Unlocking The Power Of Retirement Plan 1099 B: Your Path To Financial Freedom Starts Here!

Retirement Plan 1099 B: Understanding Your Options for a Secure Future

Introduction

Dear Readers,

2 Picture Gallery: Unlocking The Power Of Retirement Plan 1099 B: Your Path To Financial Freedom Starts Here!

Welcome to our comprehensive guide on retirement plan 1099 B! In today’s fast-paced world, planning for retirement is of utmost importance. It’s crucial to understand the various retirement plans available and choose the one that suits your financial goals. In this article, we will provide you with all the information you need to know about retirement plan 1099 B, its benefits, drawbacks, and how it can help you secure a financially stable future. So, let’s dive in and explore this topic together!

Table: Retirement Plan 1099 B Overview

Topic

Details

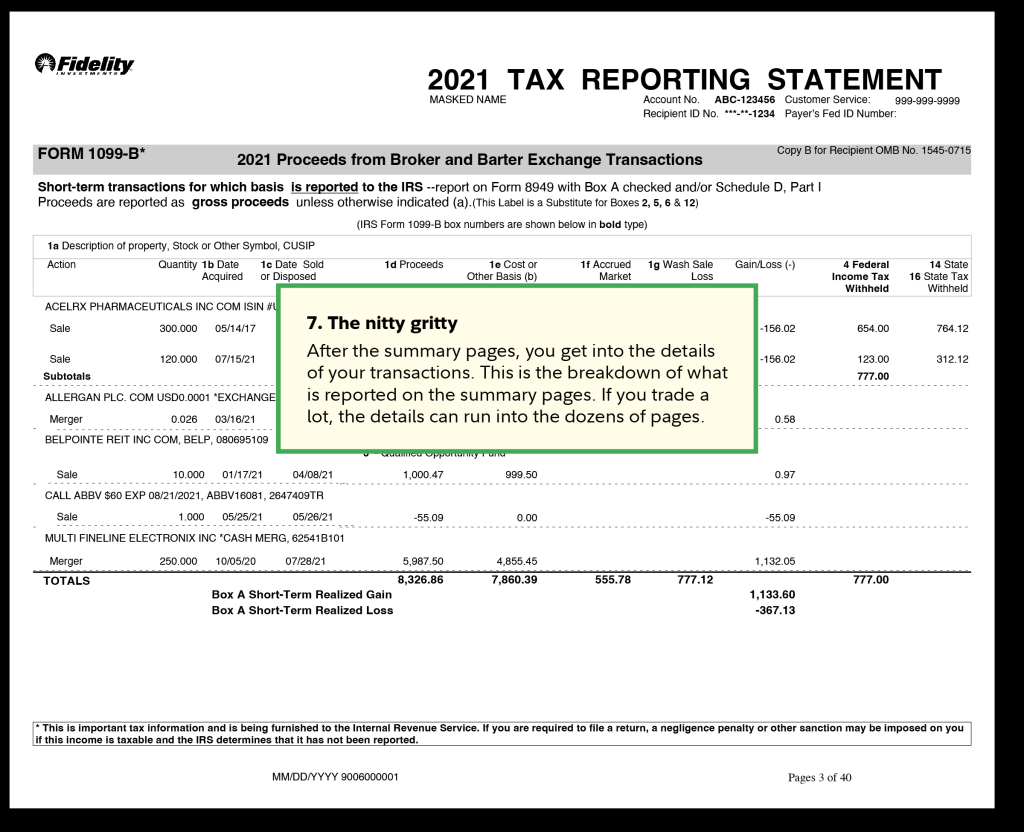

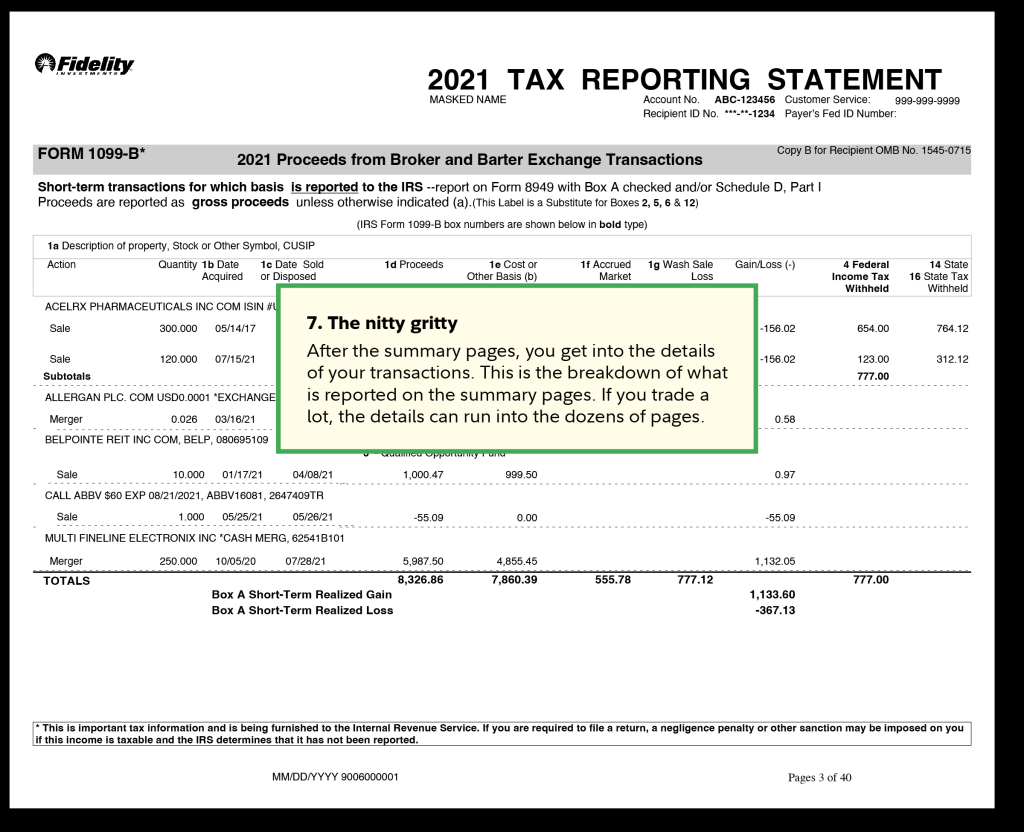

Image Source: fidelity.com

What is Retirement Plan 1099 B?

Retirement plan 1099 B is…

Who is eligible for Retirement Plan 1099 B?

Individuals who…

When can you contribute to Retirement Plan 1099 B?

Contributions to retirement plan 1099 B can be made…

Where can you open a Retirement Plan 1099 B?

Retirement plan 1099 B can be established…

Why choose Retirement Plan 1099 B?

