Secure Your Future: Use Our Retirement Savings Last Calculator Now!

Retirement Savings Last Calculator: Planning for a Secure Future

Introduction

Dear Readers,

2 Picture Gallery: Secure Your Future: Use Our Retirement Savings Last Calculator Now!

Welcome to our comprehensive guide on retirement savings last calculator. In this article, we will explore the importance of planning for your retirement, how a retirement savings last calculator can help you ensure a secure future, and the advantages and disadvantages of using such a tool.

Image Source: robberger.com

Retirement is a significant milestone in one’s life, and it is crucial to ensure that you have enough funds to enjoy a comfortable lifestyle during your golden years. However, estimating how long your retirement savings will last can be a complex task. That’s where a retirement savings last calculator comes in handy.

In this article, we will delve into the details of retirement savings last calculator, its features, and how you can use it to get accurate projections for your retirement planning. So, let’s dive in and empower ourselves to make informed decisions about our financial future.

What is a Retirement Savings Last Calculator? 📈

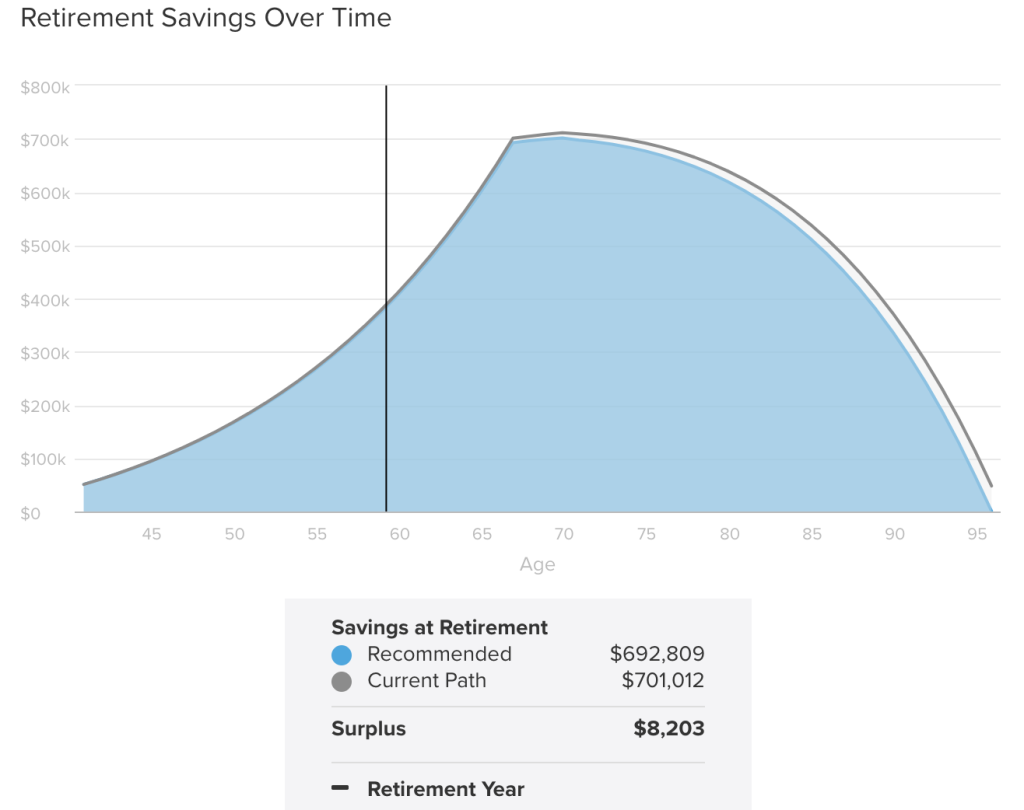

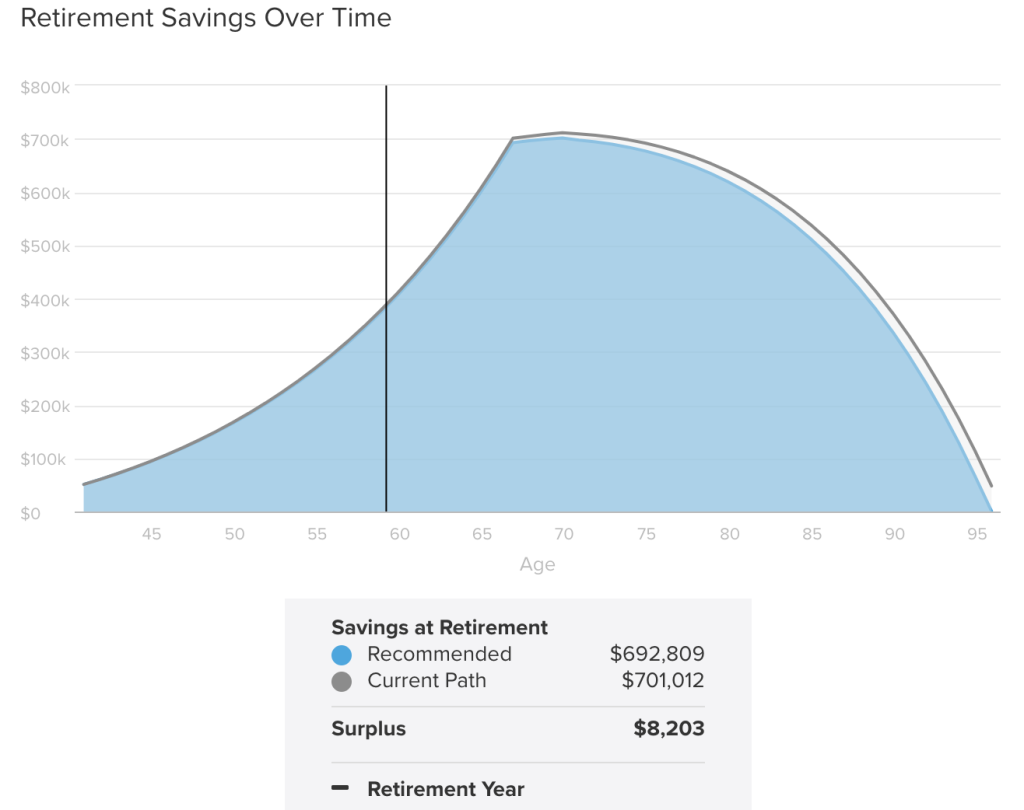

A retirement savings last calculator is a powerful tool that helps individuals determine how long their savings and investments will sustain them during retirement. It takes into account various factors such as current savings, expected retirement age, annual income, expenses, inflation, and investment growth rates to provide an estimate of the number of years your savings will last.

Image Source: amazonaws.com

By using a retirement savings last calculator, you can gain a clear understanding of whether your current savings strategy aligns with your retirement goals. It allows you to make informed decisions about contributions, investment choices, and potential adjustments to ensure a financially secure retirement.

How Does a Retirement Savings Last Calculator Work? 🔄

