Secure Your Future: Optimize Your Retirement Plan At 30 Years Old!

Planning for Retirement at 30: A Comprehensive Guide

Introduction

Dear Readers,

1 Picture Gallery: Secure Your Future: Optimize Your Retirement Plan At 30 Years Old!

Welcome to our comprehensive guide on retirement planning for 30-year-olds. In today’s fast-paced world, it’s never too early to start planning for your future. By taking the right steps now, you can secure a comfortable and financially stable retirement.

Image Source: ctfassets.net

In this article, we will provide you with valuable information, tips, and strategies to help you create a robust retirement plan that aligns with your goals and aspirations. So, let’s dive in and explore the world of retirement planning for 30-year-olds!

What is Retirement Planning?

🔍 Retirement planning is the process of setting aside funds and making financial decisions to ensure a comfortable and fulfilling retirement. It involves creating a savings and investment strategy, estimating retirement expenses, and identifying potential income sources.

In your 30s, retirement planning may seem distant, but starting early gives you a significant advantage. By taking advantage of compound interest, you can build a substantial retirement nest egg over time.

Here are some key points to consider:

📅 Start Early: The earlier you begin saving for retirement, the more time your investments have to grow.

💰 Set Clear Goals: Determine your retirement lifestyle and estimate your future expenses.

🎯 Create a Budget: Track your income and expenses to allocate funds towards retirement savings.

📊 Understand Investment Options: Educate yourself about various investment vehicles to maximize returns.

👩💼 Seek Professional Advice: Consult with a financial advisor to develop a personalized retirement plan.

🔄 Regularly Review Your Plan: Reassess your retirement goals and make adjustments as necessary.

🔒 Protect Your Plan: Consider insurance options to safeguard your retirement savings.

Who Should Start Planning for Retirement at 30?

🔍 Anyone in their 30s who wishes to have a secure financial future should start planning for retirement. While retirement may seem far away, the earlier you start, the better off you’ll be.

Here are a few reasons why it’s crucial to start planning in your 30s:

🌱 Time Is on Your Side: Starting early allows your investments to grow over several decades.

💪 Building Good Habits: Developing a habit of saving and investing early sets a solid foundation for the future.

🚀 Taking Advantage of Compound Interest: Compounding can significantly boost your savings over time.

🎯 Setting Clear Goals: Planning early allows you to set clear retirement goals and develop strategies to achieve them.

📊 Adapting to Life Changes: Starting early gives you the flexibility to adapt your plan to changing circumstances.

When Should You Start Planning for Retirement?

🔍 The ideal time to start planning for retirement is in your 30s. By beginning early, you can benefit from the power of compounding and enjoy a more financially secure future.

Here’s why it’s important to start planning as soon as possible:

👶 Secure Your Future: Planning early ensures that you have enough funds to support yourself during retirement.

💼 Take Advantage of Employer Benefits: Many companies offer retirement plans and matching contributions, providing an excellent opportunity to grow your savings.

📈 Ride Out Market Volatility: Starting early gives you a longer time frame to weather market fluctuations and potentially earn higher returns.

📅 Time to Recover from Setbacks: By starting early, you have time to recover from financial setbacks and adjust your plan accordingly.

🎯 Accomplish Your Retirement Goals: The earlier you start planning, the better chance you have of achieving your desired retirement lifestyle.

Where to Begin with Retirement Planning?

🔍 The first step in retirement planning is to assess your current financial situation and define your retirement goals. By doing so, you can develop a roadmap to guide your journey towards a comfortable retirement.

Consider the following when starting your retirement planning:

💰 Assess Your Financial Health: Evaluate your current income, expenses, and overall financial well-being.

🌟 Define Your Retirement Goals: Envision your desired retirement lifestyle and estimate the expenses required to support it.