The key advantages of retirement plan 1099 B include…

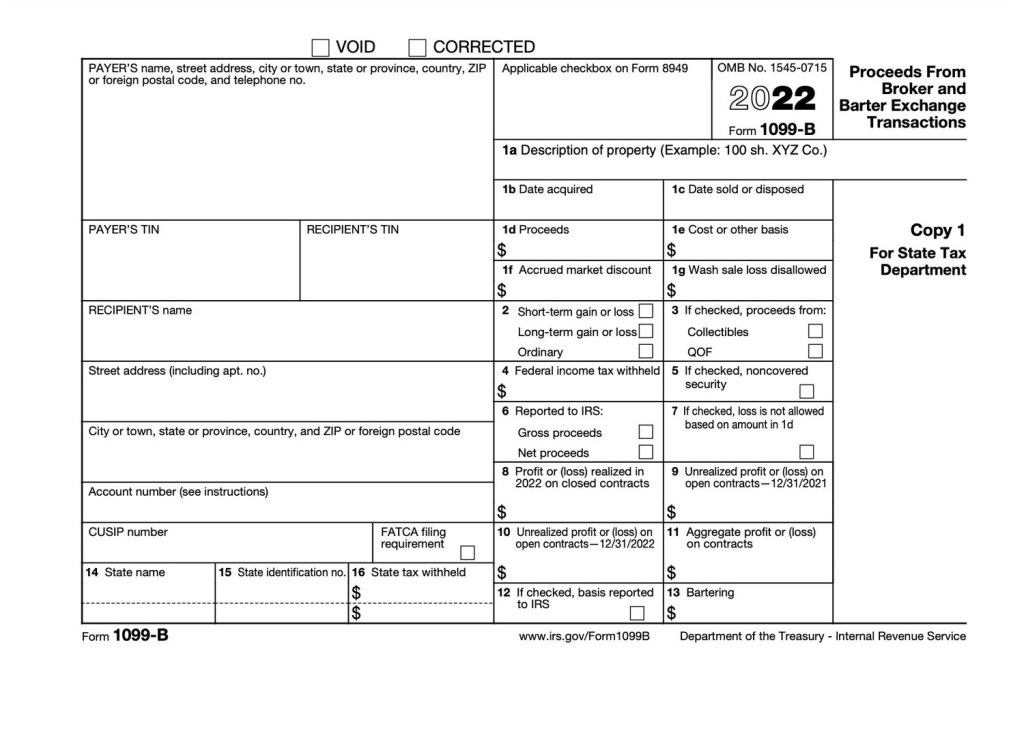

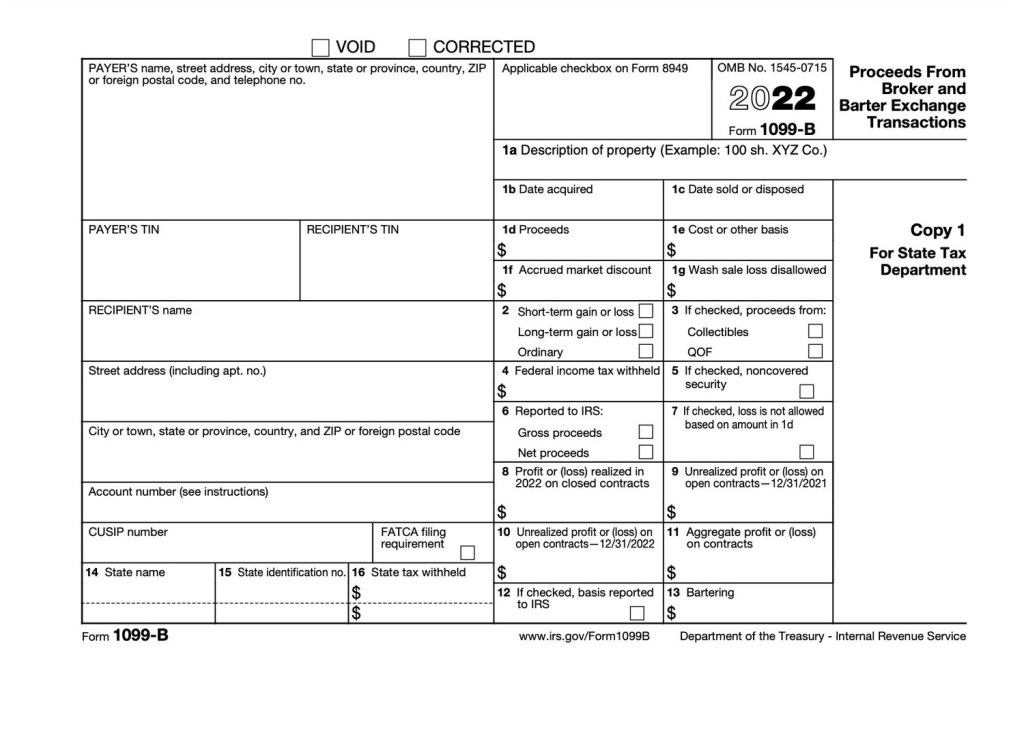

Image Source: investopedia.com

How to manage your Retirement Plan 1099 B?

Managing your retirement plan 1099 B requires…

What is Retirement Plan 1099 B? 🌟

Retirement plan 1099 B is a tax-advantaged retirement account that allows individuals to save for their future while enjoying potential tax benefits. This plan is specifically designed for self-employed individuals, freelancers, and independent contractors who do not have access to traditional employer-sponsored retirement plans. It offers a range of investment options and flexibility, making it an attractive choice for those seeking more control over their retirement savings.

Who is eligible for Retirement Plan 1099 B? 🤔

Retirement plan 1099 B is available to individuals who fall into the category of self-employed individuals or independent contractors. This includes freelancers, consultants, gig workers, and small business owners. If you receive income reported on Form 1099 B, you may qualify for this retirement plan. It is important to consult with a financial advisor or tax professional to determine your eligibility and understand the specific requirements.

When can you contribute to Retirement Plan 1099 B? ⌛

Contributions to retirement plan 1099 B can be made on an annual basis. The contribution deadline for each tax year is the same as the individual tax filing deadline, which is typically April 15th. It is crucial to contribute before the deadline to maximize the benefits of this retirement plan. The contribution limits for retirement plan 1099 B may vary each year and are subject to Internal Revenue Service (IRS) guidelines. Make sure to stay updated with the latest contribution limits to make the most out of your savings.

Where can you open a Retirement Plan 1099 B? 🌍

Retirement plan 1099 B can be established through various financial institutions, including banks, brokerage firms, and online investment platforms. It is essential to choose a reputable provider that offers a wide range of investment options, low fees, and excellent customer service. Conduct thorough research, compare different providers, and consider factors such as account fees, investment options, and user-friendly platforms to find the best fit for your retirement savings.

