Unlocking The Power Of Retirement Savings Per Age: Maximize Your Future Wealth Today!

Retirement Savings per Age: A Comprehensive Guide

Greetings, Readers! In this article, we will delve into the topic of retirement savings per age, providing you with valuable insights to help you plan for a financially secure future.

Introduction

3 Picture Gallery: Unlocking The Power Of Retirement Savings Per Age: Maximize Your Future Wealth Today!

Retirement is an important milestone in life that requires careful financial planning. The earlier you start saving and investing, the better prepared you will be for a comfortable retirement. In this section, we will discuss the various factors that influence retirement savings and the importance of tailoring your saving strategy to your specific age group.

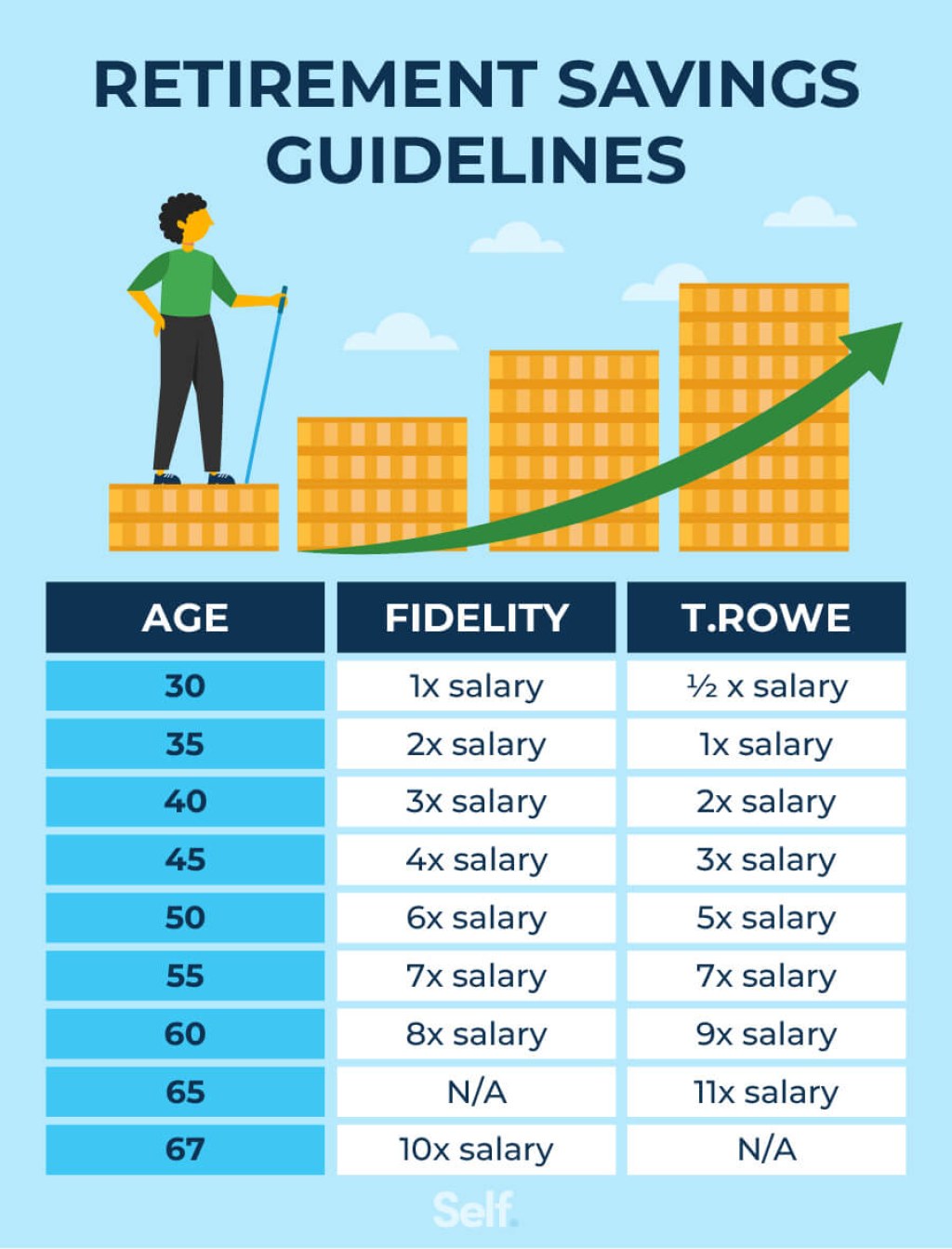

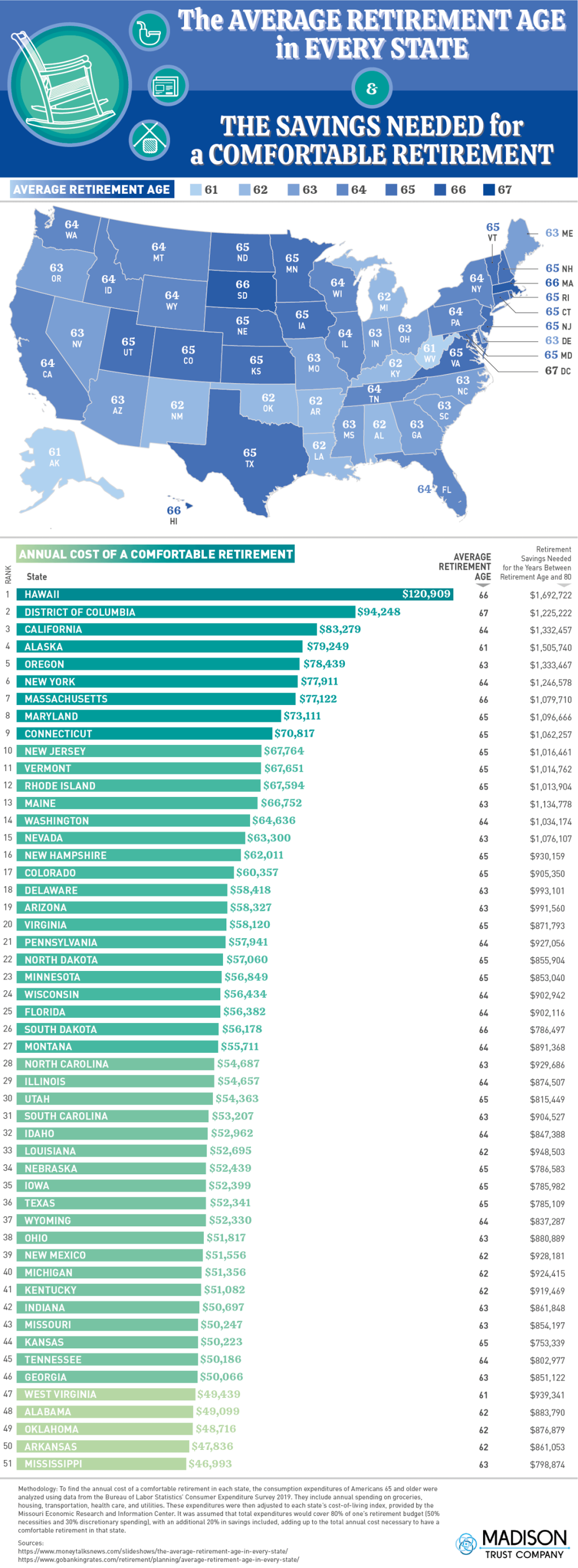

It is crucial to note that retirement savings per age can vary significantly due to a range of factors such as income, expenses, lifestyle choices, and individual goals. However, by understanding the general guidelines and strategies for each age group, you can make informed decisions to secure your financial future.