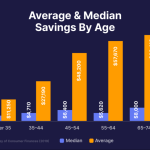

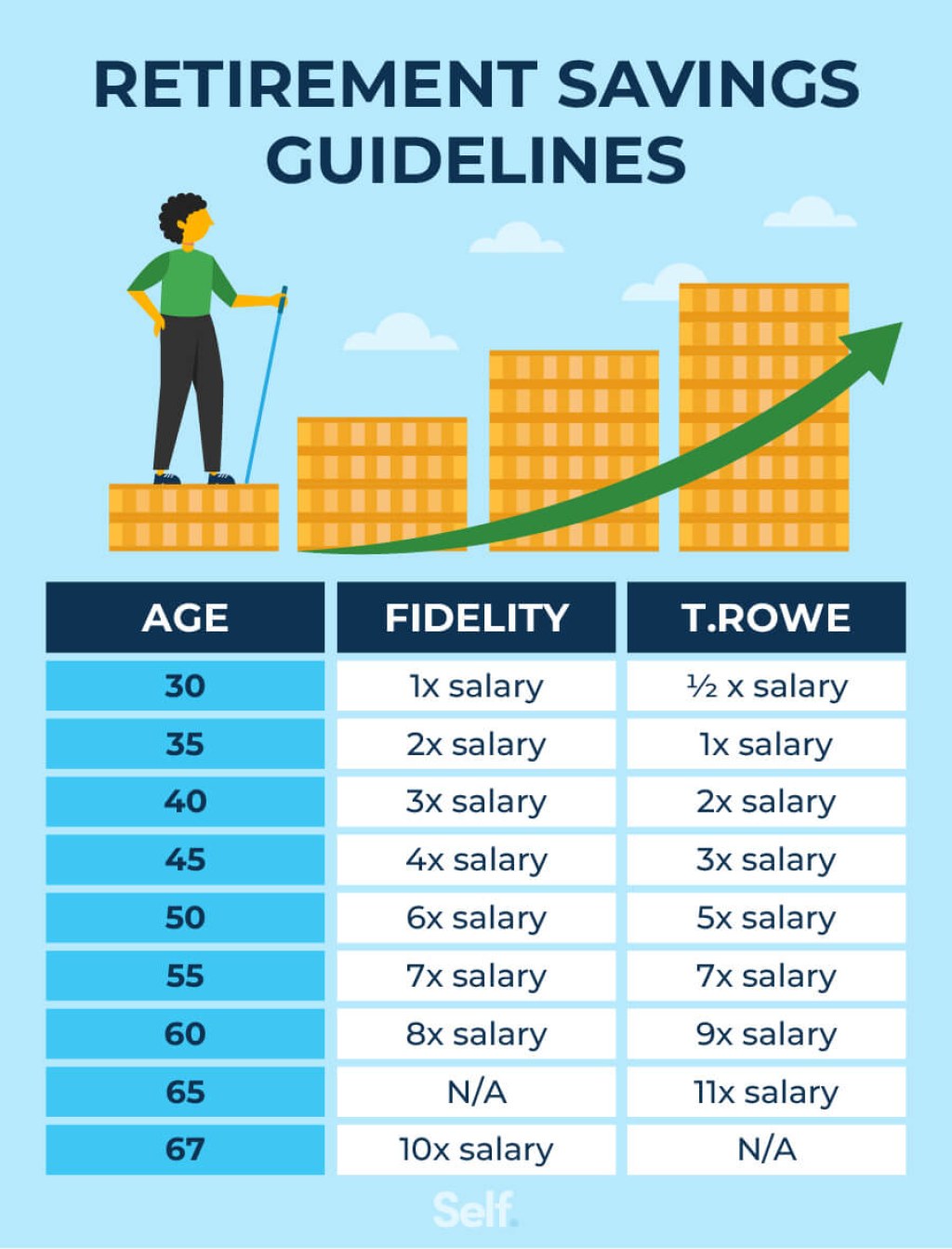

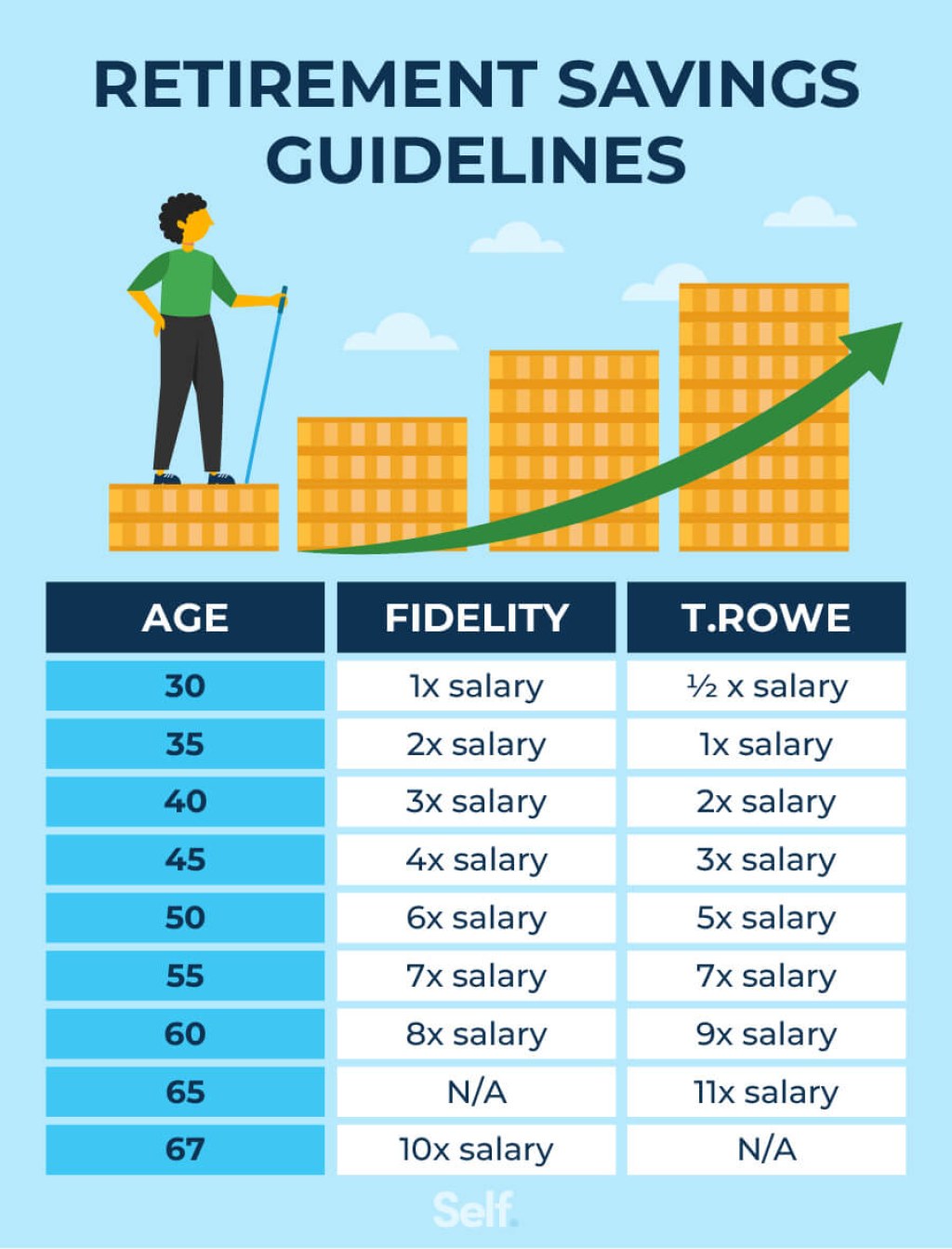

📈 Calculate Your Retirement Savings Target: Determine how much you need to save to achieve your retirement goals.

🔄 Create a Budget: Develop a budget to allocate funds towards retirement savings while managing your day-to-day expenses.

🏦 Explore Retirement Accounts: Learn about different retirement accounts such as 401(k)s, IRAs, and Roth IRAs, and choose the ones that align with your needs.

📊 Understand Investment Options: Educate yourself about different investment vehicles, such as stocks, bonds, mutual funds, and real estate.

👨👩👧👦 Consider Your Dependents: Evaluate the financial needs of your dependents and plan accordingly.

Why is Retirement Planning Important?

🔍 Retirement planning is essential for several reasons:

🌞 Financial Security: Planning ensures that you have enough money to maintain your desired standard of living during retirement.

👪 Support Loved Ones: Adequate retirement savings can provide for your dependents and protect them from financial hardship.

