Secure Your Future: Multiply Your Retirement Savings With 10 Times Annual Income!

Retirement Savings: The Importance of Having 10 Times Annual Income

Introduction

3 Picture Gallery: Secure Your Future: Multiply Your Retirement Savings With 10 Times Annual Income!

Dear Readers,

Welcome to our informative article on retirement savings. We understand that planning for your retirement can be a daunting task, but it is essential to ensure a secure and comfortable future. In this article, we will explore the concept of having retirement savings that are 10 times your annual income. Understanding this principle will help you make informed decisions and take the necessary steps towards a financially stable retirement.

Image Source: ctfassets.net

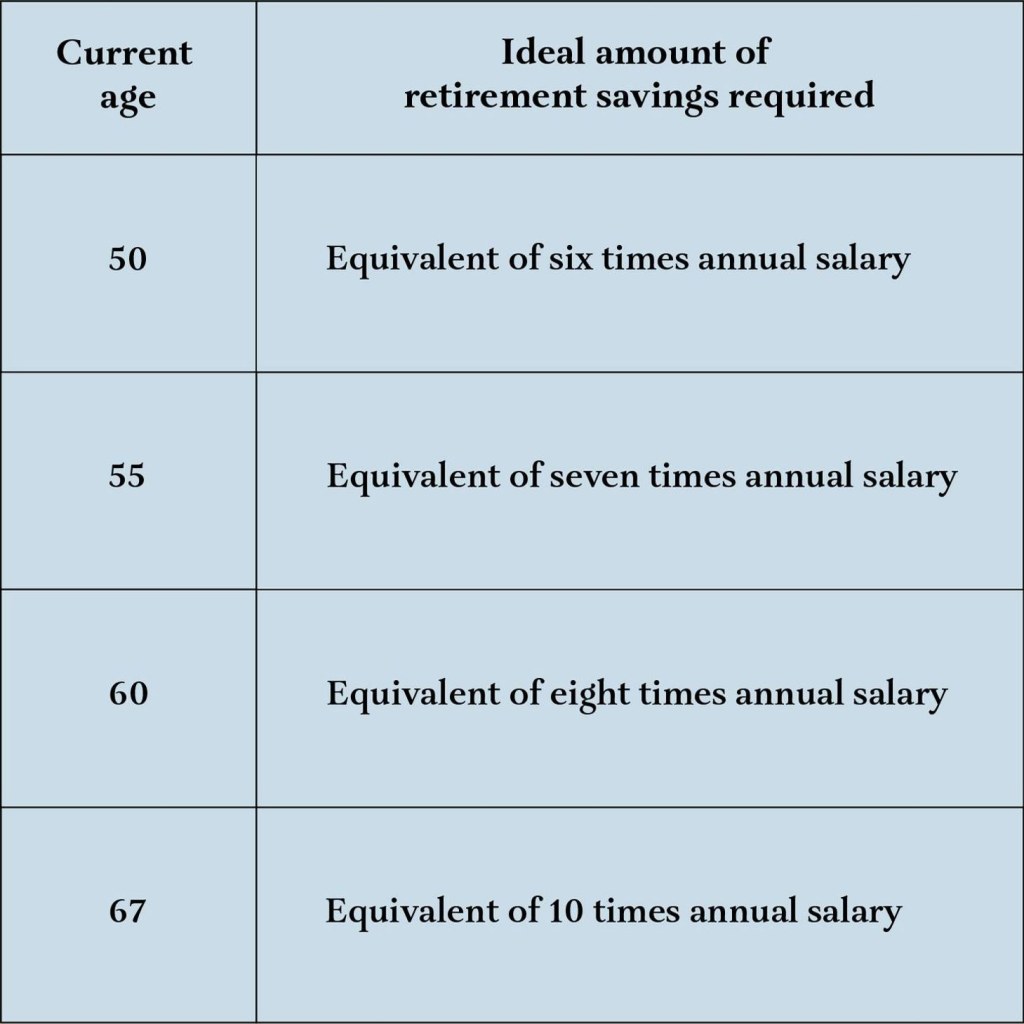

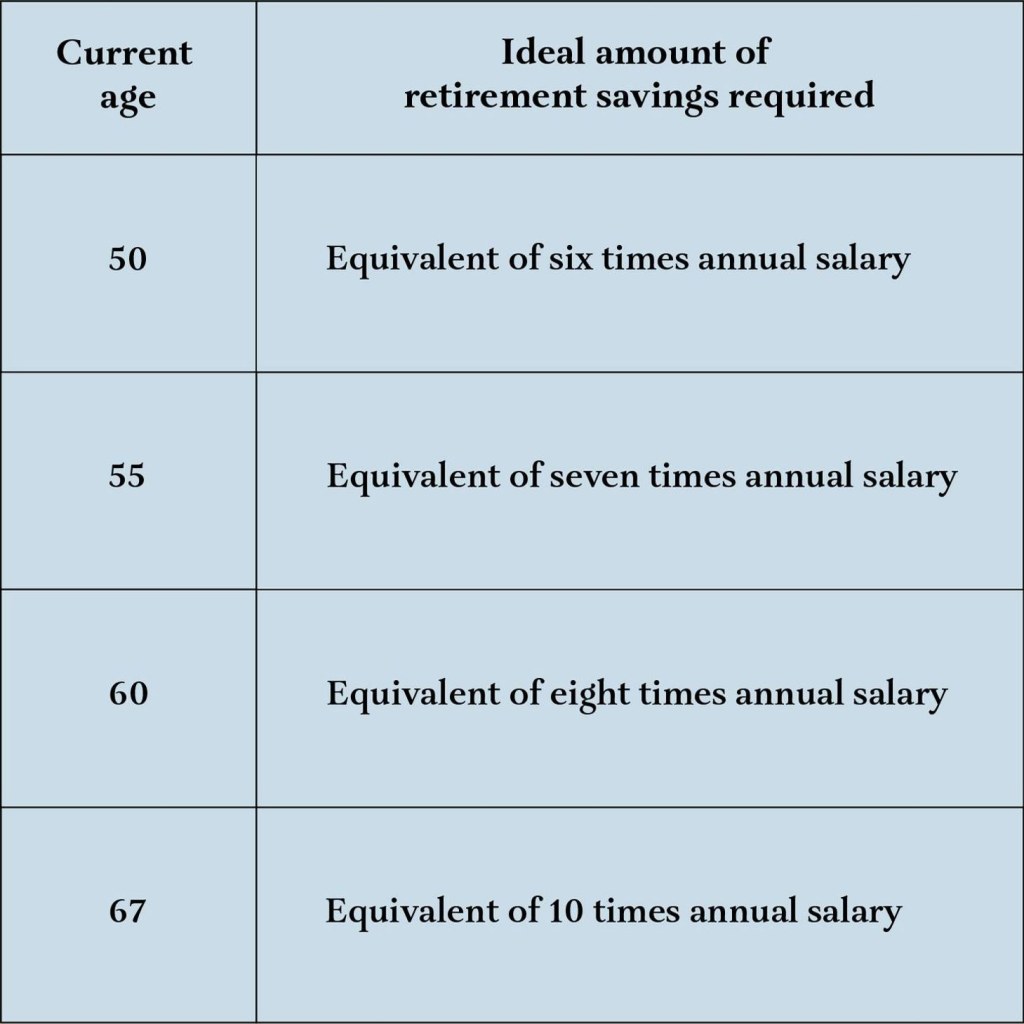

Retirement savings refer to the funds set aside during your working years to support your lifestyle after you stop working. The general rule of thumb is to accumulate savings that are at least 10 times your annual income. This provides a cushion to maintain your current standard of living and cover unforeseen expenses during your retirement years. Let’s delve deeper into the importance of this benchmark and why you should strive to achieve it.

In this article, we will cover the following topics:

1. What is Retirement Savings 10 Times Annual Income? 🌟

Image Source: webflow.com

Retirement savings 10 times annual income is a financial goal that aims to ensure a comfortable retirement by accumulating savings that are ten times your current yearly earnings. This benchmark provides a substantial nest egg that allows you to maintain your lifestyle and cover expenses once you retire.

2. Who Should Aim for 10 Times Annual Income? 🤔

Everyone who plans to retire should aim for a retirement savings goal of 10 times their annual income. Regardless of your current income level, this benchmark ensures that you have enough funds to sustain your lifestyle in retirement.

3. When Should You Start Saving for Retirement? ⏳

The ideal time to start saving for retirement is as early as possible. The power of compound interest allows your savings to grow exponentially over time. By starting early, you can take advantage of this compounding effect and build a substantial retirement fund.

4. Where Should You Invest Your Retirement Savings? 🏦

Image Source: tpt.cloud

When it comes to investing your retirement savings, it is crucial to consider a diversified portfolio. This can include a mix of stocks, bonds, real estate, and other investment vehicles. Diversification spreads the risk and helps maximize potential returns.

