Mastering Capital Budgeting Strategy: Learn From This Powerful Example!

Capital Budgeting Strategy Example: Maximizing Investments for Long-Term Success

Introduction

Welcome, Readers, to this comprehensive guide on capital budgeting strategies. In today’s fast-paced and competitive business landscape, organizations require effective financial planning to ensure optimal allocation of resources. Capital budgeting plays a vital role in this process, enabling businesses to evaluate potential investments and make informed decisions. In this article, we will explore the concept of capital budgeting, its importance, and provide a practical example to illustrate its application.

3 Picture Gallery: Mastering Capital Budgeting Strategy: Learn From This Powerful Example!

Before diving into the details, let’s first understand what capital budgeting entails.

What is Capital Budgeting?

Capital budgeting refers to the process of analyzing and selecting investment projects that yield long-term benefits for a company. It involves evaluating various investment opportunities, estimating their potential returns, and determining their feasibility. This strategic approach allows organizations to allocate their financial resources effectively, ensuring the highest possible returns on investment.

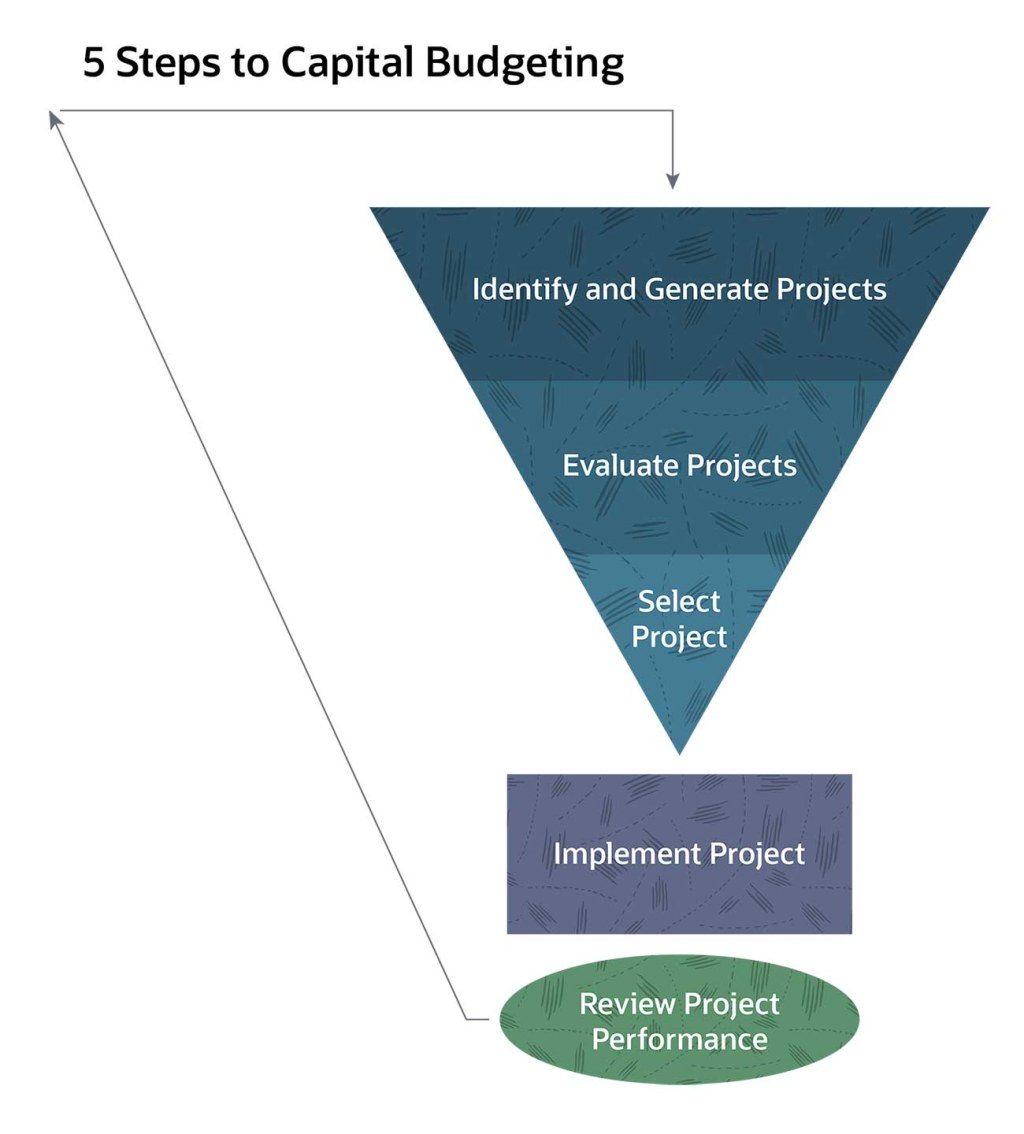

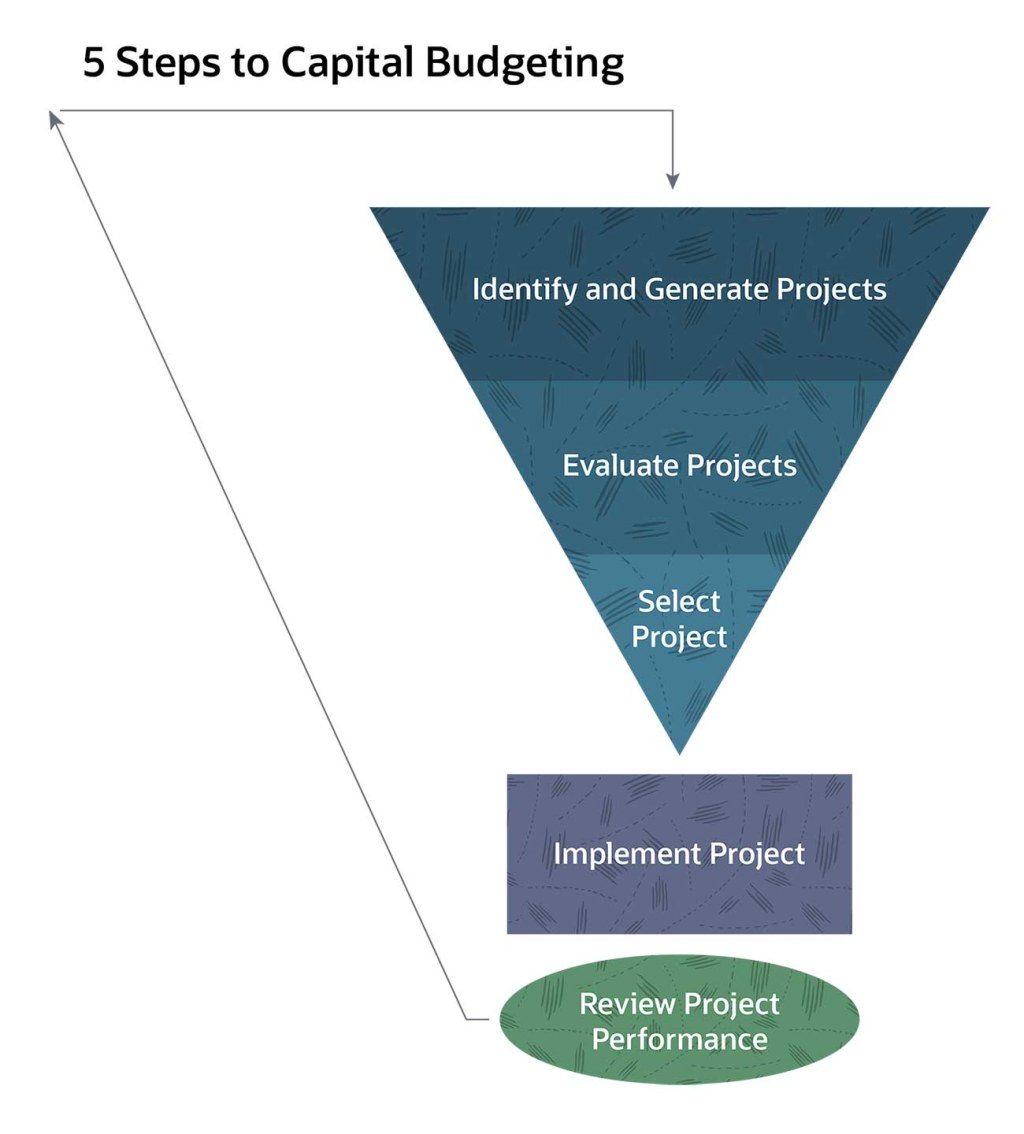

Image Source: toptal.io

The following paragraphs will delve into the key aspects of capital budgeting, including the who, when, where, why, and how.