🎯 Achieve Retirement Goals: By setting clear retirement goals, you can work towards achieving the lifestyle you desire.

📈 Maximize Investment Returns: Planning allows you to make informed investment decisions that can lead to higher returns.

🔄 Adapt to Changing Circumstances: A comprehensive retirement plan provides flexibility to adjust your strategy as life events unfold.

How to Develop a Retirement Plan?

🔍 Developing a retirement plan involves several steps:

🌟 Set Clear Goals: Define your retirement lifestyle and determine the amount of money you’ll need to support it.

💰 Assess Your Current Situation: Evaluate your current income, expenses, and savings.

📈 Estimate Retirement Expenses: Consider factors such as healthcare, housing, travel, and hobbies.

💼 Identify Income Sources: Determine potential income sources, including Social Security, pensions, and investment returns.

🔢 Calculate Savings Target: Determine the amount you need to save to achieve your retirement goals.

🔄 Create a Savings and Investment Strategy: Allocate funds towards retirement savings and choose investments that align with your risk profile.

📊 Regularly Monitor and Adjust: Review your plan periodically and make adjustments as needed.

Advantages and Disadvantages of Retirement Planning at 30

🔍 Retirement planning at 30 offers both advantages and disadvantages:

Advantages

✅ Longer Time Horizon: Starting early provides more time for your investments to grow.

✅ Compound Interest: Taking advantage of compound interest can significantly boost your savings.

✅ Financial Security: Planning early ensures that you have enough funds to support yourself during retirement.

✅ Flexibility: Starting early gives you the flexibility to adjust your plan as life circumstances change.

✅ Building Good Habits: Developing a habit of saving and investing early sets a solid foundation for the future.

Disadvantages

❌ Opportunity Cost: Saving for retirement may limit the funds available for other goals.

❌ Uncertain Future: It can be challenging to predict future expenses and factors that may affect your retirement plan.

❌ Limited Resources: Starting early may be challenging if you have significant financial obligations.

❌ Investment Risks: Investing in the market carries risks, and there’s no guarantee of returns.

❌ Sacrifice in the Present: Saving for retirement requires discipline and may require lifestyle adjustments.

Frequently Asked Questions (FAQs)

Q1: How much should I save for retirement at 30?

A1: The amount you should save depends on your retirement goals, income, expenses, and lifestyle choices. Consulting with a financial advisor can help you determine an appropriate savings target.

Q2: Should I prioritize retirement savings over other financial goals?

A2: While retirement savings are crucial, it’s essential to strike a balance between saving for retirement and other financial obligations. Prioritize debt repayment and emergency savings before allocating funds towards retirement.

Q3: Should I rely solely on my employer’s retirement plan?

A3: While employer-sponsored retirement plans, such as 401(k)s, are valuable, it’s advisable to diversify your savings by investing in other retirement accounts like IRAs or Roth IRAs. This provides greater flexibility and potentially higher returns.

Q4: Can I catch up on retirement savings if I start planning later?

A4: Starting later means you have less time to accumulate savings, but you can still catch up on retirement savings by contributing more and making smart investment choices. Consult with a financial advisor to develop a personalized plan.

Q5: Is it too late to start retirement planning in my 30s?

A5: It’s never too late to start planning for retirement. While starting early offers more advantages, taking action in your 30s can still significantly impact your financial future. The key is to be proactive and consistent in your savings and investment efforts.

Conclusion

In conclusion, dear Readers, planning for retirement in your 30s is a wise and prudent decision. By starting early, setting clear goals, and implementing a well-defined retirement strategy, you can pave the way for a financially secure and fulfilling future.

Remember, retirement planning is a lifelong journey. Regularly review and adjust your plan as circumstances change, seek professional advice when needed, and stay disciplined in your savings and investment habits.

Take charge of your financial future today and embark on the path to a comfortable retirement!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. It is always recommended to consult with a qualified financial advisor before making any investment or retirement planning decisions.

Friends, we hope you found this comprehensive guide on retirement planning for 30-year-olds useful and informative. Remember, the key to a successful retirement is to take action today and make sound financial decisions.

Wishing you a prosperous and fulfilling retirement journey ahead!

This post topic: Budgeting Strategies