Unlock Your Future: Optimize Retirement Savings Withdrawal For Maximum Benefits

Retirement Savings Withdrawal: A Guide to Making Informed Decisions

Introduction

Hello Readers,

3 Picture Gallery: Unlock Your Future: Optimize Retirement Savings Withdrawal For Maximum Benefits

Welcome to our comprehensive guide on retirement savings withdrawal. As you approach your retirement years, it becomes crucial to understand how to effectively manage and make withdrawals from your savings. This article aims to provide you with all the necessary information and insights to help you make informed decisions about your retirement funds.

Image Source: fidelity.com

Retirement savings withdrawal refers to the process of taking money out of your retirement savings accounts, such as 401(k)s or IRAs, to cover your expenses during retirement. It is essential to navigate this process carefully to ensure a secure and comfortable retirement.

In the following sections, we will delve into the various aspects of retirement savings withdrawal, including the what, who, when, where, why, and how. Additionally, we will explore the advantages and disadvantages of this approach, address common FAQs, and provide a conclusion that encourages you to take action.

What is Retirement Savings Withdrawal?

Retirement savings withdrawal is the process of accessing the funds you have accumulated in your retirement accounts over the years. These accounts are designed to provide you with financial stability during your retirement years. Understanding how to withdraw these funds effectively is essential to ensure that you don’t run out of money and can maintain your desired lifestyle.

Image Source: annuityexpertadvice.com

🔑 Key Points:

Retirement savings withdrawal involves accessing the funds you have saved for retirement.

Proper withdrawal management is crucial for financial security during retirement.

Consideration must be given to tax implications and withdrawal strategies.

Withdrawal decisions should align with your retirement goals and lifestyle.

Who Should Consider Retirement Savings Withdrawal?

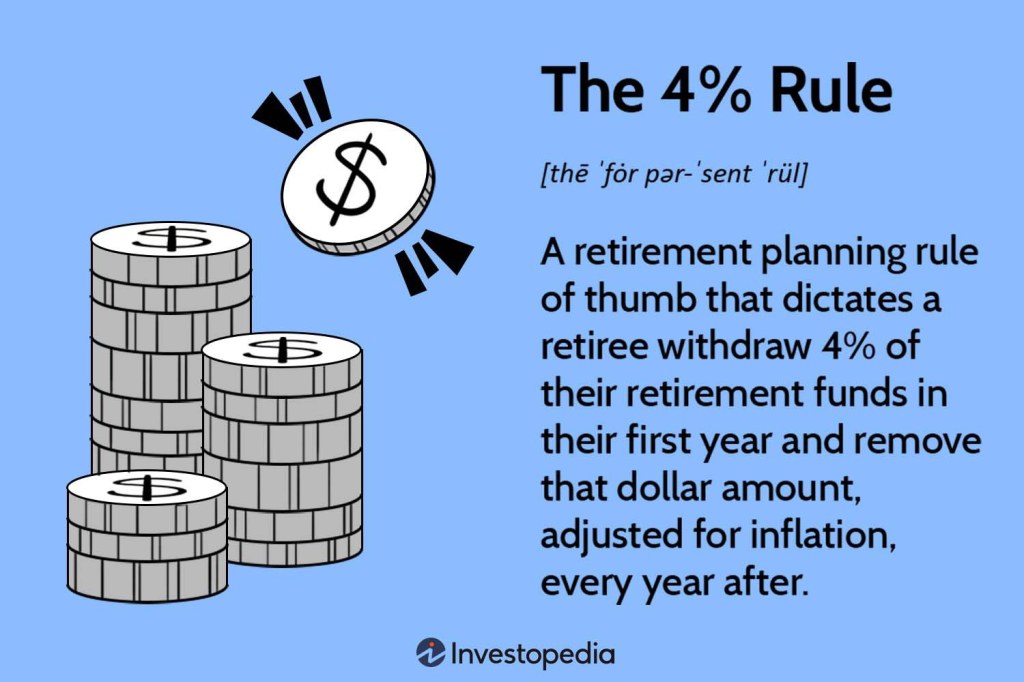

Image Source: investopedia.com

Retirement savings withdrawal is relevant to individuals who have diligently saved for their retirement and are now approaching or have reached retirement age. If you have retirement accounts, such as a 401(k) or an IRA, it is essential to understand how to withdraw funds from these accounts to support your post-employment years.

