Secure Your Future: Optimize Retirement Planning 1 Year Out For A Worry-Free Tomorrow!

Retirement Planning 1 Year Out

Introduction

Dear Readers,

Welcome to this informative article on retirement planning 1 year out. As you approach this significant milestone in your life, it is crucial to have a well-thought-out plan in place to ensure a comfortable and secure retirement. In this article, we will explore the key aspects of retirement planning one year before you retire and provide you with valuable insights to assist you in making informed decisions. So, let’s dive in and discover the essential steps you need to take to prepare for your retirement.

1 Picture Gallery: Secure Your Future: Optimize Retirement Planning 1 Year Out For A Worry-Free Tomorrow!

Table of Contents

What is Retirement Planning 1 Year Out?

Who Should Consider Retirement Planning 1 Year Out?

When Should You Start Retirement Planning 1 Year Out?

Where to Seek Professional Guidance for Retirement Planning 1 Year Out?

Why is Retirement Planning 1 Year Out Essential?

How to Effectively Plan for Retirement 1 Year Out?

Advantages and Disadvantages of Retirement Planning 1 Year Out

Frequently Asked Questions (FAQ) about Retirement Planning 1 Year Out

Conclusion

Final Remarks

What is Retirement Planning 1 Year Out? 🤔

Retirement planning 1 year out refers to the process of organizing and strategizing your finances, investments, and lifestyle choices in preparation for retirement. It is the stage where you take specific actions and make critical decisions to ensure a smooth transition from the workforce to retirement. During this period, you assess your retirement savings, estimate your future income needs, and create a comprehensive plan to achieve your retirement goals.

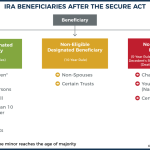

Image Source: annuityexpertadvice.com

One year before retirement is an ideal time to evaluate your financial situation, reassess your investment portfolio, and make any necessary adjustments. It allows you to address any potential gaps in your retirement savings and make informed decisions regarding Social Security benefits, healthcare options, and other retirement-related factors.

Who Should Consider Retirement Planning 1 Year Out? 📝

Retirement planning 1 year out is relevant for anyone who is approaching retirement age or planning to retire within the next year. It is a crucial phase for individuals who want to ensure a financially secure and enjoyable retirement. Whether you have diligently saved for retirement or need to catch up on your savings, this planning stage provides an opportunity to fine-tune your financial strategy and make necessary adjustments.

Additionally, if you have previously overlooked retirement planning or need guidance on navigating through the complexities of retirement, starting the process one year before retirement can significantly improve your financial outlook and peace of mind.

When Should You Start Retirement Planning 1 Year Out? ⌛

Starting retirement planning 1 year before your desired retirement date is highly recommended. This timeframe allows you to carefully evaluate your financial position, explore various retirement income sources, and make any necessary changes to your existing retirement plan. It gives you ample time to consult with financial advisors, review investment strategies, and ensure that your retirement goals align with your current financial situation.

However, it is never too late to start planning for retirement. If you find yourself within the one-year timeframe or even closer to retirement, it is still essential to take action and seek professional advice to make the most of the time you have left.

Where to Seek Professional Guidance for Retirement Planning 1 Year Out? 🏦

Retirement planning is a complex process, and seeking professional guidance can greatly benefit your retirement outcomes. There are several avenues to explore when looking for expert advice:

Financial Advisors: Consult with a certified financial planner or retirement specialist who can help you assess your financial situation, develop a retirement plan, and provide guidance on investment strategies.

Employer Retirement Services: If you have an employer-sponsored retirement plan, such as a 401(k) or pension, reach out to your company’s retirement services department for assistance and personalized advice.

Online Resources: Utilize reputable online resources, such as retirement planning calculators, retirement-focused websites, and government websites, to educate yourself and gather information.

Seminars and Workshops: Attend retirement planning seminars or workshops offered by financial institutions or community organizations to gain knowledge and insights from industry experts.

Why is Retirement Planning 1 Year Out Essential? 🧐

Retirement planning one year before your desired retirement date is crucial for several reasons:

Financial Assessment: It allows you to assess your current financial situation, including your retirement savings, investments, debts, and expenses. This assessment helps determine if you are on track to meet your retirement goals or if you need to make adjustments.

Income Planning: One year out, you can estimate your future income needs during retirement and explore potential income sources, such as Social Security benefits, pension plans, annuities, and investment portfolios.

Healthcare Considerations: Retirement planning involves evaluating healthcare options and understanding Medicare eligibility, long-term care insurance, and other health-related expenses.

