Securing Your Future: Discover The Ideal Retirement Savings Amount By Age – Take Action Now!

Retirement Savings Amount by Age: How to Secure Your Future

Introduction

Dear Readers,

1 Picture Gallery: Securing Your Future: Discover The Ideal Retirement Savings Amount By Age – Take Action Now!

Welcome to our comprehensive guide on retirement savings amount by age. In this article, we will discuss the importance of saving for retirement at different stages of life and provide you with valuable insights on how to secure your financial future.

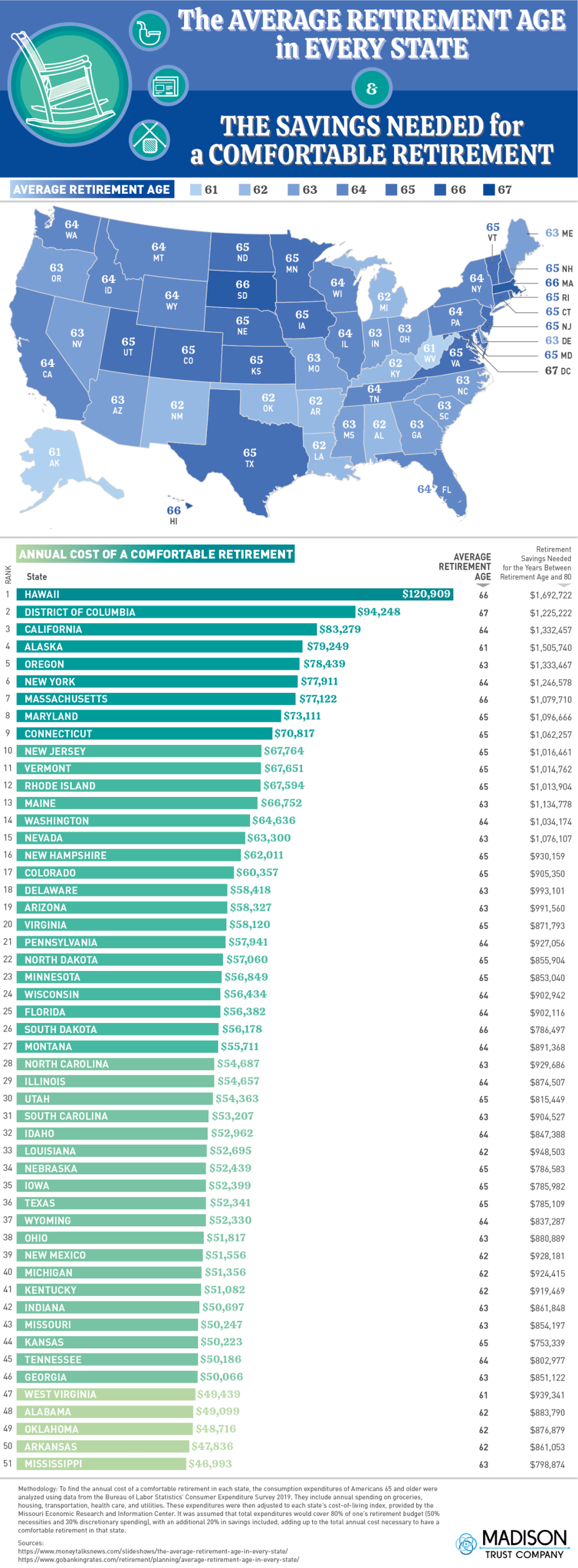

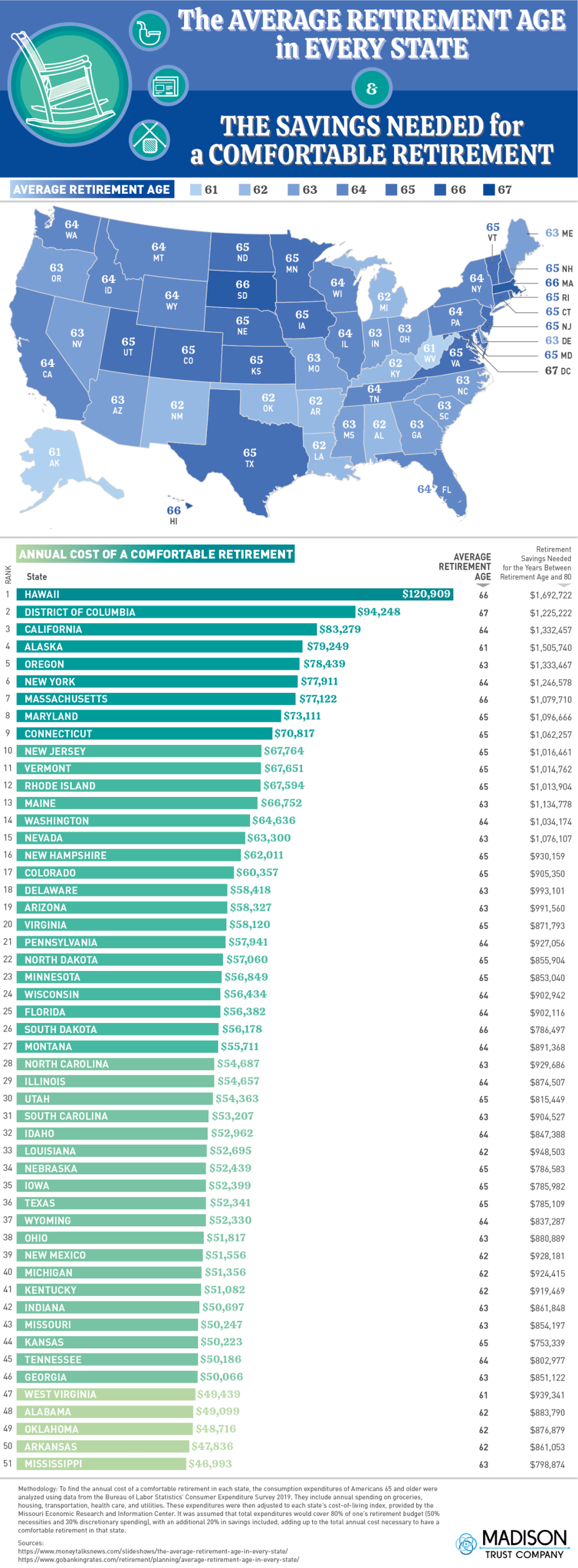

Image Source: madisontrust.com

Retirement planning is a crucial aspect of personal finance that requires careful consideration and strategic decision-making. By understanding the recommended retirement savings amounts based on your age, you can ensure a comfortable and stress-free retirement.

Now, let’s dive into the details and explore the different factors that influence your retirement savings goals.

Table: Retirement Savings Amount by Age

Age Group

Recommended Savings Amount

20-29

$XXX,XXX

30-39

$XXX,XXX

40-49

$XXX,XXX

50-59

$XXX,XXX

60 and above

$XXX,XXX

What is Retirement Savings Amount by Age?

🔍 Retirement savings amount by age refers to the recommended sum of money individuals should aim to save for retirement based on their respective age groups. It serves as a guideline to help individuals plan and allocate their financial resources effectively.

🔍 The retirement savings amount takes into account various factors such as expected retirement age, life expectancy, desired lifestyle in retirement, and inflation rate. It aims to provide individuals with a target savings goal that is sufficient to sustain their living expenses during retirement.

🔍 It is important to note that the recommended savings amount may vary depending on individual circumstances, such as existing retirement funds, income level, and financial obligations.

🔍 By understanding the retirement savings amount by age, individuals can make informed decisions about their financial priorities and take proactive steps towards achieving a secure retirement.

🔍 In the following sections, we will explore the different age groups and their corresponding retirement savings goals.

Who Should Consider Retirement Savings Amount by Age?