🔑 Key Points:

Individuals who have retirement accounts should consider retirement savings withdrawal.

It is crucial for those approaching or in retirement to understand withdrawal strategies.

Retirement savings withdrawal applies to both employer-sponsored plans and individual retirement accounts.

When Can You Start Withdrawing Retirement Savings?

The timing of retirement savings withdrawal depends on various factors, including age restrictions and retirement plan rules. Typically, individuals can start making penalty-free withdrawals from retirement accounts after reaching the age of 59½. However, certain exceptions and specific circumstances may allow for earlier withdrawals.

🔑 Key Points:

Withdrawals from retirement accounts are generally penalty-free after 59½.

Early withdrawals may incur penalties unless specific exceptions apply.

Rules regarding withdrawal age vary depending on the retirement plan.

Where Can You Withdraw Retirement Savings?

Retirement savings can be withdrawn from various sources, including employer-sponsored retirement plans, individual retirement accounts, and other investment vehicles. It is essential to understand the specific rules and regulations governing each account type to ensure that you make the most of your savings.

🔑 Key Points:

Withdrawals can be made from employer-sponsored plans and individual retirement accounts.

Understanding the rules and regulations of each account type is crucial.

Consulting with a financial advisor can help you navigate withdrawal options.

Why Should You Consider Retirement Savings Withdrawal?

Retirement savings withdrawal allows you to access the funds you have accumulated over the years and use them to support your retirement lifestyle. It offers financial flexibility and the ability to cover essential expenses, such as housing, healthcare, and leisure activities. Properly managing your withdrawals ensures that you can make the most of your retirement savings and enjoy the fruits of your labor.

🔑 Key Points:

Retirement savings withdrawal provides financial flexibility during your retirement years.

It allows you to cover essential expenses and maintain your desired lifestyle.

Effective withdrawal management helps you maximize the benefits of your savings.

How to Make Informed Retirement Savings Withdrawal?

Making informed retirement savings withdrawal decisions involves careful planning and consideration. Here are some steps to guide you:

Evaluate your retirement goals and lifestyle to determine your financial needs.

Understand the withdrawal rules and strategies applicable to your retirement accounts.

Consider tax implications and assess the impact of withdrawals on your overall finances.

Consult with a financial advisor to develop a personalized withdrawal plan.

Regularly review and adjust your withdrawal strategy based on changing circumstances.

Monitor your retirement savings to ensure they last throughout your retirement.

Advantages and Disadvantages of Retirement Savings Withdrawal

Retirement savings withdrawal offers several benefits and disadvantages that you should consider:

Advantages:

Flexibility to cover expenses: Withdrawals allow you to access your savings to meet various financial needs.

Tax advantages: Certain types of withdrawals may qualify for favorable tax treatment.

Control over finances: You have the power to decide how much and when to withdraw.

Ability to enjoy retirement: Withdrawals provide the means to enjoy your desired lifestyle without financial stress.

Disadvantages:

Reduced savings balance: Frequent or large withdrawals can deplete your retirement savings more quickly.

Tax implications: Withdrawals may be subject to income tax, reducing the amount available to you.

Early withdrawal penalties: Withdrawing funds before the eligible age may result in additional penalties.

Inflation risk: Inadequate planning or excessive withdrawals can leave you vulnerable to the effects of inflation.

Potential long-term financial instability: Poor withdrawal decisions may jeopardize your financial security in the later years of retirement.

Frequently Asked Questions (FAQs)

1. Can I withdraw money from my retirement savings before retirement age?

Yes, but early withdrawals may be subject to penalties unless specific exceptions apply. Consult with a financial advisor to understand the rules governing your retirement accounts.