A retirement savings last calculator uses a series of mathematical algorithms to analyze your financial data and provide projections. Here’s how it typically works:

Input your current age, desired retirement age, and life expectancy.

Enter details about your current savings, including the amount and the rate of return on your investments.

Include your annual income, expected Social Security benefits, and any other sources of retirement income.

Specify your expected annual expenses during retirement, considering factors such as healthcare, housing, and leisure activities.

Factor in inflation rates to ensure your projections reflect the future purchasing power of your savings.

The calculator will then generate a report that estimates how long your savings will last and any potential shortfalls or surpluses.

Based on the results, you can tweak your retirement strategy to ensure a more secure financial future.

Who Should Use a Retirement Savings Last Calculator? 👥

A retirement savings last calculator is beneficial for individuals at any stage of their career who want to plan for their retirement effectively. Whether you are just starting out in your professional journey or are nearing retirement, a retirement savings last calculator can provide valuable insights and help you make informed decisions.

Young professionals can use the calculator to set realistic savings goals, determine the impact of different contribution levels, and choose appropriate investment strategies. On the other hand, those approaching retirement can use it to assess their current savings and make adjustments to ensure their funds will last throughout their retirement years.

When is the Right Time to Start Planning? ⏳

The old adage the sooner, the better rings true when it comes to retirement planning. The earlier you start planning and saving for retirement, the more time your money has to grow and compound. However, it’s never too late to begin planning. Even if you are close to retirement age, a retirement savings last calculator can help you optimize your remaining years of work and make the most of your current savings.

