Master Your Finances: Unleashing The Power Of Budgeting Model Strategy – Take Control Now!

Budgeting Model Strategy: A Comprehensive Guide

Greetings, readers! Today, we will be delving into the world of budgeting model strategy, a crucial aspect for individuals and businesses alike. In this article, we will explore the ins and outs of budgeting models, shedding light on their significance and providing valuable insights for your financial planning endeavors.

Introduction

Understanding budgeting model strategy is essential for effective financial management. It involves the development and implementation of various models to allocate resources, track expenditures, and achieve financial goals. By employing the right budgeting model, individuals and businesses can make informed decisions, optimize their funds, and pave the way for success.

2 Picture Gallery: Master Your Finances: Unleashing The Power Of Budgeting Model Strategy – Take Control Now!

In this article, we will explore the different components of budgeting model strategy, including its purpose, benefits, and potential challenges. Moreover, we will delve into the key elements of the what, who, when, where, why, and how of budgeting models, providing you with a comprehensive understanding of this vital financial tool.

What Is Budgeting Model Strategy?

🔑 Key Point: Budgeting model strategy refers to the systematic planning and allocation of financial resources to achieve specific goals.

Budgeting model strategy involves creating a financial framework that guides decision-making processes and ensures the efficient use of funds. It encompasses various methods, techniques, and tools to streamline budgeting processes and enhance financial performance.

Who Can Benefit from Budgeting Model Strategy?

