Secure Your Future With A Powerful Retirement Savings Projection – Take Action Now!

Retirement Savings Projection: How to Plan for Your Financial Future

Introduction

Hello, Readers! Planning for retirement is a crucial aspect of ensuring financial security and peace of mind in our golden years. Retirement savings projection is a valuable tool that can help individuals estimate their future financial needs and make informed decisions regarding their savings and investments. In this article, we will explore the concept of retirement savings projection, its benefits, and how it can be used to plan for a comfortable retirement.

1 Picture Gallery: Secure Your Future With A Powerful Retirement Savings Projection – Take Action Now!

What is Retirement Savings Projection?

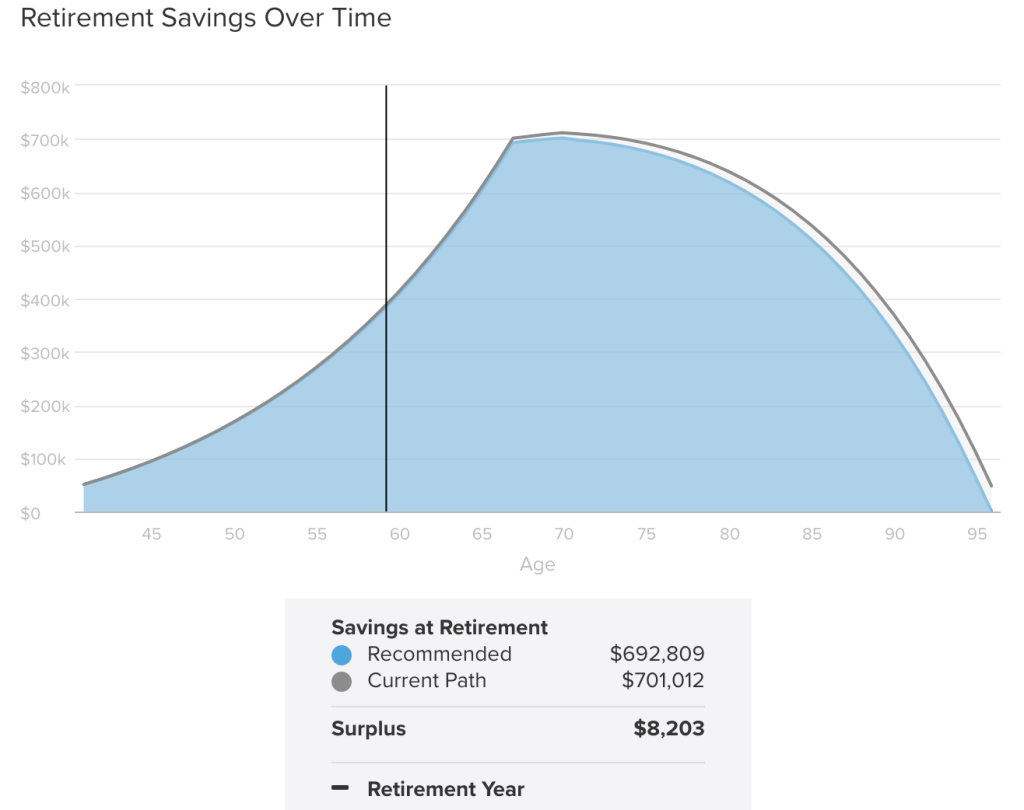

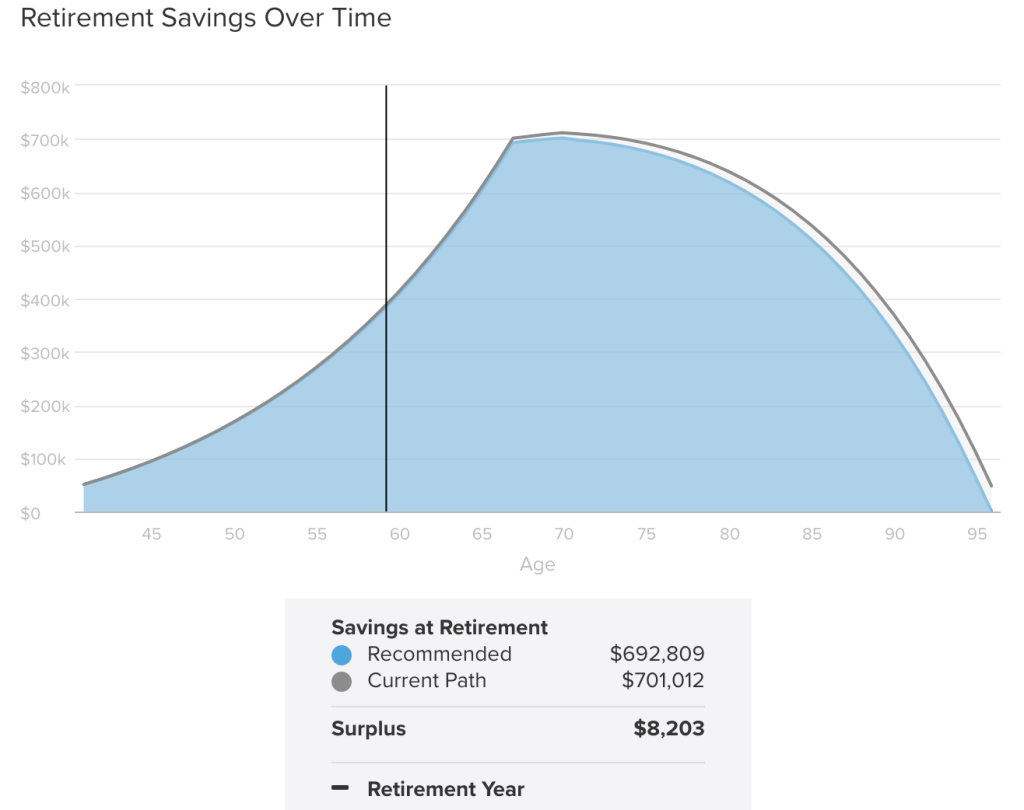

🔍 Retirement savings projection refers to the process of estimating the amount of money an individual will need to save in order to maintain their desired lifestyle after retirement. It takes into account factors such as current income, expected retirement age, life expectancy, inflation, and investment returns to provide a realistic picture of one’s financial future.

Image Source: amazonaws.com

🔍 By projecting retirement savings, individuals can determine if they are on track to meet their retirement goals or if they need to make adjustments to their savings and investment strategies. It serves as a roadmap for financial planning and helps individuals make informed decisions to ensure a secure retirement.

🔍 Retirement savings projection can be done using various tools and calculators available online, or through the assistance of financial advisors who specialize in retirement planning.

Who Should Consider Retirement Savings Projection?

🔍 Retirement savings projection is beneficial for individuals of all ages who are planning for their retirement. Whether you are just starting your career or nearing retirement age, having a clear understanding of your future financial needs can help you make informed decisions and take appropriate actions to secure your financial future.

🔍 Young professionals can use retirement savings projection to set realistic savings goals and establish a disciplined savings habit early on. It allows them to take advantage of compounding interest and potentially achieve financial independence at an earlier age.