Why choose Retirement Plan 1099 B? 📚

Retirement plan 1099 B offers several advantages that make it an appealing choice for self-employed individuals:

Advantages of Retirement Plan 1099 B:

1. Tax Benefits: Contributions to retirement plan 1099 B are tax-deductible, allowing you to lower your taxable income and potentially reduce your overall tax liability.

2. Higher Contribution Limits: Compared to traditional Individual Retirement Accounts (IRAs), retirement plan 1099 B allows higher contribution limits, enabling you to save more for retirement.

3. Flexibility in Investments: With retirement plan 1099 B, you have the freedom to choose from a wide range of investment options, including stocks, bonds, mutual funds, and more.

4. Potential for Tax-Free Growth: The earnings on your investments within the retirement plan 1099 B grow tax-free until withdrawal, allowing your savings to compound over time.

5. Catch-Up Contributions: If you are 50 years or older, retirement plan 1099 B allows additional catch-up contributions, enabling you to accelerate your savings as you approach retirement.

How to manage your Retirement Plan 1099 B? 💼

Managing your retirement plan 1099 B effectively is crucial to ensure that you are on track to achieve your retirement goals. Here are some key steps to consider:

Managing Your Retirement Plan 1099 B:

1. Set Clear Financial Goals: Determine your retirement goals, including the desired age of retirement and the amount of income you will need during retirement.

2. Regularly Monitor Your Investments: Keep an eye on the performance of your investments within the retirement plan 1099 B. Make adjustments as needed to align with your risk tolerance and long-term goals.

3. Maximize Contributions: Contribute the maximum amount allowed by the IRS each year to take full advantage of the tax benefits and accelerate your savings.

4. Review and Adjust Regularly: Regularly review your retirement plan 1099 B to ensure it aligns with any changes in your financial situation, risk tolerance, or retirement goals.

5. Seek Professional Guidance: Consider consulting a financial advisor who specializes in retirement planning to help you make informed decisions and optimize your retirement savings.

Frequently Asked Questions (FAQs) 🙋♀️

1. Can I contribute to a retirement plan 1099 B and an employer-sponsored retirement plan simultaneously?

Yes, you can contribute to both a retirement plan 1099 B and an employer-sponsored retirement plan, such as a 401(k) or SEP IRA, as long as you meet the eligibility criteria for each plan. However, the contribution limits for each plan are separate and may vary.

2. Can I withdraw funds from my retirement plan 1099 B before retirement age?

Yes, you can withdraw funds from your retirement plan 1099 B before reaching retirement age. However, early withdrawals may be subject to penalties, taxes, and potential loss of tax benefits. It is important to understand the specific rules and consult with a financial advisor before making any early withdrawals.

3. Can I rollover funds from a traditional IRA into a retirement plan 1099 B?

Yes, it is possible to rollover funds from a traditional IRA into a retirement plan 1099 B. This process is known as a direct rollover and allows you to transfer funds from one retirement account to another without incurring taxes or penalties. Consult with your financial institution to initiate a direct rollover.

4. What happens to my retirement plan 1099 B if I change my self-employment status?

If you change your self-employment status, such as becoming an employee or retiring, you may have several options for your retirement plan 1099 B. You can leave the funds in the account, rollover the funds into another qualified retirement account, or initiate a distribution. It is essential to evaluate your options carefully and consult with a financial advisor to make the best decision for your situation.

5. Are there any income limits for contributing to a retirement plan 1099 B?

No, there are no income limits for contributing to a retirement plan 1099 B. Unlike traditional IRAs or Roth IRAs, retirement plan 1099 B does not have income restrictions. This makes it accessible to individuals with a wide range of income levels.

Conclusion: Secure Your Future with Retirement Plan 1099 B

In conclusion, retirement plan 1099 B is an excellent choice for self-employed individuals and independent contractors seeking a tax-advantaged retirement savings option. By understanding the ins and outs of this plan, you can make informed decisions to secure your financial future. Remember to consult with financial professionals, review your retirement goals regularly, and stay proactive in managing your retirement plan 1099 B. Start planning today and pave the way for a comfortable and fulfilling retirement!

Final Remarks

Dear Readers,

We hope this article has provided you with valuable insights into retirement plan 1099 B and its potential benefits for your future. It is important to note that individual financial situations may vary, and it is always advisable to consult with a qualified financial advisor or tax professional before making any decisions or taking action. Secure your retirement with careful planning and make informed choices that align with your specific needs and goals. Remember, the key to a successful retirement lies in early preparation and smart financial management. Wishing you a prosperous and fulfilling retirement journey!

This post topic: Budgeting Strategies