Maximize Your Retirement Savings By Age: Insider Tips From Reddit

Retirement Savings by Age Reddit: A Comprehensive Guide to Securing Your Future

Introduction

Dear Readers,

3 Picture Gallery: Maximize Your Retirement Savings By Age: Insider Tips From Reddit

![Picture of: OC] Retirement ages in G : r/dataisbeautiful](https://fantotal.info/wp-content/uploads/2023/09/oc-retirement-ages-in-g-r-dataisbeautiful.png)

Welcome to our comprehensive guide on retirement savings by age, specifically focusing on valuable insights from Reddit. In this article, we will explore the importance of retirement savings at different stages of life and provide helpful tips and advice from the Reddit community. Whether you are just starting your career or approaching retirement, this guide will equip you with the knowledge to make informed decisions about your financial future.

Retirement planning is a fundamental aspect of financial well-being. It involves setting aside a portion of your income during your working years to ensure a comfortable and secure retirement. However, the optimal savings strategy may vary depending on your age, financial goals, and risk tolerance. By examining the experiences and advice shared on Reddit, we can gain valuable insights into retirement savings strategies tailored to different age groups.

![retirement savings by age reddit - OC] Retirement ages in G : r/dataisbeautiful retirement savings by age reddit - OC] Retirement ages in G : r/dataisbeautiful](https://fantotal.info/wp-content/uploads/2023/09/oc-retirement-ages-in-g-r-dataisbeautiful.png)

Image Source: redd.it

Now, let’s delve into the fascinating world of retirement savings by age, as discussed on Reddit.

The Importance of Retirement Savings

What is retirement savings, and why is it crucial? Retirement savings refer to the funds you accumulate throughout your working years to support yourself financially after you stop working. It is essential to save for retirement to maintain your standard of living, cover healthcare costs, and fulfill your post-retirement aspirations.

