Build Your Secure Retirement Savings: Unlock The Power Without 401k!

Retirement Savings Without 401k

Greetings, Readers! Today, we will explore the topic of retirement savings without a 401k. In this article, we will provide you with valuable information on alternative options for saving for retirement, outside of the traditional 401k plan. Whether you’re self-employed, work for a small company that doesn’t offer a 401k, or simply want to diversify your retirement savings, this article will guide you on the right path. So, let’s delve into the world of retirement savings without a 401k and discover the various options available to you.

Introduction

Retirement savings without a 401k is a topic of great interest for many individuals. While the 401k plan is a popular choice for retirement savings, it is not the only option available. This article aims to provide insights into alternative methods of saving for retirement, ensuring that individuals can make informed decisions about their financial future.

1 Picture Gallery: Build Your Secure Retirement Savings: Unlock The Power Without 401k!

In this article, we will discuss various aspects related to retirement savings without a 401k, including what it is, who can benefit from it, when to consider it, where to invest, why it may be a viable option, and how to get started. By the end of this article, you will have a clear understanding of the alternatives to a 401k plan and be equipped with the knowledge to make the right choices for your retirement savings.

What is Retirement Savings Without 401k?

🔍 Understanding the Basics

Retirement savings without a 401k refers to the practice of setting aside funds for retirement through investment vehicles other than a traditional 401k plan. While a 401k plan is a tax-advantaged retirement savings account typically offered by employers, there are alternative options for individuals to save for their future.

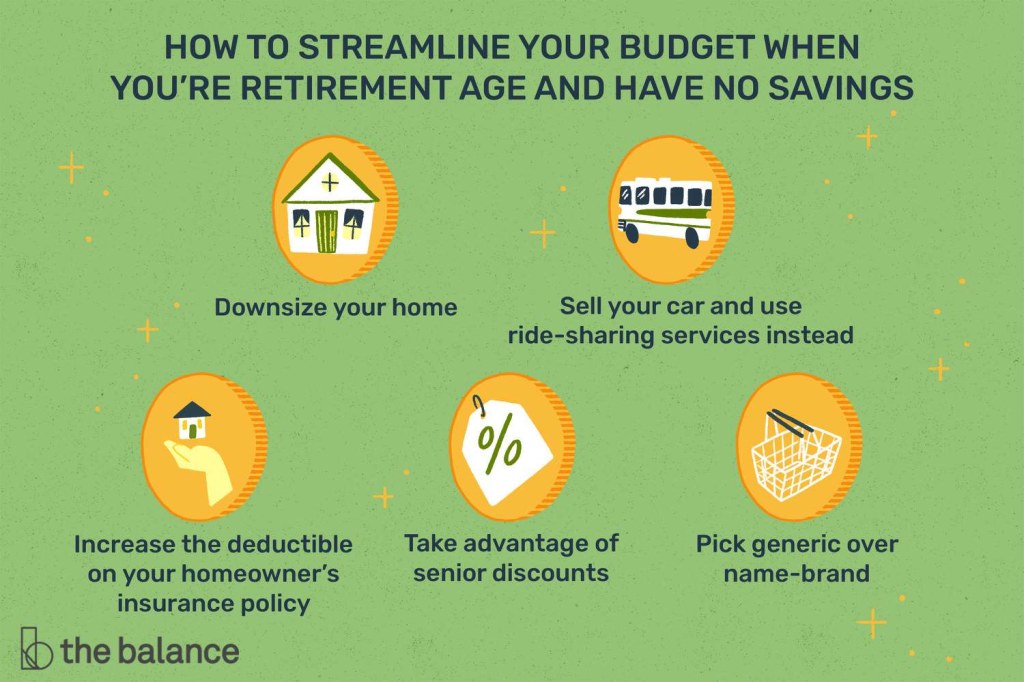

Image Source: thebalancemoney.com

These alternative options include Individual Retirement Accounts (IRAs), Roth IRAs, Simplified Employee Pension (SEP) IRAs, and Health Savings Accounts (HSAs). Each of these investment vehicles has its own unique features and benefits, enabling individuals to tailor their retirement savings strategy to their specific needs and circumstances.

👥 Target Audience

Retirement savings without a 401k is particularly relevant for individuals who do not have access to a 401k plan through their employer. This includes self-employed individuals, freelancers, gig economy workers, and employees of small businesses that do not offer a 401k plan. It is also suitable for those who simply wish to diversify their retirement savings and explore alternative investment options.

⌚ When to Consider It

Retirement savings without a 401k should be considered when individuals do not have access to a 401k plan or when they want to supplement their existing retirement savings strategy. It is important to evaluate personal financial goals, risk tolerance, and tax implications before deciding on the appropriate alternative investment option.

Who Can Benefit from Retirement Savings Without 401k?

👩💼 Self-Employed Individuals

Self-employed individuals are among the prime beneficiaries of retirement savings without a 401k. Without the option of a traditional employer-sponsored retirement plan, self-employed individuals can utilize alternative options such as a Simplified Employee Pension (SEP) IRA or a Solo 401k to save for their retirement.

👨💼 Small Business Employees

Employees of small businesses that do not offer a 401k plan can also benefit from retirement savings alternatives. Options such as Traditional and Roth IRAs allow employees to contribute to their retirement savings on an individual basis, regardless of whether their employer provides a retirement plan or not.

👵 Individuals Seeking Diversification

Even for individuals who have access to a 401k plan, diversifying retirement savings through alternative investment options is a wise strategy. By investing in IRAs, Roth IRAs, or HSAs, individuals can expand their investment portfolio and potentially earn higher returns while benefiting from tax advantages.

