Bolster Your Finances With A Game-Changing Budget Repair Strategy: Take Action Now!

Budget Repair Strategy: Restoring Financial Stability

Welcome, readers! Today, we will delve into the world of budget repair strategy, exploring its significance and benefits in restoring financial stability. In this article, we will provide a comprehensive overview of this topic, discussing its what, who, when, where, why, and how. So, let’s dive in and discover more about budget repair strategy!

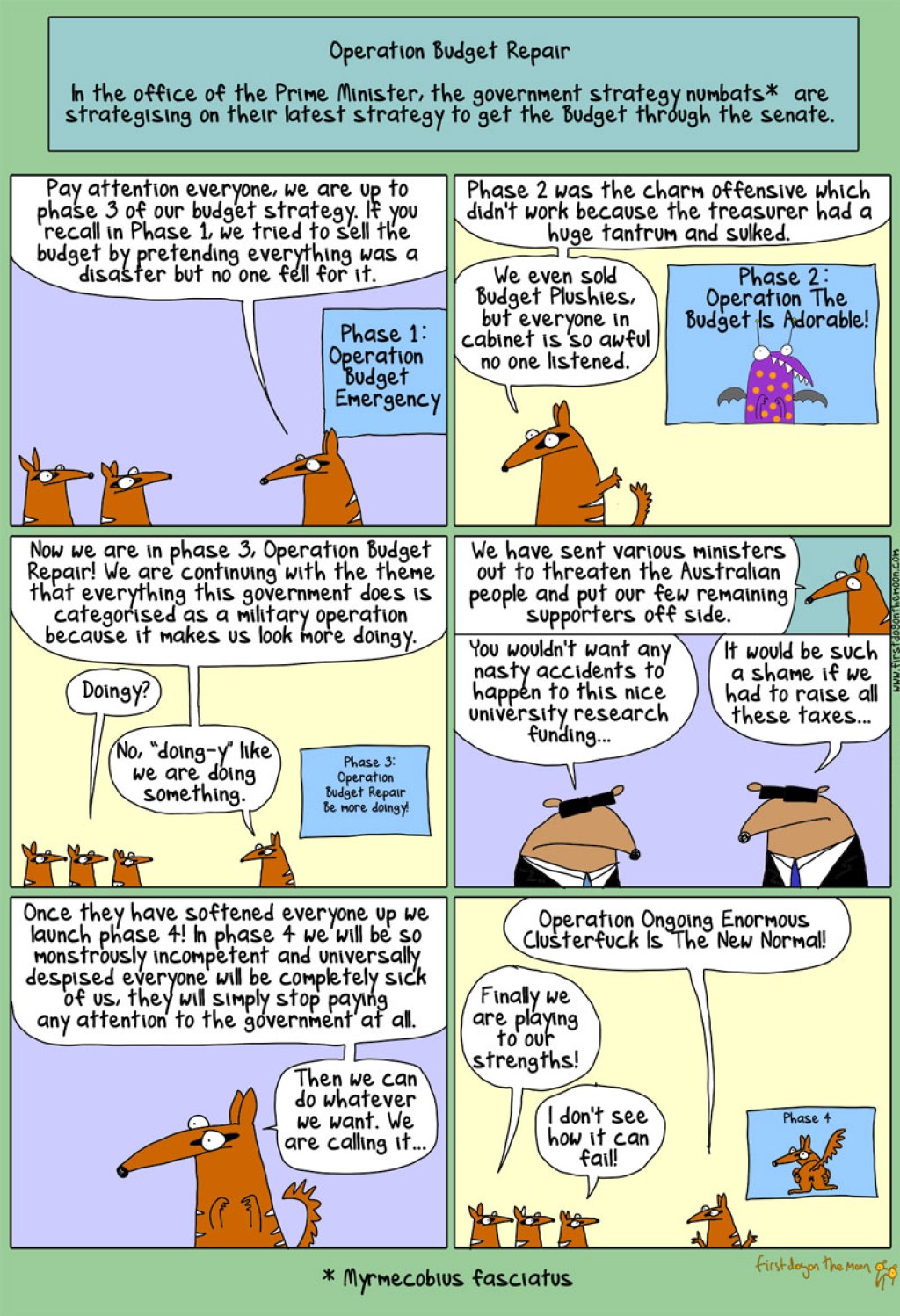

1. What is Budget Repair Strategy?

1 Picture Gallery: Bolster Your Finances With A Game-Changing Budget Repair Strategy: Take Action Now!

🔍 Budget repair strategy refers to a set of actions and measures aimed at addressing financial deficits and restoring fiscal health. It involves implementing effective strategies to reduce spending, increase revenue, and manage debts, ensuring financial stability for both individuals and organizations.

