Secure Your Future With Retirement Savings 10: Act Now For A Financially Stable Retirement!

Retirement Savings 10: Securing Your Future

Introduction

Hello Readers,

2 Picture Gallery: Secure Your Future With Retirement Savings 10: Act Now For A Financially Stable Retirement!

Welcome to Retirement Savings 10, where we will explore the importance of planning for your retirement and provide you with valuable insights on how to secure your future. Retirement is a significant milestone in everyone’s life, and having a solid financial plan is crucial to enjoy a comfortable and stress-free retirement.

Image Source: thebalancemoney.com

In this article, we will guide you through the various aspects of retirement savings, including what it entails, who should consider it, when to start planning, where to invest, why it is necessary, and how you can make the most out of your savings.

So, let’s dive into the world of retirement savings and ensure a secure and prosperous future for ourselves.

What is Retirement Savings?

Retirement savings refer to the funds set aside specifically for your retirement years. It is an essential financial strategy that ensures you have enough money to support yourself when you are no longer working. By saving consistently over the years, you build a nest egg that can provide for your living expenses, healthcare needs, and other financial obligations during your retirement.

Who Should Consider Retirement Savings?

Image Source: squarespace-cdn.com

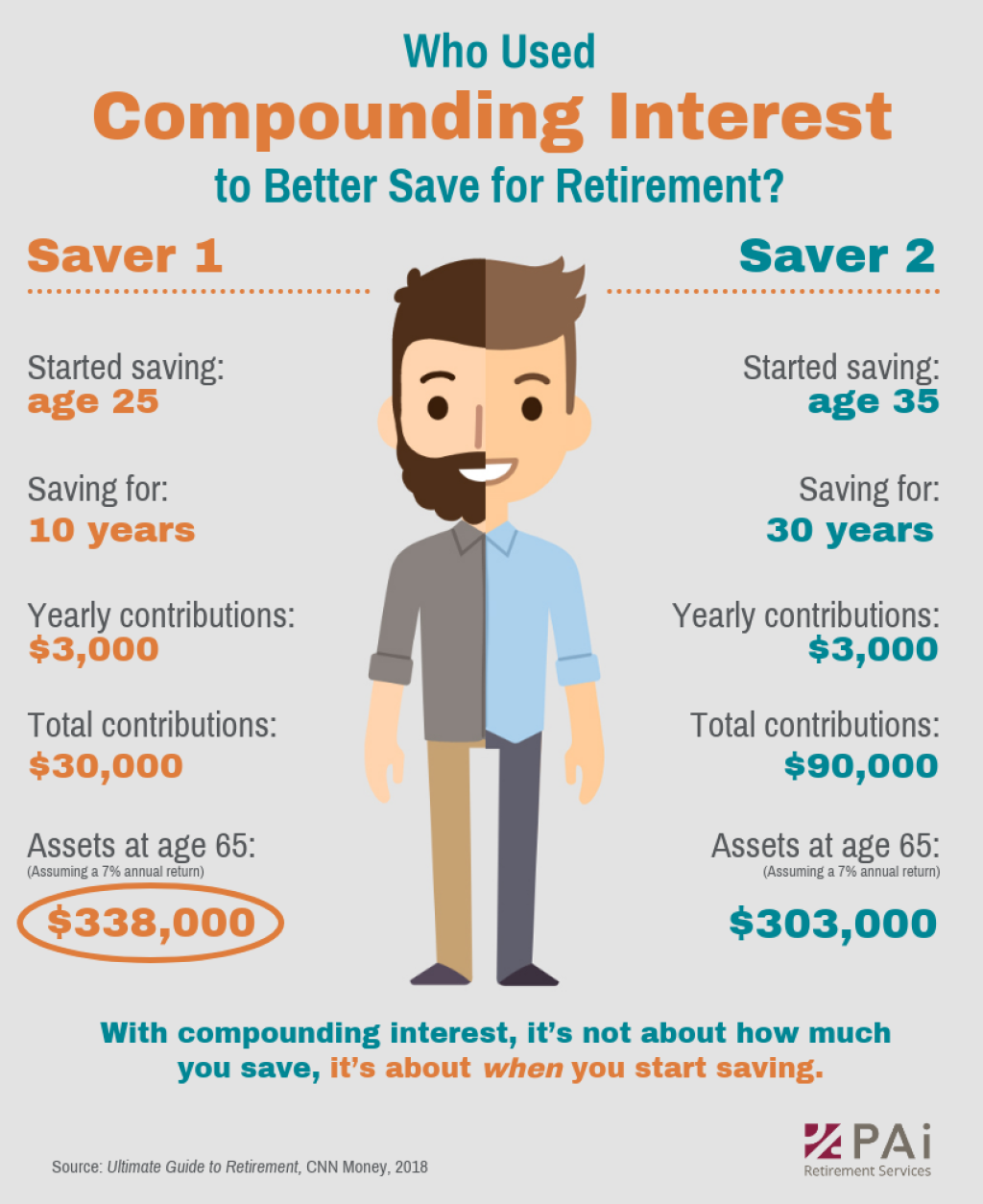

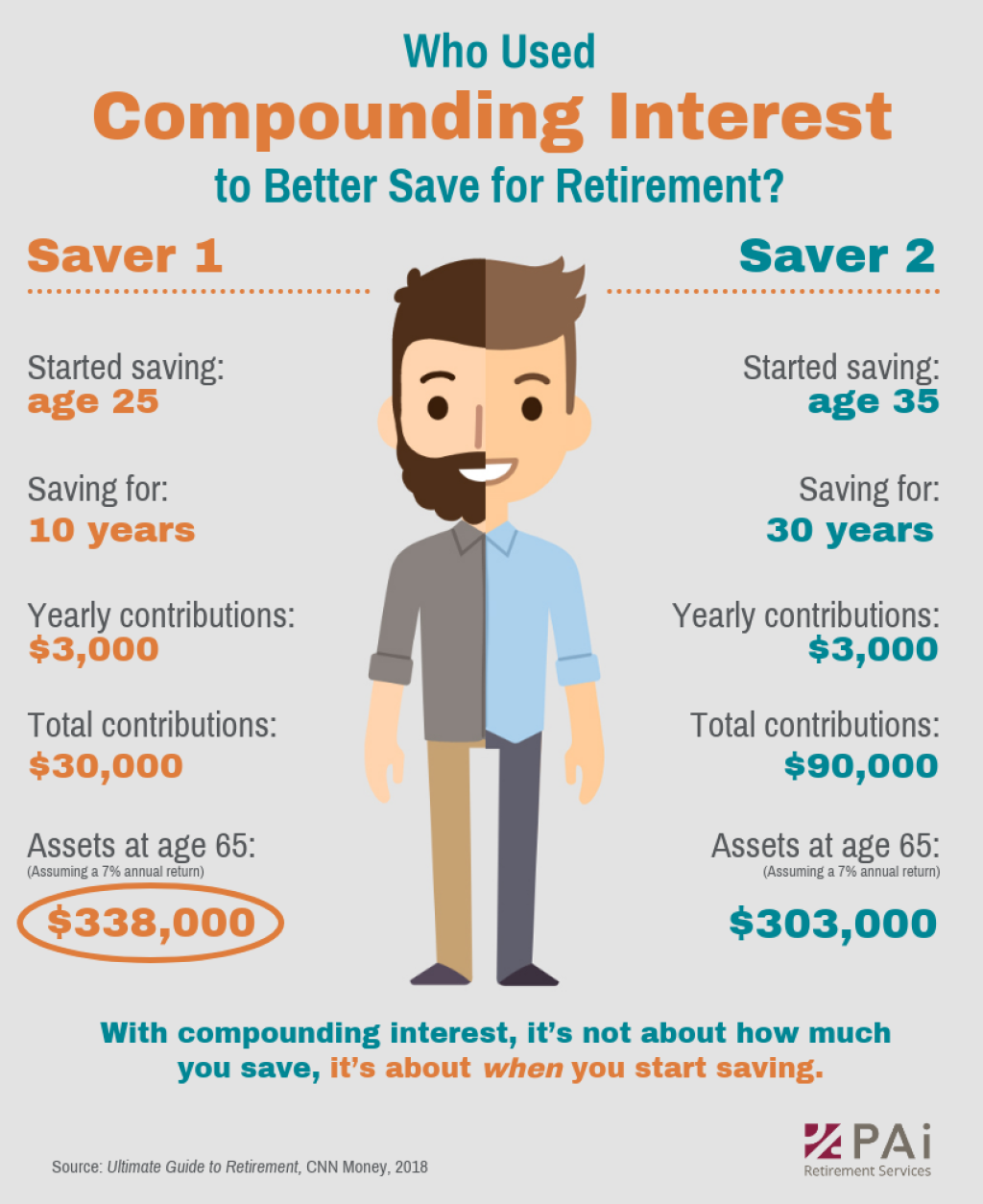

Retirement savings are relevant to everyone, regardless of age or income level. Whether you are just starting your career or approaching your golden years, planning for retirement is crucial. Young professionals can benefit from the power of compounding by starting early, while those closer to retirement need to ensure they have enough savings to maintain their desired lifestyle.

Regardless of your current financial situation, it is never too late to start saving for retirement. The earlier you begin, the more time your money has to grow.

When to Start Planning for Retirement?

The best time to start planning for retirement is now. No matter your age, the sooner you begin, the better prepared you will be for your golden years. The power of compound interest allows your savings to grow exponentially over time, so starting early gives you a significant advantage.

However, if you haven’t started saving yet, don’t worry. It’s never too late to take control of your financial future. Even if you are close to retirement, there are still strategies you can implement to boost your savings and secure a comfortable retirement.

Where to Invest for Retirement Savings?

