Unlock Financial Success: Discover The Power Of The 6 Types Of Budget

6 Types of Budget

Greetings, Readers!

3 Picture Gallery: Unlock Financial Success: Discover The Power Of The 6 Types Of Budget

Welcome to this informative article about the 6 types of budget. In this article, we will explore different budgeting strategies and their benefits. Budgeting plays a vital role in personal and professional financial management, so understanding the various types of budgets can greatly improve your financial decision-making. Let’s dive in and explore each type in detail!

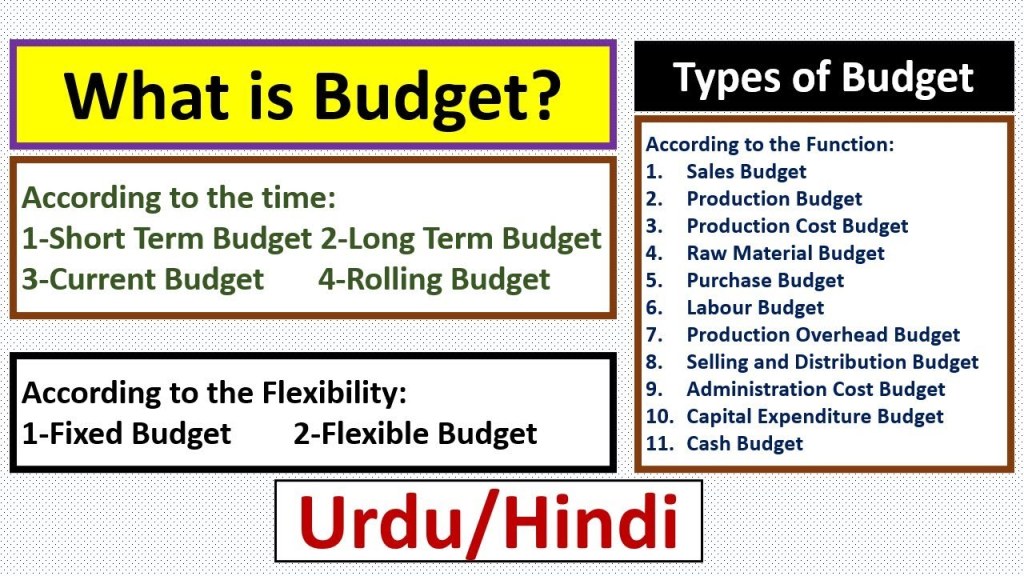

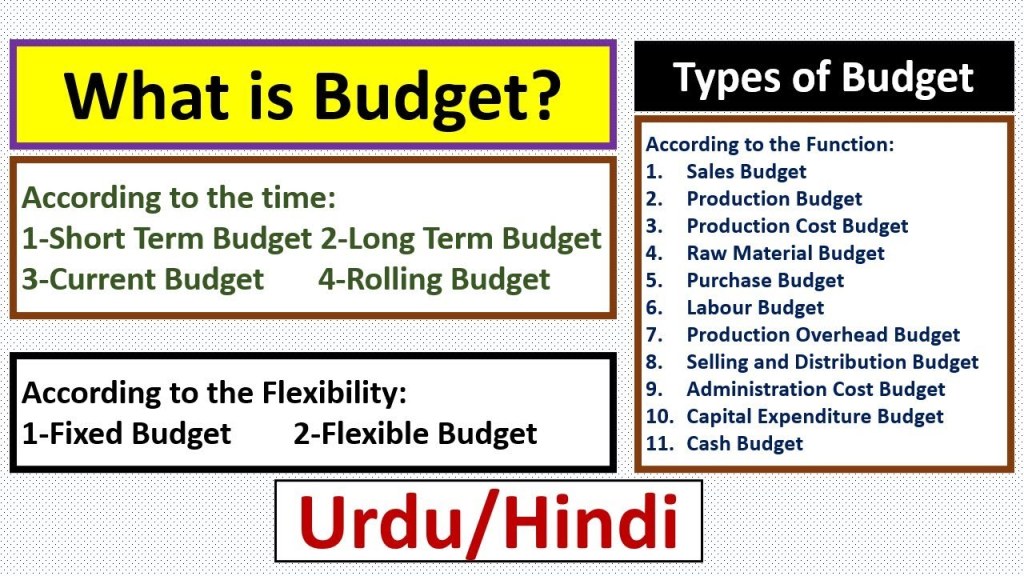

1. What is a Budget?

Image Source: ctfassets.net

Before we delve into the different types of budgets, let’s define what a budget actually is. A budget is a financial plan that outlines your income and expenses over a specific period. It helps you allocate your resources effectively, track your spending, and achieve your financial goals.