2. Who Can Benefit from Budget Repair Strategy?

🔍 Budget repair strategy is beneficial for individuals, households, businesses, and governments facing financial challenges. It offers practical solutions for those burdened with debt, struggling with financial mismanagement, or seeking to improve their economic situation.

3. When Should You Consider Budget Repair Strategy?

Image Source: guim.co.uk

🔍 Budget repair strategy should be considered whenever financial difficulties arise, such as mounting debts, increasing expenses, or declining revenue. It is essential to address these challenges promptly to prevent further financial distress and regain control over your finances.

4. Where Can Budget Repair Strategy Be Implemented?

🔍 Budget repair strategy can be implemented in various settings, including personal finances, businesses of all sizes, and government entities. It is a versatile approach that can be tailored to suit the specific needs and circumstances of different individuals and organizations.

5. Why Is Budget Repair Strategy Important?

🔍 Budget repair strategy is crucial for maintaining financial stability and overcoming financial hardships. By implementing effective budget repair measures, individuals and organizations can regain control over their finances, reduce debt burdens, and establish a solid foundation for future growth and prosperity.

6. How to Implement Budget Repair Strategy?

🔍 Implementing a budget repair strategy involves several key steps. Firstly, assess your financial situation by analyzing income, expenses, and debts. Next, identify areas where you can cut costs and reduce unnecessary spending. Additionally, explore opportunities to increase revenue through additional income streams or better financial management. Finally, create a realistic budget, stick to it, and regularly monitor your progress to ensure long-term financial stability.

Advantages and Disadvantages of Budget Repair Strategy

Advantages of Budget Repair Strategy

1. Increased Financial Stability: Implementing a budget repair strategy helps restore financial stability by reducing debt and improving financial management.

2. Debt Reduction: By carefully managing expenses and increasing revenue, individuals and organizations can effectively reduce their debt burdens.

3. Improved Credit Score: Consistently implementing a budget repair strategy can lead to an improved credit score, enabling access to better financial opportunities.

4. Enhanced Financial Planning: Budget repair strategy encourages effective financial planning, enabling individuals and organizations to set realistic goals and achieve long-term financial success.

5. Stress Reduction: Overcoming financial challenges through budget repair strategy alleviates stress and provides peace of mind, allowing individuals to focus on other aspects of life or business.

Disadvantages of Budget Repair Strategy

1. Requires Discipline: Implementing a budget repair strategy necessitates discipline and consistency in managing finances, which may be challenging for some individuals.

2. Short-term Sacrifices: Budget repair strategy often requires short-term sacrifices, such as cutting back on certain expenses or reducing discretionary spending.

3. Time-consuming: Developing and implementing a budget repair strategy can be time-consuming, as it involves thorough analysis and regular monitoring of finances.

4. Limited Financial Flexibility: Strict adherence to a budget repair strategy may limit financial flexibility, making it challenging to accommodate unexpected expenses or seize immediate opportunities.

5. Requires Patience: Achieving long-term financial stability through budget repair strategy requires patience, as it may take time to see significant results.

Frequently Asked Questions (FAQs)

1. Is budget repair strategy only for individuals?

🔍 No, budget repair strategy can be implemented by individuals, households, businesses, and governments facing financial difficulties.

2. Can budget repair strategy help in debt management?

🔍 Yes, budget repair strategy plays a crucial role in managing and reducing debt burdens by implementing effective financial management techniques.

3. How long does it take to see results with budget repair strategy?

🔍 The time required to see significant results with budget repair strategy depends on the individual or organization’s financial situation and the effectiveness of the implemented measures.

4. Is it necessary to seek professional assistance for implementing a budget repair strategy?

🔍 While seeking professional assistance can be beneficial, implementing a budget repair strategy can also be done independently with careful research and planning.

5. Can budget repair strategy help in achieving long-term financial goals?

🔍 Yes, budget repair strategy provides a solid foundation for achieving long-term financial goals by promoting effective financial planning and management.

Conclusion

In conclusion, budget repair strategy serves as a powerful tool in restoring financial stability for individuals, households, businesses, and governments. By implementing effective measures and adopting disciplined financial practices, individuals and organizations can overcome financial challenges, reduce debt burdens, and establish a strong financial foundation. Start implementing a budget repair strategy today and pave the way for a brighter financial future!

Disclaimer: The information provided in this article is for general informational purposes only and should not be construed as professional advice. Please consult with a financial advisor or expert for personalized guidance tailored to your specific financial situation.

This post topic: Budgeting Strategies