Secure Your Future: Start Retirement Planning 3 Years Ahead

Retirement Planning 3 Years Out: Setting Yourself Up for a Secure Future

Greetings, Readers! Planning for retirement is a crucial step in securing your future financial stability. As retirement approaches, it becomes even more important to strategize and make well-informed decisions. In this article, we will explore the concept of retirement planning with a 3-year outlook, providing you with valuable insights on how to prepare effectively.

Introduction

Retirement planning is the process of setting aside funds and making arrangements to support oneself financially after leaving the workforce. It involves careful consideration of various factors, such as anticipated expenses, income sources, and investment strategies.

3 Picture Gallery: Secure Your Future: Start Retirement Planning 3 Years Ahead

When planning for retirement, it is essential to establish a timeline and evaluate your progress periodically. By focusing on the 3-year mark, you can make specific adjustments and fine-tune your strategies to achieve your desired retirement goals.

In the following sections, we will delve into the different aspects of retirement planning 3 years out, covering the what, who, when, where, why, and how of this crucial financial undertaking.

What is Retirement Planning 3 Years Out?

Retirement planning 3 years out refers to the process of assessing and optimizing your financial position and strategies with a focus on retirement, considering a time frame of three years before your expected retirement date. It involves taking stock of your assets, investments, and retirement accounts to ensure that you are on track to meet your retirement goals.

Image Source: physicianonfire.com

During this period, you have the opportunity to make any necessary adjustments to your retirement plans, such as increasing contributions to retirement accounts, rebalancing investment portfolios, or exploring alternative income streams.

Who Should Consider Retirement Planning 3 Years Out?

Retirement planning 3 years out is relevant for individuals who are approaching their anticipated retirement date. It is particularly crucial for those who want to ensure a smooth transition from working life to retirement and maintain their desired standard of living after leaving the workforce.

Whether you are an employee, self-employed, or a business owner, taking the time to plan your retirement 3 years in advance can provide you with the necessary financial stability and peace of mind.

When to Start Retirement Planning 3 Years Out?

The ideal time to start retirement planning 3 years out is when you have approximately three years remaining until your planned retirement date. However, it is never too early or too late to start planning for retirement. The earlier you begin, the more time you have to build a substantial retirement nest egg.

If you find yourself with less than three years until retirement, don’t worry. You can still make significant progress by implementing strategic financial decisions and seeking expert advice tailored to your specific situation.

Where to Begin Retirement Planning 3 Years Out?

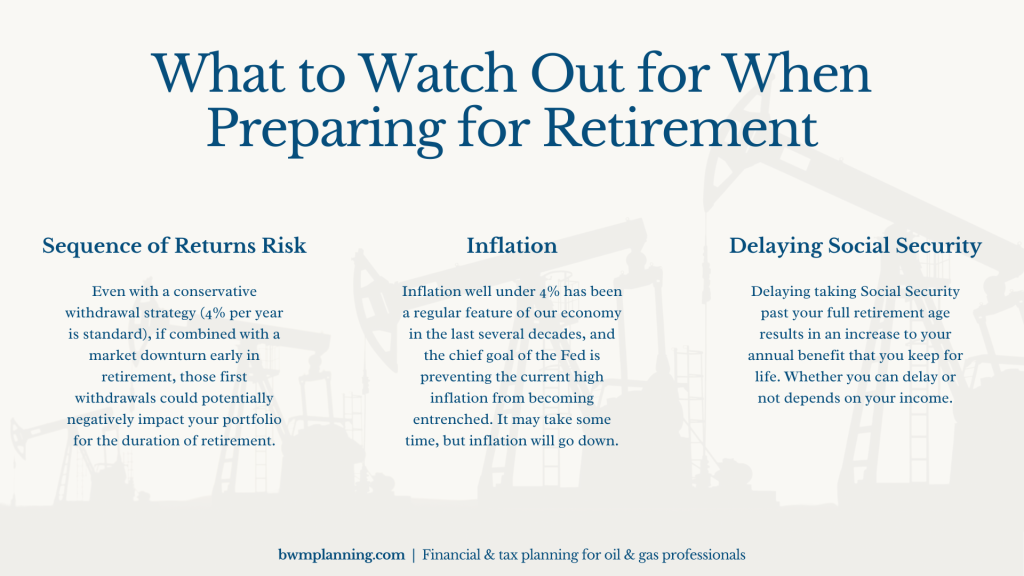

Image Source: bwmplanning.com

Retirement planning can feel overwhelming, but breaking it down into manageable steps can simplify the process. To start your retirement planning journey 3 years out, consider the following key actions:

