Secure Your Future With A 3 Percent Retirement Plan – Act Now For Financial Freedom!

Retirement Plan 3 Percent: A Secure Future for Your Golden Years

Introduction

Dear Readers,

3 Picture Gallery: Secure Your Future With A 3 Percent Retirement Plan – Act Now For Financial Freedom!

Welcome to this informative article on the retirement plan 3 percent. In today’s fast-paced world, where financial stability is essential for a comfortable retirement, it is crucial to make the right investment choices. The retirement plan 3 percent offers a secure and reliable option for individuals seeking financial security during their golden years.

Image Source: cke-cs.com

In this article, we will delve into the details of the retirement plan 3 percent and explore its advantages and disadvantages, helping you make an informed decision for your retirement savings.

Let’s begin by understanding what the retirement plan 3 percent entails and who can benefit from it.

What is the Retirement Plan 3 Percent? 🌟

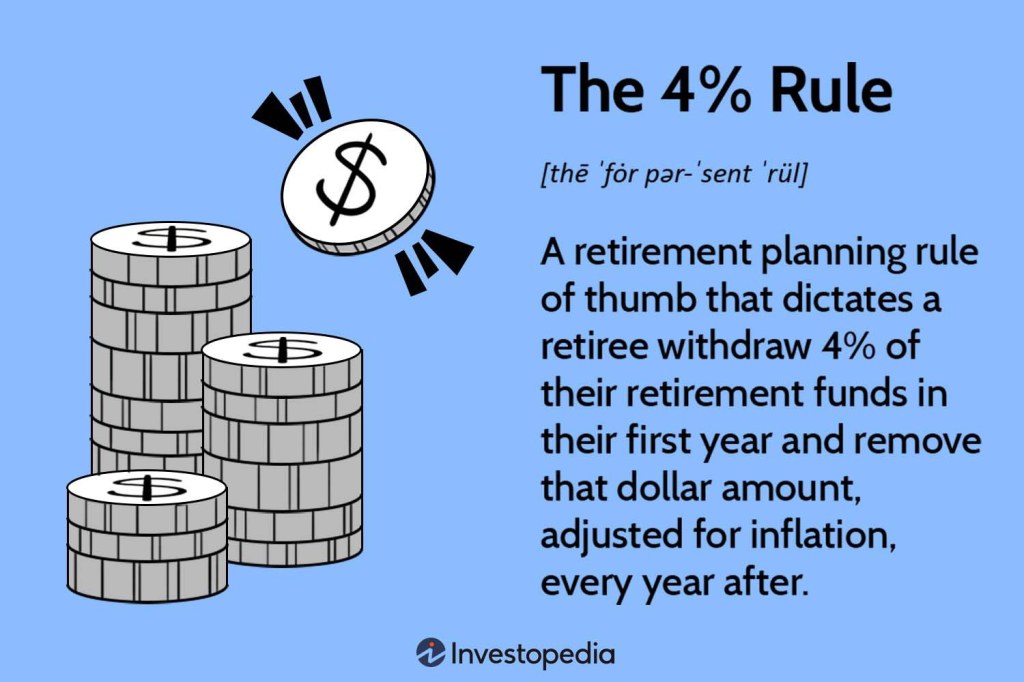

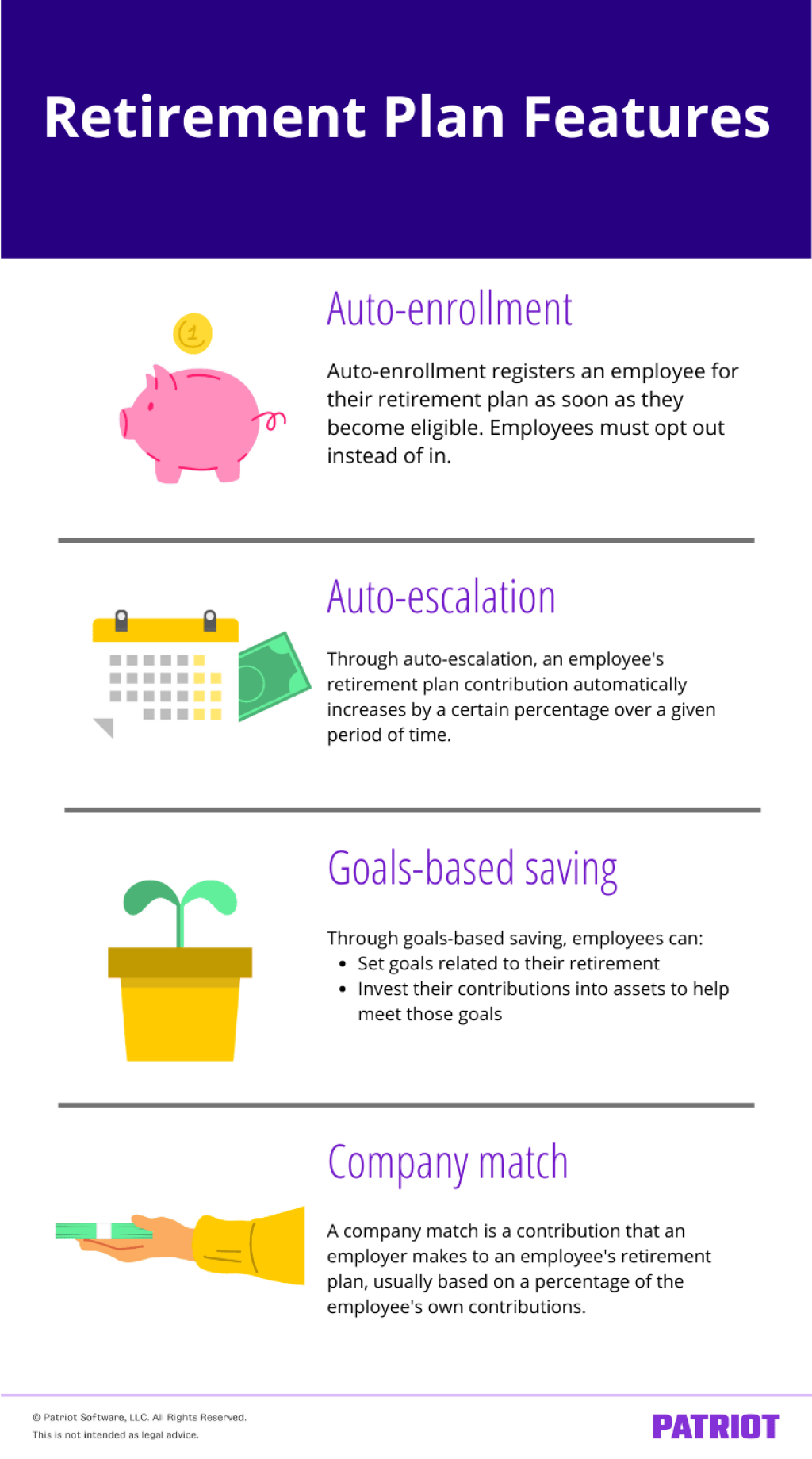

The retirement plan 3 percent is a financial option that allows individuals to save for retirement with a fixed interest rate of 3 percent annually. It is a long-term investment strategy that offers stability and consistent growth for your retirement funds.