When it comes to investing your retirement savings, there are various options to consider. Some popular choices include:

401(k) or Employer-Sponsored Retirement Plans: Many companies offer retirement savings plans, such as 401(k)s, which allow employees to contribute a portion of their salary towards retirement.

Individual Retirement Accounts (IRAs): IRAs are personal retirement accounts that provide tax advantages for those saving for retirement. There are different types of IRAs, including Traditional and Roth IRAs.

Stocks and Bonds: Investing in stocks and bonds can be a way to grow your retirement savings. However, it’s important to consider your risk tolerance and consult with a financial advisor.

Real Estate: Some individuals choose to invest in real estate as a means of building wealth for retirement. Rental properties or real estate investment trusts (REITs) can provide a steady income stream.

It is advisable to diversify your investments to mitigate risk and ensure a balanced portfolio. Consulting with a financial advisor can help you determine the best investment strategy based on your goals and risk tolerance.

Why is Retirement Savings Necessary?

Retirement savings are necessary to secure your financial future. Here are some reasons why:

Income Replacement: Retirement savings provide a source of income to replace your salary when you stop working.

Cost of Living: Expenses such as housing, healthcare, and daily needs continue during retirement. Having savings ensures you can meet these financial obligations.

Financial Independence: Retirement savings provide the freedom to pursue your interests and enjoy your golden years without relying on others for financial support.

Unforeseen Expenses: Having savings helps you prepare for unexpected events like medical emergencies or home repairs.

By planning and saving for retirement, you can enjoy the peace of mind that comes with financial security and independence.

How to Maximize Your Retirement Savings?

Here are some tips to make the most out of your retirement savings:

Start Early: The earlier you start saving, the more time your money has to grow through compounding.

Contribute Regularly: Make consistent contributions to your retirement account to maximize its growth potential.

Take Advantage of Employer Contributions: If your employer offers a matching contribution to your retirement plan, contribute enough to receive the full match.

Monitor Your Investments: Regularly review your investment portfolio and adjust it based on your risk tolerance and retirement goals.

Create a Budget: Establishing a budget helps you track your expenses and ensure you are saving enough for retirement.

Minimize Debt: Paying off high-interest debts early can free up more money for retirement savings.

Consult with a Financial Advisor: A financial advisor can provide personalized guidance to help you optimize your retirement savings strategy.

By implementing these strategies, you can maximize your retirement savings and secure a prosperous future.

Advantages and Disadvantages of Retirement Savings

Retirement savings come with both advantages and disadvantages. Let’s explore them:

Advantages:

Financial Security: Saving for retirement ensures you have enough money to support yourself when you are no longer working.

Compounding Growth: By starting early and consistently contributing to your retirement savings, you can take advantage of compounding growth.

Flexibility and Control: Building your retirement savings gives you more control over your financial future and the flexibility to pursue your goals.

Disadvantages:

Delayed Gratification: Saving for retirement requires discipline and sacrificing current wants for future needs.

Market Volatility: Investments can be subject to market fluctuations, which may impact the value of your retirement savings.

Uncertainty: It can be challenging to predict future expenses and how much money you will need for a comfortable retirement.

Understanding these advantages and disadvantages can help you make informed decisions when it comes to your retirement savings strategy.

Frequently Asked Questions (FAQs)

1. Q: What is the ideal age to start saving for retirement?

A: It is recommended to start saving for retirement as early as possible, ideally in your twenties or thirties. However, it’s never too late to begin.

2. Q: Can I rely solely on Social Security for my retirement income?

A: While Social Security provides some income, it is typically not enough to support a comfortable retirement. It is crucial to have additional savings.

3. Q: Should I prioritize paying off debt or saving for retirement?

A: It depends on your individual circumstances. Generally, it is advisable to strike a balance between debt repayment and retirement savings. Consult with a financial advisor to determine the best approach for you.

4. Q: Are there any tax advantages to saving for retirement?

A: Yes, retirement savings accounts such as 401(k)s and IRAs offer tax advantages. Contributions may be tax-deductible, and withdrawals may be taxed at a lower rate during retirement.

5. Q: What happens if I withdraw money from my retirement account before retirement age?

A: Withdrawing money from your retirement account before retirement age may result in penalties and taxes. It is generally advisable to avoid early withdrawals.

Conclusion

In conclusion, retirement savings are essential for securing your financial future. By planning early, making regular contributions, and investing wisely, you can build a substantial nest egg that will support you during your retirement years. Remember to consult with a financial advisor to create a personalized retirement savings strategy tailored to your goals and risk tolerance.

Don’t wait any longer – start saving for retirement today and enjoy a prosperous future!

Final Remarks

Friends, it is important to note that the information provided in this article should not be considered financial advice. It is always recommended to consult with a qualified financial professional before making any investment or retirement planning decisions. Each individual’s financial situation is unique, and what works for one person may not work for another. Take the time to assess your own needs, goals, and risk tolerance when planning for retirement. Wishing you all the best in your retirement savings journey!

This post topic: Budgeting Strategies