🔍 Individuals who are closer to retirement can use retirement savings projection to assess if they have accumulated enough savings to retire comfortably. It helps them identify any gaps in their savings and make adjustments to their retirement plans if necessary.

When Should You Start Retirement Savings Projection?

🔍 It is never too early to start planning for retirement. The earlier you start retirement savings projection, the more time you have to make adjustments and build a substantial retirement nest egg.

🔍 It is recommended to start retirement savings projection as soon as you start earning a steady income. By doing so, you can take advantage of the power of compounding and potentially achieve your retirement goals with less financial stress.

🔍 However, even if you have already started your career or are nearing retirement age, it is still beneficial to engage in retirement savings projection. It can provide valuable insights and help you make strategic financial decisions to ensure a comfortable retirement.

Where Can You Access Retirement Savings Projection Tools?

🔍 Retirement savings projection tools are widely available online and can be accessed through various financial websites and calculators. These tools typically require inputting information such as current income, retirement age, life expectancy, expected rate of return, and desired retirement income.

🔍 Additionally, many financial institutions and independent financial advisors offer retirement planning services that include retirement savings projection. These professionals can provide personalized guidance and recommendations based on your specific financial situation and goals.

Why is Retirement Savings Projection Important?

🔍 Retirement savings projection is important for several reasons:

1. Financial Awareness: Retirement savings projection provides individuals with a clear understanding of their future financial needs and helps them assess if they are on track to meet their retirement goals.

2. Goal Setting: By projecting retirement savings, individuals can set realistic savings goals and create a roadmap to achieve them. It allows for better financial planning and ensures that retirement plans align with personal aspirations.

3. Adjustment Opportunities: Retirement savings projection helps individuals identify any gaps or shortfalls in their savings, allowing them to make adjustments to their retirement plans at an early stage. This proactive approach can avoid financial stress in the future.

