Secure Your Future With Retirement Savings 2023: Act Now For A Stress-Free Retirement!

Retirement Savings 2023: Preparing for a Secure Future

Introduction

Dear Readers,

3 Picture Gallery: Secure Your Future With Retirement Savings 2023: Act Now For A Stress-Free Retirement!

Welcome to an informative article that will guide you through the importance of retirement savings in the year 2023. As we approach the future, it becomes crucial to plan for our retirement to ensure a financially secure and comfortable life ahead. In this article, we will delve into the key aspects of retirement savings, discuss its benefits and drawbacks, and provide you with the necessary information to make informed decisions. So, let’s begin our journey towards a prosperous retirement!

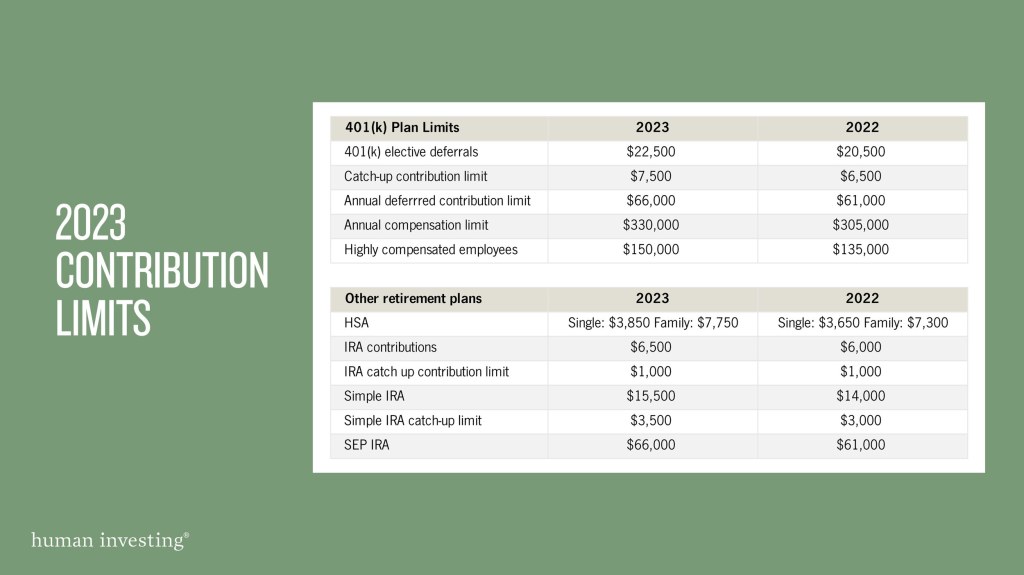

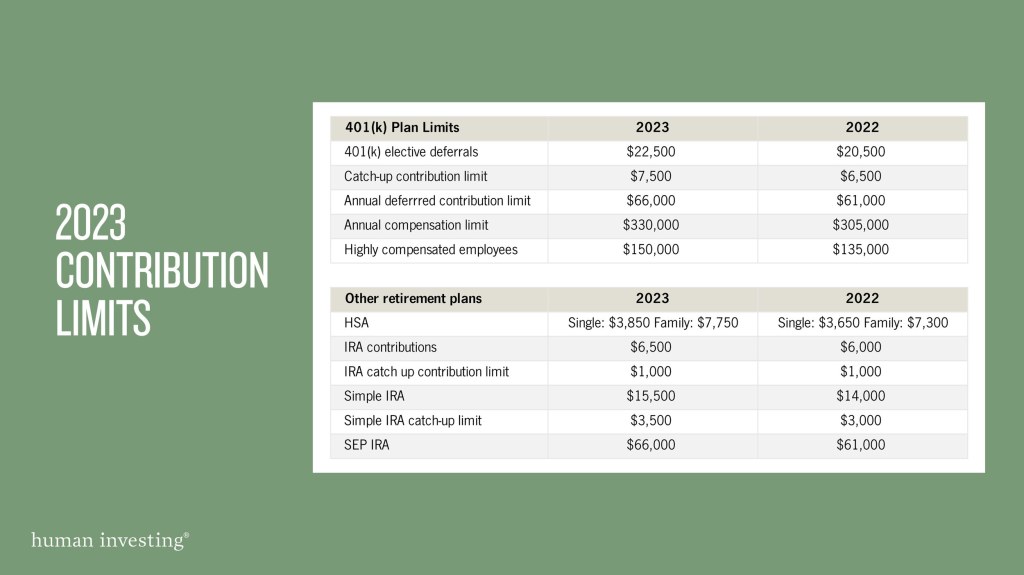

Table: Retirement Savings 2023 Overview

Topic

Information

Image Source: squarespace-cdn.com

Annual Retirement Expenses

$50,000

Required Savings

