Secure Your Future: Maximize Retirement Health Savings Now!

Retirement Health Savings: Securing Your Future

Introduction

Hello Readers,

1 Picture Gallery: Secure Your Future: Maximize Retirement Health Savings Now!

Welcome to our comprehensive guide on retirement health savings. In this article, we will explore the importance of planning for healthcare costs during retirement and provide you with valuable insights on how to secure your future. It is crucial to be well-prepared for the financial challenges that may arise as we age, especially when it comes to healthcare expenses. So, let’s delve into the world of retirement health savings and learn how you can protect yourself and your loved ones.

What is Retirement Health Savings? 🌟

Image Source: licdn.com

Retirement health savings refers to the financial planning and investment strategies aimed at covering healthcare costs during retirement. As we age, the likelihood of needing medical care increases, making it essential to have a dedicated fund to ensure a comfortable and secure retirement.

Planning for retirement health savings involves estimating future healthcare expenses, considering factors such as inflation, medical advancements, and personal health conditions. By doing so, individuals can proactively manage their finances and avoid potential financial strain caused by unforeseen medical bills.

Who Should Consider Retirement Health Savings? 🤔

Retirement health savings is relevant for individuals of all ages who aspire to enjoy a financially secure retirement. Whether you are in your 20s or nearing retirement, it is never too early or too late to start planning for your healthcare expenses.

