Revolutionize Your Future: Introducing The Retirement Savings Modernization Act – Secure Your Financial Freedom Now!

The Retirement Savings Modernization Act: A Step Towards Securing Your Future

Introduction

Dear Readers,

1 Picture Gallery: Revolutionize Your Future: Introducing The Retirement Savings Modernization Act – Secure Your Financial Freedom Now!

Welcome to our comprehensive guide on the Retirement Savings Modernization Act. In today’s fast-paced world, planning for retirement has become more crucial than ever. The Retirement Savings Modernization Act aims to revolutionize the way we save for our golden years and provides a much-needed boost to the existing retirement savings framework.

Image Source: amazonaws.com

In this article, we will delve into the details of this act and how it can positively impact your financial future. So, without further ado, let’s explore the Retirement Savings Modernization Act and its implications.

Overview of the Retirement Savings Modernization Act

The Retirement Savings Modernization Act is a legislative proposal aimed at enhancing the retirement savings landscape in the United States. Introduced by lawmakers, this act seeks to address the evolving needs and challenges faced by individuals when planning for retirement.

With the average life expectancy increasing and retirement becoming a lengthier phase of life, it is imperative to have robust savings mechanisms in place. The Retirement Savings Modernization Act aims to provide individuals with greater flexibility, incentives, and options to save for retirement, ensuring financial security during their post-working years.

Let’s now dive deeper into the key aspects of the Retirement Savings Modernization Act.

What is the Retirement Savings Modernization Act? 📜

The Retirement Savings Modernization Act is a legislative proposal that seeks to update and modernize the retirement savings system. It aims to introduce several reforms to enhance retirement savings options and make it easier for individuals to plan for their future.

This act focuses on improving access to retirement savings plans, increasing contribution limits, expanding investment options, and promoting financial literacy among individuals. By revamping the retirement savings landscape, the act aims to empower individuals to take control of their financial future.

Now, let’s explore who stands to benefit from this act.

Who Can Benefit from the Retirement Savings Modernization Act? 🤔

The Retirement Savings Modernization Act is designed to benefit a wide range of individuals, including employees, self-employed individuals, and small business owners. It aims to create a more inclusive and robust retirement savings framework that caters to the needs of diverse individuals.

Under this act, employees will have greater access to employer-sponsored retirement plans, while self-employed individuals will have access to new retirement savings options tailored to their needs. Moreover, small business owners will be incentivized to establish retirement plans for their employees, fostering a culture of financial security.

Now that we know who can benefit from this act, let’s explore when it is expected to come into effect.

When Will the Retirement Savings Modernization Act Take Effect? ⌛

The Retirement Savings Modernization Act is currently under review and has not yet been enacted into law. While it has garnered significant support, it is subject to legislative procedures and may undergo modifications before its final approval.

It is essential to stay updated with the latest developments regarding this act. Once enacted, it will bring about significant changes in the retirement savings landscape and provide individuals with new opportunities to secure their financial future.

Now, let’s move on to the geographical aspect of the Retirement Savings Modernization Act.

Where Does the Retirement Savings Modernization Act Apply? 🌍

The Retirement Savings Modernization Act applies to the United States and aims to reform the retirement savings system within the country. It encompasses all states and territories, providing a unified framework for individuals to save for retirement.

Regardless of your location within the United States, this act will have a direct impact on your retirement savings options. Its implementation will bring about positive changes to the retirement savings landscape, ensuring individuals across the nation have access to improved retirement planning tools.

Now that we know what, who, when, and where, let’s explore why the Retirement Savings Modernization Act is crucial.

Why is the Retirement Savings Modernization Act Important? ❓

The Retirement Savings Modernization Act is of paramount importance due to the evolving retirement landscape and the need to adapt to changing financial realities. As individuals live longer and face increased financial uncertainties, it is essential to have a robust retirement savings framework in place.

This act addresses the challenges faced by individuals when planning for retirement, such as limited access to retirement plans, inadequate contribution limits, and lack of investment options. By updating and modernizing the retirement savings system, the act aims to provide individuals with the tools and incentives necessary to secure their financial future.