$1,000,000

Expected Inflation Rate

3%

Recommended Retirement Age

65 years

Retirement Savings Rate

15% of income

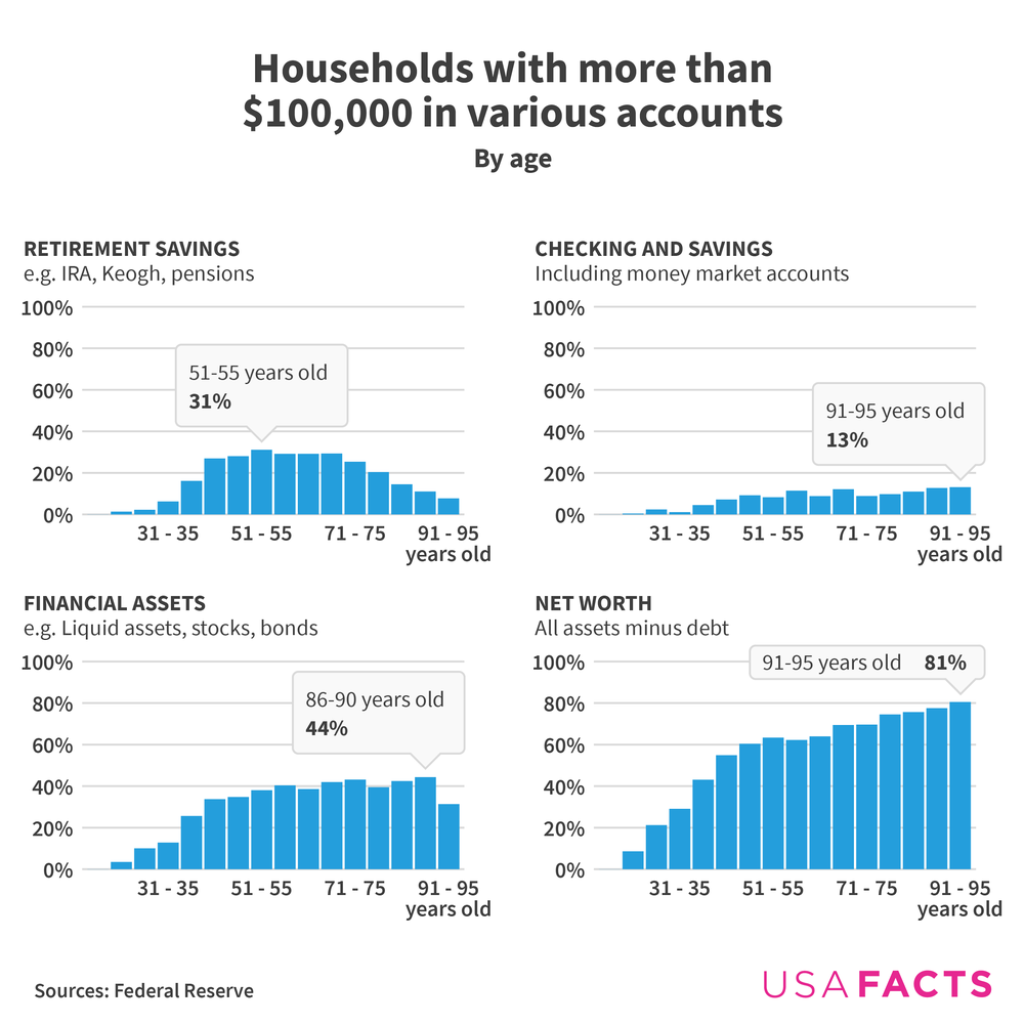

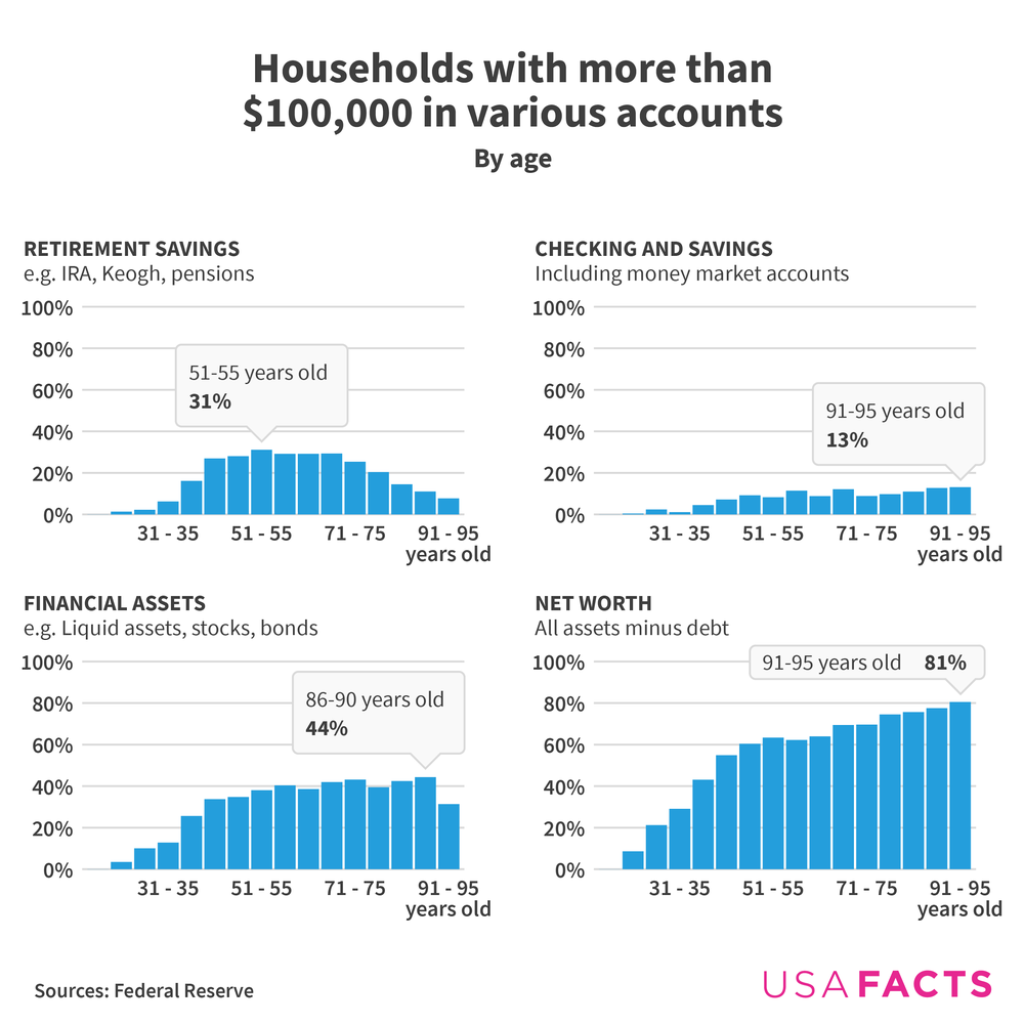

Image Source: usafacts.org

Investment Portfolio

Diversified – Stocks, Bonds, and Real Estate

What is Retirement Savings 2023?

Retirement savings 2023 refers to the financial preparations individuals make to secure their retirement in the upcoming year. It involves setting aside a portion of one’s income, wisely investing it, and accumulating a substantial savings nest to support a comfortable lifestyle post-retirement. As each year brings its unique challenges and opportunities, it is vital to adapt one’s retirement savings strategy to cater to the changing economic landscape.

Who Should Prioritize Retirement Savings?

Retirement savings should be a priority for individuals of all age groups. Whether you are just starting your career or nearing retirement age, planning for the future is