🔍 Retirement savings amount by age is relevant for individuals of all ages who are planning for their retirement. Whether you are in your 20s or nearing retirement age, it is never too early or too late to start saving for the future.

🔍 Younger individuals can benefit from understanding the recommended savings amount early on, as it allows them to harness the power of compounding interest and make strategic investment decisions to grow their retirement funds.

🔍 On the other hand, individuals approaching retirement age can use the recommended savings amount as a benchmark to assess their current financial situation and make any necessary adjustments to ensure a comfortable retirement.

🔍 Regardless of your age, considering the retirement savings amount by age is a proactive approach towards securing your financial future.

When Should You Start Saving for Retirement?

🔍 The best time to start saving for retirement is now. The earlier you begin, the more time you have to accumulate wealth and benefit from the power of compounding interest.

🔍 Ideally, individuals should start saving for retirement in their 20s. By starting early, even with small contributions, you can give your investments more time to grow and potentially achieve a more substantial retirement savings amount.

🔍 However, it is never too late to start saving for retirement. If you haven’t started yet, the key is to take action as soon as possible and make regular contributions to your retirement savings.

🔍 Remember, time is a valuable asset when it comes to building a retirement nest egg, so the earlier you start, the better.

Where Can You Invest Your Retirement Savings?

🔍 There are various investment options available for individuals looking to grow their retirement savings. The right choice depends on your risk tolerance, financial goals, and time horizon.

🔍 Common investment options for retirement savings include:

Employer-sponsored retirement plans, such as 401(k) or 403(b) accounts

Individual Retirement Accounts (IRAs), including Traditional and Roth IRAs

Stocks and bonds

Mutual funds

Real estate investments

Certificates of Deposit (CDs)

Exchange-Traded Funds (ETFs)

🔍 It is important to diversify your investments to minimize risk and maximize potential returns. Consulting with a financial advisor can help you determine the best investment strategy based on your individual circumstances and goals.