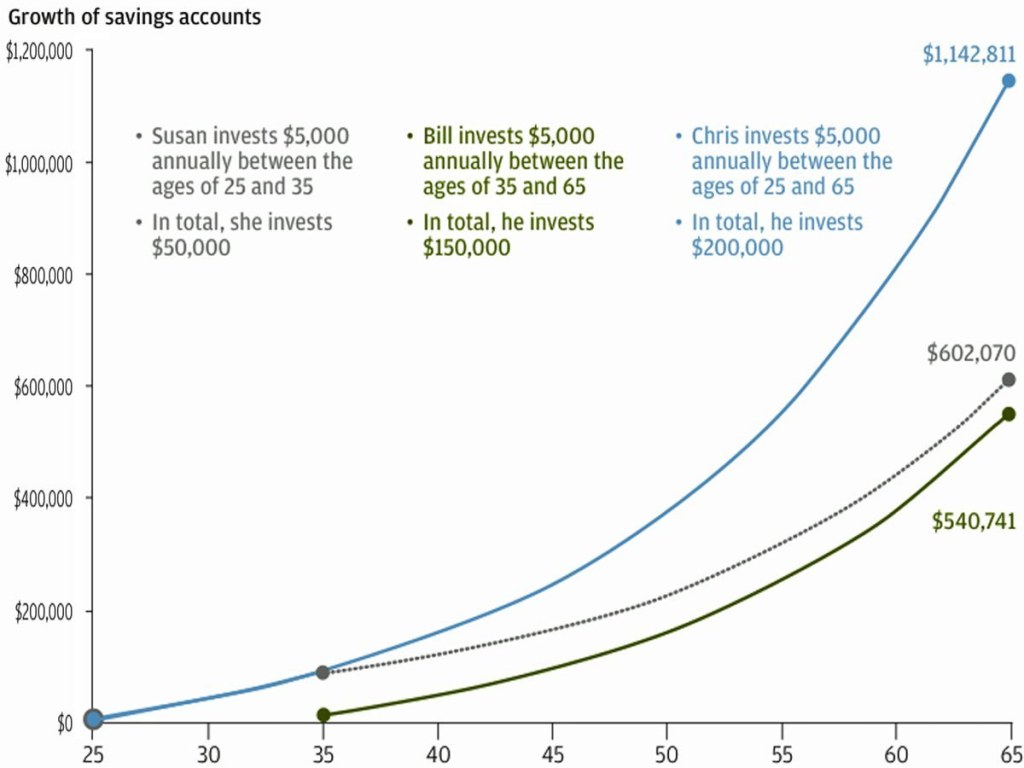

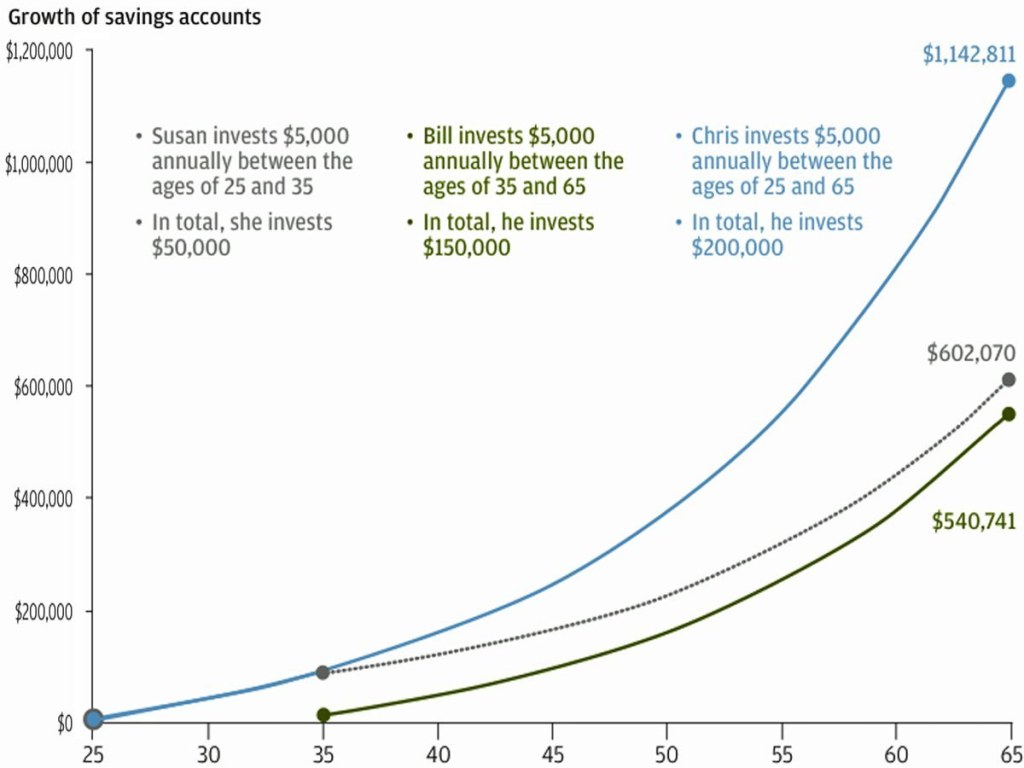

Reddit users emphasize the significance of starting early when it comes to retirement savings. By saving and investing consistently over a more extended period, you can benefit from compounding returns and potentially achieve your retirement goals more comfortably.

Who Should Be Saving for Retirement?

Image Source: imgur.com

Retirement savings are not exclusive to a particular group or age bracket; they are essential for everyone who envisions a financially secure future. Whether you are just starting your professional journey or nearing retirement, it is crucial to prioritize saving for retirement.

Young Professionals: Reddit users advise young professionals to start saving for retirement as early as possible. By taking advantage of time and compounding returns, even small contributions can grow significantly over the long term. Moreover, starting early allows you to develop disciplined saving habits and adjust your lifestyle accordingly.

Mid-Career Individuals: As you progress in your career, it is essential to reassess and increase your retirement savings contributions. With a higher income, you can save more towards your retirement goals. Reddit users recommend taking advantage of employer-sponsored retirement plans, such as 401(k) or pension plans, and maximizing employer matching contributions.

Pre-Retirees: If you are approaching retirement, it is crucial to evaluate your savings and ensure they align with your retirement goals. Reddit users suggest exploring a variety of investment options, diversifying your portfolio, and considering professional financial advice to optimize your savings. Additionally, assessing your expenses and adjusting your budget can help ensure a smooth transition into retirement.

When Should You Start Saving for Retirement?

Image Source: redd.it

One common question among individuals is when they should start saving for retirement. According to Reddit users, the answer is simple: as early as possible. The power of compounding returns allows your savings to grow exponentially over time.

Starting early in your career gives you a significant advantage due to the potential for a more extended investment horizon. Even small contributions can make a substantial difference in the long run. However, it is never too late to start saving for retirement, and Reddit users encourage individuals of all ages to take action and begin building their retirement nest egg.

Where Should You Save for Retirement?

Reddit users discuss various retirement savings options available to individuals at different stages of life. Here are some popular choices:

1. Employer-Sponsored Retirement Plans: Many individuals have access to retirement plans offered by their employers, such as 401(k) plans. These plans offer tax advantages and often provide employer matching contributions, making them an attractive option for retirement savings.

2. Individual Retirement Accounts (IRAs): IRAs allow individuals to save for retirement on their own. There are two main types of IRAs: Traditional and Roth. Traditional IRAs offer tax-deferred growth, while Roth IRAs provide tax-free withdrawals in retirement.

3. Brokerage Accounts: Investing in brokerage accounts can be an additional retirement savings strategy. These accounts provide flexibility and access to a wide range of investment options.

4. Real Estate Investments: Some Reddit users highlight the potential benefits of investing in real estate as a retirement savings strategy. However, it is essential to thoroughly research and consider the risks associated with real estate investments.

Ultimately, the choice of where to save for retirement depends on individual circumstances and financial goals. It is advisable to consult with a financial advisor to determine the most suitable options for your specific needs.

