Secure Your Future With Retirement Plan 2 FICA: Click Now To Start Planning!

Retirement Plan 2 FICA: Maximizing Your Future Financial Security

Introduction

Greetings, Readers! In today’s fast-paced world, planning for retirement has become more crucial than ever. As we age, it’s essential to ensure our financial security and enjoy a comfortable retirement. One such plan that offers promising benefits is Retirement Plan 2 FICA. In this article, we will explore the ins and outs of Retirement Plan 2 FICA and how it can help you secure a prosperous future.

3 Picture Gallery: Secure Your Future With Retirement Plan 2 FICA: Click Now To Start Planning!

Overview of Retirement Plan 2 FICA

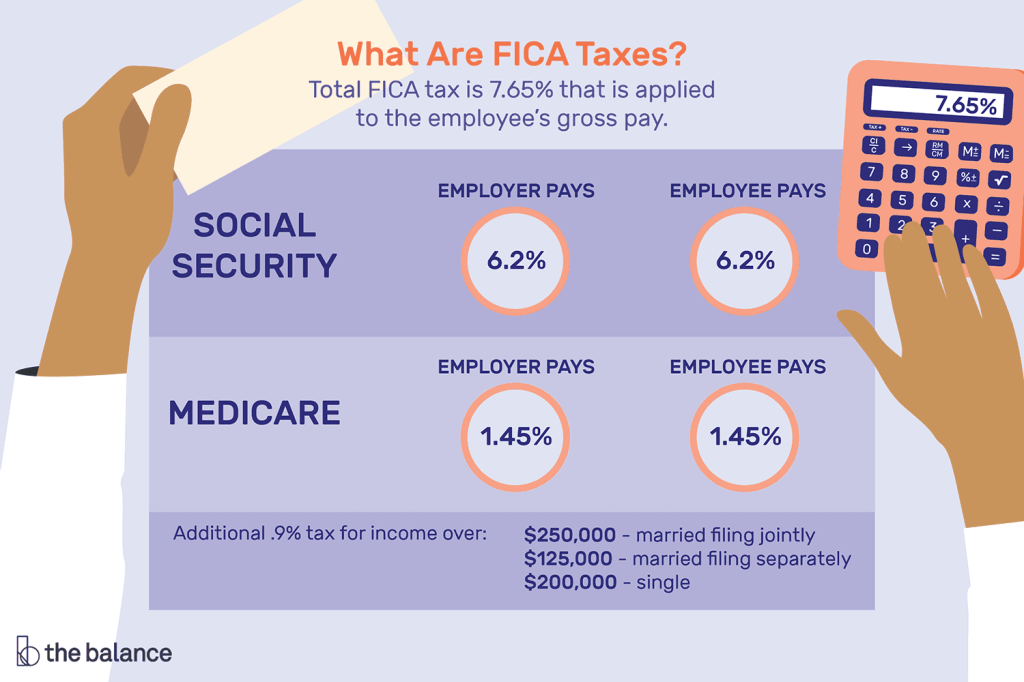

Retirement Plan 2 FICA is a comprehensive retirement plan designed to provide financial stability during your golden years. It operates under the Federal Insurance Contributions Act (FICA) and offers a range of benefits and incentives to eligible individuals. This plan is an excellent option for those seeking a reliable and efficient way to save for retirement.

What is Retirement Plan 2 FICA? 👉

Image Source: justia.com

Retirement Plan 2 FICA is a retirement savings plan available to employees of eligible organizations. It allows individuals to contribute a portion of their salary towards their retirement fund, which is then invested in a variety of financial instruments. The contributions and earnings grow tax-free until the individual reaches retirement age, ensuring a significant corpus for their post-retirement years.

Who Can Participate in Retirement Plan 2 FICA? 👥

Retirement Plan 2 FICA is available to employees of government agencies and certain non-profit organizations. To be eligible, individuals must meet specific criteria set by their employers. Generally, these criteria include factors such as the length of service, salary level, and employment status. It’s crucial to check with your employer to determine if you are eligible to participate in Retirement Plan 2 FICA.

When Can You Enroll in Retirement Plan 2 FICA? ⌛

Enrollment in Retirement Plan 2 FICA typically occurs when an individual starts their employment with an eligible organization. Upon joining, employees are often given a specific period to decide whether they want to participate in the plan. It’s important to make this decision wisely, as early enrollment allows for a longer contribution period and potentially greater retirement savings.

