The Ultimate Guide To Mastering Budget Preparation Strategies: Unlock Your Financial Success!

Budget Preparation Strategies: How to Plan Your Finances Effectively

Table of Contents

Introduction

1 Picture Gallery: The Ultimate Guide To Mastering Budget Preparation Strategies: Unlock Your Financial Success!

1. What is budget preparation strategies?

2. Who can benefit from budget preparation strategies?

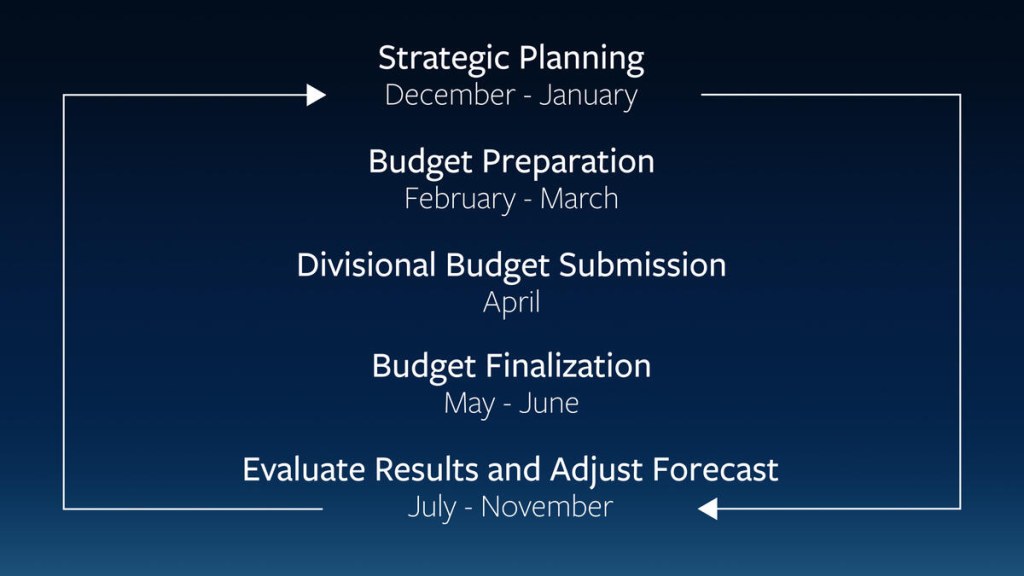

Image Source: licdn.com

3. When should you start preparing your budget?

4. Where can you find resources for budget preparation?

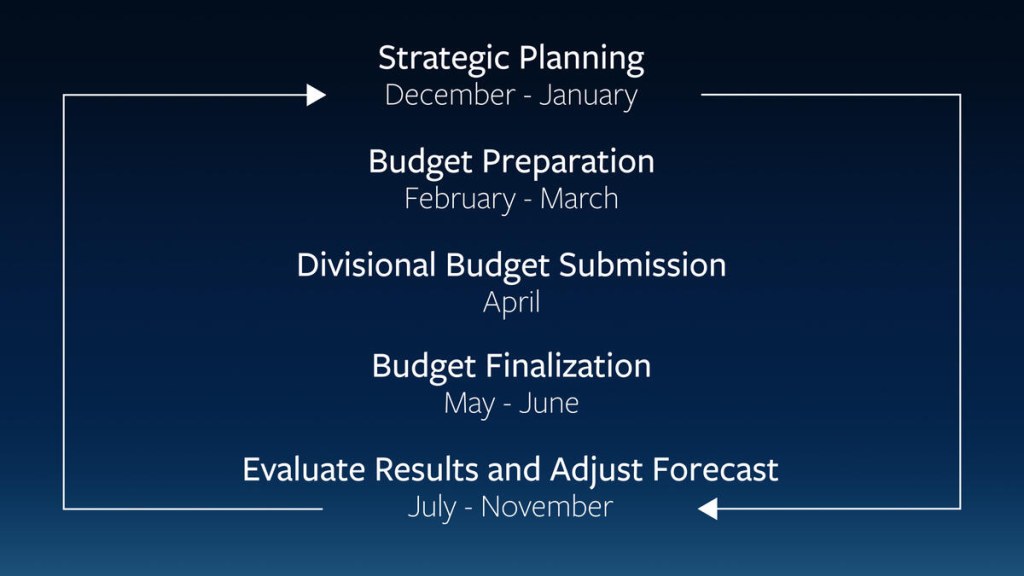

Image Source: berkeley.edu

5. Why is budget preparation important?

6. How can you effectively prepare your budget?

Advantages and Disadvantages of Budget Preparation Strategies

1. Advantages of budget preparation strategies

2. Disadvantages of budget preparation strategies

Frequently Asked Questions about Budget Preparation Strategies

1. How often should I review my budget?

2. Can I use budgeting apps to help with budget preparation?

3. What if my income fluctuates each month?

4. How can I stick to my budget and avoid overspending?

5. Should I involve my family members in the budget planning process?

Conclusion

1. Take control of your finances with budget preparation strategies

2. Start planning your budget today for a brighter financial future

3. Remember to adjust your budget as your financial situation changes

4. Stay disciplined and committed to your budgeting goals

5. Seek professional help if needed to ensure successful budget preparation

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only. It is not intended as financial or professional advice. Please consult with a qualified financial advisor or professional before making any financial decisions.

Introduction

Dear Readers,

Welcome to our guide on budget preparation strategies. In today’s fast-paced world, managing your finances effectively is crucial for achieving your financial goals. Whether you’re saving for a dream vacation, planning for retirement, or simply trying to stay on top of your bills, having a well-prepared budget can make all the difference.

In this article, we will explore the ins and outs of budget preparation strategies and provide you with valuable insights to help you plan your finances effectively. From understanding the importance of budgeting to practical tips on how to create a budget that works for you, we’ve got you covered. So let’s dive in and take control of your financial future!

1. What is budget preparation strategies?