Why is Retirement Savings Important?

Retirement savings play a critical role in ensuring financial security and independence during your retirement years. Here are some of the key reasons why retirement savings are essential:

1. Maintaining Your Lifestyle: Retirement savings allow you to maintain your desired lifestyle and cover day-to-day expenses without relying solely on Social Security benefits or other sources of income.

2. Healthcare Costs: As healthcare expenses continue to rise, having sufficient retirement savings is crucial to cover medical bills and long-term care expenses.

3. Unexpected Events: Retirement savings provide a safety net for unexpected events such as emergencies, home repairs, or job loss.

4. Pursuing Your Dreams: Retirement is an opportunity to fulfill your dreams and pursue hobbies or passions that you may not have had time for during your working years. Adequate savings give you the freedom to explore new opportunities and enjoy a fulfilling retirement.

5. Leaving a Legacy: Building a substantial retirement savings allows you to leave a financial legacy for your loved ones, ensuring their financial well-being even after you are gone.

How Can You Save More for Retirement?

Reddit users offer valuable tips for saving more for retirement:

1. Budgeting: Create a budget to track your expenses and identify areas where you can cut back and save more towards retirement.

2. Increase Contributions: Gradually increase your retirement savings contributions as your income grows or when you receive bonuses or raises.

3. Minimize Debt: Paying off high-interest debt, such as credit card debt, can free up more funds for retirement savings.

4. Automated Savings: Set up automatic contributions to your retirement accounts to ensure consistent savings without the need for constant manual intervention.

5. Reduce Expenses: Evaluate your discretionary spending and find ways to reduce expenses without compromising your quality of life.

Advantages and Disadvantages of Retirement Savings by Age Reddit

Advantages:

1. Diverse Perspectives: Reddit provides a platform for individuals of different ages and backgrounds to share their experiences and insights on retirement savings. This diverse range of perspectives can help you gain a comprehensive understanding of various strategies and approaches.

2. Real-Life Examples: Users often share their personal success stories and challenges, giving you practical examples to learn from and apply to your own retirement savings journey.

3. Community Support: The Reddit community provides a supportive environment where individuals can seek advice, ask questions, and receive guidance on retirement savings. This sense of community can help you stay motivated and accountable.

Disadvantages:

1. Anonymity: As Reddit allows users to remain anonymous, it is essential to critically evaluate the advice and opinions shared. While many users provide valuable insights, there may also be misinformation or biased perspectives.

2. Lack of Personalization: The advice on Reddit may not be tailored to your specific financial situation, goals, or risk tolerance. It is essential to consider professional advice and customize your retirement savings strategy accordingly.

Frequently Asked Questions (FAQs)

1. Can I start saving for retirement in my 40s?

Yes, it is never too late to start saving for retirement. While starting earlier provides more time for your savings to grow, saving in your 40s can still make a significant difference in your retirement funds. Maximize your contributions and consider catch-up contributions if eligible.

2. How much should I save for retirement?

The amount you should save for retirement depends on various factors, such as your desired lifestyle, expected expenses, and retirement age. Generally, financial advisors recommend saving 10-15% of your income each year. However, it is crucial to assess your individual circumstances and consult with a professional.

3. What if I cannot afford to save for retirement?

Even small contributions towards retirement savings can make a difference over time. Look for opportunities to cut expenses, increase your income, or explore government-sponsored retirement plans. It is crucial to prioritize your future financial security.

4. Should I prioritize paying off debt or saving for retirement?

It depends on the interest rates and terms of your debt. High-interest debt should generally be prioritized for repayment. However, it is essential to strike a balance between debt repayment and retirement savings. Consider speaking with a financial advisor for personalized advice.

5. What investment options should I consider for retirement savings?

Investment options vary based on your risk tolerance and investment knowledge. Common options include stocks, bonds, mutual funds, and real estate. Diversifying your portfolio is crucial to manage risk effectively. Consulting with a financial advisor can help you identify suitable investment options.

Conclusion

In conclusion, retirement savings by age is a crucial aspect of financial planning. The insights shared on Reddit highlight the importance of starting early, maximizing contributions, and diversifying investment options. Whether you are a young professional, mid-career individual, or pre-retiree, it is never too early or too late to prioritize your retirement savings.

We encourage you to take action and evaluate your current retirement savings strategy. Consider consulting with a financial advisor to tailor a plan that aligns with your goals and circumstances. Remember, the decisions you make today will shape your financial future. Start saving for retirement and secure a comfortable and fulfilling retirement.

Final Remarks

Dear Readers,

The information provided in this article is for educational purposes only and should not be considered financial advice. Retirement savings require careful consideration and should be personalized to individual circumstances. We recommend consulting with a certified financial planner or investment advisor to discuss your specific retirement goals and develop a suitable savings strategy.

Thank you for joining us on this journey to explore retirement savings by age through the lens of Reddit. We hope you found this guide informative and valuable in planning for your financial future.

Best regards,

The Article Team

This post topic: Budgeting Strategies