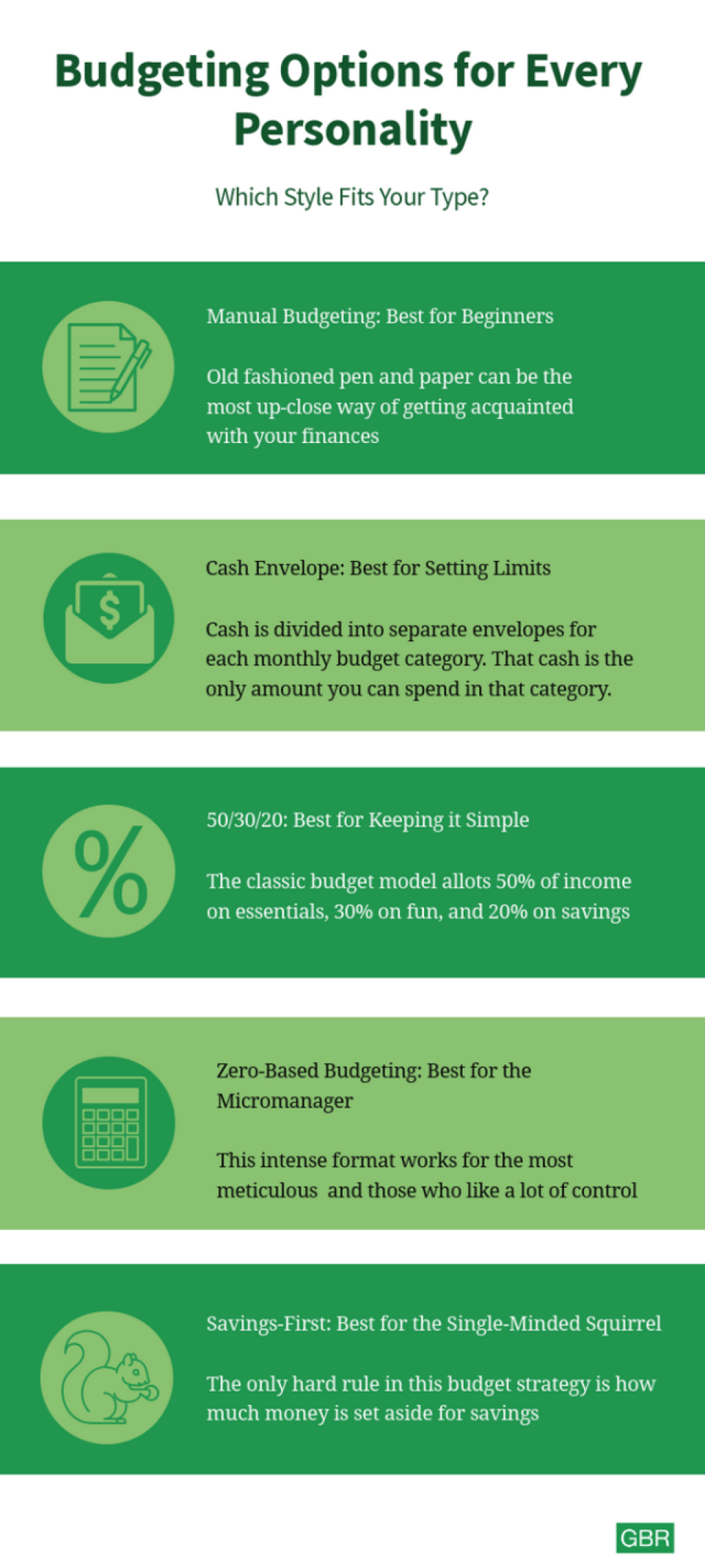

Image Source: yimg.com

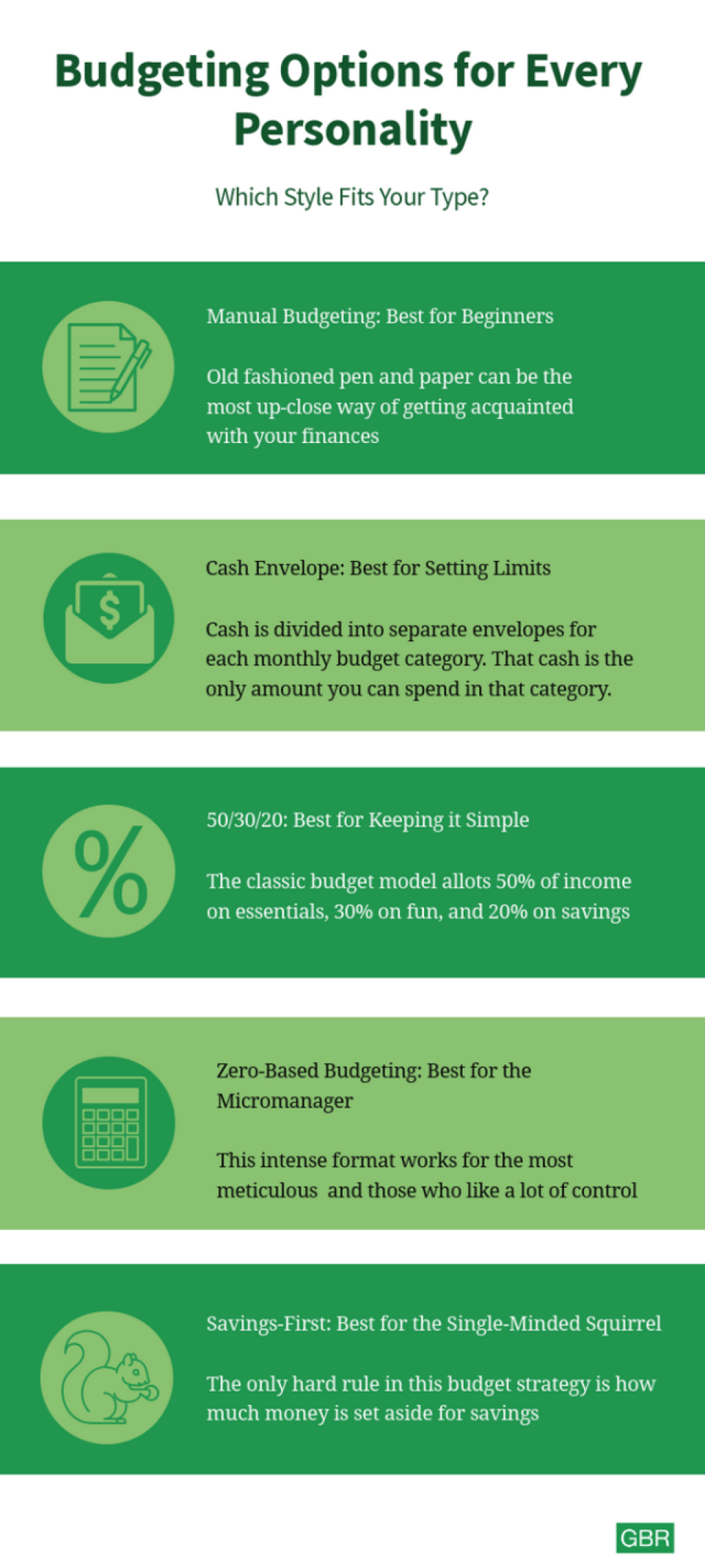

🔑 Key Point: Budgeting model strategy is beneficial for both individuals and businesses seeking to manage their finances effectively.