Image Source: googleusercontent.com

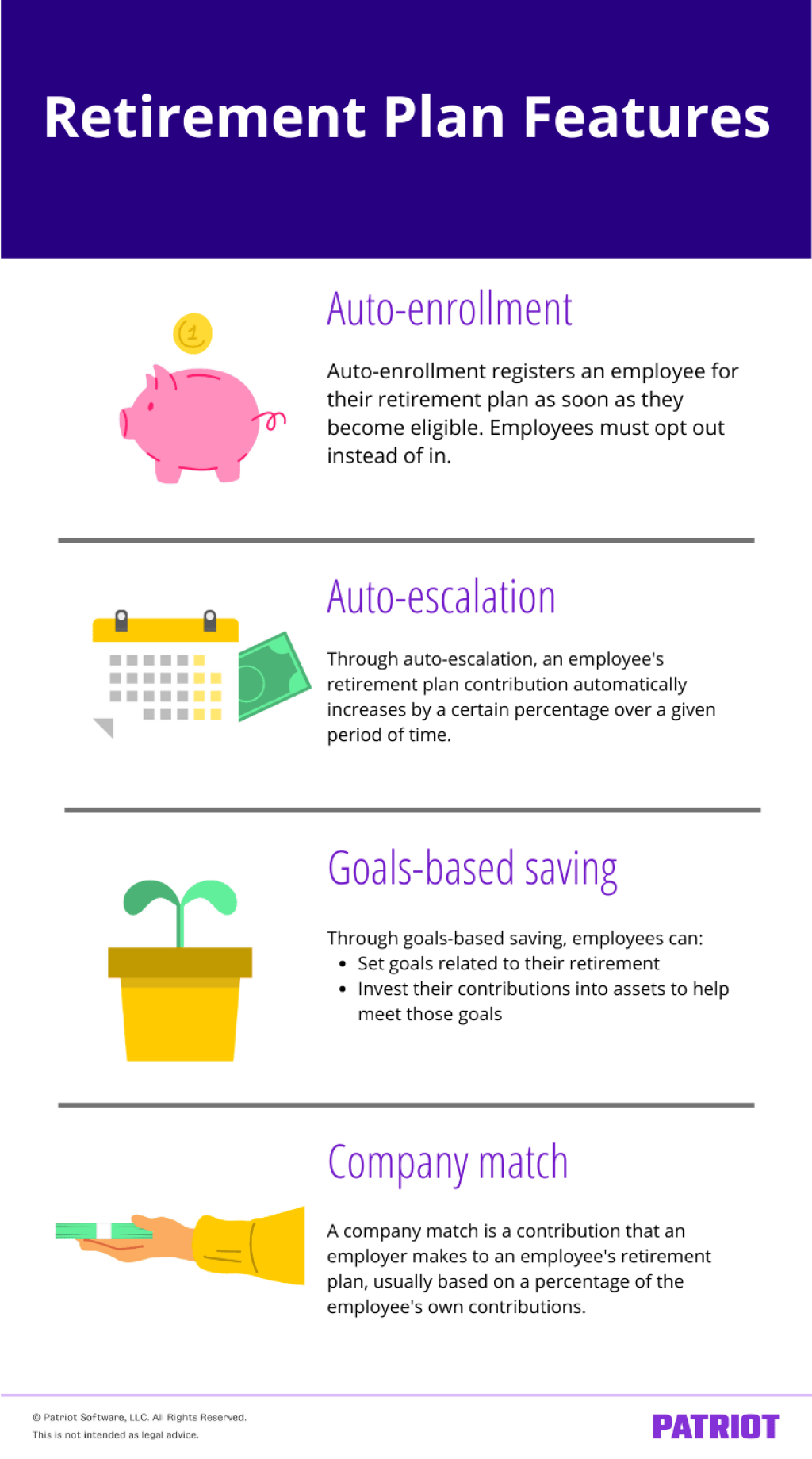

The plan involves regular contributions to a retirement account, which is managed by financial institutions or retirement plan providers. These contributions, along with the fixed interest rate, help grow your retirement savings over time.

Now that we know what the retirement plan 3 percent entails, let’s explore who can benefit from this investment strategy.