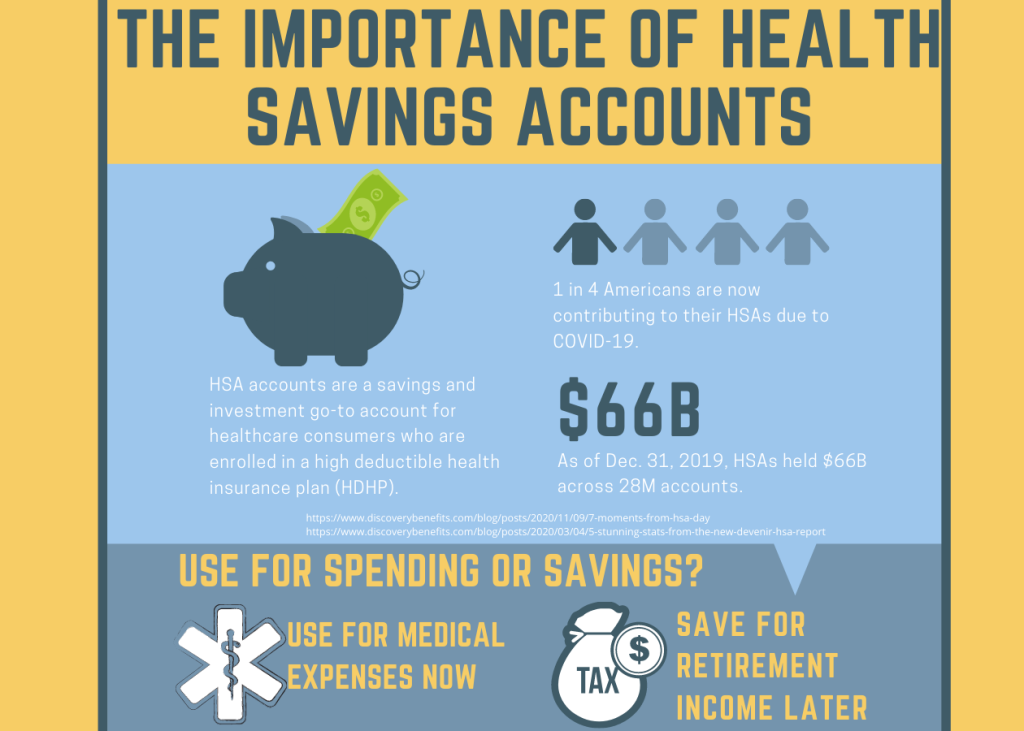

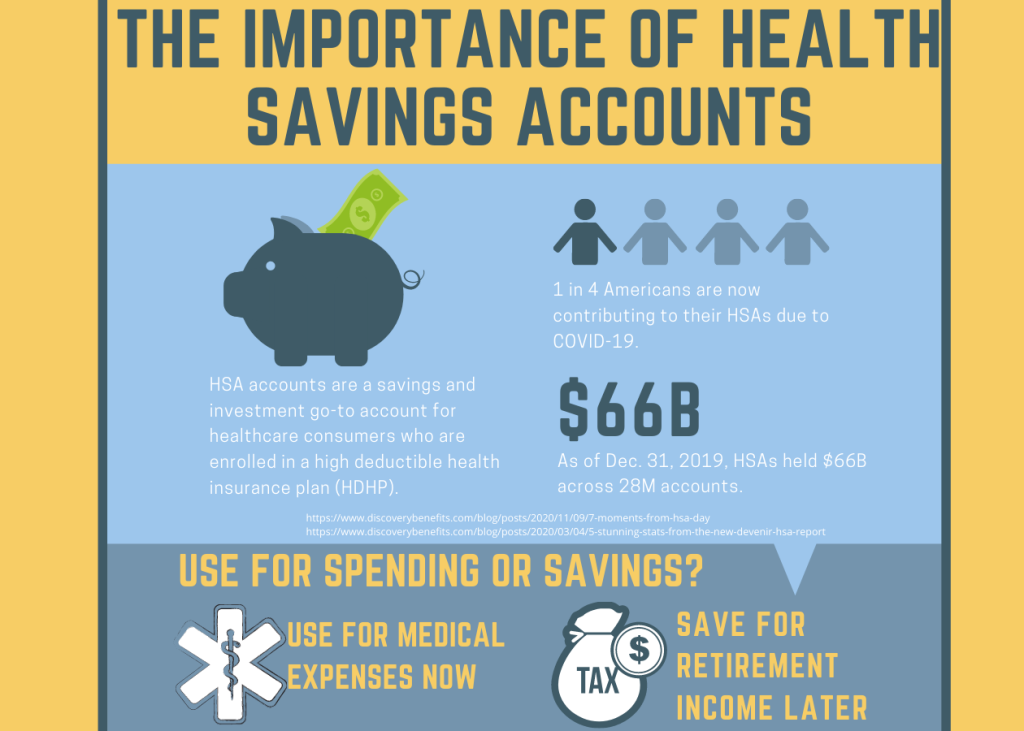

Image Source: twentyoverten.com

Younger individuals can take advantage of time and compound interest to build substantial retirement health savings over the years. On the other hand, those closer to retirement age might need to explore different strategies to catch up and ensure they have enough funds to cover healthcare costs during their golden years.

When Should You Start Saving for Retirement Health? ⏰

The best time to start saving for retirement health is today. The earlier you begin, the more time you have to grow your savings and benefit from compounding interest. By starting early, you can take advantage of investment opportunities and potentially generate higher returns on your investments.

However, it is never too late to start planning for retirement health savings. Even if you have limited time until retirement, every contribution matters, and it can help improve your financial situation during your golden years.

Where Can You Allocate Your Retirement Health Savings? 🌍

There are several options available for allocating your retirement health savings, each with its own advantages and considerations:

1. Individual Retirement Accounts (IRAs): IRAs offer tax advantages and a variety of investment options. Traditional IRAs provide tax-deferred growth, while Roth IRAs offer tax-free withdrawals during retirement.

2. Health Savings Accounts (HSAs): HSAs are tax-advantaged accounts specifically designed for healthcare expenses. They are available to individuals with high-deductible health insurance plans and offer triple tax benefits.

3. Employer-Sponsored Retirement Plans: Many employers offer retirement plans, such as 401(k) or 403(b) plans, which allow employees to save for retirement on a tax-deferred or tax-free basis.

4. Personal Savings and Investments: In addition to retirement accounts, individuals can also allocate their retirement health savings to personal savings accounts, stocks, bonds, and other investment vehicles.