essential. The earlier you start saving, the greater the benefits of compound interest, enabling you to build a larger retirement fund. However, even if you haven’t started early, it’s never too late to begin your retirement savings journey.

When Should I Start Planning for Retirement?

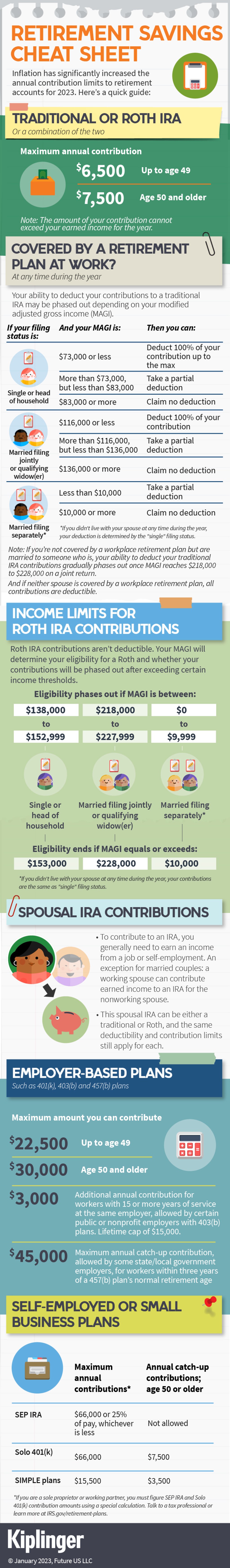

Image Source: fidelity.com

The ideal time to start planning for retirement is as soon as possible. The power of compounding allows your savings to grow exponentially over time. By starting early, you give yourself a longer period to contribute and invest your money, increasing the chances of achieving your desired retirement goals.

Where Should I Invest for My Retirement?

Retirement savings should be diversified across various investment vehicles, such as stocks, bonds, and real estate. Diversification helps spread the risk and maximize potential returns. Consult with a financial advisor who can provide personalized guidance based on your risk tolerance and financial goals.