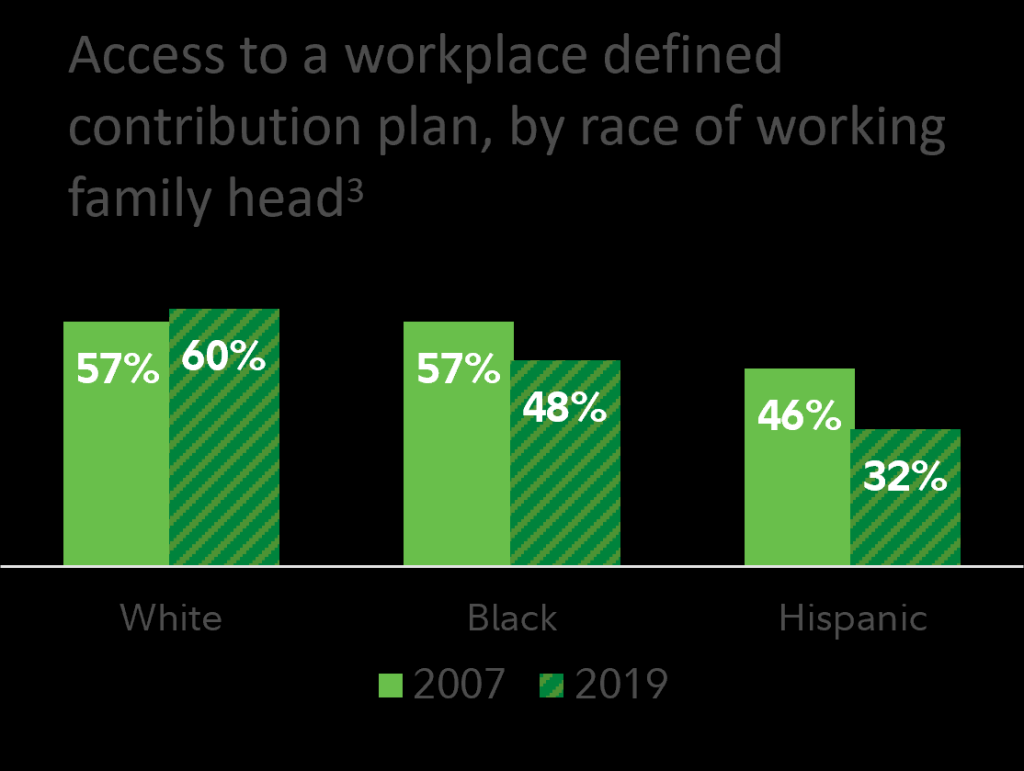

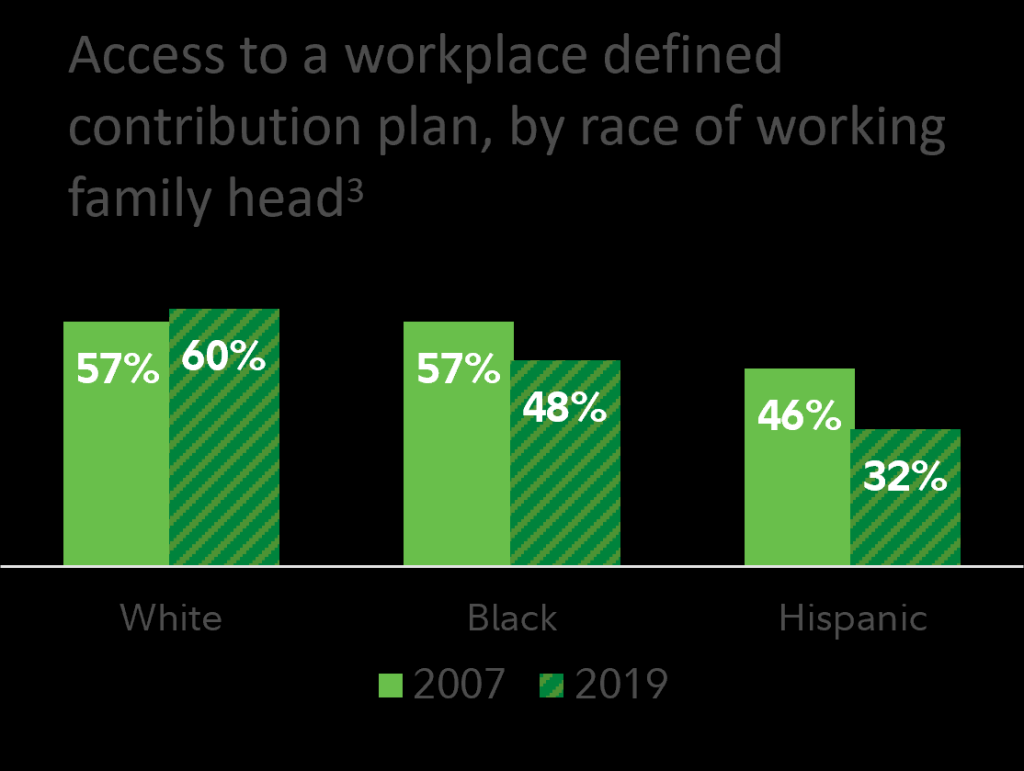

Who Can Benefit from the Retirement Plan 3 Percent? 🤔

Image Source: investopedia.com

The retirement plan 3 percent is suitable for individuals who prioritize security and consistent growth in their retirement savings. It is an ideal option for risk-averse investors who want to ensure a stable future.