Whether you are an individual looking to control personal expenses, a small business owner aiming to optimize cash flow, or a large corporation planning for future growth, budgeting model strategy is essential. It empowers individuals and organizations to make informed financial decisions, enhance resource allocation, and align their spending with their goals and objectives.

When Should You Implement Budgeting Model Strategy?

🔑 Key Point: Budgeting model strategy should be implemented as an ongoing process to ensure continuous financial stability and growth.

Implementing budgeting model strategy is crucial from the very beginning of your financial journey. Whether you are just starting out or have an established business, having a well-defined budgeting model allows you to track your income, expenses, and investments consistently. By doing so, you can identify trends, address potential issues, and make adjustments as needed.

Where Can Budgeting Model Strategy Be Applied?

🔑 Key Point: Budgeting model strategy can be applied across various sectors and industries.

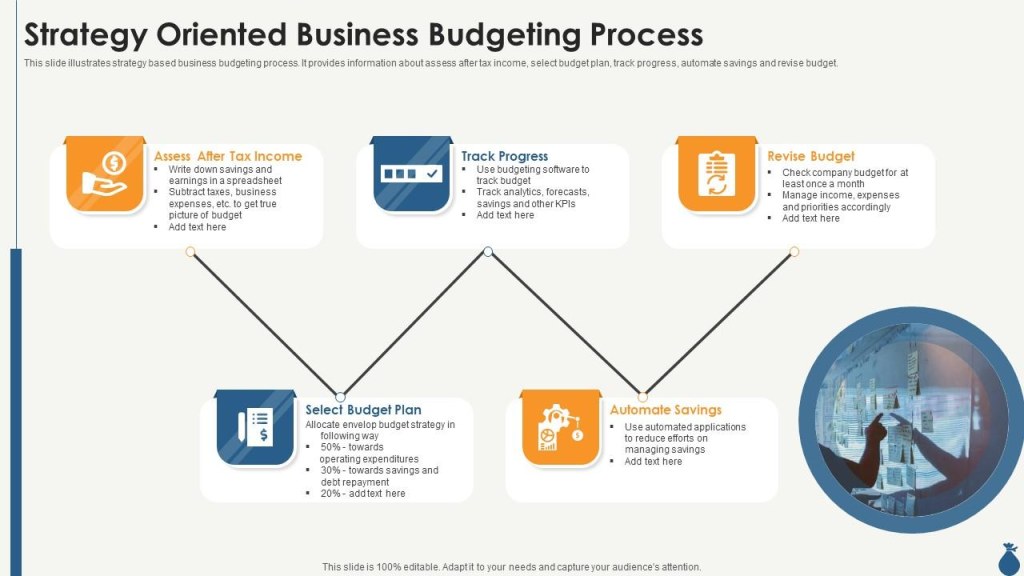

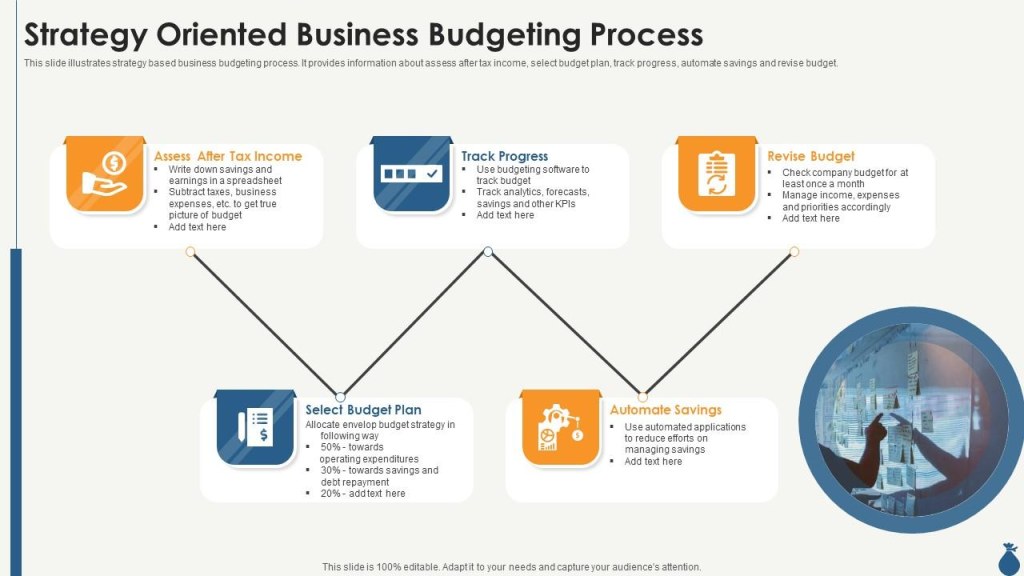

Image Source: licdn.com

Budgeting model strategy is not limited to a specific sector or industry. It can be applied in personal finance, non-profit organizations, startups, government agencies, and multinational corporations. Regardless of your field, having a budgeting model in place helps you gain control over your finances and make informed decisions based on your unique circumstances.

