Maximize Your Future: Unlock The Power Of Retirement Savings Tax Credit

Understanding Retirement Savings Tax Credit

Introduction

Hello, Readers! Welcome to our article on the retirement savings tax credit. In this article, we will explore the details and benefits of this tax credit, which is designed to encourage individuals to save for their retirement. It is important to understand how this tax credit works and how it can help you maximize your retirement savings. So, let’s dive in and explore this topic further!

1 Picture Gallery: Maximize Your Future: Unlock The Power Of Retirement Savings Tax Credit

What is Retirement Savings Tax Credit? 🌟

The retirement savings tax credit, also known as the saver’s credit, is a tax credit provided by the Internal Revenue Service (IRS) in the United States. It aims to incentivize low- to moderate-income individuals to save for their retirement by offering a tax credit based on their contributions to eligible retirement savings plans.

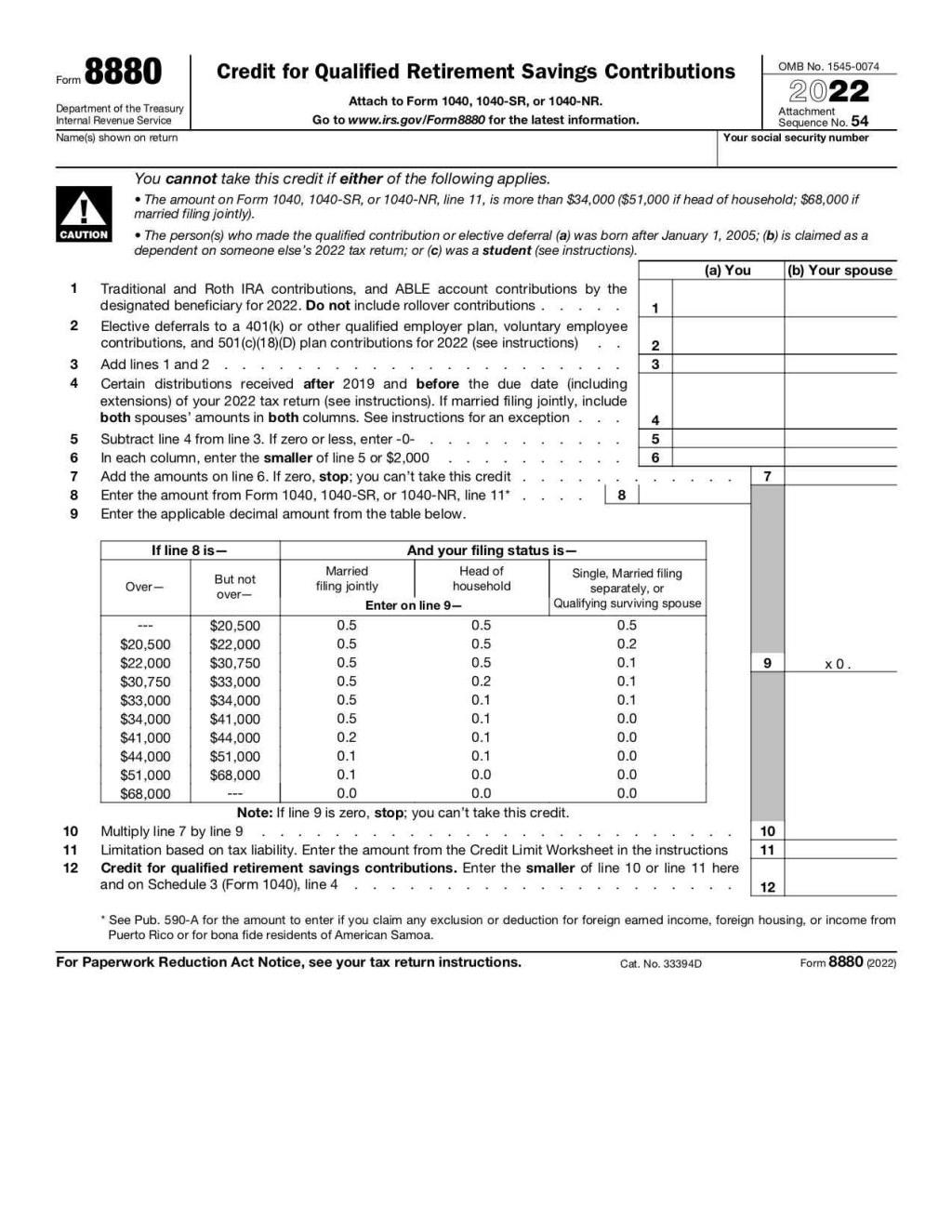

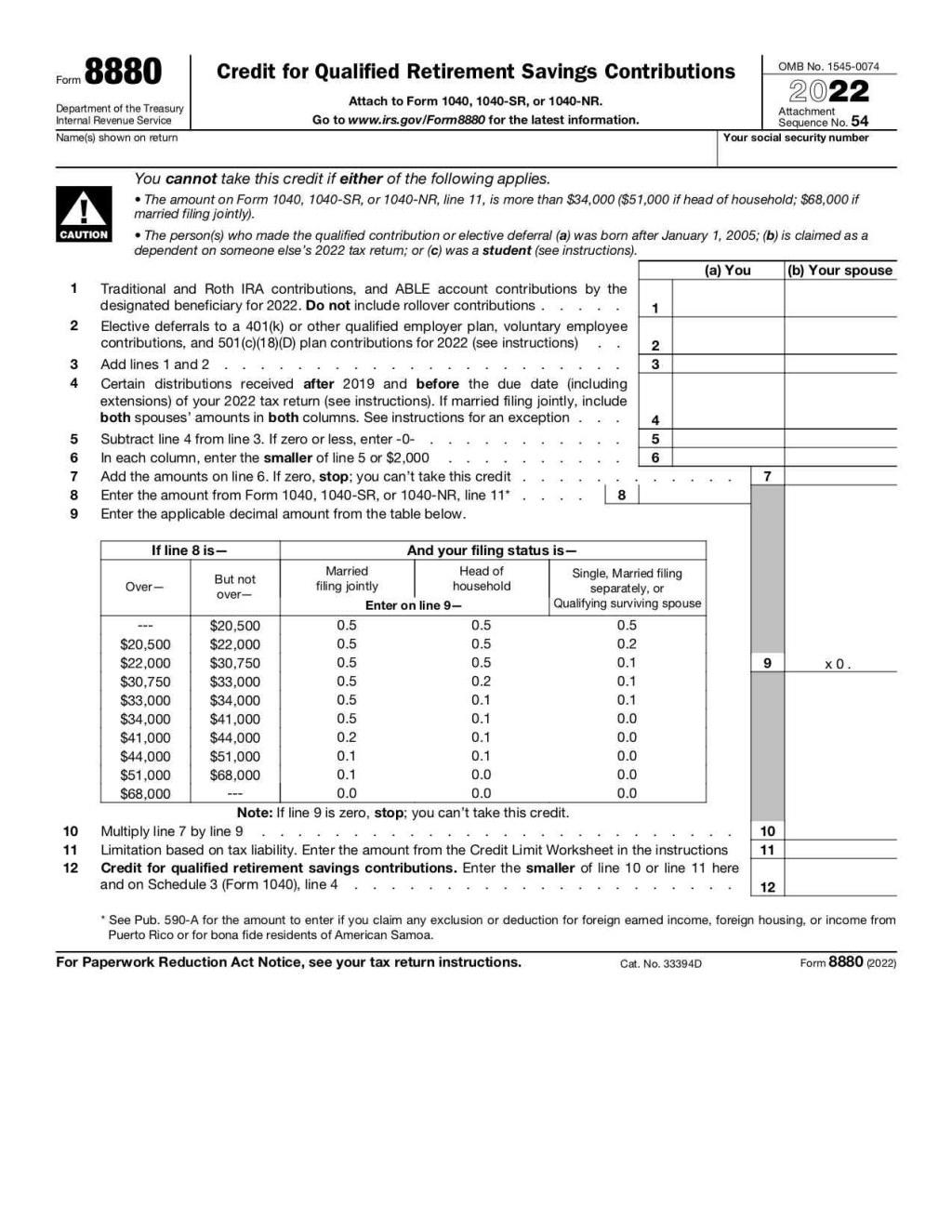

How does it work? 🧐

Image Source: investopedia.com

The retirement savings tax credit works by reducing an individual’s tax liability directly. It is a non-refundable credit, which means that it can only reduce the amount of tax owed, but not below zero. The amount of the credit is determined based on the individual’s filing status, adjusted gross income (AGI), and retirement savings contributions.

Who is eligible for the retirement savings tax credit? 🤔

The eligibility for the retirement savings tax credit depends on several factors, including the individual’s filing status, AGI, and retirement contributions. Generally, individuals with a lower income and those who contribute to eligible retirement plans, such as traditional or Roth IRA, 401(k), or 403(b) plans, may qualify for this tax credit.