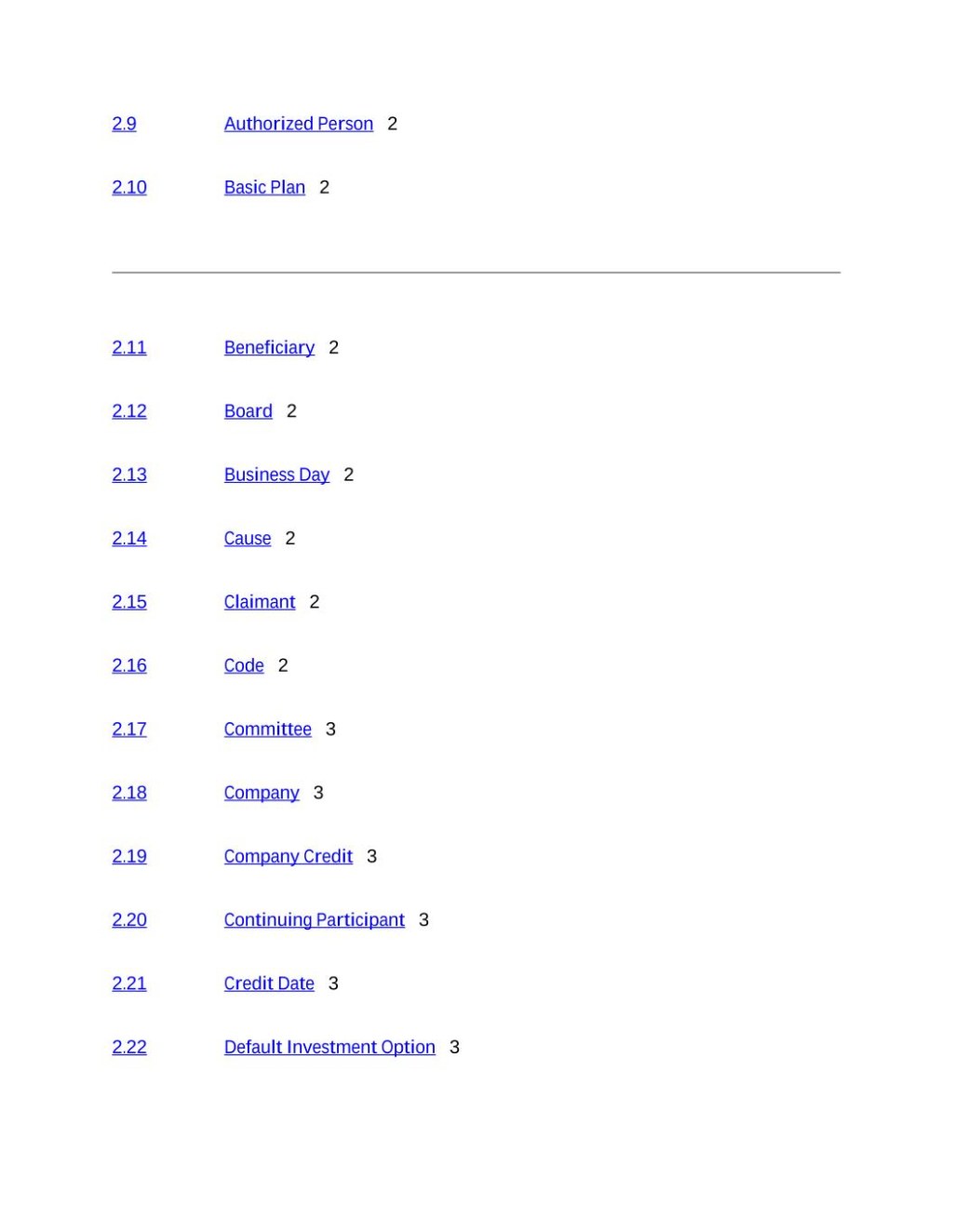

Where are Your Contributions Invested? 🌎

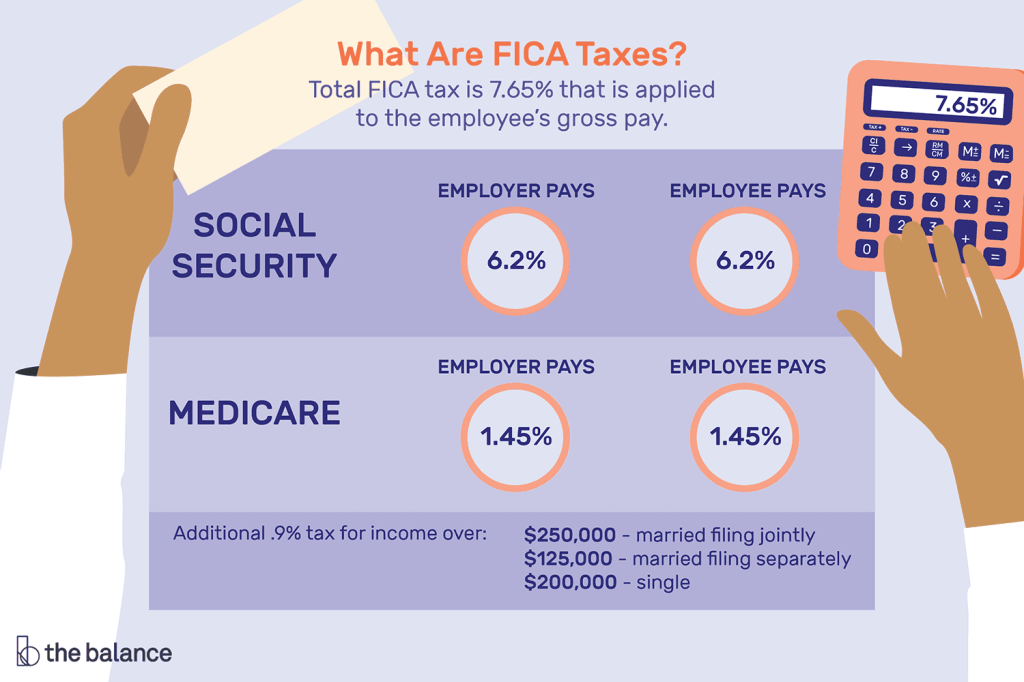

Image Source: thebalancemoney.com

Once enrolled, your contributions to Retirement Plan 2 FICA are invested in a diversified portfolio managed by professional fund managers. These investments may include stocks, bonds, mutual funds, and other financial instruments. The goal is to maximize returns while managing risks, ensuring your retirement savings grow over time.

Why Choose Retirement Plan 2 FICA? ❓

Retirement Plan 2 FICA offers numerous advantages for individuals planning their retirement. Firstly, contributions made to the plan are tax-deductible, reducing your taxable income in the present while increasing your savings for the future. Additionally, the earnings on your contributions grow tax-free, allowing your retirement savings to accumulate faster. The plan also provides the flexibility to adjust your contributions based on your financial situation, ensuring you can save more during prosperous times and less during lean periods.

What are the Advantages and Disadvantages of Retirement Plan 2 FICA? ✅❌

Image Source: calameoassets.com

Advantages of Retirement Plan 2 FICA:

1. Tax Benefits: Contributions are tax-deductible, reducing your current tax liability.

2. Compound Growth: The earnings on your contributions grow tax-free, compounding over time.

3. Employer Contributions: Some organizations offer matching contributions, boosting your savings.

4. Diverse Investment Options: Retirement Plan 2 FICA allows you to invest in various assets, spreading your risks.

5. Long-Term Financial Security: By contributing consistently, you can build a substantial retirement corpus.

Disadvantages of Retirement Plan 2 FICA:

1. Early Withdrawal Penalties: Withdrawing funds before retirement age may result in penalties and taxes.

2. Restricted Access to Funds: Retirement Plan 2 FICA limits your access to funds until retirement age.

3. Market Fluctuations: Investment returns can be influenced by market volatility, impacting overall savings.

4. Limited Employer Options: Not all employers offer Retirement Plan 2 FICA, restricting participation.

5. Complexity: Understanding the plan’s rules and regulations may require financial expertise or guidance.