Budget preparation strategies refer to the methods and techniques used to plan and allocate your financial resources effectively. It involves assessing your income, expenses, and financial goals to create a comprehensive budget that guides your spending and savings habits. By implementing budget preparation strategies, you can gain a clear understanding of your financial situation and make informed decisions about your money.

2. Who can benefit from budget preparation strategies?

Everyone can benefit from budget preparation strategies, regardless of their income level or financial goals. Whether you’re a recent graduate starting your first job, a seasoned professional looking to save for retirement, or a family trying to juggle multiple financial responsibilities, budgeting can help you take control of your finances and achieve your objectives.

3. When should you start preparing your budget?

It’s never too early or too late to start preparing your budget. Ideally, you should start budgeting as soon as you have a regular income and financial responsibilities. By starting early, you can develop healthy financial habits and avoid common pitfalls such as overspending and debt accumulation. However, even if you’ve never budgeted before, it’s never too late to take control of your finances.

4. Where can you find resources for budget preparation?

There are numerous resources available to help you with budget preparation. You can find budgeting templates and tools online, consult books and articles on personal finance, or seek guidance from financial advisors. Additionally, many mobile apps and software programs are designed specifically for budgeting purposes, making it easier than ever to track your income and expenses.

5. Why is budget preparation important?

Budget preparation is important for several reasons. First, it allows you to gain a clear understanding of your financial situation, including your income, expenses, and savings goals. By knowing where your money is coming from and where it’s going, you can make informed decisions about your spending habits and identify areas where you can cut back or save more.

6. How can you effectively prepare your budget?

Preparing your budget effectively involves several key steps. Firstly, you need to assess your income sources and calculate your monthly or annual income. Next, you should list all your expenses, including fixed costs such as rent and utilities, as well as variable expenses like groceries and entertainment. Once you have a clear picture of your income and expenses, you can allocate your resources accordingly and set realistic savings goals.