Why is Retirement Savings Amount by Age Important?

🔍 The retirement savings amount by age is crucial because it provides individuals with a tangible goal to strive for and helps them gauge their progress towards a financially secure retirement.

🔍 Without a clear savings target, individuals may risk falling short on funds during retirement, leading to financial stress and a lower quality of life.

🔍 By understanding the recommended savings amount for your age group, you can make informed decisions about budgeting, lifestyle choices, and investment strategies to ensure a comfortable and fulfilling retirement.

🔍 Additionally, knowing the retirement savings amount by age allows you to take action and make any necessary adjustments to your financial plan to achieve your retirement goals.

How Can You Calculate Your Retirement Savings Amount?

🔍 Calculating your retirement savings amount involves considering various factors such as current age, desired retirement age, life expectancy, expected inflation rate, and projected expenses during retirement.

🔍 One common method is to aim for a retirement savings target that is 25 times your annual expenses. This rule of thumb, known as the 4% rule, assumes that you can withdraw 4% of your retirement savings annually while accounting for inflation and still maintain a sustainable income throughout retirement.

🔍 However, it is important to note that individual circumstances may vary, and it is advisable to consult with a financial advisor or use retirement planning tools to get a more accurate estimation based on your specific situation.

🔍 By assessing your retirement savings needs and consulting professionals, you can develop a personalized savings plan that aligns with your financial goals.

Advantages and Disadvantages of Retirement Savings Amount by Age

Advantages:

✅ Provides a clear savings target for each age group, making it easier to plan and track progress towards retirement goals.

✅ Helps individuals prioritize saving for retirement and avoid the risk of insufficient funds during retirement.

✅ Enables individuals to make informed decisions about budgeting, investment strategies, and lifestyle choices to achieve financial security.

✅ Allows for early intervention and adjustments to retirement plans, minimizing the need for drastic measures later in life.

✅ Encourages financial discipline and regular savings habits, leading to long-term financial well-being.

Disadvantages:

❌ The recommended savings amounts may not be feasible for individuals with low income or significant financial obligations.

❌ Strict adherence to retirement savings targets may limit flexibility and hinder other financial goals, such as paying off debt or saving for other priorities.

❌ The retirement savings amount by age is based on assumptions and general guidelines, making it important to consider individual circumstances and consult professionals for personalized advice.

❌ Failure to meet the recommended savings amounts may lead to feelings of inadequacy or stress about retirement.

FAQs (Frequently Asked Questions)

1. Is the retirement savings amount by age the same for everyone?

No, the retirement savings amount by age serves as a general guideline based on common assumptions and average retirement goals. Individual circumstances, income levels, and lifestyle choices can significantly impact the recommended savings amount. It is essential to assess your unique situation and consult with professionals for personalized advice.

2. Can I catch up on retirement savings if I haven’t started early?

While starting early is ideal, it is never too late to begin saving for retirement. You can still catch up on your savings by taking advantage of catch-up contributions allowed in certain retirement accounts, making higher contributions, and exploring investment options that can potentially yield higher returns.

3. Are there penalties for withdrawing retirement savings before retirement age?

Yes, withdrawing retirement savings before the specified retirement age may result in penalties, taxes, and missed opportunities for growth. It is generally advisable to avoid early withdrawals unless in cases of extreme financial need. Consulting with a financial advisor can help you understand the implications and explore alternative options.

4. Can I adjust my retirement savings amount as I age?

Yes, it is essential to review and adjust your retirement savings amount periodically as you age. Factors such as income changes, lifestyle adjustments, and unexpected expenses may require modifications to your savings goals. Regularly reassessing your retirement plan ensures that it remains aligned with your evolving needs and circumstances.

5. Should I solely rely on retirement savings for a secure future?

While retirement savings are crucial, it is advisable to diversify your sources of income and explore other investment options to achieve a secure future. Consider additional streams of income, such as real estate investments, passive income sources, or part-time work during retirement. Building a well-rounded financial plan can provide added stability and peace of mind.

Conclusion: Secure Your Financial Future

In conclusion, understanding the retirement savings amount by age is essential for planning a financially secure future. By knowing the recommended savings goals based on your age group, you can make informed decisions, take proactive steps, and adjust your financial plan accordingly.

Remember, it is never too early or too late to start saving for retirement. Take advantage of the power of compounding interest and make regular contributions to your retirement savings. Consult with professionals to develop a personalized plan and explore investment options that align with your financial goals.

Secure your future today, and enjoy a fulfilling retirement tomorrow.

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Individual circumstances may vary, and it is recommended to consult with a qualified financial advisor before making any investment or retirement planning decisions. The authors and publishers of this article are not liable for any damages or losses arising from the use of this information.

This post topic: Budgeting Strategies