Savings by Age Group

Image Source: ctfassets.net

1. Millennials (Age 20-35) 💰

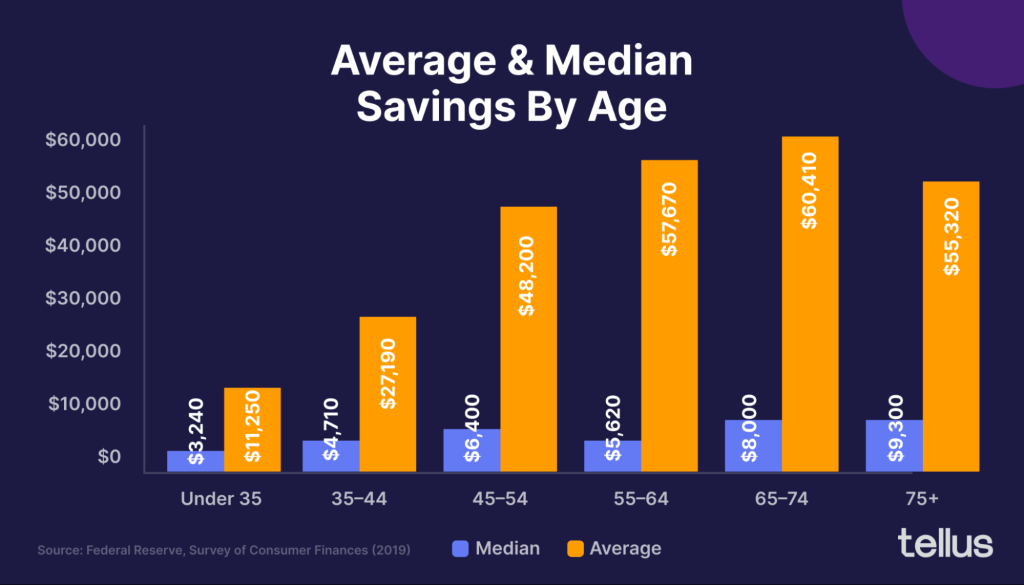

Millennials have the advantage of time on their side when it comes to retirement savings. However, due to competing financial priorities such as student loans and housing expenses, saving may seem challenging. It is essential for millennials to start saving early and take advantage of employer-sponsored retirement plans like 401(k)s and IRAs.

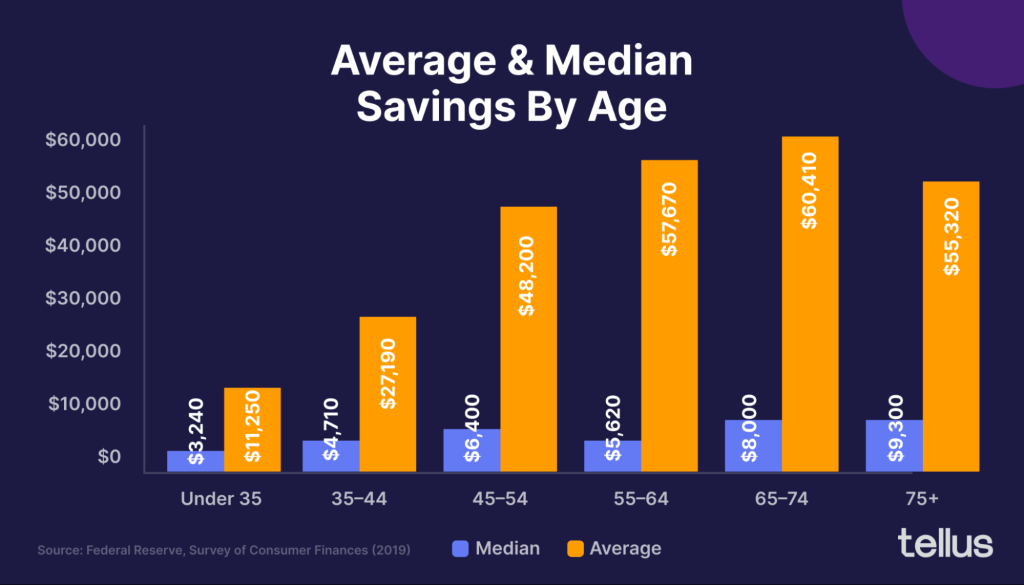

2. Generation X (Age 36-50) 💰

Image Source: tellusapp.com

Generation X faces the dual challenge of supporting their families while saving for retirement. Prioritizing retirement savings is crucial during this phase, and maxing out contributions to retirement accounts becomes imperative. Additionally, diversifying investments and considering long-term care insurance are essential steps for this age group.