Whether you are a young professional just starting your career or someone nearing retirement age, the retirement plan 3 percent can provide a reliable foundation for your financial future. It allows you to accumulate savings over time and benefit from the power of compounding interest.

Now that we understand who can benefit from this plan, let’s explore when and where you can start investing in the retirement plan 3 percent.

When and Where Can You Start Investing in the Retirement Plan 3 Percent? ⏰🌍

The retirement plan 3 percent is available for individuals to start investing at any stage of their professional lives. Whether you are in your 20s, 30s, or even approaching retirement, it is never too late to start securing your financial future.

You can find retirement plan 3 percent options offered by various financial institutions and retirement plan providers. It is essential to research and compare different providers to find the one that best suits your needs and offers the most favorable terms.

Now that we know when and where to start investing, let’s explore why the retirement plan 3 percent is a beneficial choice for your retirement savings.

Why Choose the Retirement Plan 3 Percent? 🤷♂️

The retirement plan 3 percent offers several advantages for individuals looking to secure their financial future. Let’s explore these benefits:

1. Consistent Growth and Stability 💰

The fixed interest rate of 3 percent provides steady growth for your retirement savings. This stability allows you to plan your future with confidence, knowing that your funds are steadily growing over time.

2. Mitigates Market Risks 📉

The retirement plan 3 percent is not subject to market fluctuations, protecting your investments from potential downturns. This feature makes it an appealing option for risk-averse individuals who want to safeguard their retirement savings.

3. Compound Interest Magic ✨

By starting early and consistently contributing to the retirement plan 3 percent, you can benefit from the power of compounding interest. Over time, your savings can grow exponentially, allowing you to enjoy a comfortable retirement.

4. Tax Advantages 🏦

Depending on your jurisdiction, the retirement plan 3 percent may offer tax advantages. It is essential to consult with a financial advisor or tax professional to understand the specific tax benefits available in your area.

5. Flexibility and Control 🔄

The retirement plan 3 percent offers flexibility, allowing you to choose the contribution amounts and frequency that work best for your financial situation. This control empowers you to tailor the plan to your specific needs and goals.

While the retirement plan 3 percent offers significant advantages, it also has some disadvantages or considerations. Let’s explore these:

Disadvantages of the Retirement Plan 3 Percent

1. Limited Exposure to Higher Interest Rates ⬆️

The fixed 3 percent interest rate may not match the potential returns of other investment options during periods of high-interest rates. It is crucial to consider your risk tolerance and long-term financial goals when choosing this plan.

