Mastering Your Finances: Unlocking Success With Our Budget Strategy Paper

Budget Strategy Paper: An Essential Guide to Financial Planning

Introduction

Dear Readers,

3 Picture Gallery: Mastering Your Finances: Unlocking Success With Our Budget Strategy Paper

Welcome to our comprehensive guide on budget strategy paper – a vital tool for effective financial planning. In this article, we will delve into the importance of budget strategy papers, their components, and how they can assist individuals and businesses in achieving their financial goals. So, let’s dive in and explore the world of budget strategy papers!

What is a Budget Strategy Paper?

Image Source: twimg.com

📃 A budget strategy paper is a detailed document that outlines an individual’s or organization’s financial objectives, plans, and strategies. It serves as a roadmap for managing income, expenses, investments, and savings. This paper provides a clear overview of the financial landscape and helps to make informed decisions to achieve financial stability and growth.

Who Needs a Budget Strategy Paper?

🤔 Budget strategy papers are beneficial for individuals, families, and businesses of all sizes. Whether you are a college student, a young professional, a startup owner, or a seasoned entrepreneur, having a well-defined budget strategy can greatly contribute to your financial success. It helps you gain control over your finances, allocate resources effectively, and make informed financial decisions.

When Should You Create a Budget Strategy Paper?

📅 It is recommended to create a budget strategy paper at the beginning of each financial year or whenever significant financial changes occur. This could be when starting a new job, getting married, starting a family, or expanding your business. Regularly reviewing and updating your budget strategy paper ensures that you stay on track and adapt to changing circumstances.

Where to Start with a Budget Strategy Paper?

Image Source: twimg.com

🏁 To create an effective budget strategy paper, start by gathering all your financial information. This includes your income sources, expenses, debts, investments, and savings. Analyze your financial goals and determine the timeframe for achieving them. Identify areas where you can cut costs or increase revenue. With this information, you can develop a realistic budget that aligns with your financial objectives.

Why is a Budget Strategy Paper Important?

💼 A budget strategy paper plays a crucial role in financial planning for several reasons:

📉 It helps you track your income and expenses, enabling you to identify areas where you can save or invest more.

📊 It allows you to set financial goals and create a roadmap to achieve them.

💰 It helps in managing debts and avoiding financial pitfalls.

📈 It provides a clear overview of your financial health and enables you to make informed financial decisions.

🔒 It ensures that you have a contingency plan for unexpected expenses or emergencies.

🌟 It empowers you to take control of your financial future and achieve long-term financial stability.

Image Source: sapst.org

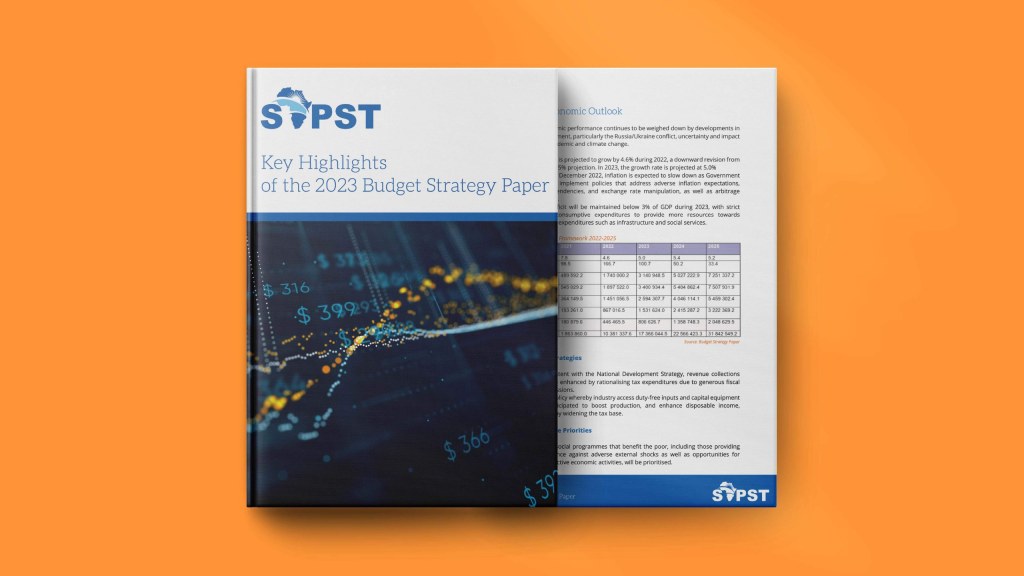

How to Create an Effective Budget Strategy Paper?

📝 Creating an effective budget strategy paper involves the following steps:

📅 Set financial goals: Define your short-term and long-term financial objectives.

💵 Assess your income: Determine your income sources and calculate the total amount.

💸 Analyze your expenses: Track your expenses and categorize them into essential and non-essential items.

📉 Create a budget: Allocate funds for each expense category, ensuring that your income exceeds your expenses.

🔄 Monitor and adjust: Regularly review your budget, track your spending, and make necessary adjustments.

💰 Save and invest: Allocate a portion of your income for savings and investments to achieve financial growth.

📊 Evaluate and reassess: Periodically review your budget strategy paper to assess your progress and make any necessary changes.

Advantages and Disadvantages of Budget Strategy Paper

Advantages:

✅ Provides financial clarity and a roadmap for achieving goals.

✅ Helps in making informed financial decisions.

✅ Enables effective allocation of resources.

✅ Assists in managing debts and avoiding financial pitfalls.

✅ Promotes financial discipline and accountability.

Disadvantages:

❌ Requires time and effort to create and maintain.

❌ May need adjustments due to unexpected financial changes.

❌ Can restrict flexibility in spending.

Frequently Asked Questions (FAQs)

1. What is the ideal duration for creating a budget strategy paper?

📝 The ideal duration for creating a budget strategy paper is at the beginning of each financial year. However, it can be created whenever significant financial changes occur.

2. Should I seek professional help in creating my budget strategy paper?

📝 Seeking professional help can be beneficial, especially if you have complex financial situations or need expert guidance. However, creating a budget strategy paper on your own is also possible with careful research and understanding.

3. How often should I review and update my budget strategy paper?

📝 It is advisable to review and update your budget strategy paper regularly, at least once every three to six months or whenever there are significant changes in your financial circumstances.

4. Can a budget strategy paper help in paying off debts?

📝 Yes, a budget strategy paper can assist in managing and paying off debts. It allows you to allocate funds specifically for debt repayments, helping you prioritize and effectively manage your debts.

5. Is it possible to achieve financial goals without a budget strategy paper?

📝 While it is possible to achieve financial goals without a budget strategy paper, having one greatly increases the likelihood of success. It provides a structured approach and ensures that you stay focused and accountable.

Conclusion

In conclusion, a budget strategy paper is an essential tool for effective financial planning. By creating a well-defined budget strategy, individuals and businesses can gain control over their finances, make informed decisions, and work towards achieving their financial goals. Remember, financial success requires discipline, dedication, and regular evaluation of your budget strategy. So, start creating your budget strategy paper today and take charge of your financial future!

Final Remarks

Dear Readers, we hope this comprehensive guide on budget strategy papers has provided you with valuable insights into the world of financial planning. While budgeting may seem daunting at first, the benefits it offers in terms of financial stability and growth are undeniable. However, please note that the information provided in this article is for informational purposes only and should not be considered as financial advice. It is always advisable to consult with a financial professional before making any significant financial decisions. Wishing you all the best on your journey towards financial success!

This post topic: Budgeting Strategies