Secure Your Future: Maximize Retirement Savings With Us – Take Action Now!

Retirement Savings in the US

Introduction

Dear Readers,

2 Picture Gallery: Secure Your Future: Maximize Retirement Savings With Us – Take Action Now!

Welcome to our comprehensive guide on retirement savings in the US. In this article, we will provide you with all the essential information you need to know about saving for retirement in the United States. It is never too early or too late to start planning for your retirement, and we are here to help you navigate the complexities of retirement savings.

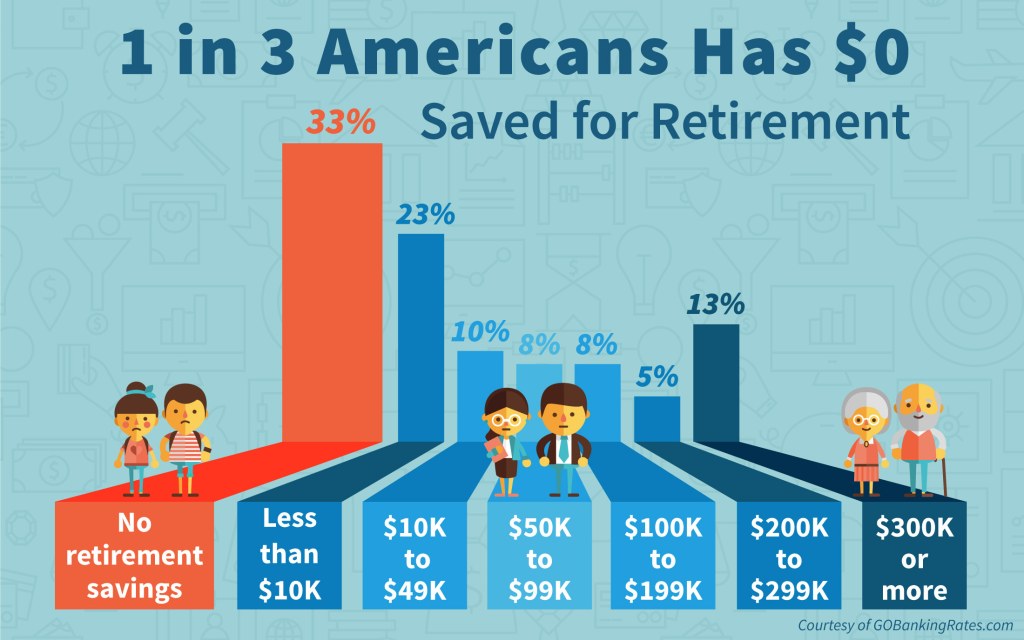

Image Source: gobankingrates.com

Retirement savings play a crucial role in ensuring financial security during your golden years. With the right strategies and knowledge, you can build a substantial nest egg to support your desired lifestyle after retirement. In this guide, we will walk you through the what, who, when, where, why, and how of retirement savings in the US, along with the advantages and disadvantages, frequently asked questions, and concluding remarks.

What is Retirement Savings?

Retirement savings refers to the financial resources individuals accumulate during their working years to support themselves after retirement. It involves setting aside a portion of your income and investing it wisely to grow your savings over time. The goal is to accumulate enough funds to maintain a comfortable lifestyle and cover expenses such as housing, healthcare, and leisure activities during retirement.

Retirement savings can take various forms, including employer-sponsored retirement plans, individual retirement accounts (IRAs), and personal investments. The US government also provides retirement benefits through programs like Social Security.

Who Should Save for Retirement?