4. Informed Decision-Making: With a clear projection of future financial needs, individuals can make informed decisions regarding their savings, investments, and retirement age. It enables them to make choices that align with their lifestyle goals and risk tolerance.

5. Peace of Mind: Having a solid retirement savings projection provides peace of mind, knowing that you have taken the necessary steps to secure your financial future. It allows individuals to enjoy retirement without worrying about financial constraints.

How Can You Make the Most of Retirement Savings Projection?

🔍 To make the most of retirement savings projection, consider the following tips:

1. Gather Accurate Information: Ensure that you have accurate and up-to-date information about your current income, expenses, retirement age, and expected rate of return on investments. This will help generate a more precise retirement savings projection.

2. Factor in Inflation: Take into account the impact of inflation when projecting your retirement savings. Inflation erodes the purchasing power of money over time, so it is important to factor in an appropriate inflation rate for a more accurate projection.

3. Regularly Review and Adjust: Review your retirement savings projection periodically and make adjustments as needed. Changes in income, expenses, or investment returns may require you to revise your savings goals or retirement plans.

4. Seek Professional Advice: Consider consulting with a financial advisor who specializes in retirement planning. They can provide personalized recommendations based on your unique financial situation and help you optimize your retirement savings projection.

5. Stay Disciplined: Stick to a disciplined savings plan and contribute regularly to your retirement accounts. Maximize your contributions to take advantage of employer matches or tax benefits, and avoid unnecessary withdrawals that may hinder your retirement savings goals.

Advantages and Disadvantages of Retirement Savings Projection

Advantages:

1. Goal Clarity: Retirement savings projection provides individuals with a clear understanding of their retirement goals and the savings needed to achieve them.

2. Informed Decision-Making: It allows individuals to make informed decisions regarding savings, investments, and retirement age, taking into account their future financial needs.

3. Peace of Mind: A well-planned retirement savings projection provides peace of mind, knowing that financial needs are taken care of during retirement.

Disadvantages:

1. Uncertain Variables: Retirement savings projection relies on assumptions for variables such as investment returns and life expectancy, which are subject to change.

2. Unexpected Life Events: Unforeseen life events, such as health issues or job loss, can impact retirement savings and require adjustments to the projection.

3. Over-Reliance on Projection: Individuals may become too reliant on the retirement savings projection and neglect regular reviews and adjustments to their savings and investment strategies.

Frequently Asked Questions (FAQs)

Q1: What happens if I don’t save enough for retirement?

A1: If you don’t save enough for retirement, you may face financial difficulties during your retirement years. It is important to start saving early and regularly contribute to your retirement accounts to ensure a comfortable retirement.

Q2: Can I rely solely on my pension for retirement?

A2: While a pension can provide a source of income during retirement, it is generally recommended to have additional savings and investments. Relying solely on a pension may limit your financial flexibility and may not be sufficient to maintain your desired lifestyle.

Q3: How often should I review my retirement savings projection?

A3: It is advisable to review your retirement savings projection at least once a year or whenever there are significant changes in your financial situation. Regular reviews allow you to make necessary adjustments and stay on track towards your retirement goals.

Q4: Can I make changes to my retirement plans after projecting my savings?

A4: Yes, retirement plans are not set in stone. You can make changes to your savings goals, investment strategies, or retirement age based on your evolving financial situation and goals. Regular reviews and adjustments are encouraged to ensure your retirement plans remain aligned with your aspirations.

Q5: Is retirement savings projection accurate?

A5: Retirement savings projection provides an estimate based on the information and assumptions provided. While it may not be 100% accurate due to uncertainties in variables such as investment returns and life expectancy, it serves as a valuable planning tool to guide your retirement savings strategy.

Conclusion

In conclusion, retirement savings projection is an essential tool for planning a secure and comfortable retirement. By projecting your future financial needs, you can set realistic savings goals, make informed decisions, and take proactive steps to ensure a financially stable future. Remember to regularly review and adjust your retirement savings plan based on changes in your financial situation, and seek professional advice for personalized recommendations. Start planning early, stay disciplined in your savings habits, and enjoy a worry-free retirement.

Final Remarks

The information provided in this article is for informational purposes only and should not be considered as financial advice. Every individual’s financial situation is unique, and it is recommended to consult with a qualified financial advisor before making any investment or retirement planning decisions. Planning for retirement requires careful consideration and should be tailored to your specific needs and goals.

This post topic: Budgeting Strategies