Mastering The Art Of Budget Allocation Strategy: Unleash Your Financial Potential Now!

Budget Allocation Strategy

Introduction

Hello Readers,

1 Picture Gallery: Mastering The Art Of Budget Allocation Strategy: Unleash Your Financial Potential Now!

Welcome to this informative article on budget allocation strategy. In this fast-paced business world, it is essential for companies to effectively manage their budgets to optimize their operations and achieve their financial goals. A well-planned budget allocation strategy can make a significant impact on the success and growth of an organization. In this article, we will explore the key aspects of budget allocation strategy, its benefits, and how it can be implemented to drive success. So, let’s dive in and understand the importance of budget allocation strategy in today’s competitive business landscape.

What is Budget Allocation Strategy?

🔍 Budget Allocation Strategy refers to the process of distributing financial resources across different areas of a business to achieve specific objectives and goals. It involves careful analysis, planning, and decision-making to determine how funds should be allocated to various departments, projects, marketing initiatives, research and development, and other essential areas of the organization.

Who is Involved in Budget Allocation Strategy?

🔍 Budget allocation strategy requires collaboration and involvement from various stakeholders within an organization. This includes top-level executives, finance team, department heads, project managers, and other key decision-makers. Each stakeholder plays a crucial role in ensuring that the allocated budget aligns with the overall objectives and priorities of the organization.

When Should Budget Allocation Strategy be Implemented?

Image Source: adtriba.com

🔍 Budget allocation strategy should be implemented during the budget planning phase, which typically occurs annually or for a specific period. It is essential to allocate budgets at the beginning of the financial year or planning cycle to provide clarity and direction to the organization’s operations. Regular reviews and adjustments should also be made throughout the year to adapt to changing business circumstances.

Where Does Budget Allocation Strategy Apply?

🔍 Budget allocation strategy applies to all sectors and industries, including businesses, non-profit organizations, government agencies, and educational institutions. Regardless of the size or nature of the organization, effective budget allocation is crucial for optimizing resources and ensuring financial stability.

Why is Budget Allocation Strategy Important?

🔍 Budget allocation strategy is vital for several reasons:

Ensures optimal resource utilization: By allocating budgets strategically, organizations can prioritize and allocate resources where they are most needed, reducing waste and maximizing efficiency.

Drives goal-oriented decision-making: A well-defined budget allocation strategy enables organizations to align their financial resources with their strategic goals and objectives, facilitating informed decision-making across departments.

Enhances financial control and accountability: Budget allocation strategy helps in tracking and monitoring the utilization of funds, ensuring accountability and transparency within the organization.

Supports effective risk management: Proper allocation of budgets allows organizations to allocate funds for risk mitigation and contingency planning, reducing financial vulnerabilities.

Facilitates performance evaluation: By comparing actual spending with allocated budgets, organizations can assess their performance and make necessary adjustments to achieve better financial outcomes.

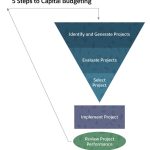

How to Implement Budget Allocation Strategy?

🔍 Implementing a successful budget allocation strategy involves the following steps:

Define organizational goals and priorities.

Analyze historical financial data and performance metrics.

Identify areas that require increased investment or cost reduction.

Allocate budgets based on the identified needs and priorities.

Monitor and track spending against allocated budgets.

Regularly review and adjust the budget allocation as needed.

Communicate and collaborate with stakeholders throughout the process.

Advantages and Disadvantages of Budget Allocation Strategy

Advantages:

Enables efficient resource allocation.

Aligns financial resources with organizational goals.

Improves decision-making based on data.

Enhances financial control and transparency.

Supports risk management and contingency planning.

Disadvantages:

May limit flexibility in resource allocation.

Requires accurate financial forecasting.

Can lead to conflicts among departments for budget allocation.

May not accommodate unforeseen expenses or opportunities.

Requires ongoing monitoring and adjustments.

Frequently Asked Questions (FAQs)

Q1: Does budget allocation strategy vary across different industries?

A1: Yes, budget allocation strategy can vary based on the nature and requirements of each industry. Industries with higher research and development needs may allocate larger portions of their budgets to innovation and product development.

Q2: Is it necessary to involve all departments in the budget allocation process?

A2: While it is beneficial to involve departments, organizations may choose to assign budget allocation responsibilities to specific individuals or teams, ensuring coordination and alignment with overall goals.

Q3: Can budget allocation strategy contribute to cost reduction initiatives?

A3: Yes, budget allocation strategy can identify areas of unnecessary spending and redirect funds to more critical areas, leading to cost reduction and improved efficiency.

Q4: Should budget allocation strategy be reviewed periodically?

A4: Yes, regular reviews and adjustments are essential to accommodate changing business conditions, market dynamics, and emerging opportunities.

Q5: What role does technology play in budget allocation strategy?

A5: Technology, such as budgeting software and financial management tools, can streamline the budget allocation process, provide real-time insights, and facilitate accurate budget tracking and analysis.

Conclusion

In conclusion, budget allocation strategy plays a crucial role in optimizing financial resources, driving goal-oriented decision-making, and enhancing overall organizational performance. By effectively allocating budgets and regularly reviewing their utilization, organizations can achieve better financial outcomes and adapt to evolving market dynamics. Implementing a well-defined budget allocation strategy requires collaboration, data analysis, and proactive decision-making. So, take the necessary steps to develop an effective budget allocation strategy and steer your organization towards success.

Final Remarks

It is important to note that budget allocation strategy should be tailored to the specific needs and goals of each organization. The information provided in this article serves as a general guide and should be supplemented with further research and analysis. Additionally, external factors, such as economic conditions and industry trends, should be considered when developing and implementing budget allocation strategies. Always consult with financial experts or advisors to ensure the suitability and effectiveness of your budget allocation strategy.

This post topic: Budgeting Strategies