Secure Your Future With The Best Retirement Plan In UAE: Take Action Now!

Retirement Plan in UAE

Greetings, Readers! In this article, we will delve into the topic of retirement planning in the United Arab Emirates (UAE). Planning for retirement is crucial to ensure financial security and a comfortable lifestyle in your golden years. With the right retirement plan, individuals can enjoy their retirement without any financial worries. Let’s explore the details of retirement planning in the UAE and understand how it can benefit you.

Introduction

Retirement planning involves setting aside funds for the future when you are no longer working. It aims to provide financial stability and maintain the same standard of living even after retirement. The UAE offers various retirement plans and schemes to help individuals save for their post-retirement years.

0 Picture Gallery: Secure Your Future With The Best Retirement Plan In UAE: Take Action Now!

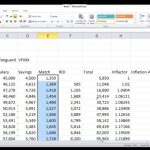

Below is a comprehensive table highlighting all the essential information about retirement plans in the UAE:

Retirement Plan

Description

Eligibility

Contributions

Withdrawals

Employee Pension Scheme (EPS)

A mandatory retirement plan provided by the UAE government for employees in the private sector.

All employees in the private sector.

Contributions made by both the employee and employer.

Withdrawals can be made after reaching the retirement age or meeting specific conditions.

Image Source: khaleejtimes.com

UAE Retirement Savings Scheme (RSS)

A voluntary savings scheme that allows individuals to save for retirement through regular contributions.

All residents and non-residents of the UAE.

Contributions made by the individual.

Withdrawals can be made after a certain period or upon reaching the retirement age.

Individual Retirement Accounts (IRA)

A self-funded retirement plan that offers flexibility and investment opportunities.

All residents and non-residents of the UAE.

Contributions made by the individual.

Withdrawals can be made after reaching the retirement age or meeting specific conditions.

What is a Retirement Plan?

A retirement plan is a financial strategy that involves saving and investing money to ensure a stable income during retirement. It allows individuals to accumulate funds over their working years, which can then be utilized to cover living expenses and fulfill their retirement goals.

Who Can Benefit from a Retirement Plan in the UAE?

Retirement plans in the UAE are designed for both residents and non-residents who want to secure their financial future. Employees in the private sector can benefit from the Employee Pension Scheme (EPS), while individuals looking for flexibility and investment options can opt for the UAE Retirement Savings Scheme (RSS) or Individual Retirement Accounts (IRA).

When Should You Start Planning for Retirement?

The earlier you start planning for retirement, the better. It is recommended to start saving for retirement as soon as you begin your professional career. By starting early, you can take advantage of the power of compounding and ensure a larger retirement corpus.

Where Can You Open a Retirement Plan in the UAE?

Retirement plans in the UAE can be opened through various financial institutions, including banks and insurance companies. It is advisable to research and compare different plans to find the one that best suits your financial goals and requirements.

Why is a Retirement Plan Important?

A retirement plan is important for several reasons. Firstly, it provides financial security and ensures that you can maintain your desired lifestyle after retirement. Secondly, it helps you build a corpus that can generate a regular income stream during your non-working years. Lastly, it offers peace of mind, knowing that you have planned for your future financial needs.

How to Choose the Right Retirement Plan in the UAE?

Choosing the right retirement plan in the UAE requires careful consideration of various factors. These include your age, financial goals, risk tolerance, and investment preferences. It is advisable to seek professional advice from financial advisors who can guide you in selecting the most suitable retirement plan.

Advantages and Disadvantages of Retirement Plans in the UAE

Advantages:

1. Financial Security: Retirement plans provide a safety net, ensuring financial stability during retirement.

2. Tax Benefits: Certain retirement plans offer tax advantages, allowing individuals to save on taxes.

3. Investment Opportunities: Retirement plans often provide investment options, enabling individuals to grow their savings.

4. Employer Contributions: Some retirement plans have employer contributions, increasing the retirement corpus.

5. Flexibility: Certain retirement plans offer flexibility in terms of contributions and withdrawals.

Disadvantages:

1. Early Withdrawal Penalties: Withdrawing funds before the retirement age may result in penalties.

2. Market Risks: Some retirement plans are subject to market fluctuations, potentially affecting the returns.

3. Limited Access to Funds: Retirement plans may restrict access to funds until the retirement age is reached.

4. Contribution Limitations: Certain retirement plans have contribution limits, which may impact the desired retirement corpus.

5. Lack of Portability: Some retirement plans are tied to specific employers, limiting portability between jobs.

Frequently Asked Questions (FAQ)

1. Can non-residents of the UAE contribute to retirement plans?

Yes, non-residents can contribute to retirement plans in the UAE, such as the UAE Retirement Savings Scheme (RSS) and Individual Retirement Accounts (IRA).

2. Are there any penalties for early withdrawals?

Yes, most retirement plans impose penalties for early withdrawals before reaching the retirement age or meeting specific conditions. The penalties vary depending on the plan.

3. Can I have multiple retirement plans in the UAE?

Yes, it is possible to have multiple retirement plans in the UAE. However, it is essential to consider the contribution limits and overall retirement goals.

4. Can I change my retirement plan in the UAE?

Yes, it is generally possible to change your retirement plan in the UAE. However, there may be certain restrictions and fees associated with the process.

5. Are retirement plans in the UAE taxable?

The tax treatment of retirement plans in the UAE varies depending on the specific plan and individual circumstances. It is advisable to consult with a tax advisor to understand the tax implications.

Conclusion

In conclusion, retirement planning is essential for individuals in the UAE to secure their financial future. The availability of various retirement plans, such as the Employee Pension Scheme (EPS), UAE Retirement Savings Scheme (RSS), and Individual Retirement Accounts (IRA), provides options for individuals to choose the most suitable plan for their needs. By starting early and making informed decisions, individuals can ensure a comfortable and worry-free retirement. Take action today and start planning for your retirement!

Disclaimer: The information provided in this article is for informational purposes only and should not be considered as financial advice. It is always recommended to consult with a qualified financial advisor before making any investment or retirement planning decisions.

This post topic: Budgeting Strategies