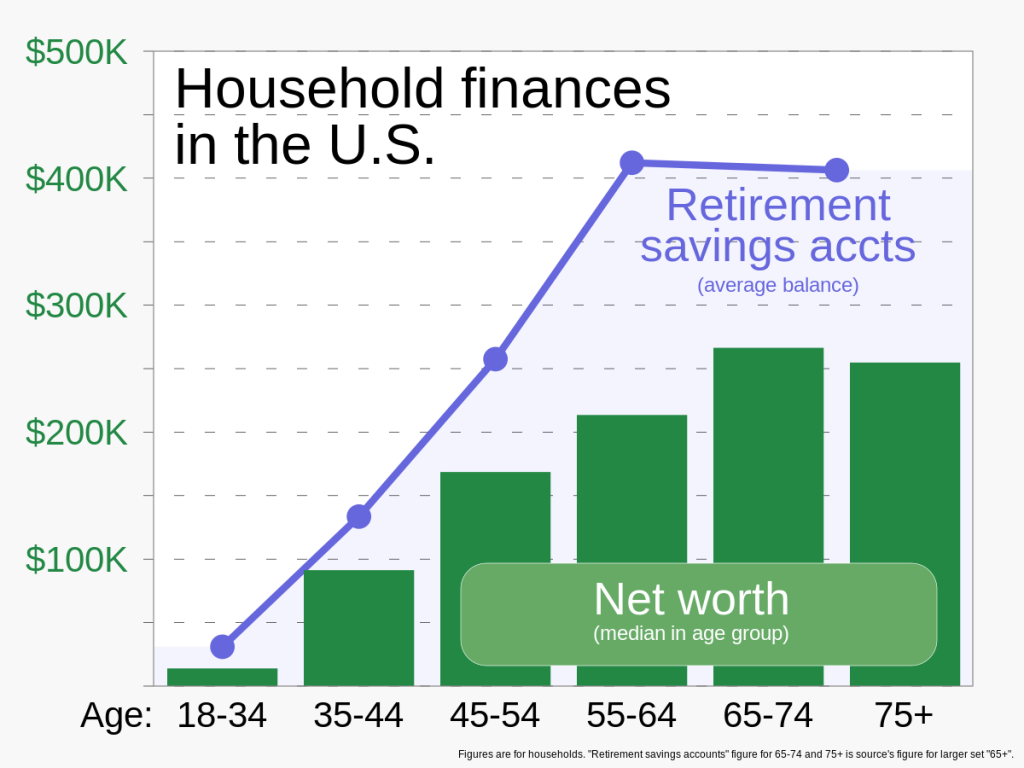

Image Source: wikimedia.org

Everyone, regardless of age or income level, should prioritize retirement savings. Whether you are just starting your career or nearing retirement, saving for the future is crucial. The earlier you start, the more time your savings have to grow through compound interest and investment returns. However, even if you are closer to retirement age, it is never too late to begin saving.

Keep in mind that relying solely on government benefits or pensions may not be sufficient to meet your desired lifestyle during retirement. By taking control of your retirement savings, you can ensure a more secure financial future.

When Should You Start Saving?

It is never too early to start saving for retirement. The power of compounding makes even small contributions over an extended period significant. Ideally, individuals should start saving for retirement as soon as they begin earning income. The earlier you start, the more time your investments have to grow, and the less you need to contribute each month to achieve your retirement goals.

However, if you have not started saving yet, it is essential to take action now. While you may need to contribute more each month to catch up, it is still possible to build a substantial nest egg with diligent saving and smart investment choices.

Where Can You Save for Retirement?

There are several avenues for retirement savings in the US. The most common options include employer-sponsored retirement plans, such as 401(k)s and 403(b)s, and individual retirement accounts (IRAs). These accounts offer tax advantages, allowing your savings to grow tax-free or tax-deferred until withdrawal during retirement.

Additionally, you can invest in stocks, bonds, mutual funds, and other financial instruments outside of retirement accounts to further grow your savings. However, it is important to consider your risk tolerance and seek professional advice when venturing into investment options.

Why is Retirement Savings Important?

Retirement savings are vital for ensuring financial security and independence during your post-work years. By saving for retirement, you take control of your financial future and reduce reliance on government programs or family support. With sufficient savings, you can enjoy a comfortable retirement, pursue your desired lifestyle, and cover unexpected expenses.

Moreover, retirement savings provide a safety net in case of emergencies or unforeseen circumstances, such as medical bills or home repairs. By planning ahead, you can mitigate financial stress and have peace of mind as you enter retirement.