2. The Traditional Budget

📊 The traditional budget is the most common and straightforward type. It involves estimating income and expenses for a set period, usually monthly or yearly. The traditional budget allows you to track your spending and make adjustments as needed.

3. The Zero-Based Budget

💰 The zero-based budget requires you to allocate every dollar of your income to a specific expense category. This type of budgeting ensures that every dollar is accounted for, leaving no room for unnecessary expenses. It encourages mindful spending and prioritization.

4. The Envelope System

Image Source: ytimg.com

📪 The envelope system is a cash-based budgeting method. It involves dividing your income into different envelopes designated for specific expenses, such as groceries, transportation, and entertainment. By using physical cash, you can visually track your spending and avoid overspending.

5. The 50/30/20 Budget

💸 The 50/30/20 budget is a popular rule of thumb for financial allocation. It suggests dividing your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This budget provides flexibility while also promoting savings and debt reduction.

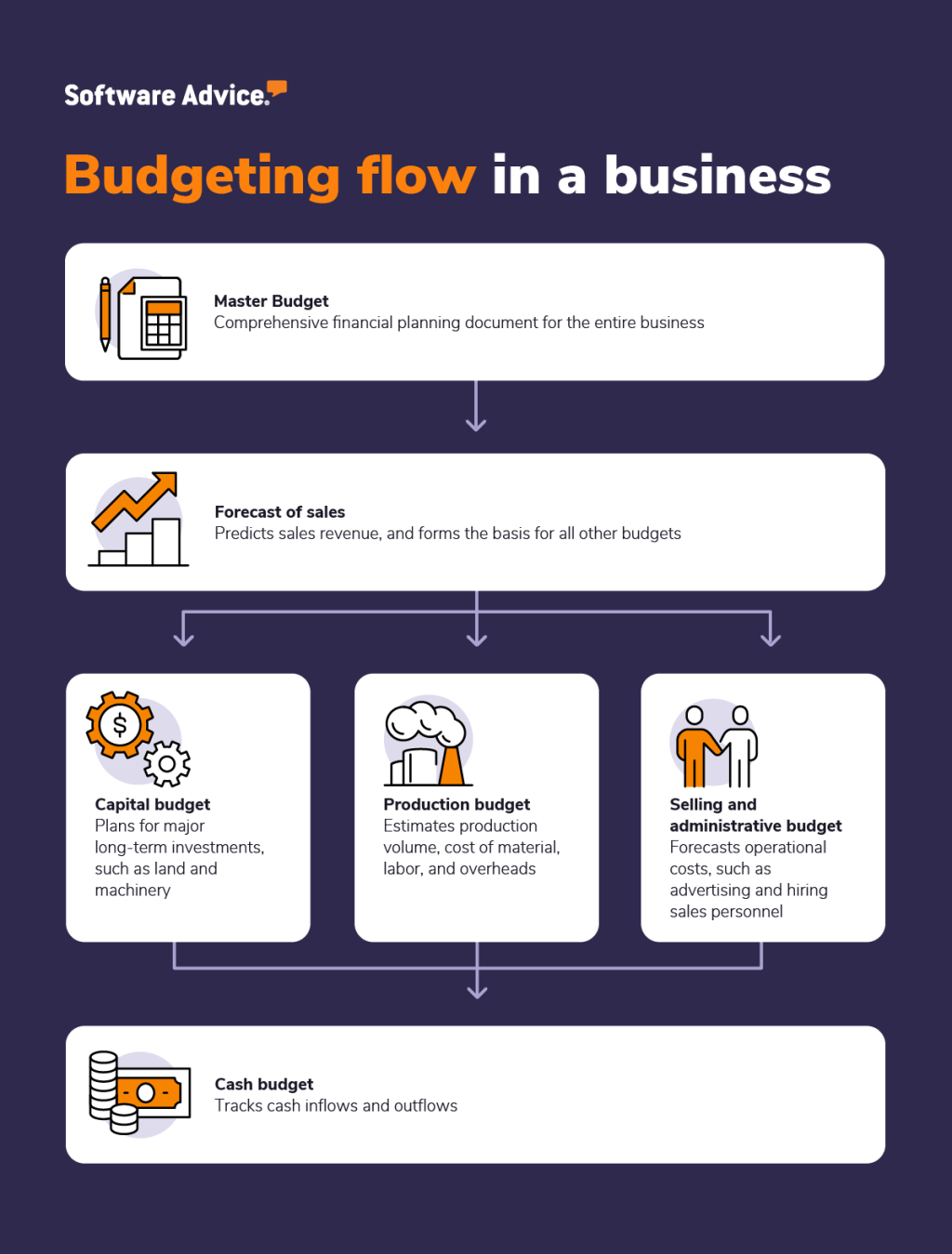

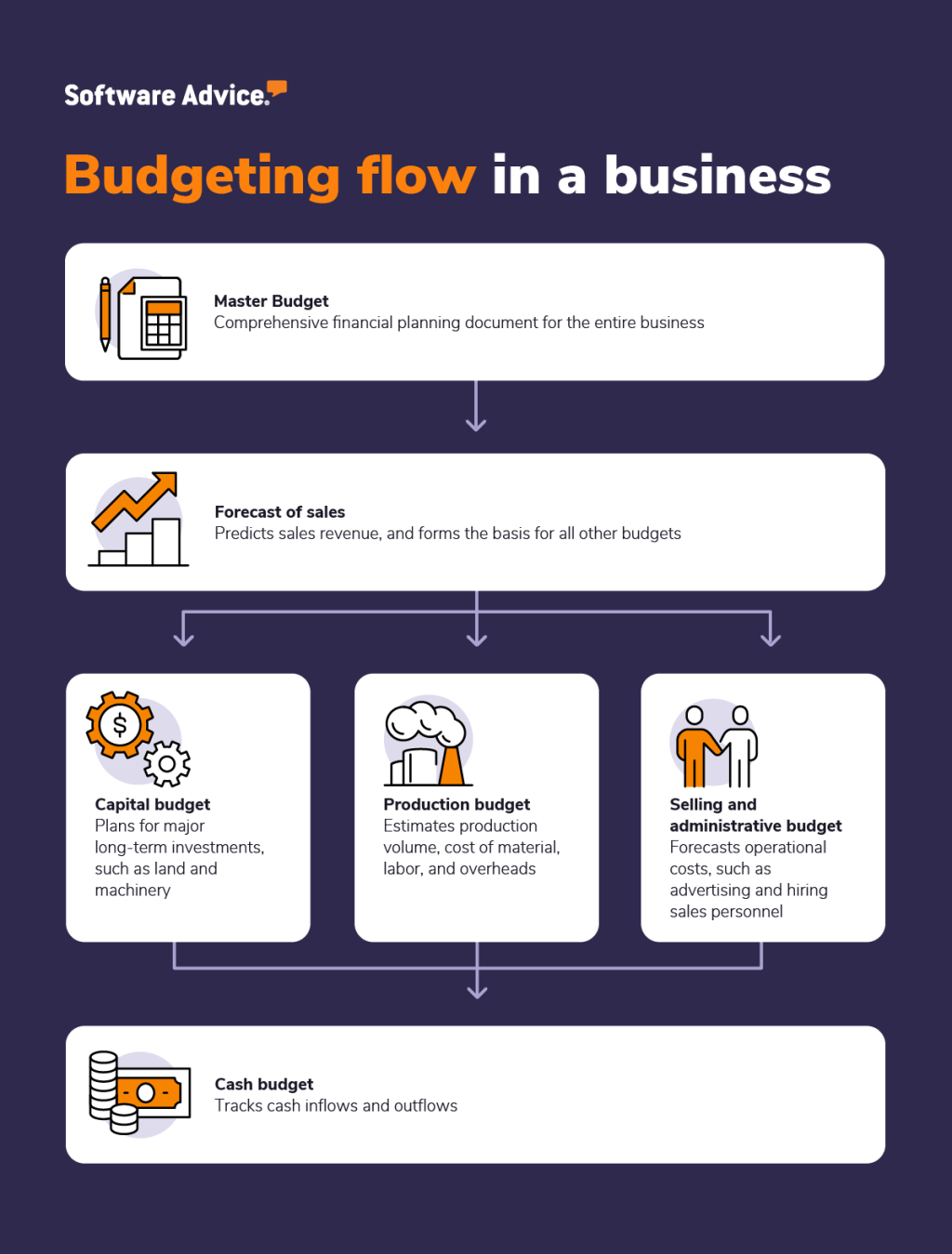

6. The Flexible Budget

Image Source: ctfassets.net

🔄 The flexible budget is ideal for individuals or businesses with fluctuating incomes or expenses. It allows for adjustments based on changes in income or unexpected expenses. This type of budgeting provides a more realistic financial plan and adapts to changing circumstances.

Advantages and Disadvantages of the 6 Types of Budget

Advantages:

1. Traditional Budget:

– Provides a clear overview of income and expenses

– Allows for easy tracking and monitoring of spending

– Helps identify areas for cost-cutting and savings

2. Zero-Based Budget:

– Ensures that every dollar is allocated effectively