1. Evaluate your current financial situation, including savings, investments, and debts.

2. Determine your retirement goals and desired lifestyle.

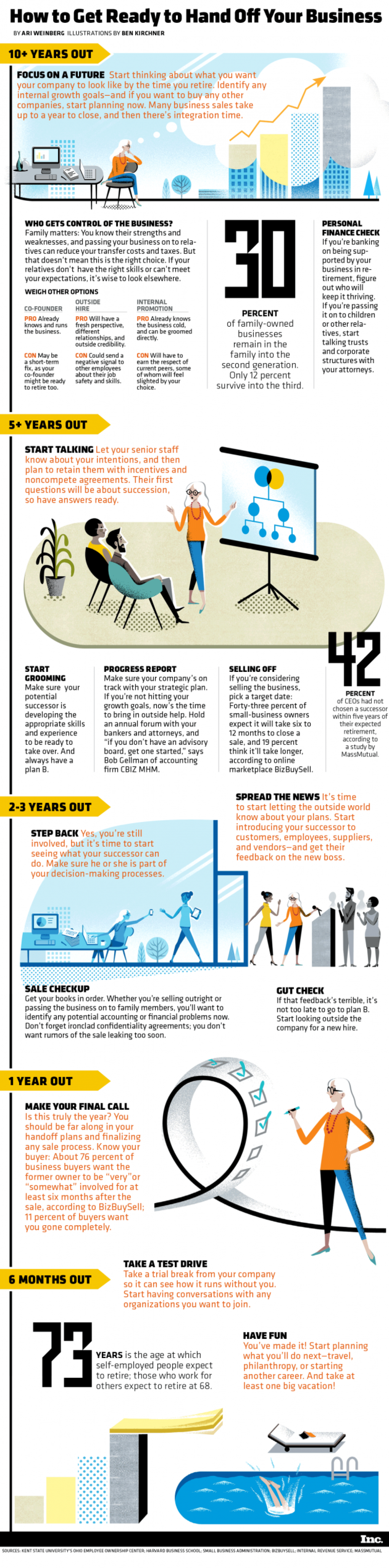

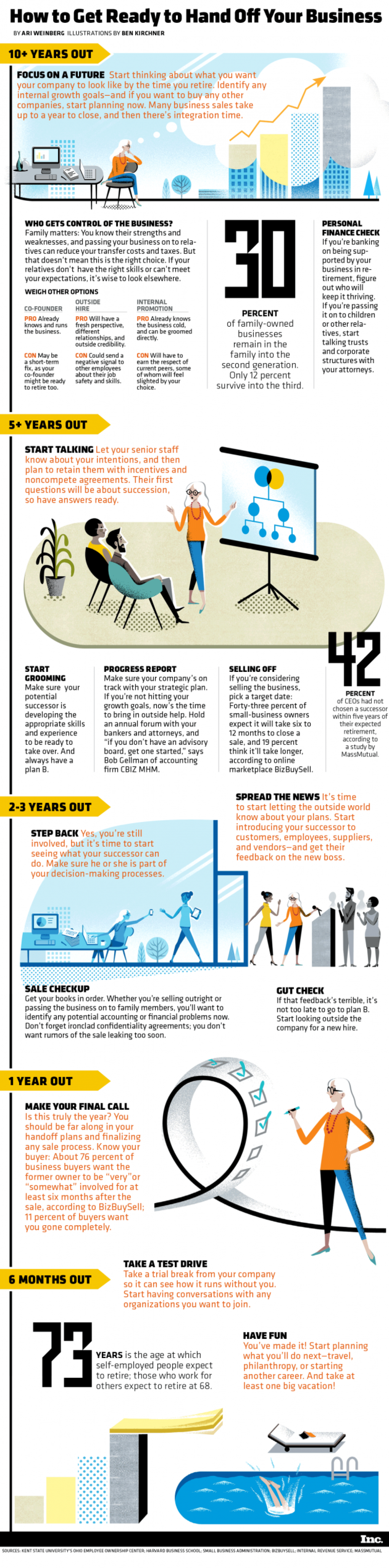

Image Source: incimages.com

3. Calculate your anticipated retirement expenses, including healthcare costs, housing, and leisure activities.

4. Assess your retirement income sources, such as Social Security, pensions, and personal investments.

5. Consider potential risks, such as inflation or unexpected expenses, and develop contingency plans.

6. Seek professional advice from financial advisors or retirement planners.

7. Regularly review and adjust your retirement plan as needed, taking into account changes in your circumstances or goals.