Advantages and Disadvantages of Budget Preparation Strategies

1. Advantages of budget preparation strategies

Implementing budget preparation strategies offers several advantages. Firstly, it helps you gain control over your finances and enables you to make informed decisions about your spending habits. By creating a budget, you can prioritize your expenses, save for future goals, and avoid unnecessary debt. Budgeting also helps you track your progress towards your financial goals and make adjustments as needed.

On the other hand, budgeting may have some disadvantages. It requires discipline and commitment to stick to your budget and resist the temptation to overspend. Additionally, unexpected expenses or changes in your financial situation may require adjustments to your budget, which can be challenging. However, with careful planning and flexibility, these disadvantages can be minimized.

Frequently Asked Questions about Budget Preparation Strategies

1. How often should I review my budget?

It’s recommended to review your budget regularly, ideally on a monthly basis. This allows you to track your progress, identify any changes in your income or expenses, and make adjustments as needed. By reviewing your budget regularly, you can ensure that it remains relevant and effective in helping you achieve your financial goals.

2. Can I use budgeting apps to help with budget preparation?

Yes, budgeting apps can be a valuable tool in the budget preparation process. They can help you track your income and expenses, set savings goals, and provide visual representations of your financial progress. Many budgeting apps also offer features such as bill reminders, spending categorization, and financial insights to help you make more informed decisions about your money.

3. What if my income fluctuates each month?

If your income fluctuates each month, budgeting can still be effective. Start by calculating your average monthly income based on your past earnings. Then, prioritize your expenses and savings goals based on this average income. By planning for fluctuations and setting aside some funds for unexpected expenses, you can create a budget that accommodates your variable income.

4. How can I stick to my budget and avoid overspending?

Sticking to your budget requires discipline and commitment. Start by setting realistic goals and expectations for your spending habits. Avoid impulsive purchases and track your expenses regularly to ensure you are staying within your budgeted amounts. If you find it challenging to stick to your budget, consider using cash envelopes or automated savings plans to help you stay on track.

5. Should I involve my family members in the budget planning process?

Involving your family members in the budget planning process can be beneficial, especially if they share financial responsibilities with you. By including everyone in the decision-making process, you can ensure that everyone is on the same page and understands the importance of sticking to the budget. This can also foster a sense of accountability and teamwork within the family.

Conclusion

1. Take control of your finances with budget preparation strategies

Creating and following a budget is essential for achieving your financial goals and living a financially stable life. By implementing budget preparation strategies, you can gain a clear understanding of your financial situation, make informed decisions about your money, and prioritize your expenses and savings goals.

2. Start planning your budget today for a brighter financial future

The sooner you start planning your budget, the sooner you can reap the benefits. Don’t wait until financial difficulties arise or until you’re overwhelmed by your expenses. Start today and take control of your financial future.

3. Remember to adjust your budget as your financial situation changes

Life is full of unexpected changes, and your financial situation may evolve over time. It’s important to regularly review and adjust your budget to reflect any changes in your income, expenses, or financial goals. This flexibility will ensure that your budget remains relevant and effective in guiding your financial decisions.

4. Stay disciplined and committed to your budgeting goals

Creating a budget is only the first step; sticking to it requires discipline and commitment. Avoid unnecessary expenses, track your spending, and regularly review your budget to stay on track. Remember that short-term sacrifices can lead to long-term financial stability and freedom.

5. Seek professional help if needed to ensure successful budget preparation

If you find it challenging to create or stick to a budget, don’t hesitate to seek professional help. Financial advisors or counselors can provide personalized guidance and strategies tailored to your specific situation. They can help you identify areas for improvement, set realistic goals, and hold you accountable throughout your financial journey.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only. It is not intended as financial or professional advice. Please consult with a qualified financial advisor or professional before making any financial decisions.

This post topic: Budgeting Strategies