Supercharge Your Future With The Ultimate Retirement Savings Spreadsheet: Start Planning Now!

Retirement Savings Spreadsheet: A Tool to Secure Your Future

Greetings, Readers! In this article, we will delve into the topic of retirement savings spreadsheets and how they can help you plan for a financially secure future. With the ever-increasing importance of saving for retirement, it is crucial to have an organized and efficient system in place. A retirement savings spreadsheet can be a game-changer in this regard, providing you with a comprehensive overview of your financial goals and progress. Let’s explore this topic further.

Introduction

Retirement can be an exciting phase of life, filled with new opportunities and experiences. However, to fully enjoy this stage, it is essential to have adequate financial resources. A retirement savings spreadsheet is a powerful tool that allows you to track and manage your savings effectively. It provides a structured framework to set goals, monitor progress, and make informed decisions for a secure future.

2 Picture Gallery: Supercharge Your Future With The Ultimate Retirement Savings Spreadsheet: Start Planning Now!

Now, let’s dive into the details and understand the various aspects of retirement savings spreadsheets.

What is a Retirement Savings Spreadsheet?

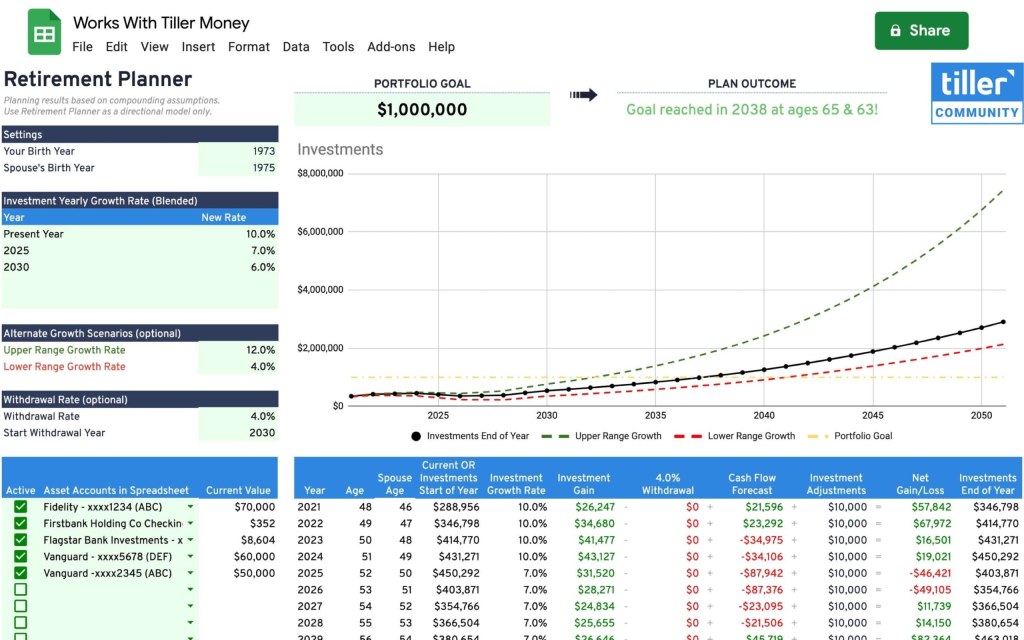

📋 A retirement savings spreadsheet is a digital document, typically created using spreadsheet software like Microsoft Excel or Google Sheets, that helps individuals track and manage their retirement savings. It serves as a centralized hub for organizing financial information and analyzing progress towards retirement goals.

This spreadsheet usually includes sections for income, expenses, investments, and projected savings growth. By inputting relevant data, users can generate reports, charts, and graphs to visualize their financial situation and make informed decisions.

How to Create a Retirement Savings Spreadsheet?