Frequently Asked Questions (FAQs) ❔

Q: Can I contribute to Retirement Plan 2 FICA if I already have another retirement plan?

A: Yes, you can contribute to Retirement Plan 2 FICA alongside other retirement plans, as long as you meet the eligibility criteria.

Q: Can I change my contribution amount after enrolling in Retirement Plan 2 FICA?

A: Yes, you can adjust your contribution amount based on your financial circumstances. Consult with your plan administrator for the necessary steps.

Q: What happens to my Retirement Plan 2 FICA if I change employers?

A: You have several options, such as rolling over your retirement savings into another eligible plan or leaving the funds in the existing plan. Consult a financial advisor to determine the best course of action.

Q: Are there any penalties or taxes for withdrawing funds from Retirement Plan 2 FICA before retirement age?

A: Yes, early withdrawals may incur penalties and taxes. It’s advisable to consult a tax professional before making any premature withdrawals.

Q: Can I assign a beneficiary to my Retirement Plan 2 FICA?

A: Yes, you can designate a beneficiary to receive the accumulated savings in the event of your passing. Ensure you keep your beneficiary designations up to date.

Conclusion: Secure Your Future Today!

In conclusion, Retirement Plan 2 FICA is an excellent choice for individuals seeking to secure their financial future. With tax benefits, diverse investment options, and long-term financial security, this plan offers a promising path to a comfortable retirement. Take the necessary steps today to enroll in Retirement Plan 2 FICA and start building a substantial retirement corpus. Your future self will thank you!

Final Remarks: Plan Wisely, Thrive Comfortably

Friends, planning for retirement is a journey that requires careful consideration and proactive steps. While Retirement Plan 2 FICA provides a solid foundation, it’s essential to assess your financial goals and seek professional advice to create a comprehensive retirement strategy. Remember, investing in your future today will ensure a comfortable and fulfilling retirement tomorrow. Take charge of your financial destiny and start planning for retirement with Retirement Plan 2 FICA!

This post topic: Budgeting Strategies