– Encourages mindful spending and prioritization

– Helps eliminate unnecessary expenses

3. Envelope System:

– Facilitates visual tracking of spending

– Prevents overspending by using physical cash

– Encourages budget adherence

4. 50/30/20 Budget:

– Provides flexibility in budget allocation

– Promotes savings and debt reduction

– Allows for guilt-free spending on wants

5. Flexible Budget:

– Adapts to changing income or expenses

– Provides a realistic financial plan

– Allows for adjustments and flexibility

Disadvantages:

1. Traditional Budget:

– Can be time-consuming to maintain and update regularly

– May not account for unexpected expenses

– Requires discipline to stick to the budget

2. Zero-Based Budget:

– Requires meticulous tracking of every expense

– Can be challenging to allocate every dollar effectively

– May need frequent adjustments based on changing circumstances

3. Envelope System:

– Inconvenient for online or large purchases

– Carrying large amounts of cash can be risky

– Requires discipline to avoid overspending

4. 50/30/20 Budget:

– May not work for individuals with high expenses

– Limited flexibility in budget allocation

– Requires self-control to stick to the suggested percentages

5. Flexible Budget:

– Requires regular monitoring and adjustments

– May not provide a clear long-term financial plan

– Can be challenging to predict income or expenses accurately

FAQs about Budgeting

1. How often should I review my budget?

It is recommended to review your budget at least once a month to track your spending and make necessary adjustments. However, you can review it more frequently if your financial situation changes or if you have significant expenses coming up.

2. Can I use multiple budgeting methods?