Debt Management: It provides an opportunity to address any outstanding debts and formulate a plan to manage or eliminate them before retirement.

Lifestyle Choices: Retirement planning allows you to envision your desired retirement lifestyle and make the necessary financial adjustments to support and sustain it.

How to Effectively Plan for Retirement 1 Year Out? 📆

Effective retirement planning one year before retirement involves several key steps:

Evaluate Your Current Financial Situation: Review your retirement savings, investments, and debts to assess your financial readiness for retirement.

Estimate Your Retirement Income Needs: Determine your expected living expenses during retirement and calculate the income required to meet those needs.

Review Social Security Benefits: Understand how Social Security benefits work and evaluate the optimal age to start receiving benefits based on your financial goals and circumstances.

Assess Your Investment Portfolio: Review your investment strategy and make any necessary adjustments to align with your risk tolerance and retirement timeline.

Consider Healthcare Options: Research and evaluate healthcare coverage options, such as Medicare, and plan for potential medical expenses during retirement.

Create a Budget: Develop a comprehensive budget that balances your retirement income and expenses, accounting for discretionary spending and unexpected costs.

Consult with Professionals: Seek guidance from financial advisors, tax professionals, and retirement planners to ensure your retirement plan is well-structured and aligned with your goals.

Advantages and Disadvantages of Retirement Planning 1 Year Out 📊

Like any financial decision, retirement planning one year out has its advantages and disadvantages. Let’s explore them in detail:

Advantages:

Ample Time for Adjustments: Starting retirement planning one year before retirement allows you sufficient time to make any necessary adjustments to your savings, investments, and lifestyle choices.

Enhanced Financial Security: By carefully evaluating your retirement income sources and expenses, you can enhance your financial security and ensure a comfortable retirement.

Opportunity for Professional Guidance: Seeking assistance from financial advisors and retirement specialists can provide valuable insights and expertise, optimizing your retirement plan.

Peace of Mind: By having a well-structured retirement plan in place, you can enjoy peace of mind and confidently transition into retirement knowing that your financial future is secure.

Flexibility in Decision-Making: Planning early enables you to explore various retirement scenarios and make informed decisions about Social Security benefits, healthcare options, and investment strategies.

Disadvantages:

Potential for Financial Uncertainty: Retirement planning one year out may highlight financial gaps or challenges, requiring you to make difficult decisions or adjust your retirement goals.

Market Volatility: Economic conditions and market volatility can impact your retirement savings and investments, necessitating careful monitoring and potential adjustments.

Uncertain Future Events: Unexpected life events, such as health issues or changes in family circumstances, can disrupt your retirement plans and require flexibility in your financial strategy.

Frequently Asked Questions (FAQ) about Retirement Planning 1 Year Out ❓

Q1: Can I start retirement planning if I am only one year away from retirement?

A1: Absolutely! While it is ideal to start retirement planning well in advance, one year is still sufficient time to make significant progress and optimize your retirement strategy.

Q2: How can I estimate my retirement income needs?

A2: Estimating your retirement income needs involves evaluating your expected living expenses, including housing, healthcare, transportation, and leisure activities. You can consult financial advisors or utilize retirement calculators to assist you in this process.

Q3: Should I consider downsizing my home as part of retirement planning?

A3: Downsizing your home can be a viable option to free up equity and reduce housing expenses during retirement. However, it is essential to consider the emotional and practical aspects of such a decision.

Q4: What role does Social Security play in retirement planning?

A4: Social Security benefits often form a significant portion of retirees’ income. Understanding the optimal age to start receiving benefits and maximizing your benefits can significantly impact your retirement finances.

Q5: Is it advisable to withdraw from retirement savings before retirement?

A5: Withdrawing from retirement savings before retirement should be carefully evaluated. While it may be necessary in certain circumstances, it can have long-term implications on your retirement nest egg. Consult with financial advisors to explore alternative options.

Conclusion ✅

In conclusion, retirement planning 1 year out is a critical phase in ensuring a successful and fulfilling retirement. By evaluating your financial situation, estimating your income needs, exploring healthcare options, and making informed decisions, you can pave the way for a financially secure future. Remember, seeking professional guidance, such as consulting with financial advisors or attending retirement planning seminars, can provide valuable insights and expertise to optimize your retirement plan.

Start planning early, take advantage of the resources available to you, and enjoy the peace of mind that comes with a well-structured retirement plan. Here’s to a happy and prosperous retirement!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial or retirement planning advice. It is essential to consult with qualified professionals and conduct thorough research before making any financial decisions related to retirement planning.

This post topic: Budgeting Strategies