Why is Retirement Health Savings Important? 📈

Retirement health savings is vital for several reasons:

1. Rising Healthcare Costs: Healthcare expenses are increasing at a rapid pace, and it is crucial to have sufficient funds to cover these costs during retirement.

2. Medicare Coverage Gaps: While Medicare provides essential healthcare coverage for individuals aged 65 and older, it does not cover all expenses. Retirement health savings can help bridge the gaps in Medicare coverage.

3. Financial Security: By planning and saving for retirement health, individuals can enjoy peace of mind knowing that they have a dedicated fund to cover medical expenses, reducing financial stress during retirement.

How Can You Start Saving for Retirement Health? 💰

Here are some steps to help you get started:

1. Assess Your Financial Situation: Evaluate your current financial position, including income, expenses, and existing retirement savings.

2. Set Retirement Health Goals: Determine how much you need to save for retirement health by estimating future healthcare expenses.

3. Create a Budget: Develop a budget that allows you to allocate a portion of your income towards retirement health savings.

4. Explore Retirement Accounts: Research and choose the retirement accounts that best suit your needs, such as IRAs, HSAs, or employer-sponsored plans.

5. Invest Wisely: Consult with a financial advisor to develop an investment strategy that aligns with your risk tolerance and long-term goals.

6. Monitor and Adjust: Regularly review and adjust your retirement health savings plan as your circumstances and goals change.

Advantages and Disadvantages of Retirement Health Savings 📊

Retirement health savings offer several advantages and disadvantages:

Advantages:

1. Financial Security: Retirement health savings provide peace of mind and protect your financial well-being during retirement.

2. Tax Benefits: Many retirement accounts offer tax advantages, such as tax-deferred growth or tax-free withdrawals.

3. Flexibility: Retirement health savings allow you to choose how and where you allocate your funds, providing flexibility and control over your healthcare decisions.

Disadvantages:

1. Limited Contribution Limits: Some retirement accounts have contribution limits, which may restrict the amount you can save for retirement health.

2. Market Volatility: Investments are subject to market fluctuations, and there is a risk of potential losses.

3. Healthcare Cost Uncertainty: Estimating future healthcare expenses can be challenging, and there may be unexpected costs that exceed your savings.

Frequently Asked Questions (FAQ) 🙋♂️

1. What happens if I don’t save for retirement health?

Not saving for retirement health can leave you vulnerable to financial difficulties in the future. Without dedicated savings, you may struggle to cover healthcare costs during retirement, potentially compromising your quality of life.

2. Can I use my retirement savings for non-healthcare expenses?

While retirement health savings should ideally be used for healthcare expenses, there may be circumstances where you can withdraw funds for non-healthcare purposes. However, doing so may incur taxes and penalties, so it is essential to consult with a financial advisor before making any withdrawals.

3. How do I estimate my future healthcare expenses?

Estimating future healthcare expenses requires careful consideration of factors such as current health conditions, family medical history, and anticipated inflation rates. Consulting with healthcare professionals and financial advisors can help you make more accurate estimates.

4. What if I have a pre-existing health condition?

If you have a pre-existing health condition, it is even more crucial to save for retirement health. Consider consulting with healthcare professionals and financial advisors to determine the potential costs associated with your condition and plan accordingly.

5. Can I save for retirement health even if I have a low income?

Yes, even individuals with a low income can save for retirement health. Start by creating a budget and allocating a small percentage of your income towards retirement health savings. Every contribution matters, and it can grow over time.

Conclusion: Secure Your Future Today ✅

Retirement health savings play a crucial role in securing your future and ensuring a comfortable retirement. By proactively planning and saving for healthcare expenses, you can protect yourself and your loved ones from potential financial strain. Remember to start early, explore different retirement accounts, and seek professional guidance when needed.

Don’t wait any longer – take control of your retirement health savings today and embark on a journey towards a financially secure and worry-free retirement. Your future self will thank you.

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial or healthcare advice. It is essential to consult with qualified professionals before making any financial decisions or relying on the information provided. Every individual’s financial situation and healthcare needs are unique, and what works for one person may not work for another.

This post topic: Budgeting Strategies