Image Source: ytimg.com

Creating a retirement savings spreadsheet is relatively easy, even for those with limited technical skills. Here are the steps to get started:

1. Open a spreadsheet software like Microsoft Excel or Google Sheets.

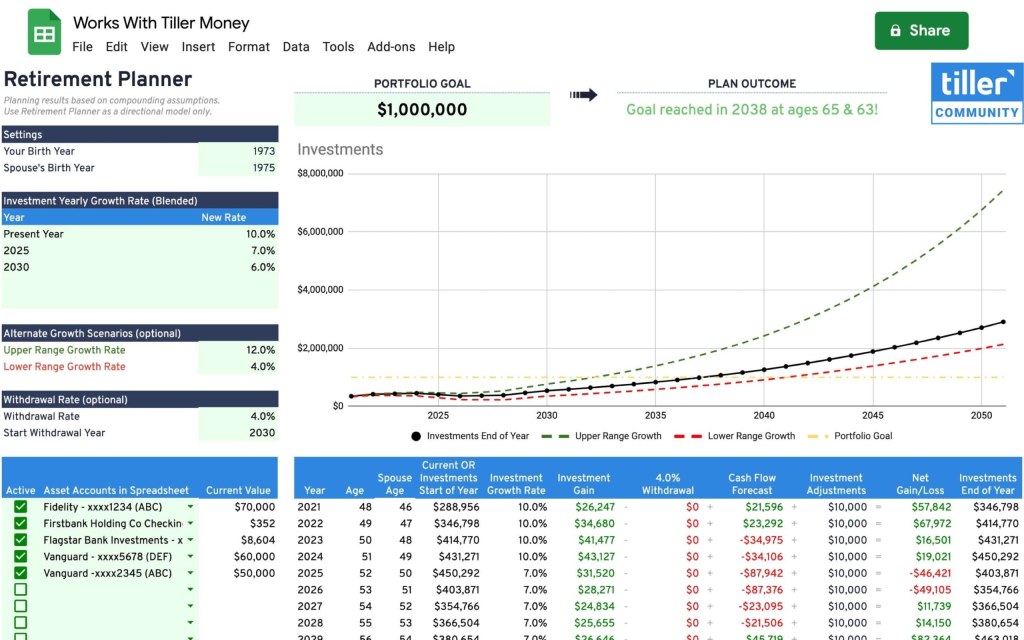

2. Create different tabs or sheets for income, expenses, investments, and projections.

Image Source: i0.wp.com

3. Input your current financial data in the respective sections, such as monthly income, expenses, and investment balances.

4. Use formulas and functions to calculate savings growth, retirement age, and other relevant factors.

5. Customize the spreadsheet based on your preferences and needs.

6. Regularly update and review the spreadsheet to track progress and make adjustments.

By following these steps, you can create a retirement savings spreadsheet tailored to your unique financial situation.

Who Can Benefit from a Retirement Savings Spreadsheet?

🙋♂️ The beauty of a retirement savings spreadsheet lies in its universal applicability. Whether you are a young professional just starting your career or someone nearing retirement, this tool can be incredibly useful.

If you are in your 20s or 30s, a retirement savings spreadsheet can help you establish good saving habits, set achievable goals, and make better financial decisions. It allows you to visualize the long-term impact of your choices and encourages you to save more consistently.

For individuals in their 40s or 50s, a retirement savings spreadsheet becomes even more critical. It helps you assess your current financial standing, identify potential gaps, and make necessary adjustments to catch up on savings. With limited time left until retirement, having a clear roadmap becomes paramount.

Even retirees can benefit from using a retirement savings spreadsheet. It serves as a tool for monitoring and managing existing retirement funds, ensuring that they last throughout your retirement years.

When Should You Start Using a Retirement Savings Spreadsheet?

⌛ The best time to start using a retirement savings spreadsheet is now! Regardless of your age or current financial situation, it is never too early or too late to take control of your retirement planning. The sooner you start, the more time you have to accumulate savings and benefit from compound growth.

By starting early, you can also avoid potential financial pitfalls and make adjustments along the way. However, even if you are closer to retirement age, a retirement savings spreadsheet can still help you improve your financial outlook and make the most of the resources you have.

Where Can You Access a Retirement Savings Spreadsheet?

🌐 Retirement savings spreadsheets can be accessed and created using popular spreadsheet software like Microsoft Excel or Google Sheets. These platforms offer a range of pre-designed templates, making it easier for users to get started. Additionally, online financial planning tools and websites may provide downloadable retirement savings spreadsheets tailored to specific needs.

Whether you choose to create your own spreadsheet or utilize a pre-existing template, the key is to find a solution that aligns with your financial goals and preferences.

Why Should You Use a Retirement Savings Spreadsheet?