Who Implements Capital Budgeting Strategies?

Capital budgeting strategies are typically implemented by financial managers, analysts, and decision-makers within organizations. Their expertise and knowledge enable them to assess investment options, consider risk factors, and make sound financial decisions on behalf of the company.

When is Capital Budgeting Strategy Utilized?

Capital budgeting strategies are employed when businesses face opportunities for expansion, acquisition, or the need to replace assets. By evaluating the potential returns and risks associated with these investment opportunities, organizations can make calculated decisions on allocating their financial resources.

Where is Capital Budgeting Strategy Applied?

Image Source: netsuite.com

Capital budgeting strategies are utilized across various industries and sectors, including manufacturing, real estate, technology, and infrastructure development. Any organization that seeks to optimize its long-term investments can benefit from implementing capital budgeting strategies.

Why is Capital Budgeting Strategy Important?

Capital budgeting strategies are crucial for several reasons. Firstly, they help organizations assess the profitability and viability of potential investments, reducing the likelihood of making poor financial decisions. Secondly, capital budgeting strategies contribute to the effective allocation of resources, ensuring that financial commitments align with the company’s goals and objectives.

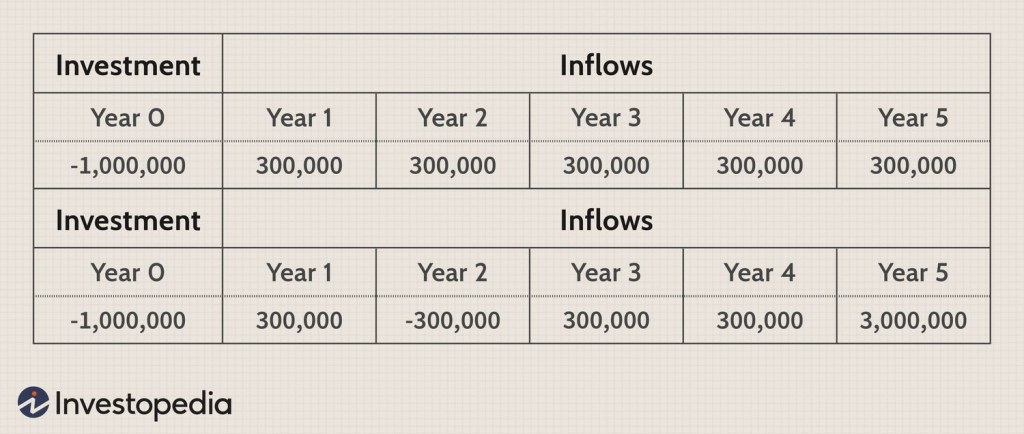

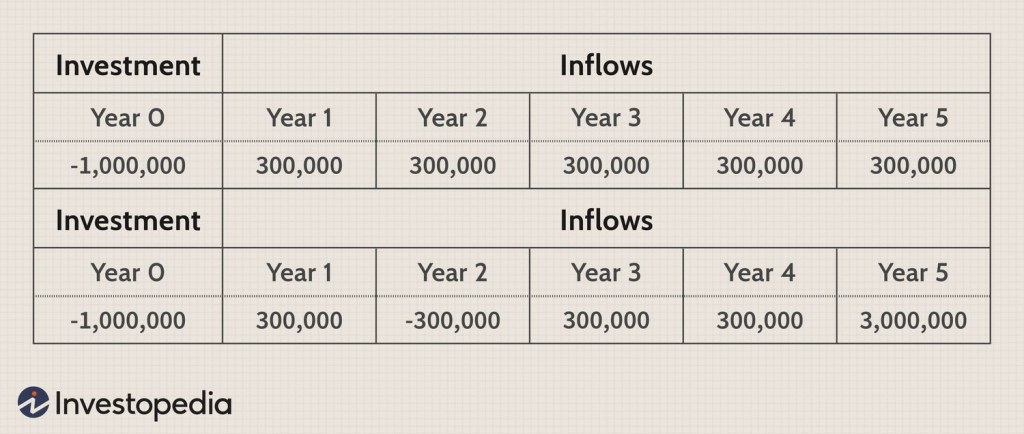

How is Capital Budgeting Strategy Implemented?