3. Baby Boomers (Age 51-70) 💰

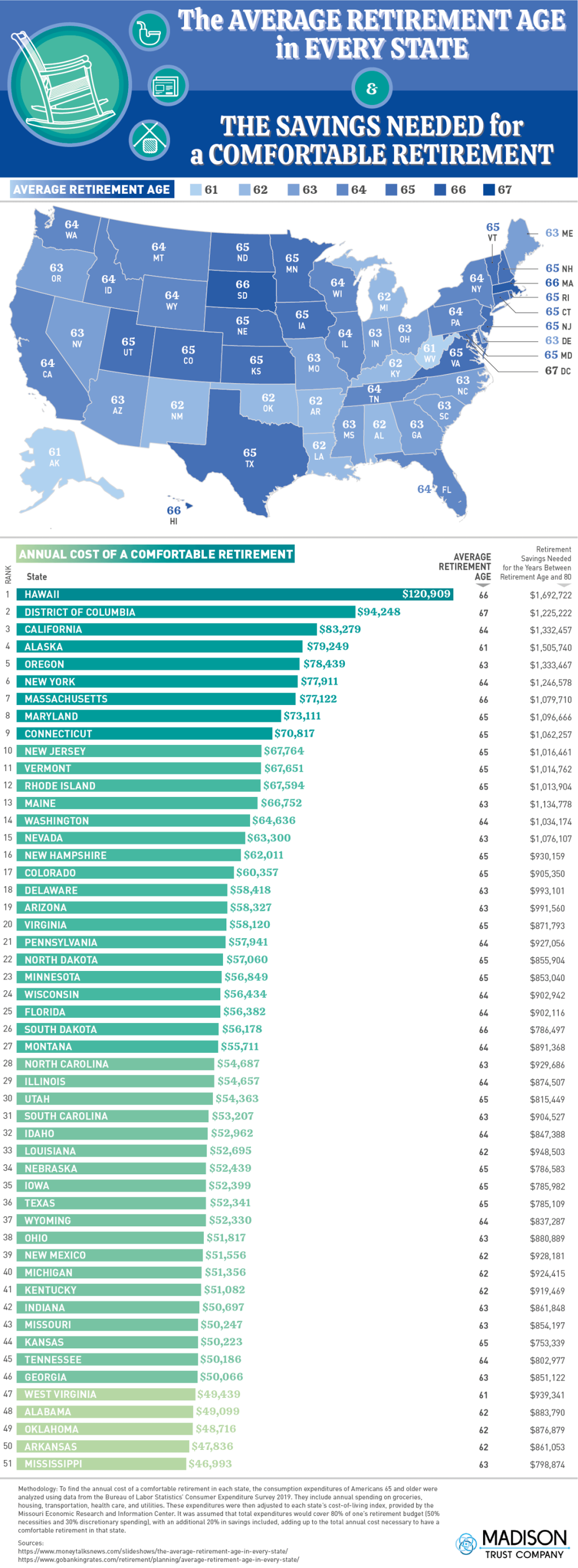

As retirement approaches, baby boomers need to evaluate their savings and make any necessary adjustments. This age group should focus on maximizing their savings, considering catch-up contributions, and exploring income streams like rental properties or part-time work. Long-term healthcare costs should also be factored into their retirement plan.

4. Seniors (Age 70 and above) 💰

Image Source: madisontrust.com

Seniors who have already retired need to maintain a careful balance between preserving their savings and enjoying their retirement. It is crucial to monitor investments, revisit withdrawal strategies, and ensure adequate healthcare coverage. Considerations like downsizing or relocating to reduce expenses may also be beneficial.

