Secure Your Future With A $1 Million Retirement Fund – Act Now!

Retirement Fund 1 Million: Planning for a Secure Future

Introduction

Dear Readers,

3 Picture Gallery: Secure Your Future With A $1 Million Retirement Fund – Act Now!

Welcome to our comprehensive guide on retirement fund 1 million. In today’s fast-paced world, preparing for retirement is more crucial than ever. Planning for a secure future requires careful consideration and informed decision-making. In this article, we will explore the various aspects of retirement fund 1 million, including its definition, benefits, potential drawbacks, and steps to achieve this financial milestone. Let’s dive in!

Table of Contents

Image Source: annuityexpertadvice.com

1. What is retirement fund 1 million?

2. Who can benefit from it?

3. When should you start planning?

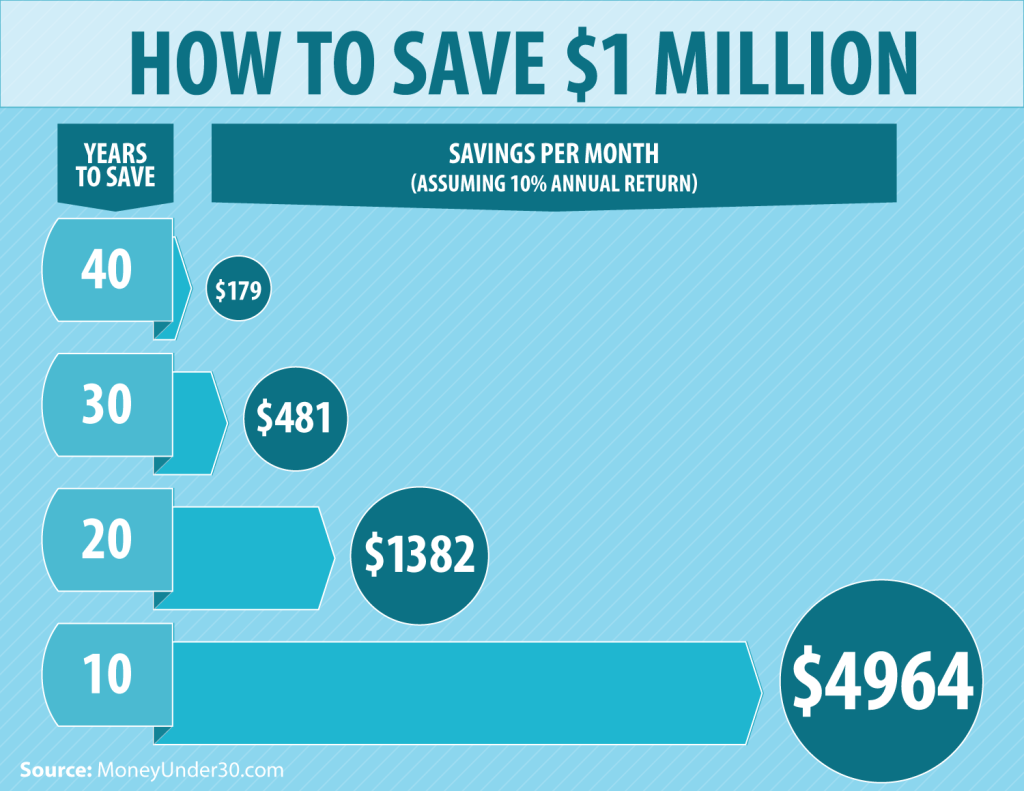

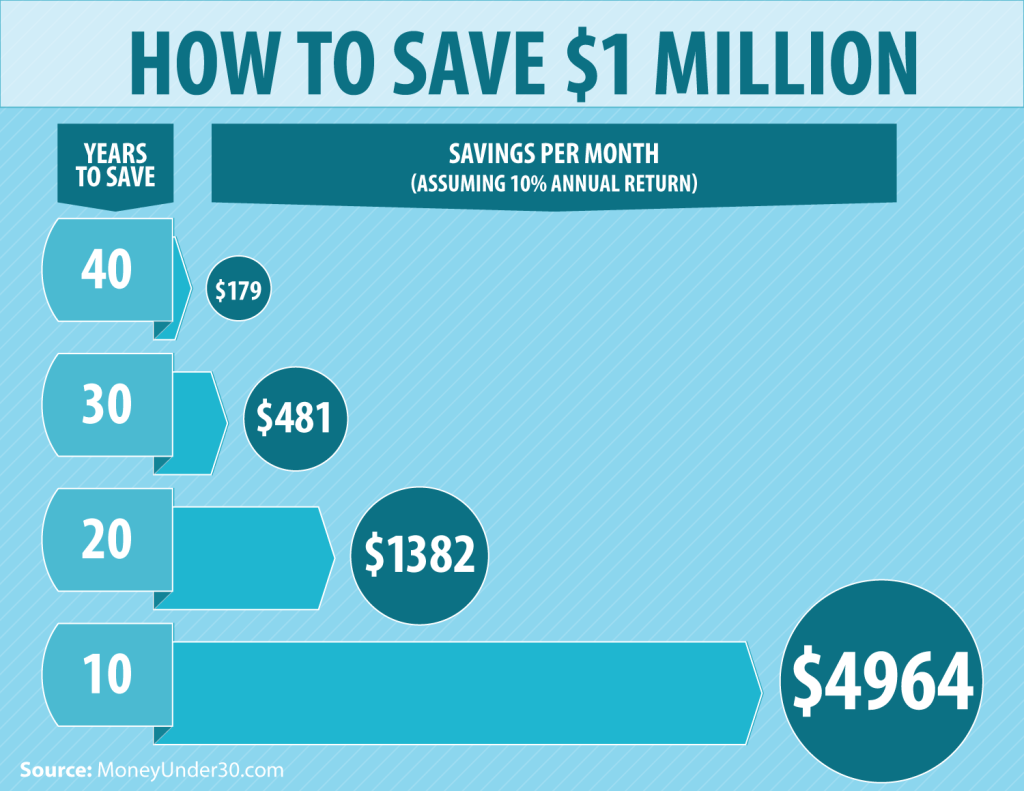

Image Source: moneyunder30.com

4. Where can you invest your retirement fund?

5. Why is retirement fund 1 million important?

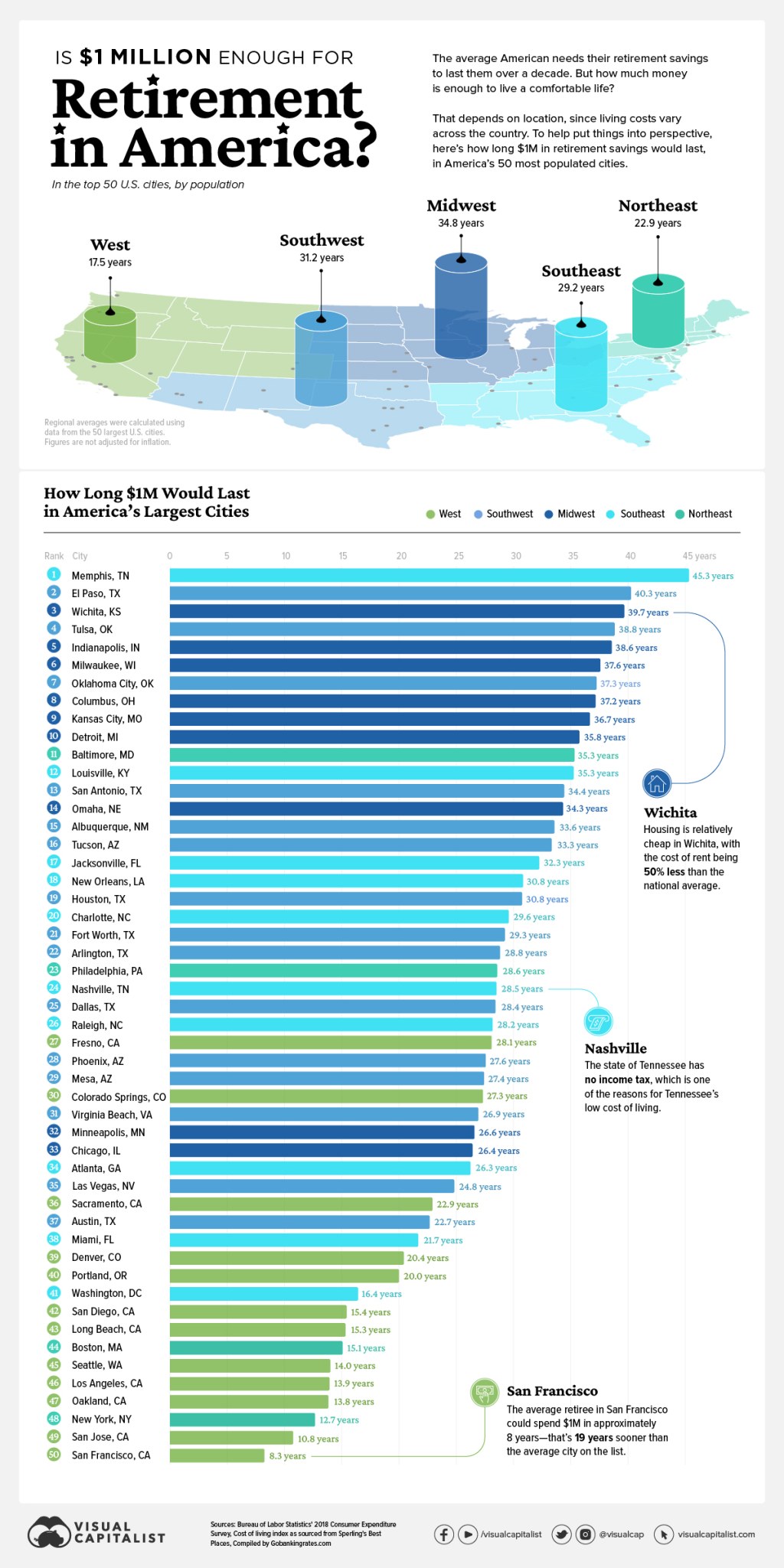

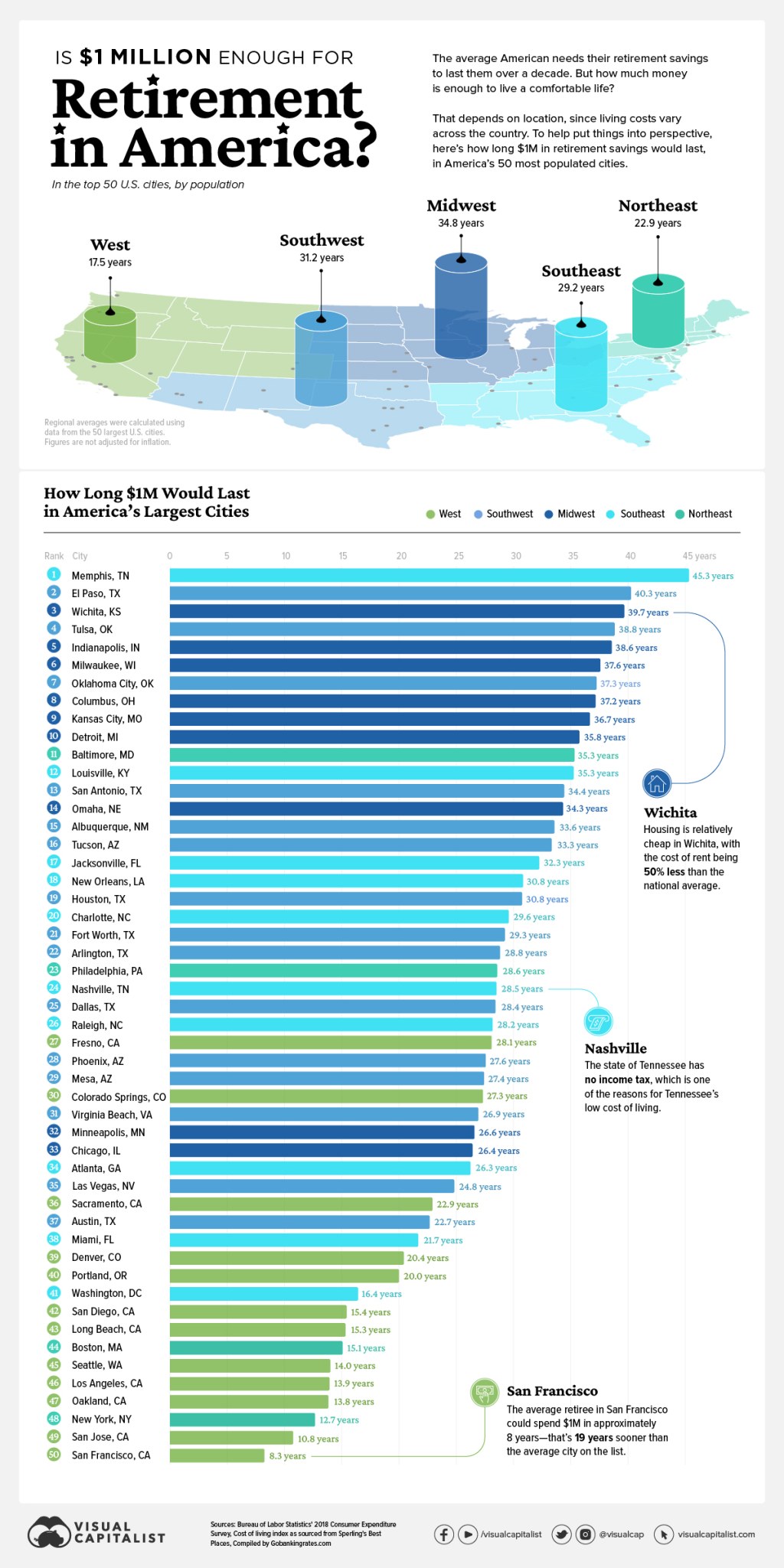

Image Source: visualcapitalist.com

6. How can you achieve this goal?

7. Advantages and disadvantages of retirement fund 1 million

8. Frequently Asked Questions (FAQ)

9. Conclusion

10. Final Remarks

What is Retirement Fund 1 Million?