Now, let’s delve into how the Retirement Savings Modernization Act will be implemented.

How Will the Retirement Savings Modernization Act Be Implemented? 📊

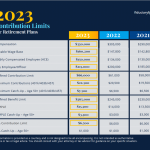

The Retirement Savings Modernization Act will be implemented through a series of reforms and amendments to existing retirement savings legislation. These changes will aim to enhance access, increase contribution limits, expand investment options, and promote financial literacy.

By partnering with financial institutions, employers, and other stakeholders, the act will facilitate the creation of retirement savings options that cater to the diverse needs of individuals. It will also emphasize the importance of financial education to empower individuals to make informed decisions about their retirement savings.

Now that we have explored the what, who, when, where, why, and how, let’s weigh the advantages and disadvantages of the Retirement Savings Modernization Act.

Advantages and Disadvantages of the Retirement Savings Modernization Act 💼

Advantages:

1. Increased access to retirement plans for employees, self-employed individuals, and small business owners.

2. Higher contribution limits, enabling individuals to save more for retirement.

3. Expanded investment options, providing individuals with a diverse range of choices to grow their retirement savings.

4. Incentives for small business owners to establish retirement plans, fostering a culture of financial security.

5. Promotion of financial literacy, ensuring individuals are equipped with the knowledge to make informed decisions about their retirement savings.

Disadvantages:

1. Potential administrative complexities for employers and financial institutions in implementing the reforms.

2. Impact on government revenue due to increased tax advantages provided to retirement savings accounts.

3. Possibility of increased regulatory requirements for employers and financial institutions.

4. The need for individuals to stay updated with changing retirement savings regulations and options.

5. Potential challenges in ensuring the act caters to the unique needs of different demographics.

Now, let’s address some frequently asked questions about the Retirement Savings Modernization Act.

Frequently Asked Questions (FAQs)

1. What are the key benefits of the Retirement Savings Modernization Act?

The key benefits of the Retirement Savings Modernization Act include increased access to retirement plans, higher contribution limits, expanded investment options, and promotion of financial literacy.

2. Will this act affect existing retirement savings accounts?

The act aims to enhance existing retirement savings accounts by providing individuals with more flexibility, incentives, and options to save for retirement.

3. How will the Retirement Savings Modernization Act impact small businesses?

The act incentivizes small business owners to establish retirement plans for their employees, promoting financial security and well-being.

4. Will this act affect Social Security benefits?

No, the Retirement Savings Modernization Act focuses on enhancing retirement savings options and does not directly impact Social Security benefits.

5. When can we expect the Retirement Savings Modernization Act to be implemented?

The act is currently under review and has not yet been enacted into law. It is essential to stay informed about the latest developments regarding its implementation.

Conclusion: Secure Your Financial Future

Friends, the Retirement Savings Modernization Act represents a significant step towards securing your financial future. By updating and modernizing the retirement savings system, this act empowers individuals to take control of their retirement planning.

As the act undergoes legislative procedures, it is crucial to stay informed and actively participate in discussions surrounding retirement savings. Take advantage of the opportunities provided by the Retirement Savings Modernization Act to ensure a comfortable and secure retirement.

Remember, planning for retirement is an ongoing process, and the choices you make today can have a profound impact on your future. Start exploring the retirement savings options available to you and take steps towards building a strong financial foundation.

Final Remarks: Plan Ahead for a Brighter Future

Disclaimer: The information provided in this article serves as a general guide to the Retirement Savings Modernization Act and should not be considered as financial or legal advice. It is essential to consult with qualified professionals or financial advisors for personalized guidance based on your specific circumstances.

Dear Readers, we hope this article has shed light on the Retirement Savings Modernization Act and its potential impact on your retirement savings. Remember, planning for retirement is an investment in your future, and the choices you make today can pave the way for a brighter tomorrow.

This post topic: Budgeting Strategies