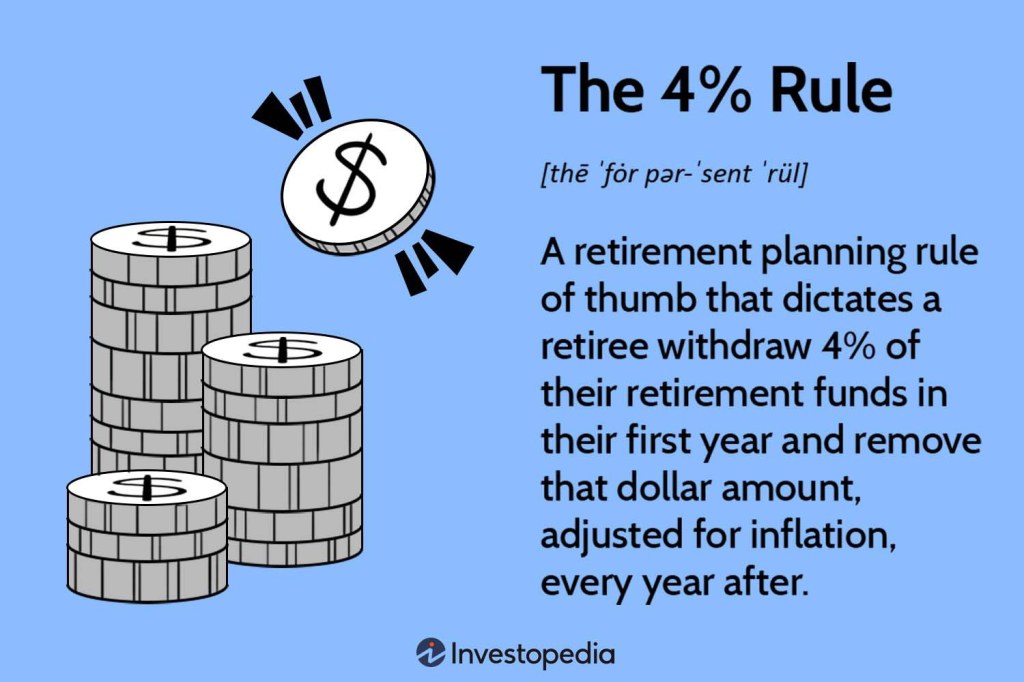

2. Inflation Impact 💹

Inflation erodes the purchasing power of money over time. While the retirement plan 3 percent offers growth, it is essential to consider the impact of inflation and ensure that your savings keep pace with rising living costs.

3. Withdrawal Restrictions 🚫

The retirement plan 3 percent may have withdrawal restrictions or penalties if you need to access your funds before reaching the designated retirement age. It is crucial to understand these terms and consider your liquidity needs.

4. Opportunity Cost ⏳

By selecting the retirement plan 3 percent, you may miss out on potential higher returns from riskier, but potentially more lucrative, investment options. It is essential to assess your risk tolerance and weigh the opportunity cost of this plan against other investment alternatives.

5. Varying Provider Terms and Conditions ⚖️

Each financial institution or retirement plan provider may offer different terms and conditions for the retirement plan 3 percent. It is crucial to carefully review these details, including fees, minimum investment requirements, and withdrawal policies, before making a decision.

Frequently Asked Questions (FAQs)

Q1: Can I start investing in the retirement plan 3 percent if I am close to retirement?

A1: Yes, the retirement plan 3 percent is suitable for individuals of all ages, including those nearing retirement. It can provide stability and secure growth for your retirement savings.

Q2: Is the retirement plan 3 percent subject to market fluctuations?

A2: No, the retirement plan 3 percent offers a fixed interest rate, making it immune to market volatility. Your investments are shielded from potential market downturns.

Q3: Are there any tax advantages associated with the retirement plan 3 percent?

A3: Depending on your jurisdiction, the retirement plan 3 percent may offer tax benefits. It is advisable to consult with a financial advisor or tax professional to understand the specific advantages available to you.

Q4: Can I withdraw my funds from the retirement plan 3 percent before reaching the designated retirement age?

A4: The retirement plan 3 percent may have withdrawal restrictions or penalties if you need to access your funds early. It is essential to review the terms and conditions of your specific plan before making any decisions.

Q5: Is the retirement plan 3 percent the best option for maximizing my returns?

A5: The retirement plan 3 percent offers stability and consistent growth, but it may not provide the highest potential returns compared to riskier investment options. It is crucial to assess your risk tolerance and long-term financial goals when choosing the right plan for you.

Conclusion

Friends, the retirement plan 3 percent offers a secure and reliable option for individuals seeking financial stability during retirement. With its steady growth, tax advantages, and flexibility, it can provide a solid foundation for your future.

However, it’s important to consider the disadvantages and review the terms and conditions of different providers before making a decision. Remember to assess your risk tolerance and long-term financial goals to choose the retirement plan that best fits your needs.

Start planning for your golden years today, and secure a comfortable retirement with the retirement plan 3 percent!

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial advice. It is essential to consult with a qualified financial advisor or professional before making any investment decisions.

This post topic: Budgeting Strategies