Image Source: investopedia.com

The implementation of capital budgeting strategies involves several steps. These include identifying investment opportunities, estimating cash flows, evaluating risk factors, and calculating the financial metrics such as net present value (NPV), internal rate of return (IRR), and payback period. By utilizing these tools, businesses can make informed decisions and select investments that align with their long-term objectives.

Advantages and Disadvantages of Capital Budgeting

Advantages of Capital Budgeting Strategy

1️⃣ Enhanced Financial Planning: Capital budgeting helps businesses plan and allocate their financial resources effectively, minimizing the risks of overspending or underutilizing funds.

2️⃣ Higher Returns on Investment: By analyzing potential investments, organizations can identify projects that offer higher returns, maximizing profitability in the long run.

3️⃣ Risk Assessment: Capital budgeting strategies enable businesses to assess the risks associated with each investment opportunity, reducing the likelihood of financial losses.

4️⃣ Improved Decision-Making: With the help of financial metrics, such as NPV and IRR, organizations can make data-driven decisions, ensuring that investments align with their overall objectives.

5️⃣ Long-Term Growth and Sustainability: Effective capital budgeting allows companies to allocate resources strategically, fostering long-term growth and ensuring their sustainability in a competitive market.

Disadvantages of Capital Budgeting Strategy

1️⃣ Inaccurate Forecasts: One of the challenges in capital budgeting is accurately predicting future cash flows and estimating the risks involved. Inaccurate forecasts can lead to poor investment decisions.

2️⃣ Time-Consuming: The process of evaluating investment opportunities and calculating financial metrics can be time-consuming, requiring thorough analysis and consideration of various factors.

3️⃣ Uncertainty: Economic factors, market conditions, and unforeseen events can introduce uncertainties into capital budgeting decisions, making it challenging to accurately predict outcomes.

4️⃣ Costly Mistakes: Poorly executed capital budgeting strategies can result in significant financial losses for organizations, undermining their financial stability and growth prospects.

5️⃣ Overlooking Intangible Factors: Capital budgeting may focus primarily on financial metrics, potentially overlooking intangible factors such as brand reputation, customer satisfaction, and employee morale.

Frequently Asked Questions (FAQs)

1. What are the key steps in capital budgeting?

The key steps in capital budgeting include identifying potential investments, estimating cash flows, evaluating risk factors, calculating financial metrics, and making informed decisions based on the analysis.

2. How can organizations mitigate the risks associated with capital budgeting?

Organizations can mitigate risks by conducting thorough market research, analyzing historical data, employing sensitivity analysis, and involving key stakeholders in the decision-making process.

3. Are there any alternative methods to evaluate investment opportunities?

Yes, there are alternative methods, such as the profitability index, discounted payback period, and modified internal rate of return. Each method has its advantages and limitations, and organizations may choose the most suitable approach based on their specific needs.

4. Can capital budgeting strategies be applied to non-profit organizations?

Yes, capital budgeting strategies can be applied to non-profit organizations as well. While the financial objectives may differ, the same principles of evaluating potential investments and allocating resources effectively apply to both profit and non-profit sectors.

5. How often should capital budgeting strategies be reviewed and adjusted?

Capital budgeting strategies should be reviewed periodically, considering changes in market conditions, organizational goals, and emerging investment opportunities. Regular evaluations ensure that the chosen strategies remain aligned with the company’s long-term objectives.

Conclusion

In conclusion, capital budgeting strategies are essential for organizations seeking to optimize their long-term investments. Proper implementation of these strategies enables businesses to evaluate potential investment opportunities, allocate financial resources effectively, and make informed decisions. While capital budgeting offers numerous advantages, it is crucial to be aware of potential disadvantages and address them through thorough analysis and risk assessment. By embracing capital budgeting strategies, businesses can pave the way for sustainable growth, profitability, and success in today’s dynamic marketplace.

Thank you for reading this comprehensive guide. We hope it provided valuable insights into capital budgeting strategies and their application. Implementing these strategies can significantly impact a company’s financial performance and long-term success. If you have any further questions or need assistance, please don’t hesitate to reach out to us.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. It is always recommended to consult with a qualified financial professional before making any investment decisions.

This post topic: Budgeting Strategies

![Template] How to Create a Marketing Budget - Sponge](https://fantotal.info/wp-content/uploads/2023/09/template-how-to-create-a-marketing-budget-sponge_0-150x150.jpg)