Where Can You Find a Retirement Savings Last Calculator? 🌐

Retirement savings last calculators are widely available online, offered by financial institutions, retirement planning websites, and government agencies. Many of these calculators are free to use and provide valuable insights into your retirement savings and planning needs. It is essential to choose a reputable source to ensure accurate calculations and reliable projections.

Why Should You Use a Retirement Savings Last Calculator? ❓

Using a retirement savings last calculator offers several benefits:

Accurate Projections: A retirement savings last calculator provides personalized projections based on your financial data, helping you make informed decisions.

Identifying Shortfalls: The calculator can highlight any gaps between your desired retirement lifestyle and your projected savings, allowing you to make adjustments to bridge those gaps.

Optimized Contributions: By inputting different contribution levels and investment strategies, you can determine the most effective way to maximize your savings and investments.

Flexibility in Planning: Retirement savings last calculators allow you to experiment with various retirement scenarios, such as retiring early or working longer, to find the best plan for your needs.

Peace of Mind: Knowing how long your savings will last can bring peace of mind, enabling you to enjoy your retirement years without financial stress.

Disadvantages of Using a Retirement Savings Last Calculator ❗

While retirement savings last calculators offer numerous advantages, it’s essential to consider potential drawbacks:

Assumptions and Variables: The accuracy of the projections relies on the accuracy of the data you input. If your assumptions about investment returns or inflation rates are unrealistic, the results may not accurately reflect your future financial situation.

Unforeseen Circumstances: Life is unpredictable, and unexpected events can impact your retirement plans. A retirement savings last calculator may not account for drastic changes in your circumstances, such as job loss, health issues, or changes in the economic environment.

Complexity: Retirement savings last calculators can be complex to use, especially for individuals with limited financial knowledge. It is essential to seek guidance or educate yourself on the basic principles of retirement planning.

Frequently Asked Questions (FAQs) 🙋

1. Can I rely solely on a retirement savings last calculator for my retirement planning?

No, a retirement savings last calculator should be used as a tool to guide your planning process. It is recommended to consult with a financial advisor or retirement planning professional to ensure a comprehensive and personalized approach.

2. Is it possible to change the input data after using a retirement savings last calculator?

Yes, you can update the input data anytime you want. It is recommended to review and adjust the data periodically based on changes in your financial situation, goals, or market conditions.

3. Can a retirement savings last calculator consider unexpected health expenses during retirement?

Most retirement savings last calculators allow you to include healthcare expenses in your projections. However, it’s important to note that unexpected medical costs can vary significantly, and it may be wise to have a separate emergency fund or health insurance coverage.

4. What if I plan to have additional sources of income during retirement?

A retirement savings last calculator typically allows you to include other sources of retirement income, such as rental properties or part-time work. By accounting for these additional income streams, you can get a more accurate estimate of your retirement savings longevity.

5. How often should I review my retirement savings plan?

It is recommended to review your retirement savings plan at least once a year or whenever significant life events occur, such as marriage, birth of a child, or career changes. Regular reviews help ensure that your plan remains aligned with your goals and circumstances.

Conclusion: Secure Your Financial Future

In conclusion, a retirement savings last calculator is a valuable tool for anyone who wants to plan for a financially secure retirement. By using this calculator, you can gain insights into your retirement savings, identify potential shortfalls, and make informed decisions to optimize your financial future.

However, it is important to remember that a retirement savings last calculator should be used as a starting point and not as the sole determining factor in your retirement planning. Seeking professional advice and regularly reviewing your retirement strategy will ensure a robust and adaptable plan tailored to your unique circumstances.

Final Remarks: Empower Yourself with Knowledge

Dear Readers,

Retirement planning can seem overwhelming at times, but by leveraging the power of tools such as a retirement savings last calculator, you can take control of your financial future. Remember to stay informed, educate yourself on retirement planning best practices, and regularly review your strategy to adapt to changing circumstances.

By making wise financial decisions today, you can ensure that your retirement years are filled with joy, security, and peace of mind.

This post topic: Budgeting Strategies