Master Your Finances With These Foolproof Common Budgeting Strategies: Boost Your Savings Now!

Common Budgeting Strategies

Greetings, Readers!

Welcome to an informative article about common budgeting strategies. In today’s fast-paced and ever-changing world, managing finances has become a crucial skill for individuals of all ages. Whether you are a college student, a young professional, or a seasoned adult, having a solid budgeting strategy is essential to achieving financial stability and reaching your goals. In this article, we will explore various common budgeting strategies that can help you effectively manage your money and improve your financial well-being.

1 Picture Gallery: Master Your Finances With These Foolproof Common Budgeting Strategies: Boost Your Savings Now!

Introduction

In this section, we will provide an overview of the different common budgeting strategies available. Understanding the principles behind these strategies will enable you to make informed decisions regarding your personal finances. Let’s dive in and explore the world of budgeting!

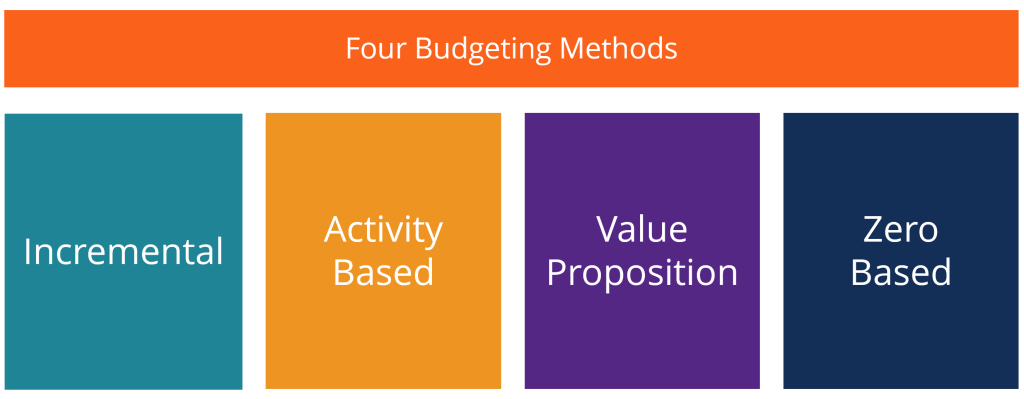

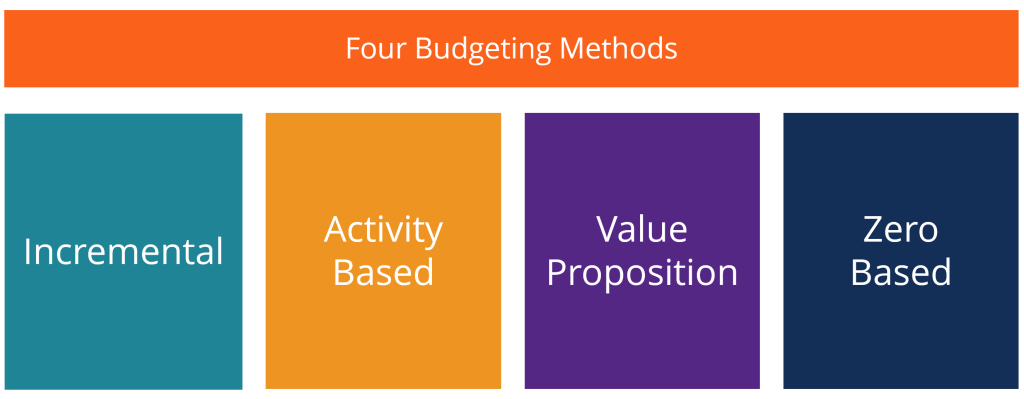

1. What are common budgeting strategies? 🤔

Image Source: corporatefinanceinstitute.com

Common budgeting strategies are systematic approaches to managing your income and expenses. These strategies provide a framework to allocate money towards different financial goals and expenses, ensuring a balanced financial life.

2. Who can benefit from using common budgeting strategies? 🙋♂️🙋♀️

Anyone who wants to take control of their finances and establish a strong foundation for their future can benefit from using common budgeting strategies. Regardless of your income level or financial goals, implementing a budgeting strategy tailored to your needs will help you make the most of your money.

3. When should you start using common budgeting strategies? ⏰

It is never too early or too late to start using common budgeting strategies. Whether you are just entering the workforce or nearing retirement, having a budgeting strategy in place can significantly improve your financial well-being. The sooner you start, the better off you will be in the long run.

4. Where can you apply common budgeting strategies? 🌍

Common budgeting strategies can be applied to various aspects of your life, including personal finances, business finances, and even budgeting for special events or projects. These strategies are versatile and can be adapted to suit different financial situations and goals.

5. Why are common budgeting strategies important? 🤷♂️🤷♀️

Common budgeting strategies provide numerous benefits, such as helping you track your spending, avoid debt, save for the future, and achieve your financial goals. They also promote financial discipline and enable you to make informed financial decisions.

6. How can you implement common budgeting strategies? 📝

Implementing common budgeting strategies involves several steps, such as creating a budget, tracking your expenses, setting financial goals, and regularly reviewing and adjusting your budget. Each strategy may have its own unique approach, but the underlying principles remain the same.

Advantages and Disadvantages of Common Budgeting Strategies

Now, let’s delve into the advantages and disadvantages of using common budgeting strategies:

1. Advantages of Common Budgeting Strategies 🌟

Common budgeting strategies provide a structured approach to managing your finances, helping you prioritize your expenses and achieve your financial goals. They promote financial discipline, reduce stress, and enable you to make informed financial decisions.

2. Disadvantages of Common Budgeting Strategies ⚠️

While common budgeting strategies offer numerous benefits, they can also be restrictive and require discipline to follow consistently. Some individuals may find it challenging to stick to a budget, especially when unexpected expenses arise.

Frequently Asked Questions (FAQ)

1. Is there a one-size-fits-all budgeting strategy? ❓

No, there is no one-size-fits-all budgeting strategy. The most effective strategy for you will depend on your unique financial situation, goals, and preferences.

2. How often should I review and adjust my budget? ❓

It is recommended to review and adjust your budget regularly, ideally on a monthly basis. This allows you to track your progress, make necessary changes, and ensure that your budget aligns with your current financial circumstances and goals.

3. Can budgeting help me save for long-term goals, such as buying a house? ❓

Absolutely! Budgeting is an excellent tool for saving towards long-term goals. By allocating a portion of your income specifically towards your desired goal, you can steadily build up savings and make your dreams a reality.

4. What should I do if I overspend in a certain category of my budget? ❓

If you overspend in a specific category of your budget, you may need to adjust other areas to compensate. Look for opportunities to cut back on discretionary expenses and prioritize essential needs. It’s important to learn from overspending and make necessary adjustments moving forward.

5. Can budgeting help me reduce debt? ❓

Yes, budgeting can be a powerful tool for reducing debt. By allocating a portion of your income towards debt repayment and prioritizing high-interest debts, you can accelerate your journey towards becoming debt-free.

Conclusion

In conclusion, implementing a common budgeting strategy is a vital step towards achieving financial stability and reaching your goals. By understanding the principles behind budgeting and selecting a strategy that suits your needs, you can take control of your finances and make informed financial decisions. Remember, it’s never too late to start budgeting and improve your financial well-being. Take action today and reap the benefits tomorrow!

Thank you for reading, and best of luck on your budgeting journey!

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial advice. It is always recommended to consult with a professional financial advisor or planner before making any financial decisions.

This post topic: Budgeting Strategies