5. Why is Having 10 Times Annual Income Important for Retirement? 📈

Having 10 times your annual income as retirement savings provides a safety net that ensures you can maintain your standard of living during your retirement years. It allows you to cover essential expenses, healthcare costs, and enjoy your desired lifestyle without financial worries.

6. How Can You Achieve Retirement Savings 10 Times Annual Income? 💡

Building retirement savings that are 10 times your annual income requires careful planning and disciplined saving habits. It involves setting realistic savings goals, maximizing contributions to retirement accounts, and making wise investment decisions.

Advantages and Disadvantages of Retirement Savings 10 Times Annual Income

Advantages:

1. Financial Security: By having retirement savings that are 10 times your annual income, you can enjoy financial security during your retirement years.

2. Peace of Mind: Knowing that you have enough funds to cover your expenses allows you to enjoy your retirement without constant financial stress.

3. Flexibility: Having a substantial retirement fund gives you the flexibility to pursue your passions, travel, or engage in activities that bring you joy.

4. Legacy Planning: With sufficient retirement savings, you can leave a lasting legacy for your loved ones or contribute to causes that are important to you.

5. Independence: Having 10 times your annual income as retirement savings gives you the freedom to make choices based on your preferences and not solely driven by financial constraints.

Disadvantages:

1. Ongoing Saving Efforts: Building retirement savings that are 10 times your annual income requires consistent saving efforts over an extended period.

2. Market Volatility: Investments made to achieve this goal may be subject to market fluctuations, which can impact the value of your retirement savings.

3. Potential Unexpected Expenses: While having 10 times your annual income as retirement savings provides a safety net, unforeseen expenses may still arise that require additional funds.

4. Sacrifices during Working Years: Achieving this retirement savings goal may require making sacrifices in the present, such as limiting discretionary spending or delaying certain purchases.

5. Inflation Risk: The purchasing power of your retirement savings may be eroded over time due to inflation, necessitating careful investment strategies to mitigate this risk.

Frequently Asked Questions (FAQs) 🙋♀️

1. Can I still retire comfortably if I don’t have 10 times my annual income saved?

Yes, it is still possible to retire comfortably even if you don’t have 10 times your annual income saved. However, having a higher retirement savings amount provides a greater financial buffer and allows for a more secure retirement.

2. Is it ever too late to start saving for retirement?

No, it is never too late to start saving for retirement. While starting early provides more time for your savings to grow, even starting later in your career can still make a significant impact on your retirement funds.

3. How can I determine how much I need to save for retirement?

You can determine how much you need to save for retirement by considering factors such as your desired lifestyle, estimated expenses, and the age at which you plan to retire. Working with a financial advisor can help provide personalized guidance.

4. What should I do if I am behind on saving for retirement?

If you find yourself behind on saving for retirement, it is essential to reassess your financial situation and make necessary adjustments. Consider increasing your savings rate, reducing expenses, and exploring investment options that can help accelerate your savings growth.

5. Should I rely solely on my retirement savings or have additional income streams?

While having substantial retirement savings is vital, it is beneficial to have additional income streams during retirement. This can include part-time work, rental income, or investments that generate passive income. Diversifying your income sources can provide added financial security.

Conclusion

In conclusion, having retirement savings that are 10 times your annual income is a prudent goal to ensure a financially secure retirement. It provides a cushion to cover expenses, maintain your desired lifestyle, and enjoy peace of mind during your golden years. By starting early, saving consistently, and making wise investment decisions, you can work towards achieving this financial milestone.

Remember, retirement planning is a lifelong journey, and it is never too early or too late to start. Take control of your financial future today and strive towards retirement savings that will provide the foundation for a fulfilling retirement. Plan wisely, save diligently, and consult with financial professionals, if needed, to make informed decisions. Your future self will thank you.

Best regards,

Final Remarks

Retirement savings should be tailored to individual financial goals and circumstances. The information provided in this article is meant to serve as a general guideline and should not replace personalized financial advice. It is important to consider factors such as your risk tolerance, investment horizon, and overall financial situation when planning for retirement. Always consult with a qualified financial advisor or planner to develop a comprehensive retirement savings strategy that suits your needs. Remember that investing involves risks, and past performance is not indicative of future results. Be sure to understand the potential risks and rewards associated with any investment vehicles. Your financial future is in your hands, so make informed decisions and plan for a comfortable retirement.

This post topic: Budgeting Strategies