How Can You Save for Retirement?

Saving for retirement involves adopting a disciplined approach and making strategic financial decisions. Here are some key steps to get started:

Set Clear Retirement Goals: Determine how much money you will need during retirement and set specific savings targets.

Create a Budget: Analyze your income and expenses to identify areas where you can cut back and allocate more towards savings.

Maximize Employer Contributions: If your employer offers a retirement plan with matching contributions, take full advantage of it to maximize your savings.

Explore Individual Retirement Accounts (IRAs): Consider opening an IRA to benefit from tax advantages and additional savings options.

Invest Wisely: Seek professional advice to develop an investment strategy that aligns with your risk tolerance and retirement goals.

Monitor and Adjust: Regularly review your retirement savings plan and make necessary adjustments to ensure you stay on track.

Stay Informed: Stay updated on retirement savings trends, changes in regulations, and new investment opportunities to make informed decisions.

Advantages and Disadvantages of Retirement Savings

Retirement savings offer numerous advantages, but it is important to consider potential disadvantages as well. Here are some key points to consider:

Advantages:

Financial Security: Retirement savings provide a safety net and ensure financial stability during your post-work years.

Flexibility: With sufficient savings, you have the freedom to choose how you want to spend your retirement and pursue your passions.

Tax Advantages: Retirement accounts offer tax benefits, such as tax-free growth or tax deductions, depending on the account type.

Compound Growth: Starting early and investing wisely can result in significant compounded growth over time.

Reduced Dependence: By saving for retirement, you reduce reliance on government programs or family support.

Disadvantages:

Market Volatility: Investments involve risks, and market fluctuations can impact the value of your retirement savings.

Early Withdrawal Penalties: Withdrawing funds from retirement accounts before a certain age may result in penalties and tax implications.

Uncertain Future: Predicting future expenses and the cost of living during retirement can be challenging and may require adjustments along the way.

Frequently Asked Questions (FAQ)

1. Can I start saving for retirement if I have debt?

Yes, it is possible to save for retirement while managing debt. Prioritize high-interest debt repayment while making consistent contributions to your retirement savings. Finding a balance between debt repayment and retirement savings is crucial.

2. How much should I save for retirement?

The amount you should save for retirement depends on various factors, such as your desired lifestyle, expected expenses, and retirement age. It is recommended to aim for saving 10-15% of your annual income, but adjust this percentage based on your individual circumstances.

3. What happens to my retirement savings if I change jobs?

If you change jobs, you have several options for your retirement savings. You can leave your savings in the previous employer’s retirement plan, roll it over to your new employer’s plan, transfer it to an IRA, or cash it out (subject to taxes and penalties).

4. Can I rely solely on Social Security for retirement?

While Social Security provides a foundation for retirement income, it is generally not enough to support a comfortable lifestyle. It is important to supplement Social Security benefits with personal savings to ensure financial security.

5. What if I started saving for retirement late?

If you started saving for retirement late, you may need to contribute more each month to catch up. Consider consulting with a financial advisor to develop a personalized plan and explore investment options that align with your goals.

Conclusion

In conclusion, retirement savings in the US are essential for securing financial independence during your golden years. By starting early, setting clear goals, and making informed financial decisions, you can build a substantial nest egg to support your desired lifestyle after retirement.

Remember, it is never too late to start saving for retirement. Take control of your financial future and enjoy a comfortable retirement by prioritizing your savings today. Keep yourself informed, seek professional advice, and stay committed to your retirement savings plan. Your future self will thank you.

Final Remarks

Retirement savings require careful planning and consideration. The information provided in this article serves as a general guide, and it is crucial to consult with financial professionals for personalized advice based on your specific circumstances.

Additionally, the economic landscape and retirement laws may change over time, impacting retirement savings strategies. Stay updated and adapt your approach accordingly. Remember, the earlier you start saving, the better prepared you will be for a financially secure retirement.

Thank you for reading, and we wish you all the best on your journey towards a comfortable retirement.

This post topic: Budgeting Strategies