Why Is Budgeting Model Strategy Essential?

🔑 Key Point: Budgeting model strategy is essential to achieve financial stability, plan for the future, and make informed financial decisions.

Effective budgeting model strategy offers numerous benefits. It enables individuals and businesses to set realistic financial goals, allocate resources efficiently, monitor progress, and make necessary adjustments. It acts as a roadmap for financial success and provides a framework for decision-making, allowing you to prioritize your expenses, reduce debt, and build wealth over time.

How Can You Implement Budgeting Model Strategy?

🔑 Key Point: Implementing budgeting model strategy involves several steps, including goal setting, data analysis, forecasting, and regular monitoring.

To implement budgeting model strategy effectively, you need to start by setting clear financial goals. Analyze your income, expenses, and financial data to gain insights into your current financial situation. Next, forecast your future income and expenses, accounting for potential risks and opportunities. Finally, regularly monitor and review your budgeting model, making adjustments as necessary to stay on track towards your financial objectives.

Advantages and Disadvantages of Budgeting Model Strategy

Image Source: slideteam.net

Advantages:

1. Improved Financial Control: By implementing a budgeting model strategy, you gain better control over your financial resources, making it easier to allocate funds according to your priorities.

2. Goal Alignment: Budgeting models enable you to align your financial goals with your spending habits, ensuring that your expenses support your long-term objectives.

3. Resource Optimization: Through effective budgeting, you can optimize your resources, minimizing wasteful spending and maximizing returns on investment.

4. Financial Decision-Making: Budgeting models provide you with the necessary data and insights to make informed financial decisions, reducing the risks associated with impulse spending or uninformed choices.

5. Debt Management: By incorporating debt repayment strategies into your budgeting model, you can effectively manage and reduce your debt over time, improving your overall financial health.

Disadvantages:

1. Time-Consuming: Developing and maintaining a budgeting model requires time and effort, as it involves data collection, analysis, and ongoing monitoring.

2. Flexibility Challenges: Budgeting models can sometimes limit flexibility, making it challenging to adapt to unexpected financial circumstances or changes in priorities.

3. Complexity: Depending on the size and complexity of your finances, implementing a budgeting model strategy may require specialized knowledge or assistance from financial professionals.

4. Potential for Error: Mistakes in data entry or calculation can impact the accuracy of your budgeting model, leading to incorrect financial projections or decisions.

5. Unforeseen Expenses: Despite careful planning, unforeseen expenses or financial emergencies may arise, requiring you to adjust your budgeting model accordingly.

Frequently Asked Questions (FAQs)

Q1: How often should I review my budgeting model?

A: It is recommended to review your budgeting model on a monthly basis to ensure it remains aligned with your financial goals and current circumstances.

Q2: Is it necessary to consult a financial advisor to develop a budgeting model strategy?

A: While consulting a financial advisor can provide valuable insights, it is not always necessary. With proper research and guidance, you can develop a budgeting model strategy yourself.

Q3: Can a budgeting model strategy help me save for retirement?

A: Absolutely! A well-designed budgeting model can help you allocate funds towards retirement savings, ensuring you are financially prepared for your golden years.

Q4: How can I track expenses effectively using a budgeting model?

A: Utilize expense tracking apps or spreadsheets to record and categorize your expenses. Regularly review your spending patterns to identify areas where you can cut back or reallocate funds.

Q5: What should I do if my actual expenses differ from my budgeting model projections?

A: It is common for actual expenses to differ from projections. If this occurs, reassess your budgeting model, identify areas for adjustment, and modify your spending habits accordingly.

Conclusion

In conclusion, budgeting model strategy plays a vital role in effective financial management. It empowers individuals and businesses to take control of their finances, align their spending with their goals, and make informed decisions. By implementing a well-defined budgeting model, you can optimize resource allocation, reduce debt, and pave the way for a financially secure future. Start implementing budgeting model strategy today and unlock the full potential of your financial journey.

Remember, financial success begins with proper planning!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial or professional advice. Consult with a certified financial planner or advisor for personalized guidance regarding your specific financial situation.

This post topic: Budgeting Strategies