Retirement fund 1 million refers to the financial goal of accumulating one million dollars specifically for retirement. This fund is intended to provide individuals with a comfortable lifestyle and financial security during their golden years. It acts as a safety net, ensuring that retirees can maintain their desired standard of living without worrying about financial constraints.

Explanation:

Retirement fund 1 million is not a fixed amount that everyone needs to achieve. It varies depending on factors such as your desired lifestyle, inflation rates, healthcare costs, and the number of years you expect to live after retirement. However, aiming for a retirement fund of one million dollars provides a tangible goal to work towards, considering the average expenses and investment returns.

Benefits:

1️⃣ Financial security in retirement

2️⃣ Ability to enjoy desired lifestyle

3️⃣ Peace of mind

4️⃣ Potential to leave a legacy for loved ones

5️⃣ Flexibility to pursue passions and hobbies

6️⃣ Protection against unexpected expenses

Who Can Benefit from Retirement Fund 1 Million?

Retirement fund 1 million is an essential financial goal for individuals who aspire to retire comfortably and maintain their standard of living. It is suitable for anyone who wishes to have financial security during their retirement years, regardless of their current age or income level. Whether you are just starting your career or nearing retirement, it is never too early or too late to begin planning for your future.

Explanation:

Retirement fund 1 million is not limited to a specific demographic. It is a goal that individuals from all walks of life can strive to achieve. By taking the necessary steps and making informed financial decisions, anyone can build a substantial retirement fund over time. It is a proactive approach towards securing your financial well-being in the long run.

Considerations:

1️⃣ Age at which you plan to retire

2️⃣ Current income level

3️⃣ Monthly expenses

4️⃣ Expected healthcare costs

5️⃣ Desired lifestyle after retirement

6️⃣ Investment risk tolerance

When Should You Start Planning for Retirement Fund 1 Million?

The ideal time to start planning for retirement fund 1 million is as early as possible. The power of compounding and long-term investment strategies can significantly benefit those who start saving and investing at a young age. However, even if you are in your 40s, 50s, or beyond, it is never too late to begin securing your financial future.

Explanation:

Time is a crucial factor when it comes to retirement planning. The earlier you start, the more time you have to accumulate wealth and benefit from compounding returns. However, it is important to note that everyone’s financial situation is unique, and it is never too late to take action. It may require more substantial contributions and a potentially more aggressive investment approach, but the goal of retirement fund 1 million can still be achievable.

Steps to Start Planning:

1️⃣ Assess your current financial situation

2️⃣ Set clear retirement goals

3️⃣ Create a budget and reduce unnecessary expenses

4️⃣ Maximize contributions to retirement accounts

5️⃣ Diversify your investments

6️⃣ Consult with a financial advisor

Where Can You Invest Your Retirement Fund?

Investing your retirement fund wisely is crucial to achieving your goal of one million dollars. There are several investment options available, each with its own advantages and considerations. It is important to diversify your portfolio and choose investments that align with your risk tolerance, time horizon, and financial goals.

Explanation:

Retirement funds can be invested in various asset classes, including stocks, bonds, mutual funds, real estate, and retirement accounts such as 401(k)s and IRAs. Each investment option carries its own level of risk and potential return. Diversification is essential to minimize risk and maximize growth potential. Consulting with a financial advisor can help you determine the most suitable investment strategy for your retirement fund.

Investment Options:

1️⃣ Stocks

2️⃣ Bonds

3️⃣ Mutual Funds

4️⃣ Real Estate

5️⃣ Retirement accounts (401(k), IRA)

6️⃣ Exchange-Traded Funds (ETFs)

Why is Retirement Fund 1 Million Important?