When can you claim the retirement savings tax credit? ⏰

The retirement savings tax credit can be claimed when filing your annual income tax return. As this tax credit is designed to encourage retirement savings, it is important to make eligible contributions to retirement plans before the tax year ends. The deadline for contributions is usually the due date of the tax return, typically April 15th of the following year.

Where can you claim the retirement savings tax credit? 📍

To claim the retirement savings tax credit, you need to fill out Form 8880, Credit for Qualified Retirement Savings Contributions, and attach it to your income tax return. This form will help you calculate the amount of tax credit you are eligible for based on your contributions and income.

Why should you consider the retirement savings tax credit? 🤩

The retirement savings tax credit offers several advantages for individuals who qualify. Some of the key benefits include:

Reduced Tax Liability: The tax credit directly reduces your tax liability, allowing you to save more money for retirement.

Encouragement to Save: By providing a financial incentive, the tax credit motivates individuals to contribute to retirement savings plans and build a secure financial future.

Additional Tax Savings: The retirement savings tax credit can be combined with other tax deductions and credits, potentially leading to even greater tax savings.

Long-Term Retirement Planning: By taking advantage of this credit, individuals can start building their retirement savings early and benefit from the power of compounding over time.

What are the potential disadvantages of the retirement savings tax credit? 😕

While the retirement savings tax credit offers significant benefits, it is essential to consider the potential disadvantages as well. These include:

Income Limitations: The tax credit is only available to individuals with lower income levels, which means that higher-income individuals may not qualify for this credit.

Non-Refundable: The tax credit is non-refundable, so if your tax liability is already zero, you may not receive any additional benefit from this credit.

How can you maximize the retirement savings tax credit? 💡

If you are eligible for the retirement savings tax credit, there are a few strategies you can employ to maximize its benefits:

Contribute to Eligible Retirement Plans: Ensure that you contribute to eligible retirement plans, such as traditional or Roth IRAs, 401(k), or 403(b) plans, to qualify for the tax credit.

Review Income Limits: Be aware of the income limits for each filing status and adjust your contributions accordingly to maximize the tax credit.

Seek Professional Advice: Consider consulting a tax professional or financial advisor to understand the specific eligibility criteria and optimize your retirement savings strategy.

Frequently Asked Questions (FAQs)

1. Can I claim the retirement savings tax credit if I am already receiving Social Security benefits?

No, Social Security benefits are not considered eligible earned income for the retirement savings tax credit. Therefore, you cannot claim this credit based on your Social Security benefits.

2. Is the retirement savings tax credit available for contributions to non-retirement investment accounts?

No, the retirement savings tax credit is only available for contributions to eligible retirement plans, such as traditional or Roth IRAs, 401(k), or 403(b) plans. Contributions to non-retirement investment accounts do not qualify for this credit.

3. What is the maximum tax credit amount I can receive through the retirement savings tax credit?

The maximum tax credit amount varies based on your filing status, adjusted gross income, and retirement contributions. It is important to refer to the IRS guidelines and use Form 8880 to calculate the specific tax credit amount.

4. Can I claim the retirement savings tax credit if I am self-employed?

Yes, self-employed individuals can claim the retirement savings tax credit. They can contribute to eligible retirement plans, such as a solo 401(k) or a Simplified Employee Pension (SEP) IRA, and qualify for the tax credit based on their income and contributions.

5. How can I check if I am eligible for the retirement savings tax credit?

You can use the IRS Interactive Tax Assistant tool or consult a tax professional to determine your eligibility for the retirement savings tax credit. They will assess your income, filing status, and retirement contributions to determine if you qualify for this credit.

Conclusion

Friends, the retirement savings tax credit can be a valuable tool to boost your retirement savings while reducing your tax liability. By understanding the details and benefits of this tax credit, you can take advantage of the incentives it offers and secure your financial future. Remember to review the eligibility criteria, contribute to eligible retirement plans, and consult a professional for personalized advice. Start saving for retirement today and enjoy the benefits of the retirement savings tax credit! Happy saving!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial or tax advice. It is important to consult with a qualified tax professional or financial advisor regarding your specific situation before making any financial decisions. The retirement savings tax credit is subject to change based on IRS regulations and guidelines. Stay updated with the latest information and ensure compliance with the applicable tax laws.

This post topic: Budgeting Strategies