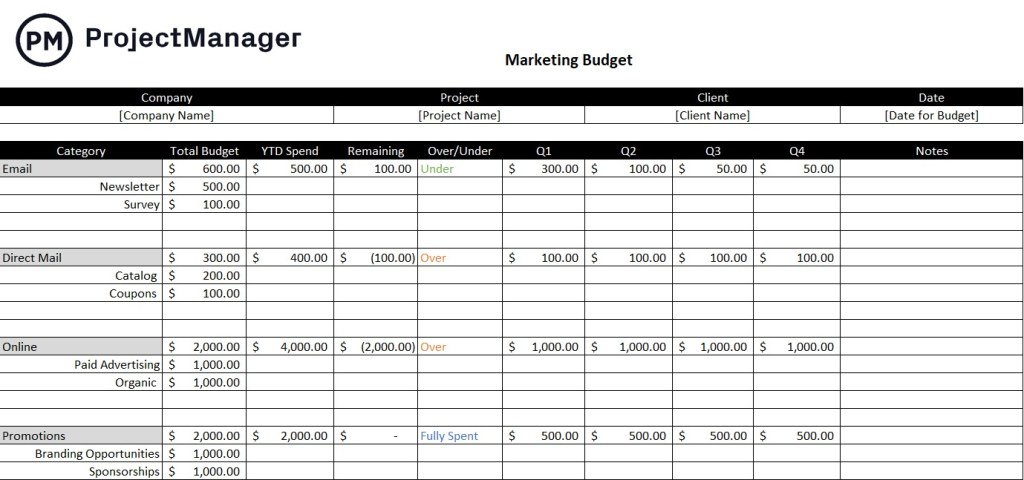

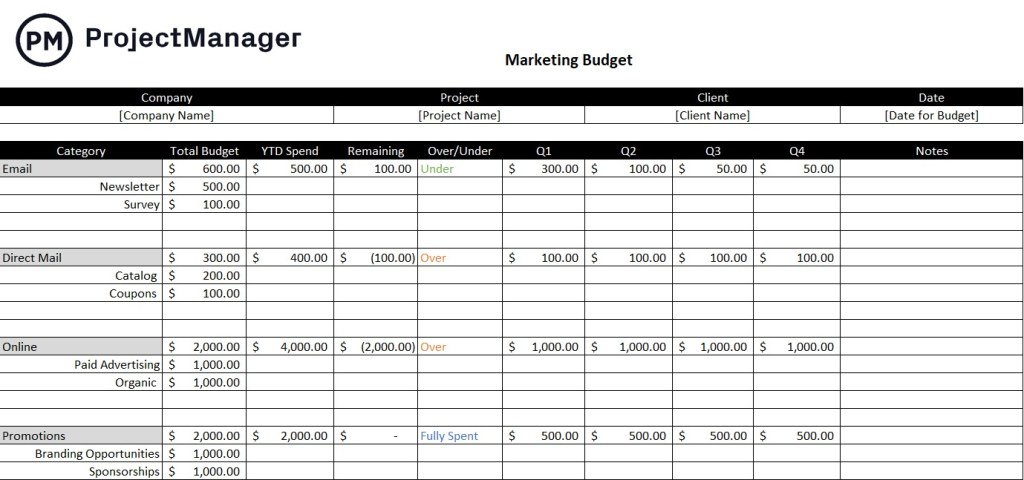

Image Source: projectmanager.com

Now, let’s explore the advantages and disadvantages of using budget strategy templates:

Advantages:

1. 📈 Enhanced Financial Control: A budget strategy template provides a comprehensive overview of your financial situation, empowering you to make informed decisions and take control of your money.

2. 💰 Increased Savings: By allocating specific amounts for savings in your budget strategy template, you can develop a habit of saving and work towards achieving your financial goals.

3. 👥 Better Decision-making: A well-structured budget strategy template enables you to evaluate different financial options and choose the best course of action based on your priorities and resources.

4. 📉 Debt Management: With a budget strategy template, you can allocate funds towards debt repayment, helping you reduce interest payments and work towards becoming debt-free.

5. ⏰ Time Efficiency: Utilizing a budget strategy template saves you time as it provides a ready-made framework, eliminating the need to start from scratch and reducing the chances of overlooking important financial aspects.

Disadvantages:

1. 📊 Initial Setup: Creating a budget strategy template requires time and effort to gather and organize financial information. However, the long-term benefits outweigh the initial setup process.

2. ⚖️ Flexibility Constraints: Some budget strategy templates may lack flexibility, making it challenging to adapt to unexpected financial changes or unique circumstances. It is crucial to choose a template that allows customization.

3. 📉 Overcomplicating Finances: In some cases, individuals may get overwhelmed by the complexity of a budget strategy template, leading to frustration or abandonment of the budgeting process. It is essential to find a balance and choose a template that suits your comfort level.

Frequently Asked Questions (FAQs)

Q1: Can I modify a budget strategy template to suit my specific needs?

A1: Yes, most budget strategy templates can be customized to align with your unique financial goals and circumstances. Feel free to adapt the template to suit your preferences and make it more personalized.

Q2: How often should I update my budget strategy template?

A2: It is recommended to review and update your budget strategy template regularly, preferably on a monthly basis. This allows you to track your progress, make necessary adjustments, and stay on top of your financial goals.

Q3: What if my actual expenses exceed my budget?

A3: If your actual expenses exceed your budget, it may be necessary to reevaluate your spending habits and identify areas where you can cut back. Analyze your discretionary expenses and prioritize essential needs to bring your expenses back in line with your budget.

Q4: Can a budget strategy template help me save for long-term goals?

A4: Absolutely! A budget strategy template enables you to allocate specific amounts towards savings, making it easier to save for long-term goals such as retirement, education, or buying a house.

Q5: Is it necessary to seek professional help when using a budget strategy template?

A5: While it is not necessary to seek professional help, consulting a financial advisor or accountant can provide valuable insights and guidance to optimize your budget strategy template according to your specific financial situation and goals.

Conclusion

To conclude, implementing a budget strategy template is a powerful tool for effective financial planning. By utilizing a well-designed template, you can gain better control over your finances, track your progress, and achieve your financial goals. Whether you are an individual or a business, a budget strategy template acts as a roadmap to success, helping you make informed decisions and optimize your financial resources. So, take the first step towards financial empowerment today and start using a budget strategy template!

Remember, financial success is within your reach, and a budget strategy template can be your guiding light on this journey.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as professional financial advice. Always consult with a certified financial advisor or accountant before making any financial decisions or implementing a budget strategy template.

This post topic: Budgeting Strategies