Why is Retirement Planning 3 Years Out Important?

Retirement planning 3 years out holds significant importance for several reasons:

1. Time for Adjustments: By focusing on the 3-year mark, you have enough time to make necessary adjustments to your retirement plans, such as increasing savings or adjusting investment strategies.

2. Financial Stability: Planning for retirement in advance allows you to build a solid financial foundation, ensuring a stable income during your retirement years.

3. Peace of Mind: Having a well-thought-out retirement plan reassures you that you are on track to achieve your financial goals and provides peace of mind.

4. Flexibility and Control: By planning in advance, you have the flexibility to adapt and make informed decisions based on changing circumstances.

5. Minimize Risks: Retirement planning 3 years out enables you to identify and mitigate potential risks, such as market volatility or unexpected expenses.

How to Approach Retirement Planning 3 Years Out?

Retirement planning 3 years out requires a systematic approach to ensure a smooth transition into retirement. Consider the following steps:

1. Set Clear Goals: Define your retirement goals and determine the lifestyle you aspire to during retirement.

2. Assess Your Finances: Evaluate your current financial situation, including savings, investments, and debts.

3. Establish a Realistic Budget: Calculate your anticipated retirement expenses and create a budget that aligns with your goals.

4. Maximize Contributions: Contribute the maximum amount allowed to retirement accounts, such as 401(k)s or IRAs.

5. Diversify Investments: Review your investment portfolio and ensure that it is appropriately diversified to minimize risk.

6. Consider Healthcare Costs: Account for potential healthcare expenses by exploring insurance options or setting up a health savings account.

7. Seek Professional Advice: Consult with financial advisors or retirement planners who can provide personalized guidance and expertise.

Advantages and Disadvantages of Retirement Planning 3 Years Out

Advantages:

1. Increased Preparation Time: Planning 3 years in advance allows for more time to make adjustments and build a robust retirement plan.

2. Enhanced Financial Stability: By focusing on retirement planning, you can ensure a more secure financial future.

3. Reduced Stress: Having a well-thought-out retirement plan in place alleviates the stress and uncertainty associated with post-retirement finances.

Disadvantages:

1. Market Volatility: Economic fluctuations can impact your retirement savings and investments, requiring careful monitoring and adjustment.

2. Inflation: The rising cost of living can diminish the purchasing power of your retirement funds over time.

3. Unexpected Life Events: Despite meticulous planning, unexpected events such as health issues or family emergencies can impact retirement finances.

FAQs About Retirement Planning 3 Years Out

Q1: Is it too late to start retirement planning if I am already approaching retirement in 3 years?

A1: It is never too late to start planning for retirement. While the timeline may be shorter, strategic financial decisions and professional guidance can still make a considerable difference.

Q2: Can I retire earlier than planned if I have a sound retirement plan in place?

A2: Depending on your financial situation and retirement plan, early retirement may be feasible. However, it is crucial to evaluate the impact on your long-term financial stability.

Q3: How can I ensure that my retirement savings will last throughout my retirement years?

A3: Proper planning, diversification of investments, and regular monitoring can help ensure that your retirement savings last throughout your retirement years.

Q4: Should I consider downsizing my home as part of my retirement plan?

A4: Downsizing your home can be a viable option to free up equity and reduce living expenses during retirement. However, it is essential to consider the associated costs and lifestyle implications.

Q5: Is it necessary to have a financial advisor for retirement planning 3 years out?

A5: While not mandatory, a financial advisor can provide valuable insights, expertise, and guidance tailored to your specific retirement goals and financial situation.

Conclusion

In conclusion, planning for retirement 3 years out is a crucial step in securing your financial future. By taking the time to evaluate your finances, set clear goals, and make necessary adjustments, you can ensure a smooth transition into retirement and maintain your desired standard of living. Remember to seek professional advice and regularly review your retirement plan to adapt to changing circumstances. Start planning today for a secure and fulfilling retirement!

Final Remarks

Retirement planning is an essential endeavor that requires careful consideration and proactive decision-making. While the information provided in this article serves as a valuable starting point, it is crucial to consult with financial professionals and experts who can provide personalized advice based on your unique circumstances. Additionally, remember that the financial landscape is subject to change, and it is essential to stay informed and adapt your retirement plan accordingly. Here’s to a successful retirement planning journey and a prosperous future!

This post topic: Budgeting Strategies

![OC] Retirement ages in G : r/dataisbeautiful](https://fantotal.info/wp-content/uploads/2023/09/oc-retirement-ages-in-g-r-dataisbeautiful-150x150.png)