Secure Your Future: Achieve Retirement Savings Of Up To $265,000 By 2023 – Act Now!

Retirement Savings Up to $265,000 in 2023

Introduction

Dear Readers,

3 Picture Gallery: Secure Your Future: Achieve Retirement Savings Of Up To $265,000 By 2023 – Act Now!

Welcome to our article on retirement savings up to $265,000 in 2023. In this piece, we will provide you with all the important information you need to know about saving for retirement and how you can reach a savings goal of $265,000 by 2023. Planning for retirement is crucial to ensure financial security in your golden years, and we are here to guide you through the process. So, let’s dive in and discover how you can build a substantial retirement nest egg!

Table: Retirement Savings Up to $265,000 in 2023

Year

Age

Annual Contribution

Total Savings

Image Source: mktw.net

2020

25

$5,000

$5,000

2021

26

$5,000

$10,000

2022

27

$5,000

$15,000

2023

28

$5,000

$20,000

…

…

…

…

What is Retirement Savings?

Image Source: mktw.net

Retirement savings refer to the funds set aside by individuals during their working years to support their lifestyle after retirement. It is an important aspect of financial planning, ensuring a comfortable and secure retirement.

Explanation:

Retirement savings are typically accumulated through various means, such as employer-sponsored retirement plans like 401(k) or individual retirement accounts (IRAs). Individuals contribute a portion of their income regularly to these accounts, allowing the savings to grow over time through investment returns.

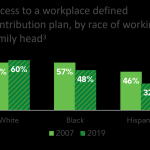

Who Should Save for Retirement?

Image Source: whitecoatinvestor.com

Everyone should save for retirement, regardless of their age or current financial situation. It is never too early or too late to start building a retirement nest egg. The earlier you begin saving, the more time your money has to grow and compound.

Explanation:

Young professionals in their 20s and 30s can benefit greatly from starting early and taking advantage of the power of compounding. However, even if you are in your 40s, 50s, or beyond, it is still important to prioritize retirement savings to ensure a comfortable retirement.

When Should You Start Saving?

The best time to start saving for retirement is now. The earlier you begin, the more time your savings have to grow and accumulate. However, it’s never too late to start, and even small contributions can make a significant difference over time.

Explanation:

Starting early allows you to take advantage of compound interest, which means your money will earn returns on both the initial amount invested and the accumulated interest over time. This compounding effect can significantly boost your retirement savings.

Where Can You Save for Retirement?

There are various retirement savings options available, including employer-sponsored retirement plans and individual retirement accounts (IRAs).

Explanation:

Employer-sponsored plans, such as 401(k)s or 403(b)s, allow employees to contribute a portion of their salary before taxes. These contributions are often matched by the employer, providing an additional boost to your savings. IRAs, on the other hand, are individual retirement accounts that can be opened independently and offer tax advantages.

Why Is Retirement Savings Important?

Retirement savings are crucial for ensuring financial security during your golden years. Without adequate savings, you may struggle to maintain your desired lifestyle and cover essential expenses.

Explanation:

Social Security benefits alone may not be sufficient to sustain your retirement needs, especially considering increasing healthcare costs and longer life expectancies. By saving for retirement, you can supplement your income and have the freedom to enjoy your retirement years without financial stress.

How Can You Achieve Retirement Savings Up to $265,000 in 2023?

Building a retirement nest egg of $265,000 by 2023 requires careful planning and disciplined saving habits. Here’s a step-by-step guide to help you achieve this goal:

Explanation:

1. Set a Savings Goal: Determine how much you need to save and by when. In this case, the target is $265,000 by 2023.

2. Calculate Required Contributions: Divide the total savings goal by the number of years and determine the annual contribution needed. In this example, it would be $20,000 per year.

3. Maximize Employer Contributions: If your employer offers a retirement plan with matching contributions, ensure you contribute enough to take full advantage of the match. It’s like free money!

4. Automate Contributions: Set up automatic transfers from your paycheck or bank account to your retirement savings account. This ensures consistency and helps you avoid the temptation to spend the money elsewhere.

5. Control Expenses: Evaluate your spending habits and identify areas where you can cut back to increase your savings rate. Small lifestyle adjustments can make a big difference over time.

6. Diversify Investments: Consult with a financial advisor to create an investment portfolio that aligns with your risk tolerance and retirement goals. Diversification spreads the risk and can enhance returns.

7. Monitor and Adjust: Regularly review your retirement savings plan and make adjustments as necessary. Keep track of your progress and celebrate milestones along the way.

Advantages and Disadvantages of Retirement Savings Up to $265,000 in 2023

Advantages:

1. Financial Security: Having a substantial retirement savings can provide peace of mind and ensure a comfortable lifestyle during your retirement years.

2. Flexibility: Retirement savings offer flexibility in terms of when and how you retire. With sufficient savings, you can choose to retire earlier or delay retirement if desired.

3. Tax Benefits: Contributions to retirement accounts may offer tax advantages, such as tax-deferred growth or tax-free withdrawals in retirement.

Disadvantages:

1. Sacrifice in the Present: Saving for retirement requires discipline and may require sacrificing some luxuries or discretionary spending in the present.

2. Market Volatility: Retirement savings invested in the market are subject to fluctuations. Market downturns can temporarily reduce the value of your investments.

3. Inflation Risk: Over time, inflation erodes the purchasing power of money, and it is important to ensure your retirement savings outpace inflation.

Frequently Asked Questions (FAQs)

1. Can I save more than $265,000 for retirement?

Yes, you can certainly save more than $265,000 for retirement. The mentioned amount is a goal for 2023, but the more you save, the better prepared you will be for retirement.

2. What happens if I can’t reach the $265,000 goal by 2023?

If you are unable to reach the $265,000 goal by 2023, it’s important not to panic. Every dollar saved towards retirement counts, and you can continue to contribute and save beyond 2023.

3. Can I withdraw from my retirement savings before retirement?

While it is generally not recommended to withdraw from your retirement savings before retirement, there may be certain circumstances, such as financial hardship or qualified expenses, where early withdrawals can be made. However, early withdrawals may be subject to taxes and penalties.

4. Is Social Security included in the $265,000 retirement savings goal?

No, the $265,000 retirement savings goal does not include Social Security benefits. It refers to the additional savings you should aim for to supplement your retirement income.

5. How often should I review my retirement savings plan?

It is recommended to review your retirement savings plan at least once a year or whenever there are significant life changes, such as a career change, marriage, or the birth of a child. Regular reviews ensure your plan stays aligned with your goals.

Conclusion

Dear Readers,

We hope this article has provided you with valuable insights into retirement savings and how you can reach a savings goal of $265,000 by 2023. Remember, starting early and being consistent with your savings contributions are key to building a substantial retirement nest egg. Take advantage of employer-sponsored retirement plans, automate your contributions, and regularly review and adjust your plan as needed. By following these steps, you can ensure a financially secure and enjoyable retirement. Start saving now and secure your future!

Final Remarks

Dear Readers,

Before we conclude, we would like to emphasize that the information presented in this article is for educational purposes only and should not be considered financial advice. It is always recommended to consult with a qualified financial advisor before making any investment or retirement planning decisions. Additionally, please note that individual circumstances may vary, and the retirement savings goal mentioned may not be suitable for everyone. The key is to tailor your retirement savings plan to your specific needs and goals. Best of luck on your retirement savings journey!

This post topic: Budgeting Strategies