What is Retirement Savings per Age?

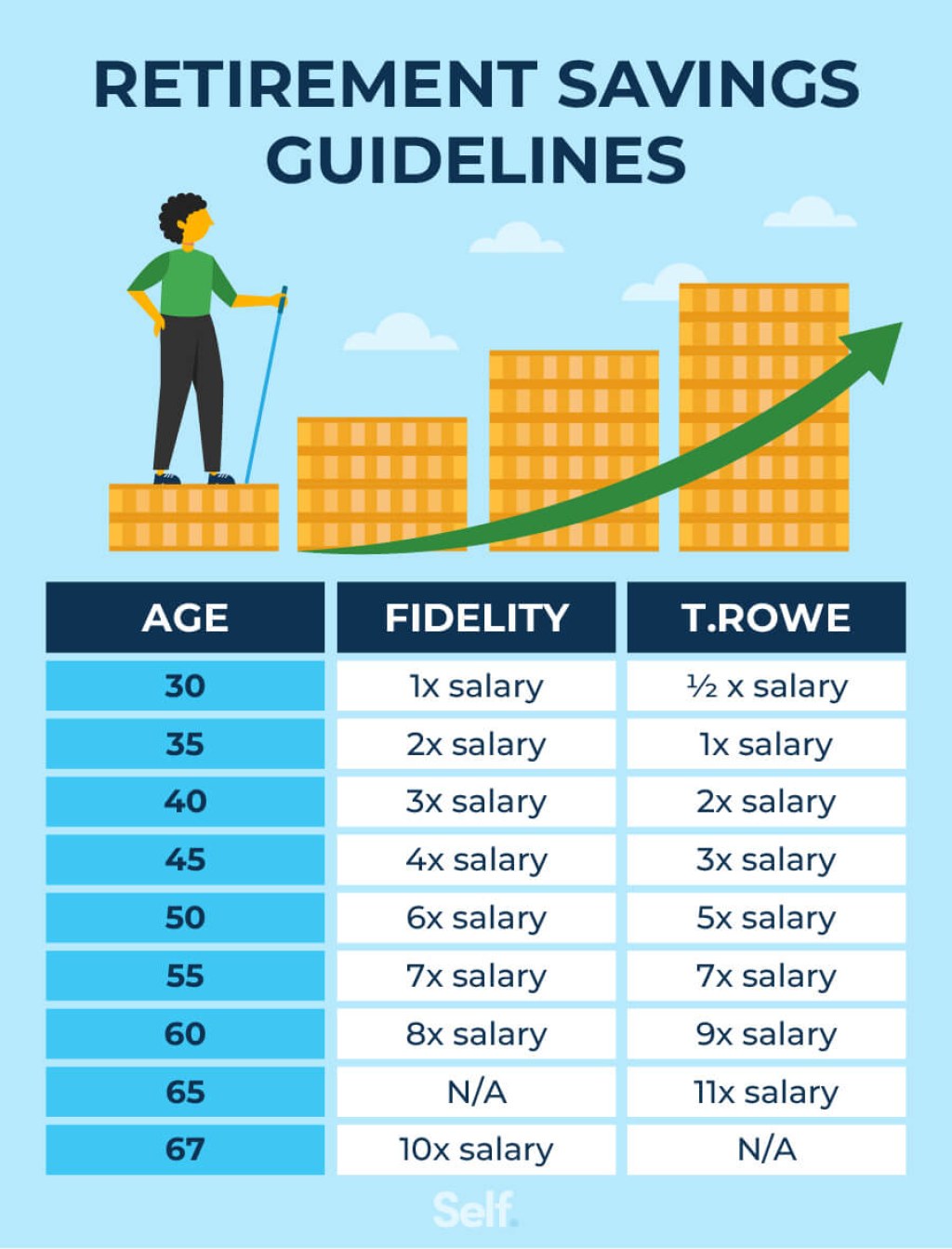

Retirement savings per age refers to the amount of money individuals should aim to accumulate based on their age group. It takes into account factors such as life expectancy, inflation, and expected lifestyle expenses during retirement. By following these guidelines, individuals can estimate the amount they need to save to maintain their desired lifestyle post-retirement.