🔍 The benefits of using a retirement savings spreadsheet are numerous. Here are some compelling reasons to consider:

1. Organization: A retirement savings spreadsheet helps you organize your financial information in a centralized location, making it easier to track and manage.

2. Goal setting: By setting clear goals within the spreadsheet, you can work towards achieving specific retirement targets.

3. Progress tracking: With regular updates, the spreadsheet provides a visual representation of your progress and allows you to identify areas that need improvement.

4. Informed decision-making: The spreadsheet’s analytical capabilities enable you to make informed decisions regarding savings, investments, and retirement age.

5. Flexibility: A retirement savings spreadsheet can be tailored to your unique needs, allowing you to customize categories, formulas, and visualizations.

These advantages make a retirement savings spreadsheet an invaluable tool for anyone looking to secure their financial future.

Advantages and Disadvantages of Retirement Savings Spreadsheets

Advantages

👍 Retirement savings spreadsheets offer several advantages, including:

1. Comprehensive overview: The spreadsheet provides a holistic view of your retirement savings, income, and expenses.

2. Customization: Users can customize the spreadsheet to reflect their unique financial situation and goals.

3. Data analysis: With built-in functions and formulas, the spreadsheet simplifies data analysis and informs decision-making.

4. Goal tracking: By setting milestones and monitoring progress, the spreadsheet keeps you accountable towards your retirement goals.

5. Visualization: The graphical representation of data helps users understand their financial situation at a glance.

Disadvantages

👎 While retirement savings spreadsheets offer numerous benefits, they also have some limitations:

1. Manual input: The accuracy and effectiveness of the spreadsheet depend on regular and accurate data input by the user.

2. Learning curve: Users unfamiliar with spreadsheet software may require some time to grasp the functionalities and optimize its usage.

3. Limited automation: While some functions can automate calculations, the overall management still requires manual adjustments.

4. External factors: The spreadsheet’s projections and assumptions may not account for unforeseen market fluctuations or economic conditions.

5. Lack of professional advice: A retirement savings spreadsheet cannot replace personalized advice from financial professionals.

It is essential to consider these advantages and disadvantages when deciding whether a retirement savings spreadsheet is the right tool for you.

Frequently Asked Questions (FAQs)

1. Is using a retirement savings spreadsheet better than hiring a financial advisor?

🤔 While a retirement savings spreadsheet can provide valuable insights and assist in managing your finances, it cannot replace the expertise and personalized advice of a financial advisor. Consider seeking professional guidance to complement your spreadsheet-based approach.

2. Can I use a retirement savings spreadsheet if I have multiple income sources?

🤔 Yes, a retirement savings spreadsheet can accommodate multiple income sources. Simply create separate sections or tabs for each income stream and track them accordingly. This will allow you to have a comprehensive overview of your financial situation.

3. How often should I update my retirement savings spreadsheet?

🤔 It is recommended to update your retirement savings spreadsheet at regular intervals, such as monthly or quarterly. This will ensure that your data remains accurate and up-to-date, allowing you to monitor progress effectively.

4. Can I share my retirement savings spreadsheet with my spouse or financial advisor?

🤔 Yes, you can share your retirement savings spreadsheet with your spouse or financial advisor. Most spreadsheet software allows you to collaborate and grant access to specific individuals. However, ensure that you only share the spreadsheet with trusted individuals to maintain data privacy and security.

5. Are there alternatives to retirement savings spreadsheets?

🤔 Yes, there are alternative tools available for retirement planning, such as online retirement calculators, mobile apps, and dedicated financial planning software. Explore different options and choose the one that suits your preferences and needs.

Conclusion

In conclusion, a retirement savings spreadsheet is a valuable tool for individuals seeking financial security in their retirement years. It provides a structured framework to track savings, set goals, and make informed decisions. By utilizing this tool, you can take control of your financial future and work towards a stress-free retirement.

Final Remarks

🔒 It is important to note that while a retirement savings spreadsheet can be a useful resource, it should not be the sole basis for making financial decisions. Consult with a qualified financial advisor to ensure your retirement plan aligns with your individual circumstances and goals. Remember, everyone’s financial situation is unique, and professional advice can provide personalized insights and recommendations.

This post topic: Budgeting Strategies