Absolutely! You can combine different budgeting methods to suit your financial needs. For example, you might use the envelope system for your monthly expenses and the 50/30/20 budget for long-term savings and debt repayment.

3. What if I overspend in a particular category?

If you overspend in a specific category, you can adjust your budget for the following month to compensate for the overspending. You might need to reduce spending in other areas or allocate more funds to the affected category.

4. Should I include savings in my budget?

Yes, it is crucial to include savings as a category in your budget. Allocating a portion of your income for savings ensures that you are building an emergency fund or working towards financial goals.

5. Can budgeting help me achieve financial freedom?

Yes, budgeting is a powerful tool that can help you achieve financial freedom. By tracking your expenses, prioritizing savings, and making informed financial decisions, you can improve your financial situation and work towards your long-term goals.

Conclusion

In conclusion, understanding the 6 types of budget can greatly benefit your financial management. Each type offers different advantages and disadvantages, allowing you to choose the one that suits your needs and goals best. By implementing an effective budgeting strategy and making informed financial decisions, you can take control of your finances and work towards a more secure future. Start budgeting today and pave the way to financial success!

Final Remarks

Thank you for taking the time to read this comprehensive article about the 6 types of budget. It is important to remember that budgeting is a personal process, and what works for one person may not work for another. Experiment with different budgeting methods and find the one that aligns with your financial goals and preferences. Remember, budgeting is a journey, and it requires dedication and discipline. Happy budgeting!

This post topic: Budgeting Strategies