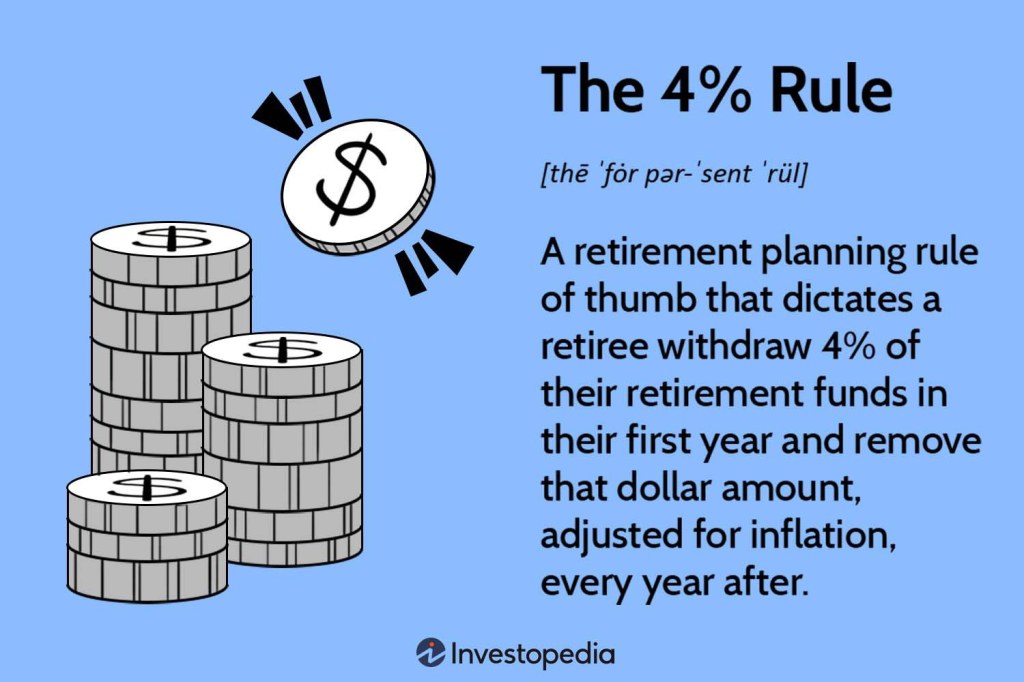

2. How much can I withdraw from my retirement savings each year?

There is no universal limit on annual withdrawals. The amount you can withdraw depends on various factors, including your retirement goals, account balances, and applicable tax rules. A financial advisor can help you determine a suitable withdrawal strategy.

3. Do I have to pay taxes on retirement savings withdrawals?

Retirement savings withdrawals are generally subject to income tax. However, specific circumstances, such as withdrawals from Roth IRAs, may qualify for tax-free treatment. Consult with a tax professional for personalized advice.

4. Are there any alternatives to retirement savings withdrawal?

Yes, alternative options include annuities, part-time employment, and other passive income sources. These alternatives can supplement your retirement savings and provide additional financial stability.

5. How often should I review my retirement savings withdrawal strategy?

It is recommended to review your withdrawal strategy annually or whenever there are significant changes in your financial situation. Regular reviews ensure that your strategy remains aligned with your retirement goals.

Conclusion

Friends, retirement savings withdrawal is a critical aspect of planning for a secure and fulfilling retirement. By understanding the what, who, when, where, why, and how of this process, you can make informed decisions that align with your goals and lifestyle. Remember to evaluate the advantages and disadvantages, seek professional advice when needed, and regularly review your withdrawal strategy to ensure a financially stable retirement.

Take action today and embark on a journey towards a worry-free retirement!

🔔 Final Remarks:

The information provided in this article is for educational purposes only and should not be considered as financial or legal advice. Please consult with a qualified professional before making any decisions regarding retirement savings withdrawal or other financial matters. The authors and publishers of this article are not liable for any damages or losses arising from any decisions made based on the information provided. Retirement planning is a complex process, and individual circumstances may vary.

This post topic: Budgeting Strategies