Who Should Save for Retirement?

Everyone should save for retirement, regardless of their current financial situation. It is never too early or too late to start saving. Even small contributions can make a significant impact over time. Saving for retirement is a long-term commitment that ensures financial security during your golden years.

When Should You Start Saving for Retirement?

The earlier you start saving for retirement, the better. Time is a powerful ally when it comes to compounding returns on investments. Ideally, individuals should start saving as soon as they enter the workforce and continue to contribute consistently throughout their working years.

Where Should You Invest Your Retirement Savings?

Retirement savings can be invested in various vehicles such as employer-sponsored retirement plans, individual retirement accounts (IRAs), stocks, bonds, and real estate. The choice of investment depends on factors such as risk tolerance, time horizon, and individual goals. Diversification is key to minimizing risk and maximizing returns.

Why is Retirement Savings Important?

Retirement savings are crucial because they provide financial security during your post-working years. Without proper savings, individuals may face a significant decline in their standard of living, relying solely on government benefits or family support. By saving for retirement, you can maintain your desired lifestyle and enjoy the fruits of your labor.

How Much Should You Save for Retirement?

The amount you should save for retirement depends on various factors, including your desired lifestyle, expected healthcare costs, and retirement age. Financial experts often recommend saving at least 10-15% of your annual income for retirement. However, it is advisable to consult with a financial advisor to determine a personalized savings goal based on your specific circumstances.

Advantages and Disadvantages of Retirement Savings per Age

1. Advantages of Retirement Savings per Age 😊

By saving for retirement in accordance with your age group, you can:

– Build a substantial nest egg over time

– Take advantage of compounding returns

– Minimize the risk of outliving your savings

2. Disadvantages of Retirement Savings per Age 😞

However, there are a few potential drawbacks:

– Unexpected life events may interfere with savings plans

– Economic downturns can impact investment returns

– Inadequate savings may lead to a reduced standard of living during retirement

Frequently Asked Questions (FAQs)

1. How can I start saving for retirement if I have limited income?

Even with limited income, it is crucial to start saving early. Look for opportunities to increase your income and reduce expenses. Consider contributing to a Roth IRA, as it offers tax advantages and flexibility.

2. Can I save for retirement if I have debt?

Yes, you can still save for retirement while managing debt. It is advisable to strike a balance between debt repayment and retirement contributions. Focus on high-interest debts first and seek professional advice if needed.

3. Is it too late to start saving for retirement if I am in my 50s?

While it is optimal to start saving early, it is never too late to begin. Maximize your contributions and explore catch-up provisions offered by retirement plans. Also, consider working with a financial advisor to develop a robust retirement strategy.

4. Should I solely rely on Social Security for retirement?

Social Security benefits alone may not be sufficient to maintain your desired lifestyle during retirement. It is essential to supplement these benefits with personal savings and investments to ensure financial security.

5. How often should I review my retirement savings plan?

Regularly reviewing your retirement savings plan is crucial to ensure it remains on track. Aim to evaluate your progress annually and make adjustments as necessary. Life changes, such as marriage, birth, or job transitions, may necessitate modifications to your plan.

Conclusion

In conclusion, securing a comfortable retirement requires diligent savings and investment strategies tailored to your age group. Start saving early, maximize contributions, and invest wisely to build a substantial nest egg. Remember, it is never too late to start saving, and consulting with a financial advisor can provide valuable guidance on your retirement journey. Act now and secure a financially sound future!

Final Remarks

Friends, retirement savings per age is a critical aspect of financial planning that should not be overlooked. While this article provides valuable insights, it is essential to consult with a professional advisor to develop a personalized retirement strategy. Remember, your financial future is in your hands, and by taking proactive steps today, you can enjoy a fulfilling retirement tomorrow. Let’s embark on this journey together!

This post topic: Budgeting Strategies