Why is Retirement Savings Important?

Retirement savings is crucial to ensure financial security and independence during your golden years. Relying solely on government benefits or Social Security may not be sufficient to meet your desired lifestyle. By saving and investing for retirement, you take control of your financial future and have the freedom to enjoy your retirement years to the fullest.

How Can I Start Saving for Retirement?

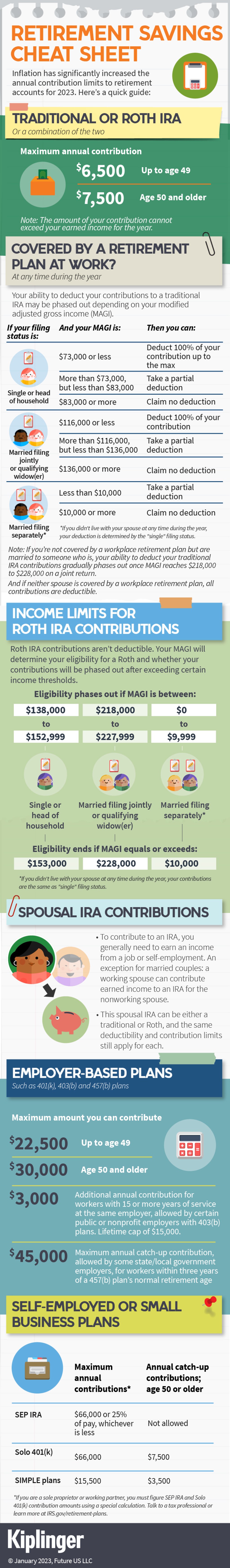

Starting your retirement savings journey is simple. Start by creating a budget, identifying areas where you can reduce expenses, and allocating a portion of your income towards retirement savings. Set up automatic contributions to your retirement accounts and take advantage of employer-sponsored retirement plans, such as 401(k)s, and individual retirement accounts (IRAs).

Advantages and Disadvantages of Retirement Savings 2023

Advantages:

Financial Security: Retirement savings provide a safety net for future expenses and unexpected emergencies.

Flexibility: It allows you to have the freedom to pursue your hobbies, travel, and spend quality time with loved ones.

Tax Benefits: Contributions to retirement accounts often offer tax advantages, reducing your taxable income.

Compound Interest: Starting early enables your savings to grow exponentially over time through the power of compound interest.

Peace of Mind: With a well-funded retirement account, you can enjoy your retirement years without financial worries.

Disadvantages:

Market Volatility: Investing in the stock market involves risks, and your retirement savings may be subject to market fluctuations.

Delayed Gratification: Saving for retirement requires discipline and sacrifices in the present to secure your future.

Inflation: The rising cost of living can erode the purchasing power of your retirement savings over time.

Healthcare Expenses: Medical costs during retirement can be substantial, and it’s essential to plan accordingly.

Uncertain Future: Predicting future economic conditions and life expectancy can be challenging, making retirement planning complex.

Frequently Asked Questions (FAQs) about Retirement Savings 2023

1. Is there an ideal age to start saving for retirement?

There is no specific age to start saving for retirement. However, the earlier you start, the better, as it allows your savings to grow over a longer period through compound interest.

2. How much should I save for retirement?

The amount you should save for retirement depends on your desired lifestyle and retirement goals. A general guideline is to save at least 15% of your income, but consulting with a financial advisor can help you determine a more accurate target.

3. What if I haven’t saved enough for retirement?

If you haven’t saved enough for retirement, consider increasing your savings rate, extending your working years, or exploring investment options with higher potential returns. It’s never too late to take action and improve your financial situation.

4. How can I minimize taxes on my retirement savings?

Utilize tax-advantaged retirement accounts, such as 401(k)s and IRAs, and consider consulting with a tax professional to optimize your retirement savings strategy and minimize taxes.

5. Can I retire before the recommended retirement age?

Retiring before the recommended age is possible if you have sufficient savings and a solid retirement plan in place. However, early retirement may require careful financial planning to ensure long-term sustainability.

Conclusion

In conclusion, preparing for retirement is not an option but a necessity. By focusing on retirement savings in 2023, you are taking a significant step towards securing a financially stable future. Remember to start early, diversify your investments, and regularly review your retirement plan to adapt to changing circumstances. Take control of your financial well-being and enjoy a fulfilling retirement. Start today!

Best regards,

Your Name

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Consult with a qualified financial professional before making any investment or retirement planning decisions. The future is uncertain, and it is essential to continually review and adapt your retirement savings strategy to meet your individual needs and goals. Remember, your retirement savings should align with your risk tolerance, financial situation, and long-term objectives. Wishing you a prosperous retirement!

This post topic: Budgeting Strategies