When to Consider Retirement Savings Without 401k?

⌚ Early Career Stage

Individuals in the early stages of their careers, particularly those who have not yet secured a job with a company offering a 401k plan, should consider retirement savings alternatives. Starting early allows for long-term growth and the potential to accumulate a substantial retirement nest egg over time.

⌚ Limited Availability of 401k Plan

When a traditional 401k plan is not available through an employer, it is essential to explore other retirement savings options. By doing so, individuals can ensure they are actively saving for retirement and not missing out on the opportunity to build a secure financial future.

Where to Invest for Retirement Savings Without 401k?

🌍 Investment Options

Retirement savings without a 401k provides individuals with a wide range of investment options. Some popular choices include stocks, bonds, mutual funds, real estate, and precious metals. These investment vehicles can be accessed through various accounts, such as IRAs, Roth IRAs, and HSAs.

🏦 Financial Institutions

Individuals can invest in these alternative options through different financial institutions, including banks, brokerage firms, and online investment platforms. It is important to conduct thorough research and compare fees, services, and investment options before selecting a financial institution.

Why Is Retirement Savings Without 401k a Viable Option?

🔑 Flexibility and Control

One of the primary advantages of retirement savings without a 401k is the flexibility and control it provides. Individuals can choose from a variety of investment options and have the freedom to customize their retirement savings strategy to align with their goals and risk tolerance.

💰 Potential for Higher Returns

Alternative investment options, such as stocks and real estate, have the potential to generate higher returns compared to the limited investment options within a 401k plan. By diversifying their investments, individuals may benefit from increased growth and wealth accumulation.

💼 Business Contributions

For self-employed individuals, certain retirement savings alternatives, like a Solo 401k or SEP IRA, allow for higher contribution limits compared to traditional IRAs. This enables business owners to contribute more towards their retirement savings while potentially benefiting from tax deductions.

How to Get Started with Retirement Savings Without 401k?

📝 Evaluate Your Financial Goals

The first step to getting started with retirement savings without a 401k is to evaluate your financial goals. Determine how much you need to save for retirement and the timeline you wish to achieve it. This will help guide your investment decisions and ensure you are on track to meet your retirement objectives.

📊 Assess Your Risk Tolerance

Understanding your risk tolerance is essential when selecting the appropriate investment options. Consider factors such as age, financial stability, and personal preferences. Individuals with a higher risk tolerance may opt for more aggressive investment options, while those with a lower risk tolerance may prefer more conservative investments.

📞 Seek Professional Advice

If you are unsure about the best retirement savings alternatives for your specific situation, it is advisable to seek professional advice. Financial advisors can provide personalized guidance based on your financial goals, risk tolerance, and unique circumstances, ensuring you make informed decisions.

Advantages and Disadvantages of Retirement Savings Without 401k

Advantages:

Flexibility in investment options and control over retirement savings.

Potential for higher returns compared to limited 401k investment options.

Opportunity to diversify investment portfolio and reduce risk.

Higher contribution limits for self-employed individuals.

Ability to access retirement funds penalty-free before the age of 59½ in certain circumstances.

Disadvantages:

Lack of employer contributions and matching.

Potential for higher fees compared to employer-sponsored retirement plans.

Less familiarity and understanding among individuals due to the prevalence of 401k plans.

Requirement to actively manage and monitor investments.

Possible tax implications and limitations depending on the chosen investment vehicles.

Frequently Asked Questions (FAQs)

1. Can I contribute to a retirement savings account without a 401k?

Yes, you can contribute to alternative retirement savings accounts such as IRAs, Roth IRAs, and HSAs, even if you do not have a 401k. These accounts offer tax advantages and can help you save for retirement.

2. How much should I contribute to my retirement savings without a 401k?

The amount you should contribute depends on various factors, including your financial goals, age, and income. It is recommended to contribute as much as you can afford to maximize your retirement savings.

3. What investment options are available for retirement savings without a 401k?

Investment options for retirement savings without a 401k include stocks, bonds, mutual funds, real estate, and precious metals. These investments can be accessed through IRAs, Roth IRAs, and HSAs.

4. Are there any penalties for early withdrawal from retirement savings without a 401k?

Yes, there may be penalties for early withdrawal from certain retirement savings accounts. However, some exceptions allow penalty-free withdrawals, such as for first-time homebuyers or certain medical expenses.

5. How can I track and monitor my retirement savings without a 401k?

You can track and monitor your retirement savings by regularly reviewing your investment statements and performance. Many financial institutions provide online platforms for easy access to account information and performance tracking.

Conclusion

In conclusion, retirement savings without a 401k offers individuals the opportunity to secure their financial future through alternative investment options. By exploring options such as IRAs, Roth IRAs, and HSAs, individuals can enjoy flexibility, potential for higher returns, and the ability to diversify their investment portfolio. It is important to evaluate personal financial goals, risk tolerance, and seek professional advice when making decisions regarding retirement savings. Start planning today and take control of your retirement savings journey!

Final Remarks

Disclaimer: The information presented in this article is for informational purposes only and should not be considered financial or investment advice. It is always recommended to consult with a qualified financial advisor or tax professional before making any investment decisions. The author and the website are not responsible for any actions taken based on the information provided above.

This post topic: Budgeting Strategies

![OC] Retirement ages in G : r/dataisbeautiful](https://fantotal.info/wp-content/uploads/2023/09/oc-retirement-ages-in-g-r-dataisbeautiful-150x150.png)