Retirement fund 1 million holds great significance in today’s society due to several factors. It provides individuals with financial security, freedom, and the ability to enjoy their retirement years without financial stress. Here are some reasons why retirement fund 1 million is important:

Explanation:

1️⃣ Rising cost of living: As the cost of living continues to increase, having a substantial retirement fund ensures that you can cover your expenses and maintain your desired lifestyle.

2️⃣ Longer life expectancy: People are living longer, which means they need more savings to sustain their retirement years.

3️⃣ Uncertain future of Social Security: Depending solely on Social Security benefits for retirement income may not be sufficient, making it important to have a separate retirement fund.

4️⃣ Healthcare expenses: Healthcare costs can be significant during retirement. Having a retirement fund 1 million allows you to afford quality healthcare without depleting your savings.

5️⃣ Legacy planning: A retirement fund 1 million provides an opportunity to leave a financial legacy for loved ones or charitable causes.

6️⃣ Peace of mind: Knowing that you have a substantial retirement fund gives you peace of mind and allows you to focus on other aspects of life without financial worries.

How Can You Achieve Retirement Fund 1 Million?

Building a retirement fund of one million dollars requires meticulous planning, disciplined saving, and strategic investing. While the journey may seem daunting, it is achievable by following these steps:

Explanation:

1️⃣ Start early and be consistent with saving

2️⃣ Maximize contributions to retirement accounts

3️⃣ Set clear financial goals and create a budget

4️⃣ Reduce unnecessary expenses and prioritize saving

5️⃣ Diversify your investments and review your portfolio regularly

6️⃣ Consider additional sources of income or side hustles

Advantages and Disadvantages of Retirement Fund 1 Million

Retirement fund 1 million, like any financial strategy, has its own advantages and disadvantages. It is important to weigh these factors before making decisions regarding your retirement savings. Here are the pros and cons:

Advantages:

1️⃣ Financial security during retirement

2️⃣ Ability to maintain desired lifestyle

3️⃣ Flexibility to pursue passions and hobbies

4️⃣ Potential to leave a legacy for loved ones

5️⃣ Peace of mind

Disadvantages:

1️⃣ Requires disciplined saving and investing

2️⃣ Market volatility may impact investment returns

3️⃣ Inflation erodes purchasing power over time

4️⃣ May require sacrifices in the present to secure the future

5️⃣ Uncertainty regarding future expenses

Frequently Asked Questions (FAQ)

1. Is one million dollars enough for retirement?

Yes, one million dollars can be sufficient for retirement, depending on your lifestyle, expenses, and investment returns. However, it is important to evaluate your individual needs and consider consulting with a financial advisor.

2. How long will one million dollars last in retirement?

The duration one million dollars will last in retirement depends on factors such as your annual expenses, investment returns, and any other sources of income. Creating a comprehensive retirement plan can help estimate the longevity of your savings.

3. What if I am unable to save one million dollars for retirement?

While one million dollars is a notable financial goal, it is not a requirement for a comfortable retirement. It is essential to save and invest as much as possible based on your individual circumstances. Additionally, Social Security benefits and other sources of income can contribute to your retirement funds.

4. Should I invest my retirement fund aggressively to maximize returns?

The investment strategy for your retirement fund should align with your risk tolerance, time horizon, and financial goals. While aggressive investments may offer higher returns, they also come with increased risk. It is important to find a balance that suits your individual circumstances.

5. How often should I review and adjust my retirement plan?

Regularly reviewing and adjusting your retirement plan is essential to ensure it remains aligned with your goals and financial situation. It is recommended to review your plan at least once a year or whenever significant life events occur.

Conclusion

In conclusion, retirement fund 1 million is a crucial financial goal that provides individuals with financial security, flexibility, and peace of mind during their retirement years. By starting early, consistently saving, and making informed investment decisions, you can work towards achieving this milestone. Remember, everyone’s financial journey is unique, and it is essential to assess your individual circumstances and consult with professionals to create a retirement plan that suits your needs. Start planning today and secure a prosperous future!

Final Remarks

Dear Readers,

We hope this comprehensive guide on retirement fund 1 million has provided you with valuable insights and useful information. Planning for retirement is a significant undertaking, and we encourage you to take proactive steps towards securing your financial future. Remember, achieving a retirement fund of one million dollars requires discipline, consistency, and informed decision-making. Consult with financial advisors, create a personalized plan, and stay committed to your goals. The journey may have its challenges, but the rewards of financial security and a comfortable retirement are worth it. Start today, and enjoy a prosperous future!

This post topic: Budgeting Strategies